LDC Infrastructure Replacement and Expansion: Rate Issues Jesse S. Reyes

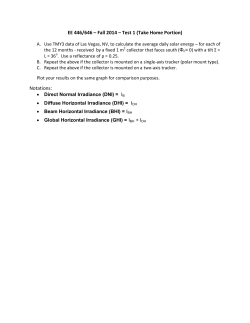

LDC Infrastructure Replacement and Expansion: Rate Issues Jesse S. Reyes Assistant Attorney General Massachusetts Attorney General’s Office June 17, 2014 INFRASTRUCTURE REPLACEMENT 2 Base Rate Cost of Service Approach • Base Rate Recovery Approach – Representative levels of cost • Depreciation expense fixed in rates over time • Declining actual depreciation creates funding for new cap-x (along with growth and debt) – The “old school” method • Regulatory lag provides some deterrence to excessive or imprudent investment • Less direct regulation of capital expenditures Capital Trackers: The Regulatory Challenge • Risk of costs recovered more than once – Many manifestations of this risk • Changes in accounting practices • Operational changes after program approval • Inadequate formula tariff • Cumbersome annual review process – Can be like a mini rate case Tracker Creation • By Commission – Discretionary: commissions sometimes reject requests to create special mechanisms – Some courts say a commission cannot change the cost recovery formula of a reconciling mechanism, outside of a base distribution rate proceeding. • E.g. Attorney General v. Department of Public Utilities, 453 Mass. 191 (2009); Consumers Organization For Fair Energy Equality v. Department Of Public Utilities, 368 Mass. 599 (1975). • By Legislature – e.g. An Act Relative to Natural Gas Leaks (Mass. H.4164 (2014)) Some Issues When Creating the Mechanism • Risk Reduction – If the company is able to recover a cost on a dollar-fordollar basis, it will face lower business risk, and require a lower rate of return to attract capital. – This lower return must be reflected in rates when the tracker goes into effect • Cost Purging – A full based rate case gives you the opportunity to ensure that all costs to be recovered through the tracker are first actually taken out of the distribution rates Recommended TIRF Conditions • • • • Pre-approved plan Metrics Rate Impact Cap Incremental costs only There Needs to Be a Plan • The company should be directed to implement a comprehensive risk management and asset management program based on sound risk analysis and economically driven decisions to achieve the lowest long-term total cost ways to manage risk levels going forward. – Set specific risk level targets, such as leak rates for unprotected steel pipe and cast iron, and develop coordinated maintenance, life extension, and replacement programs that achieve the targeted risk levels at the lowest long term total cost to the ratepayer. – Include appropriate assessment of root causes of the corrosion and other chronic problems, as well as full consideration of alternatives to replacement to mitigate risk and prioritize replacements of inside meters, services and mains to reduce the most risk first. • The absence of metrics, targets or to otherwise explain how it would measure the success of additional investments in achieving increased public safety leads to little or no accountability. Tracker Metrics • A leak reduction target or benchmark is needed. – The tracker is premised on the need to replace defective equipment that is a danger to the public. – We need to measure performance. • Examples: – Strict leak-rate based performance target of 5% per year reduction in corrosion-related leaks from mains and 7% per year reduction in corrosionrelated leaks from services. – ROE reduction: A direct one-to-one penalty provision on allowed return on investment associated with the mechanism, such that for every percentage point deficiency in the company’s leak reduction target, the company’s return on investment is also reduced by a percentage point. – Penalty and incentive: allowed rates of return should be adjusted to increase or decrease as leak performance improves or worsens. • The AGO recommended that a 25-basis point cap be placed on increases or decreases to allowed return on equity from these performance adjustments based on five-year average leak reduction rates determined prior to the adoption of the tracker. Recovery Should Be Capped • There needs to be a cap on amount recovered. – Massachusetts – 1.0% revenue increase cap based on total revenues. – Historically, the companies have invested far less in main and service replacement than allowed under the 1% rate impact cap. – Expenditures over the cap to be considered in next rate case under traditional ratemaking. Limit Recovery to Incremental Costs • All expenditures in the tracker program should be incremental investments to the amounts included in the test year rate base that are being recovered through base rates. • The Two-Step Test: – First, compare actual labor overheads and clearing account burdens charged to O&M each year of the tracker to the amount of O&M labor overheads and clearing account burdens included in the most recent base rate proceeding. • If actual O&M labor overheads and clearing account burdens charged to the tracker are less than the amounts included in base rates and amounts included in other trackers, (i.e. Pension and PBOPs), then reduce the total capitalized labor overheads and clearing account burdens in a given year of its tracker filing by the difference. • If the TIRF actual labor overheads and clearing account burdens charged to O&M expense exceed the level set in base rates and in the other trackers, then no such adjustment would be made. Limit Recovery to Incremental Costs (continued) – Second, demonstrate that the overall level of the actual capitalized labor overheads and clearing account burdens, as adjusted, are allocated equally to all capital projects in any given year, including tracker projects. – The cost recovery should be limited to the lesser of: (1) the total non-growth capital investments less the depreciation expense allowance included in base rates; and (2) actual TIRF capital investments. Used & Useful versus Plant Held for Future Use • Are they replacing worst first? – Look at leak rates. – Risk ranking. • Operational needs versus worst first. Used and Useful Versus Plant Held For Future Use (continued) • Network Analysis – Will replacement pipe generate higher deliverable volumes of gas? • Request contemporaneous documentation that the company should have retained and produced when replacement mains are not “like-for-like.” – Get the Network Analysis. This is a tool that permits the distribution engineer to examine the amount of deliverable volumes before and after a main segment replacement project. It is critical to evaluating the classification of tracker projects because it would provide the commission with objective analysis as to whether a project is designed for load growth or not, and thus appropriate for recovery in rate base at all or should be classified as plant held for future use. – “Replacement” does not necessarily mean the same size & pressure. Prudence: Escalation Of Costs • Prudence - Have the company’s replacement costs per mile of replaced main and replaced service increased? – Compare them to what they said when the commission approved the tracker. – Compare them to their peers. • Are the services being replaced when the main is replaced? LDC SYSTEM EXPANSION 16 Price Differentials SOURCE: Massachusetts Department of Energy Resources 17 Residential House Heating Fuels Connecticut Number Percent Number Percent 554,543 1,357,812 Total: Maine Massachusetts Number 1,249,253 49.53% 104,858 20.20% 208,173 50.39% 41,601 16.09% 2.72% 72,091 13.89% 10,361 2.51% 38,497 14.89% 7.56% 38,606 9.35% 12,532 41,477 7.48% Electricity 212,708 15.67% 23,260 4.19% 365,060 14.47% Fuel oil, kerosene 615,734 45.35% 374,110 67.46% 772,641 30.63% 39,257 245,324 47.26% 144,208 34.91% 4.85% 114,708 44.37% 716 0.28% 3,563 0.14% 593 0.11% 413 0.10% 76,225 13.75% 43,393 1.72% 43,948 8.47% 7,592 1.84% 635 0.11% 487 0.02% 593 0.11% 204 0.05% 206 0.08% 0.73% 6,995 1.26% 14,495 0.57% 7,870 1.52% 2,165 0.52% 3,749 1.45% 0.29% 942 0.17% 4,985 0.20% 4,603 0.89% 1,361 0.33% 460 0.18% 0.11% 27,351 2.01% 378 0.03% Other fuel 9,891 No fuel used 3,932 Solar energy 68,517 0.41% 1,526 Wood 258,520 413,083 3.23% Coal or coke Percent Number Percent 519,137 5.16% 43,849 Vermont 2,522,394 28,621 Bottled, tank, or LP Rhode Island Percent Number Percent Number 442,443 32.58% Utility gas New Hampshire 2,278 46,051 17.81% SOURCE: U.S. Census Bureau, 2012 American Community Survey 1-Year Estimates, B25040 (House Heating Fuel) 18 Policy Goals of an Expansion Program • • • • Reliability Affordability Fairness Economic efficiency Traditional Hurdle Rate Model • Method: NPV of cash flow stream discounted to the present by the hurdle rate (or calculate internal rate of return compared to hurdle rate). • Contribution in Aid of Construction (CIAC). • Ensures that new customers are not subsidized by existing customers. • Might be too conservative and miss investments that would have benefited customers. • CIAC plus cost of new heating system may be a barrier to efficient investment. Alternative Rate Mechanisms • CIAC financing (on-bill, or other programs) • Portfolio Approach – Pool customers in a geographic area. – “Open season” at a pre-announced CIAC level. • Zone Rate – Charge new customers a higher rate to fund expansion. – Need to comprehensively separate TIRF costs from expansion costs. Alternative Rate Mechanisms continued • Charge expansion cost to all new and existing customers – Although all customers benefit from expansion, economies of scope to existing customers are only residual compared to direct benefit to new customers. – This creates a subsidy. • Free Service Lines – Creates a subsidy, because only new customers benefit. Or, it could be viewed as a free loan from existing customers. – This could be mitigated by taking this out of base rates and adding it to a new on-main expansion rate. • Infrastructure Expansion Tracker – Same problems as TIRF. – Need to ensure that charges to existing customers are minimized.

© Copyright 2026