Crompton Greaves 2QFY2015 Results Update

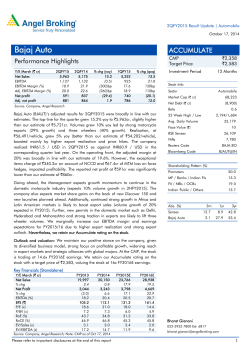

2QFY2015 Result Update | Capital Goods October 21, 2014 Crompton Greaves BUY Performance Highlights CMP Target Price Investment Period Quarterly Data (Consolidated) ( ` cr) `190 `235 2QFY15 2QFY14 % chg (yoy) 1QFY15 % chg (qoq) 3,430 3,205 7.0 3,442 (0.3) Stock Info EBITDA 168 161 4.4 173 (2.5) Sector EBITDA margin (%) 4.9 5.0 (12) 5.0 (11) Market Cap (` cr) 70 58 19.1 64 8.7 Revenues Reported PAT 12 months Source: Company, Angel Research Capital Goods 11,908 Net Debt (` cr) 1,357 Beta For 2QFY2015, Crompton Greaves (CG)’s top-line performance was below our estimates, growing by 7% yoy to `3,430cr. On the EBITDA front, the company's margin decline by 10bp yoy to 4.9%, which is lower than our estimate of 5.3%, due to lower-than-expected recovery in margins of international operations. Consequently, the profit improved by 19% yoy to `70cr, but was lower by 16% than our estimate of `83cr. Stable standalone performance: CG reported a modest growth of 8.9% yoy in domestic operations to `1,923cr. The growth was lead by the consumer segment, which grew by 13% yoy. Revenue from the industrial segment grew by 6.9% yoy and that from the power segment grew by 6.4% yoy. However, the EBITDA margin on a standalone basis declined by 30bp yoy to 8.7%. Board approves consumer business demerger: CG board has approved the demerger of its consumer business into a wholly owned subsidiary Crompton Consumer Products Ltd. CG will retain a 25% stake in the demerged business and share holders will get 3 shares in Crompton Consumer Products Ltd for every 4 held in CG. Outlook and Valuation: We are of the opinion that CG’s margins has room for improvement and expect the operating margin to gradually improve over the next year as international business recovers. Given the attractive valuation (stock trading at 0.9x FY2015E EV/Sales compared to its five year trading range of 0.5x to 1.5x), we maintain our Buy recommendation on the stock. We have assigned a multiple of 1x EV/Sales to arrive at a target price of `235. 1.9 52 Week High / Low 231/94 Avg. Daily Volume 5,86,638 Face Value (`) 2 BSE Sensex 26,109 Nifty 7,780 Reuters Code CROM.BO Bloomberg Code CRG IN Shareholding Pattern (%) Promoters 42.7 MF / Banks / Indian Fls 24.7 FII / NRIs / OCBs 15.9 Indian Public / Others 16.7 Abs. (%) 3m 1yr 3yr Sensex 2.1 27.9 53.4 CG (9.4) 98.7 13.1 Key Financials (Consolidated) Y/E March (` cr) FY2013 FY2014 FY2015E FY2016E Operating income 12,094 13,481 14,518 16,800 7.5 11.5 7.7 15.7 % chg Adj PAT % chg EBITDA (%) 85 244 422 645 (77.4) 188.9 72.8 52.8 3.2 5.1 5.8 7.0 EPS (`) (0.6) 3.9 6.7 10.3 P/E (x) - 48.7 28.2 18.5 P/BV (x) 3.4 3.3 3.0 2.7 RoE (%) 2.4 6.8 11.1 15.4 RoCE (%) 3.7 7.8 9.8 13.7 EV/Sales (x) 1.1 1.0 0.9 0.8 33.9 19.5 15.9 11.7 EV/EBITDA (x) Source: Company, Angel Research; Note: CMP as of October 20, 2014 Please refer to important disclosures at the end of this report Shrenik C. Gujrathi 022 39357800 Ext: 6872 [email protected] 1 Crompton Greaves | 2QFY2015 Result Update Exhibit 1: Quarterly Performance (Consolidated) (` Cr) Net Sales Other operating income Total income Stock adjustments Raw Material (% of total income) 2QFY15 2QFY14 % chg (yoy) 1QFY15 % chg (qoq) 1HFY2015 1HFY2014 % chg (yoy) 3,430 3,205 7.0 3,442 (0.3) 6,872 6,362 8.0 - - 7.0 3,442 (0.3) 6,872 6,362 101 (141) 4,553 4,535 67.7 69.1 - - 3,430 3,205 63 (8) 2,278 2,203 3.4 2,274 68.2 68.5 (0.3) 67.2 (0.4) Employee Cost 487 489 (% of total income) 14.2 15.3 Other Expenses 434 359 (% of total income) Total Expenditure EBITDA 12.7 11.2 3,262 3,044 38 507 0.2 (4.0) 994 938 14.5 14.7 (3.5) 884 724 14.7 8.0 0.4 6.0 20.8 450 12.9 11.4 7.2 3,269 (0.2) 6,531 6,056 7.8 (2.5) 341 306 11.5 5.0 4.8 13.1 22.0 168 161 4.4 173 (EBITDA %) 4.9 5.0 (12) 5.0 Interest 23 19 16.6 24 (7.8) 47 39 19.1 Depreciation 66 66 (0.1) 67 (1.4) 133 119 12.0 Other Income 45 33 39.6 39 17.9 84 68 23.8 16 120 4.5 245 216 13.7 3.6 3.4 112 97 45.7 45.0 133 119 PBT 125 108 PBT (%) 3.7 3.4 Total Tax 57 51 (% of PBT) 3.5 12.7 55 3.7 45.5 46.7 Reported PAT (After Min. Int.) 70 58 PAT Margins(%) 2.0 1.8 1.9 1.9 1.9 0 0 0 - - Adj PAT 70 58 19.1 64 8.7 133 119 12.2 EPS (`) 1.1 0.9 23.1 1.0 8.7 2.2 1.8 16.4 Extra ordinary exp/(inc) 45.9 15.4 19 64 8.7 12.2 Source: Company, Angel Research Exhibit 2: Actual vs Estimate Revenue EBITDA PAT Actual Estimate Var (%) 3,430 3,484 (1.6) 168 185 (8.8) 70 83 (16.2) Source: Company, Angel Research October 21, 2014 2 Crompton Greaves | 2QFY2015 Result Update Exhibit 3: Segment-wise performance (Standalone) Y/E March (` cr) 2QFY15 2QFY14 % chg (yoy) 1QFY15 Power Systems 709 Consumer Products 743 Industrial systems 386 % chg (yoy) 1HFY15 1HFY14 667 6.4 659 12.7 362 6.9 % chg (yoy) 592 19.9 1,301 1,231 5.6 861 (13.7) 1,604 1,448 10.8 346 11.5 733 732 0.1 Revenue Others 94 90 4.4 118 (20.1) 213 201 6.0 1,933 1,778 8.7 1,917 0.8 3,850 3,612 6.6 Power Systems 59 62 (4.8) 47 25.9 107 108 (1.6) Consumer Products 91 77 17.8 109 (16.7) 199 171 16.6 Industrial systems 41 38 9.4 30 36.5 72 80 (10.6) Others (5) 3 (274.8) (4) 12.2 (9) (2) 445.8 187 180 3.7 182 2.5 369 358 3.0 Power Systems 36.7 37.5 30.9 33.8 34.1 Consumer Products 38.4 37.1 44.9 41.7 40.1 Industrial systems 20.0 20.3 18.1 19.0 20.3 4.9 5.1 6.2 5.5 5.6 8.4 9.4 8.0 8.2 8.8 Consumer Products 12.2 11.7 12.6 12.4 11.8 Industrial systems 10.7 10.5 8.8 9.8 11.0 Others (5.1) 3.0 (3.6) (4.3) (0.8) Total EBIT Total Revenue Mix Others EBIT Margin Power Systems Source: Company, Angel Research October 21, 2014 3 Crompton Greaves | 2QFY2015 Result Update Exhibit 4: Segment-wise performance (Consolidated) Y/E March (` cr) 2QFY15 2QFY14 % chg (yoy) 1QFY15 % chg (yoy) 1HFY15 1HFY14 % chg (yoy) Revenue Power Systems 2,138 2,026 5.5 2,019 5.9 4,157 3,844 8.1 Consumer Products 743 659 12.7 861 (13.7) 1,604 1,448 10.8 Industrial systems 462 438 5.4 453 2.0 914 890 2.7 Others 97 93 4.0 121 (19.8) 218 206 5.8 3,440 3,217 6.9 3,454 (0.4) 6,894 6,389 7.9 Power Systems 48 41 17.0 36 34.0 83 68 22.6 Consumer Products 89 77 15.6 109 (18.3) 198 171 15.6 Industrial systems 42 33 26.3 31 37.3 73 72 1.5 Others (4) 3 (261.6) (4) 7.6 (8) (1) 498.5 175 154 13.5 171 2.0 346 310 11.7 Power Systems 62.1 63.0 58.5 60.3 60.2 Consumer Products 21.6 20.5 24.9 23.3 22.7 Industrial systems 13.4 13.6 13.1 13.3 13.9 2.8 2.9 3.5 3.2 3.2 2.2 2.0 1.8 2.0 1.8 12.0 11.7 12.6 12.3 11.8 9.2 7.6 6.8 8.0 8.1 (4.4) 2.8 (3.3) (3.8) (0.7) Total EBIT Total Revenue Mix (%) Others EBIT Margin (%) Power Systems Consumer Products Industrial systems Others Source: Company, Angel Research International business continues to struggle: CG’s international business revenue grew by 5% yoy to `1,506cr. The EBITDA margin remained flat at 0.1%; at the PAT level, the company reported a loss of `57.7cr. The Management has indicated that the international business will report better numbers in 2HFY2015 as new orders will come for execution which are basically high margin orders. The Management expects the international business to recover on back of strong orders in the automation and system segment. The order inflow during the quarter for the international business was down by 4% yoy to `1,406cr and the order book stands at `5,600cr as at the quarter end (2QFY2015). October 21, 2014 4 Crompton Greaves | 2QFY2015 Result Update 200 24 - 20 (200) 15 10 (1,305) (641) (400) 6 6 5 6 6 7 6 5 7 7 6 7 International Subs 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 2QFY13 1QFY13 (1,000) 4QFY12 0 3QFY12 (800) Standalone business Source: Company, Angel Research (0.6) 30 (22) 0.2 (0.1) 17 0.2 2.0 14 0.1 - 0.1 (2.0) (4.0) (4.8) (600) 5 23 (76) 2QFY15 24 22 22 1QFY15 26 4QFY14 26 25 25 3QFY14 28 2QFY14 27 1QFY14 25 28 27 3QFY13 30 Exhibit 6: Reduction in losses of International operations yoy 4QFY13 Exhibit 5: Employee expense as % of total revenue (6.0) (8.0) (1,200) (10.0) (10.6) (1,400) EBIDTA (`cr) (12.0) EBIDTA Margins (%) Source: Company, Angel Research Margin expected to improve On the EBITDA front, the company's consolidated margin for the quarter fell marginally by 10bp yoy to 4.9%. This was on account of lower-than-expected recovery in international operations. However we expect margin to improve going forward as new orders will come for execution which are basically high margin orders. Exhibit 7: Consolidated: EBITDA and EBITDA margin 8.8 7.6 6.9 185 9.0 9.1 8.4 171 167 16.0 12.0 9.1 9.0 8.7 8.0 4.0 4.0 - EBITDA (` cr, LHS) 2QFY15 1QFY15 0.0 4QFY14 2QFY15 1QFY15 1QFY14 4QFY14 EBITDAM (%, RHS) 10.8 10.2 9.5 133 142 169 3QFY14 4.9 147 152 159 2QFY14 5.0 158 1QFY14 5.0 197 4QFY13 5.0 0.0 EBITDA (` cr, LHS) Source: Company, Angel Research 5.0 90 175 3QFY13 2.3 4QFY13 3QFY13 2QFY13 1QFY13 4QFY12 3QFY12 - 4.6 180 2QFY13 4.7 2 0.1 16.0 8.0 78 5.9 6.0 173 168 12.0 3QFY14 6.9 188 1QFY13 145 137 161 167 20.0 4QFY12 167 2QFY14 183 180 270 3QFY12 213 90 Exhibit 8: Standalone: EBITDA and EBITDA margin 20.0 270 EBITDAM (%, RHS) Source: Company, Angel Research Consumer Products business demerger will unlock value CG’s board has approved the demerger of its consumer business into a wholly owned subsidiary Crompton Consumer Products Ltd (CCPL). CG will retain its 25% stake in the demerged business and share holders will get 3 shares in CCPL for every 4 held in CG. The demerged entity (CCPL) will have a new management and will focus on higher growth. The Management expects CCPL’s revenue to reach `60bn by FY2018 and EBITDA margin to improve to 14% from the current 11.9% levels in FY2014. We believe this demerger will unlock value as CCPL has strong brand and distribution network and healthy return ratio. In our opinion CCPL will get a valuation multiple of as high as 25x (going by valuation of peers in the consumer segment). In this case the consumer business would be valued at ~`8,000cr, which illustrates that CG (excluding CCPL) is trading at an attractive valuation. Going forward as CG’s power and industrial October 21, 2014 5 Crompton Greaves | 2QFY2015 Result Update segment growth improves there would be sufficient scope for margin improvement as currently the margins are at low levels. The same would help the company in commanding a higher valuation. Order Book The consolidated order intake for 2QFY2015 grew by 11.4% yoy to `2,510cr, primarily on account of strong order inflow from domestic power and industrial segment. The Management expects revival in industrial and rail capex and strong export orders, especially from the MENA region. The order backlog stood at `9,109cr, declining by 7% yoy. Exhibit 9: Order inflow Exhibit 10: Order backlog 3,500 10,500 35 32 30 2,800 25 (%) 5 (2) 0 9109 9,586 9,293 2 (7) (5) 2QFY15 1QFY15 2QFY13 order backlog 4QFY14 2510 2QFY15 3QFY14 2900 1QFY15 2QFY14 2,490 4QFY14 1QFY14 2,624 3QFY14 9,126 2,250 2QFY14 4 (10) 4QFY13 2,441 1QFY14 9,200 2,983 4QFY13 Source: Company, Angel Research 7 7,500 - 3QFY13 2,267 3QFY13 9,400 2,575 700 10 10 10,074 9 9,743 9,000 9,771 (` cr) 15 15 1,400 2QFY13 (` cr) 20 2,100 Growth (yoy) Source: Company, Angel Research Outlook and Valuation: We are of the opinion that CG’s margins have room for improvement and expect the operating margin to gradually improve over the next year as international business recovers. Given the attractive valuation (stock trading at 0.9x FY2015E EV/Sales compared to its five year trading range of 0.5x to 1.5x), we maintain our Buy recommendation on the stock. We have assigned a multiple of 1x EV/Sales to arrive at a target price of `235. Exhibit 11: One year forward P/E Band 10.0 X 15.0 X 20.0 X 25.0 X Aug-14 Apr-14 Dec-13 Aug-13 Apr-13 Dec-12 Aug-12 Apr-12 Dec-11 Aug-11 Apr-11 Dec-10 Aug-10 Apr-10 Dec-09 Aug-09 Apr-09 Dec-08 Aug-08 Apr-08 500 450 400 350 300 250 200 150 100 50 0 30.0 X Source: Company, Angel Research October 21, 2014 6 Crompton Greaves | 2QFY2015 Result Update Company Background Crompton Greaves (CG), a part of the US$4bn Avantha Group, is one of the leading players in the power T&D equipment business in India. The company operates across three segments - Power Systems, Consumer Products and Industrial Systems. CG is a globally diversified company and derives ~50% of its order backlog from international operations, led by a series of acquisitions undertaken over FY2006-12. Europe and North America are two of the biggest markets outside Asia for the company and jointly account for ~40% of its order backlog. October 21, 2014 7 Crompton Greaves | 2QFY2015 Result Update Profit & Loss Statement (consolidated) Y/E March (` cr) FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E Operating income 10,005 11,249 12,094 13,481 % chg 11.5 7.7 15.7 8,661 10,445 11,711 12,799 13,675 15,624 EBITDA 1,344 804 383 682 843 1,176 (% of Net Sales) Depreciation& Amortisation EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of PBT) Recurring PBT % chg 7.5 5.2 (40.2) (52.3) 78.0 23.6 39.5 13.4 7.1 3.2 5.1 5.8 7.0 194 260 203 262 281 306 1,150 544 180 420 561 870 2.5 (52.7) (66.8) 132.9 33.7 54.9 11.5 4.8 1.5 3.1 3.9 5.2 34 57 71 97 99 104 113 63 75 172 189 218 9.2 11.4 40.8 34.7 29.0 22.2 1,229 550 185 495 652 984 3.4 (55.3) (66.4) 167.8 31.7 51.1 (38) 0 (121) 0 0 0 PBT 1,191 550 64 495 652 984 Tax 310 182 101 236 215 325 (% of Recurring PBT) 25.2 33.1 54.6 47.7 33.0 33.0 PAT (reported) 881 368 (37) 259 437 659 8 5 (0) (15) (15) (15) 0.4 (1)` (1) (1) (1) (1) 0 0 0 0 0 0 889 374 (36) 244 422 645 Extraordinary Inc/(exp) Add: Share of earnings of asso. Less: Minority interest (MI) Prior period items Reported PAT (After MI) Adjusted PAT 927 374 85 244 422 645 % chg 12.4 (59.7) (77.4) 188.9 72.8 52.8 (% of Net Sales) October 21, 2014 12.4 16,800 Total Expenditure % chg 9.5 14,518 9.3 3.3 0.7 1.8 2.9 3.8 Basic EPS (`) 14.4 5.8 (0.6) 3.9 6.7 10.3 Fully Diluted EPS (`) 14.4 5.8 (0.6) 3.9 6.7 10.3 % chg 12.4 (59.7) (109.8) 786.5 72.8 52.8 8 Crompton Greaves | 2QFY2015 Result Update Balance Sheet (consolidated) Y/E March (` cr) FY2011 FY2012E FY2013 FY2014 FY2015E FY2016E SOURCES OF FUNDS Equity Share Capital 128 128 128 125 125 125 Preference Capital - - - - - - Reserves & Surplus 3,146 3,483 3,433 3,519 3,834 4,310 Share holders Funds 3,275 3,611 3,562 3,645 3,959 4,435 16 16 9 12 12 12 Total Loans 395 985 1,851 2,193 2,413 2,633 Deferred Tax Liability 124 136 147 188 188 188 Other Liabilities 266 235 218 160 160 160 4,076 4,982 5,788 6,197 6,732 7,427 Gross Block 3,780 4,409 5,342 5,862 6,382 6,902 Less: Acc. Depreciation 1,943 2,261 2,472 2,729 3,010 3,317 Net Block 1,837 2,148 2,870 3,368 3,372 3,586 104 110 196 92 92 92 - - - - - - 272 285 290 278 278 278 Minority Interest Total Liabilities APPLICATION OF FUNDS Capital Work-in-Progress Goodwill Investments Deferred Tax Asset 108 187 315 341 341 341 4,967 6,036 6,481 6,938 7,422 8,385 Cash 298 498 583 815 875 821 Loans & Advances 436 522 382 545 567 648 Inventories 1,189 1,223 1,637 1,671 1,790 2,071 Debtors 2,543 3,143 3,160 3,591 3,978 4,603 501 649 719 315 212 242 Current liabilities 3,213 3,783 4,365 4,819 4,773 5,254 Net Current Assets 1,755 2,253 2,116 2,118 2,649 3,131 Net Current Assets (exc. Cash) 1,456 1,755 1,533 1,304 1,773 2,310 Total Assets 4,076 4,982 5,788 6,197 6,732 7,427 Current Assets Others October 21, 2014 9 Crompton Greaves | 2QFY2015 Result Update Cash Flow Statement (consolidated) Y/E March (` cr) Profit before tax Depreciation 1,229 550 64 495 652 984 194 260 203 262 281 306 (507) (228) 222 229 (470) (537) (15) 75 75 172 189 218 (334) (244) (101) (236) (215) (325) 567 413 313 579 60 211 (Inc.)/Dec.in Fixed Assets (746) (372) (1,020) (476) (504) (520) (Inc.)/Dec. in Investments (10) (90) (5) 12 - - - - 75 172 189 218 (756) (462) (950) (292) (316) (302) - - - (134) - - (Inc)/Dec in Working Capital Others Direct taxes paid Cash Flow from Operations Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans (38) 423 867 342 220 220 (119) (119) (90) (89) (122) (184) (14) (55) (28) (87) 218 1 Cash Flow from Financing (172) 248 750 32 98 36 Inc./(Dec.) in Cash (361) 199 85 231 60 (54) Opening Cash balances 659 298 498 583 815 875 Closing Cash balances 298 498 583 815 875 821 Dividend Paid (Incl. Tax) Others October 21, 2014 FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E 10 Crompton Greaves | 2QFY2015 Result Update Key Ratios Y/E March FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E Valuation Ratio (x) P/E (on FDEPS) 13.2 32.6 (334.6) 48.7 28.2 18.5 P/CEPS 10.9 19.2 42.4 23.5 16.9 12.5 P/BV 3.7 3.4 3.4 3.3 3.0 2.7 Dividend yield (%) 0.8 0.8 0.6 0.6 1.0 1.5 EV/Sales 1.2 1.1 1.1 1.0 0.9 0.8 EV/EBITDA 8.8 15.2 33.9 19.5 15.9 11.7 EV / Total Assets 2.9 2.4 2.2 2.1 2.0 1.8 OB/Sales 0.7 0.7 0.8 0.7 0.4 0.1 EPS (Basic) 14.4 5.8 (0.6) 3.9 6.7 10.3 EPS (fully diluted) 14.4 5.8 (0.6) 3.9 6.7 10.3 Cash EPS 17.5 9.9 4.5 8.1 11.2 15.2 1.6 1.6 1.2 1.2 1.9 2.9 50.8 56.3 55.5 58.2 63.2 70.8 Per Share Data (`) DPS Book Value DuPont Analysis(%) EBIT margin 11.5 4.8 1.5 3.1 3.9 5.2 Tax retention ratio (%) 74.8 66.9 45.4 52.3 67.0 67.0 1.8 1.6 1.5 1.4 1.4 1.5 RoIC (Pre-tax) 20.1 7.9 2.2 4.5 5.6 7.9 RoIC (Post-tax) 15.1 5.3 1.0 2.4 3.7 5.3 Asset turnover (x) Cost of Debt (Post Tax) 5.7 5.5 2.3 2.5 2.9 2.8 Leverage (x) (0.1) (0.0) 0.1 0.3 0.4 0.4 Operating ROE 13.8 5.3 0.9 2.3 4.0 6.3 RoCE (Pre-tax) 33.7 13.4 3.7 7.8 9.8 13.7 Angel RoIC (Pre-tax) 20.5 8.0 2.3 4.6 5.6 8.0 RoE 32.1 10.9 2.4 6.8 11.1 15.4 Asset Turnover (Gross Block) (X) 3.0 2.7 2.5 2.4 2.4 2.5 Inventory / Sales (days) 41 39 43 45 44 44 Returns (%) Turnover ratios (x) Receivables (days) 86 92 95 91 95 93 133 130 137 143 143 130 37 43 39 26 23 31 (0.1) (0.0) 0.2 0.4 0.4 0.4 Net debt to EBITDA (0.2) (0.0) 2.0 2.0 1.8 1.5 Interest Coverage 33.5 9.6 2.5 4.3 5.7 8.4 Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to Equity October 21, 2014 11 Crompton Greaves | 2QFY2015 Result Update Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement Crompton Greaves 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors Ratings (Returns): October 21, 2014 Buy (> 15%) Reduce (-5% to -15%) Accumulate (5% to 15%) Sell (< -15%) Neutral (-5 to 5%) 12

© Copyright 2026