Morning Express Focus of the Day Consumer Staples Sector

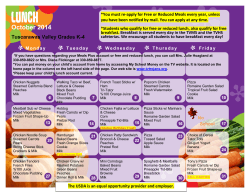

Morning Express 05 November 2014 Focus of the Day Indices Consumer Staples Sector Summer Breeze「夏天小语」: Reaffirm SELL on Want Want (151 HK) on market share loss risk Summer WANG [email protected] MP UP OP Yihaodian is marketing Anchor-branded UHT milk for children during 1-9 Nov. To our knowledge, this should be the first imported milk particularly for children (under a mainstream foreign dairy company/brand) sold at Yihaodian, the nation’s #1 e-commerce platform mainly for consumer staples. We highlight three selling points for Anchor’s children-oriented milk to the Chinese parents and grandparents: (1) 100% imported from New Zealand; (2) health benefits - using fresh milk (rather than milk powder) and fruit juice (instead of white sugar); and (3) “buy one pack, get one free” promotion by Yihaodian (though the promotion ads disappeared on 4 Nov quickly). In our opinion, Anchor could expand the production and increase penetration of its kids’ milk across China if this SKU receives positive feedback from the Chinese shoppers (which is highly possible). Coupled with a handful of other children milk launched by the domestic players, we believe bigger threats could be facing Want Want (151 HK) ahead. In light of the rising market share loss risk, we lower the target P/E to 20.8x (20% discount to Tingyi’s 26.0x, vs previously 10% discount). By rolling over to 2015E EPS (from 2014/15E EPS), we reach our new TP at HK$9.40 (from former HK$9.80). Reaffirm SELL on Want Want. Our preferred name in the dairy sector is Shengmu Organic Milk (1432 HK, BUY, TP HK$4.20) with notable re-rating potential. Brilliance China (1114.HK) Neutral More affirmative on the 2014 high-growth outlook Wei YAO Last Closing: HK$13.54 [email protected] Upside: +30.0% LT BUY BUY SELL Stock Target Price: HK$17.60→ 1. BMW GY released its 3Q results, of which 3Q investment gains reached 0.17 bn euro, equivalent to RMB1.389 bn, up 37% YoY. According to the corresponding relationship between the investment gains of BMW GY and that of Brilliance China, by our conservative estimate, 3Q investment gains of Brilliance China reached approximately RMB1.432 bn, accounting for approximately 79% of our estimated profit for 2H. The release of 3Q results will further strengthen the estimated Download our reports from Bloomberg: BOCM〈enter〉 Close HSI 23,846 H Shares 10,728 SH A 2,545 SH B 264 SZ A 1,414 SZ B 970 DJIA 17,384 S&P 500 2,012 Nasdaq 4,624 FTSE 6,454 CAC 4,130 DAX 9,166 Source: Bloomberg 1d % -0.29 0.63 0.03 -0.42 -0.55 -1.47 0.10 -0.28 -0.33 -0.52 -1.52 -0.92 Ytd % 2.31 -0.82 14.93 3.90 28.14 11.72 4.87 8.86 10.70 -4.37 -3.86 -4.04 Close 82.82 1,169.31 16.05 6,720.00 113.47 1.60 1.26 3m % -21.43 -9.27 -18.84 -5.01 -9.58 -5.21 -6.15 Ytd % -25.25 -3.01 -17.56 -8.70 -7.19 -3.33 -8.65 bps change HIBOR 0.37 US 10 yield 2.33 Source: Bloomberg 3m 0.00 -0.15 6m 0.00 -0.27 Indicators Brent Gold Silver Copper JPY GBP EURO HSI Technical HSI 50 d MA 200 d MA 14 d RSI Short Sell (HK$m) Source: Bloomberg BOCOM Int'l Corporate Access 11 Nov Kingsoft (3888.HK) 23,846 23,960 23,180 56 7,060 Morning Express 05 November 2014 completion rate for the whole year. 2. The profit margin of BMW Brilliance is set to exceed full-year guidance. 3. 3. BMW 3-series and X1 are drivers of growth for 2014. 4. The company will enter the stage of product introduction after 2016. 5. We maintain Buy. BMW’s 3Q results further affirmed the feasibility of our full-year assumptions. We still uphold our earnings estimates of the company, and anticipate 2014/15/16 EPS to be RMB1.06 /RMB 1.16 /RMB 1.42. The stock is trading at 14/15 PE of 10.1/9.2x, which is at the lower level of its historic valuation range. We maintain Buy rating and keep our TP of HK$17.6. Catalysts come from 1) the strong-than-expected monthly sales; 2) the swap of valuation base number by year end; and 3) better-than-expected annual results. The risks involved are attributable to the risk of economic downturn and lower-than-expected sales due to anti-monopoly. Hang Seng Index (1 year) 26,000 25,000 24,000 23,000 22,000 21,000 Source: Company data, Bloomberg HS China Enterprise Index (1 year) 13,000 12,000 11,000 10,000 9,000 8,000 Sohu (SOHU.US) Neutral Sogou and mobile games as near-term drivers; lift TP on improving Sogou performance Yuan MA Last Closing: US$50.3 BUY SELL [email protected] Upside: 17.3% LT BUY Source: Company data, Bloomberg Shanghai A-shares (1 year) Stock 2,600 Target Price: US$59.0↑ 2,400 Sohu 3Q14 bottom line beat consensus. Revenue was US$430mn, 2% lower than consensus but in line with our estimate. Sohu Video’s ad revenue grew by 40% YoY even though there were no popular TV shows during the quarter, in line with management guidance. Attributable to the strong licensed drama library and self-produced programs, Sohu video’s traffic in 3Q doubled from the level in the beginning of 2014. 60% of the total traffic was from mobile. The acquisition of 56.com will continue to contribute more contents in the future. Sogou’s revenue grew by 88% YoY and 16% QoQ. Sogou's mobile search traffic grew rapidly at 20% QoQ, though mobile search volume was still less than PC volume. Mobile revenue accounted for about 15% of its total revenue. We continue to be positive on Sogou as it is one of the only two companies that have search business on both PC and mobile. In addition, Wechat search differentiates itself from its competitors. Game revenue fell in 3Q, and is expected to grow by US$5-15mn driven by mobile games and newly launched MMO games. The resignation of Wang Tao won’t affect much of the company strategy and we believe Carol Yu, CFO of Sohu, who has been nominated as co-CEO, will have better control of the margin level of Changyou in the future. Lift TP to US$59 and maintain Neutral. HSBC (5.HK) Neutral Expense growth led to lower-than-expected earnings Shanshan LI Last Closing: HK$78.25 [email protected] Upside: +11.65% Target Price: HK$87.37→ Download our reports from Bloomberg: BOCM〈enter〉 LT BUY BUY SELL Stock 2,200 2,000 1,800 Source: Company data, Bloomberg Shenzhen A-shares (1 year) 1,500 1,400 1,300 1,200 1,100 1,000 900 800 Source: Company data, Bloomberg Morning Express 05 November 2014 9M14 net profit attributable to the shareholders of the parent company dropped 2.3% YoY, lower than the consensus of 4.8%, mainly due to the higher-than-expected operating expenses. The interest-earning assets of its major businesses declined QoQ. 9M14 cost efficiency ratio was 62.5%, up 2.9 ppts YoY, mainly due to lower revenue and higher expenses. The booked benchmark operating expenses rose 4.9% YoY, the first positive growth since 1Q13. 3Q14 NIM stabilized QoQ. Industrial, commercial and financial businesses showed better performance. The YoY decline in pre-tax profit mainly came from other businesses in Asia. We trim our FY14/15E earnings estimates by 3.1%/11.1%. Maintain Neutral. Energy Sector Bocom Energy Weekly Fei WU [email protected] MP UP OP This week, crude oil continued its slide to reach a four-year low. In China, a few oil services companies reported their Q3 operating data, in addition to the regular reporting from big oils and petrochemical companies. Cheung Kong (1.HK) Neutral HK$15.7bn-ticket to aircraft leasing Alfred Lau Last Closing: HK$135.50 BUY SELL [email protected] Upside: +7.2% LT BUY Stock Target Price: HK$145.2 What new? Cheung Kong announced the acquisition of 60 aircrafts (45 aircrafts + 15 aircrafts @ 60% stake) for US$2.02bn (or HK$15.7bn). All aircrafts are Boeing 737 or above class, or mostly Airbus A320 or above. The average age of the aircrafts is about 1.8-4.1 years, and they are currently leased to various airlines for 6-9 years in the remaining terms. The company views this segment as a long-term steady income stream for the group. Comment: The acquisition marks CK's further diversification and entry into the aircraft leasing business. Despite no profit forecast in the announcement, we estimate this aircraft leasing business could yield a gross recurring income of 5%+ or close to HK$800m per year. And we believe the company can finance the acquisition by internal resource, given its HK$33bn cash on hand and only 4.1% net gearing as of June 2014. We estimate net gearing will only increase to 8.4% following the acquisition, which is still low in our view. While we agree the aircraft acquisition is value-enhancing, this also suggests that CK, again, sees HK/China property not attractive enough as compared with the overseas infrastructure/utility business, which is also an advantage to the company, as it has a worldwide acquisition platform, tapping different cycles / entry points of various business globally. Therefore, we believe the company may not need to rush for property development and may see fewer catalysts in the near term. And we believe investors can also opt for Hutchison (13 HK, NR) if they are interested in overseas investment, as well as betting on Europe's recovery. We maintain Neutral on Cheung Kong, and a target price of HK$145.2, based on a 40% ex-Hutch NAV discount Download our reports from Bloomberg: BOCM〈enter〉 Morning Express Target company Aircrafts GECAS BOCA JSA MCAP and JVA 11 Airbus A320-200; 8 Boeing 737-800; 2 Boeing 737-900ER 3 Airbus A320-200; 1 Airbus A330-300; 1 Boeing 737-700 aircraft; 3 Boeing 737-800; 1 Boeing 737-900ER; 1 Boeing 777-300ER aircraft. 1 Airbus A319-100; 7 Airbus A320-200; 1 Airbus A321-200; 3 Boeing 737-800; 2 Boeing 737-900ER 8 Airbus A320-200; 5 Boeing 737-800; 1 Boeing 787-8; 1 Boeing 777-300ER Total Source: Company Download our reports from Bloomberg: BOCM〈enter〉 05 November 2014 Average age Average remaining lease term Consideration Consideration (years) 3.1 4.1 2.6 1.8 (years) 6.5 6.3 8.1 9.0 (US$m) 816 492 584 132 (HK$bn) 6.3 3.8 4.5 1.0 2,024 15.7 05 Nov 2014 「夏天小语 夏天小语」: 0005 Summer Breeze「 夏天小语 夏天小 语 」 Consumer Staples Sector UP MP Reaffirm SELL on Want Want (151 HK) on market share loss risk Yihaodian is marketing Anchor-branded UHT milk for children during 1-9 Nov. To our knowledge, this should be the first imported milk particularly for children (under a mainstream foreign dairy company/brand) sold at Yihaodian, the nation’s #1 e-commerce platform mainly for consumer staples. We highlight three selling points for Anchor’s children-oriented milk to Chinese parents and grandparents: (1) 100% imported from New Zealand; (2) health benefits - using fresh milk (rather than milk powder) and juice (instead of white sugar); and (3) “buy one pack, get one free” promotion by Yihaodian (though the promotion ads disappeared on 4 Nov quickly). In our opinion, Anchor could expand the production and increase penetration of its kids’ milk across China if this SKU receives positive feedback from the Chinese shoppers (which is highly possible). Coupled with a handful of other children milk launched by the domestic players, we believe bigger threats could be facing Want Want (151 HK) ahead. In light of the rising market share loss risk, we lower the target P/E to 20.8x (20% discount to Tingyi’s 26.0x, vs previously 10% discount). By rolling over to 2015E EPS (from 2014/15E EPS), we reach our new TP at HK$9.40 (from HK$9.80). Reaffirm SELL on Want Want. Our preferred name in the dairy sector is Shengmu Organic Milk (1432 HK, BUY, TP HK$4.20) with notable re-rating potential. OP Summer Wang [email protected] Tel: +852 2977 9221 Presently, Want Want is the only mainstream children milk brand which is made of milk powder. Other key players including Shengmu, Mengniu, Yili and Bright Dairy all use fresh milk to manufacture their UHT milk for children, while Shengmu and Mengniu even offer organic children’s milk. It is inevitable that Want Want would face tougher days ahead given the increasing availability of children milk with fresher raw material, in our view. Despite that Want Want may start to offer fresh milk-based dairy products (evidenced by its purchase of raw milk from Shengmu), it takes time. We currently forecast 1.5%/6.1% YoY growth of Want Want’s dairy revenue in 2H14E/2015E. The company’s dairy segment, led by Hot-kid milk, contributes almost 60% of Want Want’s operating profit. Our 2014-16E earnings forecasts are 6%-9% below street consensus. We believe market share gain with reduced product concentration risk would be the top thing to watch rather than margin progression on lower milk powder cost (largely factored in) in Want Want’s case in the next few years. Upside risk to our call includes its faster launch of new fresh milk-based dairy products. Figure 1: Prices of children-oriented UHT milk by brand Company BBG code Product name Chinese name Shengmu 1432 HK Shengmu organic children white milk Mengniu 2319 HK Future Star organic children white milk Fonterra FCG NZ Anchor children white milk MD Group NA Balibar children white milk Mengniu 2319 HK Future Star children white milk Yili 600887 CH QQ Star children white milk Bright Dairy 600597 CH Brigth Dudu children white milk Sanyuan 600429 CH Sanyuan children white milk Want Want 151 HK Hot-kid milk Overall average price Organic Non-organic 圣牧全程有机儿童奶 蒙牛未来星儿童成长有机牛奶 安佳新西兰进口儿童牛奶 芭乐芭全脂儿童成长纯牛奶 蒙牛未来星儿童成长牛奶 伊利QQ星儿童成长牛奶 光明嘟嘟儿童高品质牛奶 三元妙乐星儿童牛奶 旺仔牛奶 Source: BOCOM Int’l price check on Yihaodian on 4 Nov, 2014 Download our reports from Bloomberg: BOCM [enter] Key raw material Retail price Unit price Vs Overall Specification (RMB/box) (RMB/190ml) average price Organic fresh milk 62.8 5.2 9% 190ml x 12 Organic fresh milk 57.0 5.7 18% 190ml x 10 Fresh milk 168.0 6.2 29% 190ml x 27 Fresh milk 85.0 8.1 68% 200ml x 10 Fresh milk 42.9 3.6 -26% 190ml x 12 Fresh milk 54.0 3.6 -25% 190ml x 15 48.0 4.0 -17% 190ml x 12 Fresh milk 41.8 3.3 -31% 200ml x 12 Fresh milk 56.9 3.6 -25% 250ml x 12 Milk powder 4.8 5.5 14% 4.6 -4% Shelf life (months) 6 6 10 12 6 6 6 6 9 05 November 2014 Last Closing: US$50.3 Upside: 17.3% Target Price: US$59.0↑ Internet Sector Sohu (SOHU.US) UP MP Sogou and mobile games as near-term drivers; lift TP on improving Sogou performance OP Financial Highlights Y/E 31 Dec 2012 Revenue (US$m) 1,067 YoY growth 25% Net profit (US$m) 177 YoY growth -23% EPS (US$) 2.55 DPS (US$) Dividend yield PE 19.8 Source: Company, BOCOM Int’l estimates 2013 1,400 31% 167 -6% 1.84 27.3 2014E 1,662 19% -184 -210% -3.54 -14.2 2015E 2,114 27% -158 -14% -2.85 -17.7 2016E 2,473 17% 8 -105% 0.70 71.5 Stock Attributable to Sohu’s strong library of licensed drama and self produced programs, its video traffic in 3Q doubled from the beginning of 2014, 60% of the total traffic was attributable to mobile. The acquisition of 56.com will continue to offer more diversified contents in the future. We continue to be positive on Sogou as it is one of the only two companies that have search business for both PC and mobile. In addition, Wechat search has differentiated itself from its competitors. Management expects 3.3%-10% QoQ growth in revenue in 4Q14, given the good performance of Fantasy Frontier ol and TLBB. We think the resignation of Mr. Wang Tao will not change the company’s key strategy in both PC and mobile fields. With the nomination of Carol Yu, CFO of Sohu, as co-CEO, we believe the company will better control the margin level of Changyou in the future. Maintain Neutral and lift TP to US$59. Video ads to drive further ad revenue growth. 1) Branded ad revenue grew by 19% YoY and 12% QoQ, respectively to US$149mn in 3Q14. 2) Auto, FMCG and real estate ad contributed 20% of total branded ad revenue. 3) Sohu Video’s ad revenue grew by 40% YoY, even when there were no popular TV shows during the quarter. The growth was in line with management guidance. Attributable to strong licensed drama library and self produced programs, Sohu video’s traffic in 3Q doubled from the beginning of 2014. 60% of the total traffic was attributable to mobile. The acquisition of 56.com will continue to offer more diversified contents in the future, i.e. UGC (user generated content/PGC (professional generated content)), which will also help increase Sohu video penetration in the future. A subscription fee model in the forms of either monthly payment or pay–to-watch model is to be rolled out soon. Game revenue fell in 3Q. We expect growth of US$5-15mn driven by mobile games and newly launched MMO games; the resignation of Wang Tao won’t affect much of the company’s strategy. Game revenue decreased by 2% QoQ and 7% YoY to US$150mn, lower than the management guidance of US$158-163mn. The decrease was mainly due to the reduced revenue from TLBB given the new strategy of TLBB featuring an easier play mode, the lower user spending in the short run and the decrease of web games Wartune and DDTank. Average MAU (MMO/web games/mobile games) during the quarter increased from 24mn to 29mn sequentially, mainly due to growing active accounts of TLBB after the release of new expansion packs and the launch of new game – Fantasy Frontier ol (幻想神域). MAU of the Changyou 17173 platform channel grew to 275mn, up 9% QoQ and 178% YoY, attributable to the company’s continuous focus on its mobile expansion strategy. Among the users, there were 84mn MAU of mobile apps, and users of 17173 website doubled from last year as video contents increased. Besides TLBB, newly launched game Fantasy Frontier ol received very positive feedback during the quarter, with 100k PCU in the 1st week of launch. Web games have entered into the maturity phase. The company would focus more on the operation of the web game platform and has seen positive result with about US$2mn in revenue increase. On the mobile front, the mobile version of TLBB 3D was launched on 29 Oct and the DAU passed 1mn on the first day of launch. By year-end, another new game Echo of Souls (灵魂回响), together with some new mobile games, ie, Qin Shi Ming Yue (秦时明月) are scheduled to be launched. Management expects 3.3%-10% QoQ growth in revenue in 4Q14, given the good performance of Fantasy Frontier ol and TLBB. We think that the resignation of Mr. Wang Tao will not change the company’s key strategy in both PC and mobile fields. Carol Yu, CFO of Sohu, was nominated as Co-CEO, who will have better control of the margin level of Changyou in future. Lift TP to US$59; maintain Neutral. The company will maintain Changyou’s strategy of investing in in the Internet field and also expanding into the mobile game business. Adding that spending on videos and Sogou will continue, we maintain our rating but lift TP to US$59, on better-than-expected Sogou performance. In addition, we think that the appointment of Carol Yu may improve Changyou’s margin and the new management team may change the company’s future investment strategy. Download our reports from Bloomberg: BOCM〈enter〉 BUY SELL 3Q14 bottom line beat consensus: Non-GAAP fully diluted EPS attributable to Sohu was US$-0.61, better than consensus of US$-0.825 and our estimate of US$-0.85. Revenue was US$430mn, up 8% QoQ and 17% YoY, 2% lower than consensus but in line with our estimate. Net loss before non-controlling interest was US$32mn and non-GAAP net loss attributable to Sohu was US$22mn, better than the management guidance of a net loss of US$29-33mn. Sogou was profitable for two consecutive quarters, driven by strong revenue growth. Sogou’s revenue grew by 88% YoY and 16% QoQ. Sogou's mobile search traffic grew rapidly with a 20% QoQ growth, though the mobile search volume was still less than that of PC. Mobile revenue accounted for about 15% of the total revenue. Sogou has 50-60k clients and spending per customer of USD1,500, up 18% QoQ. Mobile RPM (revenue per thousand searches) was 40% of that of PC. Sogou’s PC RPM was 60% higher than its competitors, but mobile RPM was 50% lower than its peers. Mobile CPC is close to the PC side. We continue to be positive on Sogou as it is one of the only two companies that have search business for both PC and mobile. In addition, Wechat search differentiates itself from its competitors. LT BUY Neutral Stock data 52w High 52w Low Market cap (US$m) Issued shares (m) Avg daily vol (m) 1-mth change(%) YTD change(%) 50d MA 200d MA 14-day RSI Source: Company data, Bloomberg 87.68 42.03 1,935 38 1.16 3.16 -31.03 50.61 59.94 61.82 1 Year performance chart sohu us Equity AHXH Index MXCN Index 40% 20% 0% N/13 J/14 A/14 J/14 -20% -40% Source: Company data, Bloomberg Ma Yuan (Martina), Ph.D [email protected] Tel: (8610) 8800 9788 - 8039 Gu Xinyu (Connie), CPA [email protected] Tel: (8610) 8800 9788 - 8045 S/14 05 November 2014 Energy Weekly Energy Sector Bocom Energy Weekly MP UP OP Sector news around the block Sinopec Yizheng Chem (1033 HK) loss Rmb2bn in first three quarter. Yizheng’s Q3 recorded a net loss Rmb 262m to bring the first three quarters of loss to Rmb2bn from a net loss of Rmb0.69bn in the same period last year. Yizheng had initiated a reform plan to acquire Sinopec Oilfield Service Co in Sep. to avoid a third consecutive year of loss. This week’s energy updates: Sinopec buy Saudi refinery stake with US$562mn. Russia and Ukraine reached gas agreement. Anton Oil (3337 HK) released strategy guidelines for next three years. Anton announced strategy guideline for 2015 to 2017 on Nov 03, with 2015 order backlog details for the two segments. For the production operation service business, the executable part of its order backlog in 2015 amounts to about Rmb140mn, in addition to Rmb150mn for the workover service business. Yizheng Chemical (1033 HK) loss Rmb2bn in first three quarter NDRC oil product prices were adjusted down on Oct 17, for the seventh consecutive time. rd PetroKing (2178 HK) announced Q3 operating data. The company released 3 quarter operating data on Oct 31. For the production enhancement business, 54 wells in China, of which 43 wells were fully completed. Drilling business achieved 12 wells in China and 10 wells were completed. Its well completion business provides five wells, of which four were completed. The company commented the domestic market showed signs of recovery in Q3 compared with 1H this year. Brent Crude Price USD/bbl Brent 120 Brightoil bid Newfield Global for upstream assets. Brightoil Petroleum said Monday that low oil prices are prompting it to bid. Newfield indirectly holds interests in 2 upstream oil and gas blocks in China, 12% interest in Bohai bay block 05/36 and a 49% interest in Pearl River Block 16/05. The bid results will come out in Dec this year. NDRC oil product prices adjusted down (Oct 31, 2014). NDRC’s latest product price adjustment on Oct 31 saw gasoline and diesel prices adjusted down Rmb245/tonne and Rmb235/tonne (Rmb0.18/liter and Rmb0.20/liter), decreasing 3.2% and 3.4%, respectively. Prices have been cut seven times since June 23; gasoline and diesel prices dropped 1325 and 1275 Rmb/tonne. 115 110 105 100 95 90 85 80 75 Nov-13 Jan-14 Mar-14 Performance O&G Last Price Jul-14 Sep-14 WTI Crude Price USD/bbl WTI 120 Share price performance & commodities May-14 Source: Company data, Bloomberg 115 1-D 1-Week 1-mth 3-mth 1H 2014 chg(%) chg( %) chg(% ) chg(%) chg (%) 1-yr YTD chg(%) chg(%) 110 105 100 95 PetroChina 857 HK Equity Sinopec 386 HK Equity CNOOC 883 HK Equity Gas Utility Hong Kong China Gas 3 HK Equity ENN Energy 2688 HK Equity China Resource Gas 1193 HK Equity Tianlun Gas 1600 HK Equity Chem Shanghai Petrochemical338 HK Equity Oil Services COSL 2883 HK Equity Hilong 1623 HK Equity Comm odities Brent WTI Dubai Cinta Henry hub Index EUCRBREN Index USCRWTIC Index PGCRDUBA Index APCRCNTA Index NGUSHHUB Index HSI Shanghai S&P 500 HSI Index SHCOMP Index SPX Index 9.60 6.66 12.02 0.4 0.0 -1.3 0.3 0.0 -3.4 -4.0 -0.4 -8.5 -5.0 -11.9 -14.8 15.2 16.7 -3.5 9.2 4.4 -22.6 12.9 5.2 -16.6 18.12 50.00 21.70 8.99 -0.3 -1.0 -1.4 0.8 0.7 -7.9 -2.5 -1.2 7.3 -1.6 1.9 -3.1 6.5 -10.9 -12.9 -2.8 -4.6 -2.9 -9.6 25.7 8.9 12.5 7.7 29.4 12.1 -12.8 -19.6 22.1 2.41 1.3 1.7 -6.2 -2.0 -3.1 19.9 8.1 15.44 2.72 -2.3 6.3 -12.2 7.1 -23.2 -15.8 -20.4 -38.3 -22.5 -42.0 -30.9 -51.0 -35.8 -59.0 83.1 78.8 80.8 82.7 3.7 -0.6 -2.2 -3.0 0.3 -1.9 -2.6 -2.7 -3.8 -0.5 4.7 -9.1 -12.2 -12.4 -8.6 -6.0 -20.3 -19.5 -22.4 -19.1 -1.0 1.1 13.1 -2.4 0.4 2.7 -21.3 -16.7 -22.9 -23.9 7.3 -25.1 -20.0 -25.2 -24.6 -14.6 23846 2431 2018 -0.3 0.0 0.0 3.4 2.8 2.5 -3.1 9.3 4.1 2.8 13.1 14.1 2.3 14.9 9.2 90 85 80 75 Nov-13 Jan-14 Mar-14 May-14 Source: BOCOM Int’l, Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 -0.5 -3.2 10.9 Sep-14 Source: Company data, Bloomberg Fei Wu [email protected] Tel: (852) 2977 9392 Tony Liu 1.4 4.0 2.9 Jul-14 [email protected] Tel: (852) 2977 9390 Morning Express 05 November 2014 Market Review Hong Kong stocks fell on Tuesday. The Hang Seng Index dropped 70 points, or 0.3%, to close at 23,845. The decline was mainly led by casino operators and developers. Sands China (1928.HK) fell 3.3% and Galaxy Entertainment (27.HK) dropped 2.8% as gambling revenue in Macau fell by 23% YoY in October. Hong Kong developers slumped after Fed officials said an interest raise rise may come earlier than expected. Cheung Kong (1.HK) fell 1.7% and Wharf (4.HK) dropped 1.9%. Mainland lenders rose. CQRCB (3618.HK) jumped 4.1% and Bank of Chongqing (1963.HK) gained 1.7%. The S&P 500 closed at 2,012.10 on Tuesday, down 5.71 points, with energy shares leading the market lower as crude oil prices declined for a fourth straight day. The DJIA gained 17.60 points, or 0.1%, to 17,383.84. European stocks fell. The Stoxx Europe 600 slumped 1.01% to close at 330.88. News Reaction Mainland government studying the likely loosening of the NPL write-off mechanism. As reported, the mainland government is drafting measures to reduce and waive loans of financial enterprises. The policy is set to be rolled out in the near term and the centerpiece of which is to strengthen the reduction, waiver and write-off of bad debts of financial enterprises, especially banks, so as to eliminate banks’ concerns on the grant of SME loans. Interbank deposits of domestic banks hurdled over RMB100 bn for 3 consecutive months. It is reported that interbank deposits continued to exhibit strong growth. Since Aug, the amount of banks’ interbank deposits issued surged. As estimated by WIND, the issue volume of interbank deposits in July had not yet reached RMB50 bn (RMB hereafter), and soared to more than RMB100 bn for three consecutive months afterwards with new record highs constantly. The issue volume in Oct reached RMB175.3 bn. Repurchase of PBOC reached RMB20 bn with interest rate flat at 3.4%. PBOC announced that a RMB20 bn 14-day repurchase exercise had been undertaken in the open market today at a bid rate maintained at 3.4%. SGCC commenced construction of UHV Project with a total investment of RMB68.3 bn. SGCC commenced construction of its ‘‘Two AC, One DC’’ UHV project. The construction covered Huinan-Nanjing-Shanghai, Ximeng-Shandong and Nindong-Zhejiang, involving a total investment of RMb6.83 bn. All construction will be completed and put into production in 2016, adding 26 GW to the transmission capacity. Download our reports from Bloomberg: BOCM〈enter〉 Morning Express 05 November 2014 Economic releases for this week - USA Date Time 5-Nov 6-Nov 7-Nov 7-Nov 7-Nov Source: Bloomberg Event MBA mortgage applications Initial jobless claims (k) Change in Non-farm payrolls(k) Change in Private payrolls(k) Unemployment rate Economic releases for this week - China Survey 230.0 225.0 5.9% Prior -6.6% 287.0 248.0 236.0 5.9% Date Time - Event - Survey - Prior - Source: Bloomberg BOCOM Research Latest Reports Data 04 Nov 2014 04 Nov 2014 04 Nov 2014 03 Nov 2014 03 Nov 2014 Report COSL (2883.HK) - Take advantage of recent fall - Solid Q3 results point to real value; Re-iterate BUY Container Shipping Sector - Weekly container shipping commentary Insurance Sector - Raising mainland insurers' earnings on strong 3Q results; Maintain Outperform Neptune Orient Limited (NOL.SP) - Downgrade on weak 3Q14 Property Sector - Not yet a turning point 01 Nov 2014 01 Nov 2014 01 Nov 2014 01 Nov 2014 01 Nov 2014 01 Nov 2014 30 Oct 2014 Energy Sector - Time to switch into Sinopec - PetroChina and Sinopec's Q3 results read-through China Southern Airlines (1055.HK) - 3Q14 results review - improving as expected Transportation Sector - Weekly transportation news wrap ASM Pacific (522.HK) - 186% growth in net profit CITICS (6030.HK) - 3Q review; Buy maintained Baidu (BIDU.US) - 3Q14 results beat; another investment year to come with O2O Guangshen Railway (525 HK) - 3Q14 results review - 3Q14 improvement insufficient to lift YTD performance CNOOC (883.HK) - Uncertainty looms - Lower crude price, higher cost and flat production in the near future SITC (1308.HK) -3Q14 result review - average freight rate ahead of our expectation Vinda (3331 HK) - Better positioned in China's growth game; BUY Digital China (861.HK) - Distribution business grew for four consecutive quarters Energy Sector - Bocom Energy Weekly Air China (753.HK) - 3Q14 results review - RMB appreciation during the quarter reduced forex loss in 1H14 Sinopharm (1099.HK) - 1-3Q14 Results In line; Maintain "Buy" with TP of HK$34.00 Biostime (1112 HK) - Second downward guidance in 2014; cut TP 30 Oct 2014 30 Oct 2014 30 Oct 2014 29 Oct 2014 29 Oct 2014 29 Oct 2014 28 Oct 2014 28 Oct 2014 Source: Company data, BOCOM International Download our reports from Bloomberg: BOCM〈enter〉 Analyst Fei Wu, Tony Liu Geoffrey Cheng, CFA Li Wenbing Geoffrey Cheng, CFA Luella Guo, Alfred Lau, CFA, FRM, Toni Ho, CFA, FRM Fei Wu, Tony Liu Geoffrey Cheng, CFA Ian Feng, Geoffrey Cheng, CFA Miles XIE Li Wenbing Ma Yuan (Martina), Ph.D, Gu Xinyu (Connie), CPA Geoffrey Cheng, CFA Fei Wu, Tony Liu Geoffrey Cheng, CFA Summer Wang Miles XIE Fei WU, Tony LIU Geoffrey Cheng, CFA Johnson Sun, Milo Liu Summer Wang Morning Express 05 November 2014 Hang Seng Index Constituents Company name Cheung Kong Hang Lung Proper Hengan Intl China Shenhua-H Hang Seng Bk China Res Land Cosco Pac Ltd Henderson Land D Aia Group Ltd Hutchison Whampo Kunlun Energy Co Ind & Comm Bk-H China Merchant Want Want China Sun Hung Kai Pro New World Dev Belle Internatio China Coal Ene-H Swire Pacific-A Sands China Ltd Clp Hldgs Ltd Bank East Asia Ping An Insura-H Boc Hong Kong Ho China Life Ins-H Citic Pacific China Res Enterp Cathay Pac Air Hong Kg China Gs Tingyi Hldg Co Esprit Hldgs Bank Of Commun-H China Petroleu-H Hong Kong Exchng Bank Of China-H Wharf Hldg Li & Fung Ltd Hsbc Hldgs Plc Power Assets Hol Mtr Corp China Overseas Tencent Holdings China Unicom Hon Sino Land Co China Res Power Petrochina Co-H Cnooc Ltd China Const Ba-H China Mobile Lenovo Group Ltd Hang Seng Index BBG code 1 HK 101 HK 1044 HK 1088 HK 11 HK 1109 HK 1199 HK 12 HK 1299 HK 13 HK 135 HK 1398 HK 144 HK 151 HK 16 HK 17 HK 1880 HK 1898 HK 19 HK 1928 HK 2 HK 23 HK 2318 HK 2388 HK 2628 HK 267 HK 291 HK 293 HK 3 HK 322 HK 330 HK 3328 HK 386 HK 388 HK 3988 HK 4 HK 494 HK 5 HK 6 HK 66 HK 688 HK 700 HK 762 HK 83 HK 836 HK 857 HK 883 HK 939 HK 941 HK 992 HK Share price (HK$) 135.50 24.00 80.75 21.55 131.10 18.62 10.60 52.10 43.05 97.10 10.18 5.09 25.35 10.06 115.30 9.68 9.76 4.73 102.90 46.80 66.60 32.35 62.70 25.80 23.00 13.58 18.32 14.68 18.12 19.04 9.83 5.81 6.66 173.10 3.72 55.30 9.28 78.25 74.45 31.15 22.85 122.70 11.48 12.66 22.10 9.60 12.02 5.76 96.65 11.40 Mkt cap (HK$m) 313,840 107,646 99,064 393,316 250,643 108,577 31,169 156,318 518,542 413,973 82,177 1,663,342 64,576 132,752 314,631 83,877 82,318 76,276 150,093 377,508 168,262 75,921 454,367 272,778 589,305 338,187 44,218 57,749 190,543 106,680 19,096 419,377 773,989 202,184 1,004,018 167,566 77,584 1,501,477 158,896 181,379 186,775 1,149,205 274,512 76,158 106,006 1,799,590 536,662 1,435,399 1,969,681 126,639 5d chg (%) 0.9 2.8 5.1 1.4 0.8 5.0 4.7 0.2 1.1 -0.5 -1.4 0.8 4.5 3.0 0.5 0.5 4.7 3.1 1.8 4.7 0.7 1.1 2.9 1.4 2.9 -0.1 -0.5 2.4 0.7 0.3 -3.6 1.6 0.0 2.3 1.1 -1.3 0.5 -0.8 0.1 0.0 4.6 2.2 0.9 1.3 3.5 0.3 -3.4 1.2 5.7 -0.5 Ytd chg (%) 16.8 -2.0 -11.8 -11.9 4.3 -3.1 -0.4 29.5 10.7 -1.5 -25.5 -2.9 -10.4 -10.2 17.2 5.0 8.8 8.5 13.2 -25.1 8.6 -1.5 -9.7 3.8 -5.2 14.5 -28.9 -10.5 12.1 -15.0 -34.2 6.2 5.2 33.9 4.2 -6.7 13.1 -7.0 20.8 6.1 4.8 24.0 -1.0 19.4 20.2 12.9 -16.6 -1.5 20.2 20.9 23,845.7 14,642,981 1.4 2.3 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) 152.00 105.95 27.00 19.80 99.70 74.05 27.00 19.12 133.00 117.60 22.55 13.62 11.92 9.40 56.40 36.46 44.20 34.65 108.50 86.88 14.82 10.00 5.66 4.33 29.80 22.75 13.10 9.32 120.20 90.35 10.48 7.15 10.58 7.25 5.26 3.72 108.00 80.55 68.00 38.70 67.80 56.00 35.00 28.50 76.50 55.60 26.65 21.50 25.80 19.72 16.88 9.35 27.90 18.14 17.26 13.56 18.40 13.91 23.65 17.82 17.42 9.70 5.98 4.53 8.23 5.73 185.00 112.80 3.79 3.03 66.30 46.35 10.70 7.72 87.35 75.75 75.85 57.85 32.30 26.55 24.60 17.52 134.00 77.56 14.22 9.03 14.16 9.83 24.90 17.10 11.70 7.31 16.06 11.42 6.37 4.89 102.20 63.65 12.70 7.62 25,363.0 21,137.6 –––––––––– PE ––––––––––– 2013A 2014E 2015E (X) (X) (X) 7.3 8.8 9.1 14.1 17.5 16.9 27.3 26.0 21.6 7.9 8.6 8.5 15.0 14.7 13.5 7.1 9.3 8.0 13.6 12.1 10.8 8.7 16.5 16.5 27.2 21.1 18.4 8.8 12.3 11.4 12.9 12.9 11.8 5.1 5.1 4.8 14.7 15.2 13.8 24.6 24.0 20.9 9.3 14.9 13.9 7.3 10.9 10.7 14.5 14.2 13.3 35.9 40.1 25.0 11.8 14.8 13.6 18.4 17.9 16.1 18.7 15.9 15.6 10.9 11.7 11.1 12.4 10.7 9.6 11.8 11.1 10.1 19.1 15.5 13.3 9.6 9.6 8.2 24.1 33.9 27.3 19.6 17.1 11.7 27.4 25.4 23.4 21.8 27.0 22.1 90.0 31.5 20.0 5.3 5.2 5.0 8.9 9.1 8.9 43.7 38.6 29.3 4.9 4.9 4.6 7.0 14.1 12.4 11.9 18.1 15.8 12.7 11.2 10.3 2.5 18.0 18.3 12.2 17.5 16.1 7.5 8.1 7.0 44.4 37.0 27.9 17.2 16.6 14.3 8.5 14.4 14.0 9.1 8.6 7.9 10.5 10.5 10.0 7.6 7.8 7.9 5.0 4.9 4.6 13.2 14.0 13.9 17.8 17.3 14.9 10.3 11.0 10.2 Yield P/B (%) 2.6 3.1 2.3 5.4 4.2 2.4 2.9 1.9 1.0 2.4 2.3 N/A 3.0 2.7 2.9 4.3 1.0 2.2 3.5 3.7 3.9 3.4 1.4 3.9 1.7 2.0 1.4 1.8 1.8 1.5 0.7 N/A 4.6 2.1 6.7 3.2 5.1 4.9 3.5 3.0 2.1 0.2 1.8 3.9 3.4 4.2 4.8 6.6 3.3 2.1 (X) 0.8 0.9 6.0 1.2 2.3 1.3 0.9 0.6 2.4 1.0 1.6 1.0 1.0 9.1 0.8 0.5 2.5 0.6 0.7 9.3 1.9 1.1 1.9 1.6 2.1 0.6 0.9 0.9 3.8 4.8 1.1 0.7 1.0 9.1 0.8 0.6 2.1 1.0 1.3 1.2 1.6 12.9 1.0 0.7 1.6 1.2 1.2 0.9 1.9 4.7 3.6 1.3 Morning Express 05 November 2014 China Ent Index Constituents Company name Shandong Weig-H China Shenhua-H Sinopharm-H China Shipping-H Zoomlion Heavy-H Yanzhou Coal-H Agricultural-H New China Life-H Ind & Comm Bk-H Tsingtao Brew-H China Com Cons-H China Coal Ene-H China Minsheng-H Guangzhou Auto-H Ping An Insura-H Picc Property & Great Wall Mot-H Weichai Power-H Aluminum Corp-H China Pacific-H China Life Ins-H China Oilfield-H Zijin Mining-H China Natl Bdg-H Bank Of Commun-H Jiangxi Copper-H China Petroleu-H China Rail Gr-H China Merch Bk-H Bank Of China-H Dongfeng Motor-H Citic Securiti-H Haitong Securi-H China Telecom-H Air China Ltd-H Petrochina Co-H Huaneng Power-H Anhui Conch-H China Longyuan-H China Const Ba-H China Citic Bk-H Hang Seng China Ent Indx BBG code 1066 HK 1088 HK 1099 HK 1138 HK 1157 HK 1171 HK 1288 HK 1336 HK 1398 HK 168 HK 1800 HK 1898 HK 1988 HK 2238 HK 2318 HK 2328 HK 2333 HK 2338 HK 2600 HK 2601 HK 2628 HK 2883 HK 2899 HK 3323 HK 3328 HK 358 HK 386 HK 390 HK 3968 HK 3988 HK 489 HK 6030 HK 6837 HK 728 HK 753 HK 857 HK 902 HK 914 HK 916 HK 939 HK 998 HK Share price (HK$) Mkt cap (HK$m) 5d chg (%) Ytd chg (%) 7.90 21.55 31.65 5.45 4.33 6.51 3.58 28.80 5.09 55.60 6.57 4.73 7.68 7.00 62.70 14.18 36.15 30.20 3.47 28.85 23.00 15.44 1.99 7.28 5.81 13.90 6.66 5.04 14.52 3.72 11.28 19.26 13.24 4.95 5.17 9.60 9.52 25.55 8.20 5.76 5.04 35,363.34 393,315.78 81,286.48 23,903.74 47,803.19 47,009.62 1,056,920.94 105,394.86 1,663,341.87 70,070.40 120,379.37 76,276.09 270,083.37 58,202.42 454,367.43 192,906.67 117,458.87 54,369.68 62,268.02 236,516.63 589,304.52 96,457.92 66,121.21 39,304.91 419,376.93 56,644.43 773,988.84 119,148.53 343,872.66 1,004,018.25 97,189.84 186,462.03 128,914.70 400,615.25 73,934.64 1,799,590.33 120,636.77 119,252.60 65,898.39 1,435,398.80 268,749.48 2.9 1.4 5.3 13.1 19.6 3.8 0.6 2.5 0.8 -0.6 14.3 3.1 1.3 -3.0 2.9 2.3 12.8 6.0 6.4 0.5 2.9 -12.2 3.1 2.7 1.6 7.9 0.0 8.9 3.7 1.1 -4.1 5.7 6.1 0.8 8.6 0.3 8.1 1.6 8.2 1.2 1.4 -24.5 -11.9 42.2 -9.5 -40.2 -8.1 -6.0 10.8 -2.9 -15.2 5.1 8.5 7.0 -17.5 -9.7 23.3 -15.5 -3.4 28.5 -5.1 -5.2 -35.8 19.9 -12.7 6.2 -0.7 5.2 26.0 -12.1 4.2 -7.1 -8.9 -1.9 26.3 -10.7 12.9 35.8 -11.1 -17.9 -1.5 19.7 11.2 27.0 31.8 6.3 8.0 8.7 4.1 29.7 5.7 68.3 6.7 5.3 8.2 10.9 76.5 15.0 48.9 35.5 3.9 33.5 25.8 26.0 2.2 9.1 6.0 15.4 8.2 5.1 17.6 3.8 15.2 21.7 14.5 5.2 6.3 11.7 9.7 35.7 10.3 6.4 5.3 6.9 19.1 19.7 4.0 3.5 4.9 3.0 21.1 4.3 53.1 4.9 3.7 5.9 6.7 55.6 9.8 26.1 25.8 2.5 23.6 19.7 15.0 1.6 6.7 4.5 11.6 5.7 3.0 12.1 3.0 9.6 13.7 9.5 3.1 4.2 7.3 6.1 24.2 7.1 4.9 3.6 64.6 7.9 25.0 N/A 14.2 6.8 5.1 11.8 5.1 29.8 6.5 35.9 4.6 11.3 12.4 14.2 10.7 9.1 N/A 19.3 19.1 7.1 16.0 5.0 5.3 10.7 8.9 8.5 5.0 4.9 5.7 21.1 23.7 17.0 19.1 10.5 9.2 8.8 26.7 5.0 4.6 26.3 8.6 22.7 48.3 11.6 18.6 5.0 10.5 5.1 29.0 6.2 40.1 4.3 9.7 10.7 12.3 10.6 10.2 N/A 17.7 15.5 7.2 14.4 5.4 5.2 13.9 9.1 8.1 5.0 4.9 6.0 22.4 18.5 16.8 16.1 10.5 8.6 9.1 19.5 4.9 4.5 10,728 4,307,638 1.7 -0.8 11,638.3 9,159.8 7.4 7.3 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) ––––––––––– PE ––––––––––– 2013A 2014E 2015E (X) (X) (X) Yield P/B (%) (X) 21.6 8.5 18.9 14.9 9.8 15.9 4.6 9.5 4.8 25.2 5.8 25.0 4.1 7.6 9.6 11.0 8.3 9.8 N/A 15.1 13.3 7.0 14.1 5.0 5.0 14.0 8.9 7.4 4.5 4.6 5.6 19.4 15.8 15.2 11.7 10.0 8.4 8.4 14.3 4.6 4.2 1.0 5.4 1.0 0.0 4.4 0.4 N/A 0.7 N/A N/A 3.6 2.2 2.6 3.3 1.4 2.0 2.9 1.0 N/A 1.8 1.7 3.5 N/A 2.8 N/A 4.6 4.6 1.7 5.4 6.7 2.0 N/A 1.1 2.4 1.1 4.2 5.1 1.7 0.7 6.6 N/A 3.0 1.2 2.9 0.7 0.6 0.6 1.0 1.6 1.0 3.8 0.9 0.6 0.9 1.0 1.9 2.4 2.9 1.5 0.9 1.9 2.1 1.3 1.3 0.9 0.7 0.9 1.0 1.0 1.0 0.8 1.1 1.8 1.6 1.1 1.0 1.2 1.6 1.8 1.6 0.9 0.7 6.7 4.4 1.1 Morning Express 05 November 2014 BOCOM International 11/F, Man Yee Building, 68 Des Voeux Road, Central, Hong Kong Main: + 852 3710 3328 Fax: + 852 3798 0133 Rating System Company Rating www.bocomgroup.com Sector Rating Buy: Expect more than 20% upside in 12 months LT Buy: Expect more than 20% upside but longer than 12 months Neutral: Expect low volatility Sell: Expect more than 20% downside in 12 months Outperform (“OP”): Expect more than 10% upside in 12 months Market perform (“MP”): Expect low volatility Underperform (“UP”): Expect more than 10% downside in 12 months Research Team Head of Research @bocomgroup.com Raymond CHENG, CFA, CPA, CA (852) 2977 9393 raymond.cheng (852) 2977 9384 hao.hong (852) 2977 9212 yangqingli Shanshan LI, CFA (86) 10 8800 9788 - 8058 lishanshan Li WAN, CFA (86) 10 8800 9788 - 8051 Wanli Strategy Economics Hao HONG, CFA Banks Consumer Discretionary (86) 10 8800 9788 - 8043 miaoxian.li Fei WU (852) 2977 9392 fei.wu Tony LIU (852) 2977 9390 xutong.liu Alfred LAU, CFA, FRM (852) 2977 9235 alfred.lau Toni HO, CFA, FRM (852) 2977 9220 toni.ho Luella GUO (852) 2977 9211 luella.guo (86) 21 6065 3606 louis.sun (852) 2977 9209 lizhiwu (852) 2977 9216 miles.xie Geoffrey CHENG, CFA (852) 2977 9380 geoffrey.cheng Ian FENG (852) 2977 9381 Yinan.feng (86) 21 6065 3675 wei.yao Property Phoebe WONG (852) 2977 9391 phoebe.wong Anita CHU (852) 2977 9205 anita.chu Consumer Staples Renewable Energy Summer WANG (852) 2977 9221 summer.wang Shawn WU (852) 2977 9386 shawn.wu Johnson SUN (852) 2977 9203 johnson.sun Milo LIU (852) 2977 9387 milo.liu (852) 2977 9389 liwenbing Healthcare Louis SUN Telecom & Small/ Mid-Caps Insurance Zhiwu LI Technology Internet Miles XIE Transportation & Industrial Yuan MA (86) 10 8800 9788 - 8039 yuan.ma Connie GU, CPA (86) 10 8800 9788 - 8045 conniegu (852) 2977 9243 jovi.li Metals & Mining Jovi LI Miaoxian LI Oil & Gas/ Gas Utilities Qingli YANG Jerry LI @bocomgroup.com Automobile Download our reports from Bloomberg: BOCM〈enter〉 Wei YAO Morning Express 05 November 2014 Analyst Certification The authors of this report, hereby declare that: (i) all of the views expressed in this report accurately reflect their personal views about any and all of the subject securities or issuers; and (ii) no part of any of their compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report; (iii) no insider information/ non-public price-sensitive information in relation to the subject securities or issuers which may influence the recommendations were being received by the authors. The authors of this report further confirm that (i) neither they nor their respective associates (as defined in the Code of Conduct issued by the Hong Kong Securities and Futures Commission) have dealt in or traded in the stock(s) covered in this research report within 30 calendar days prior to the date of issue of the report; (ii)) neither they nor their respective associates serve as an officer of any of the Hong Kong listed companies covered in this report; and (iii) neither they nor their respective associates have any financial interests in the stock(s) covered in this report. Disclosure of relevant business relationships BOCOM International Securities Limited, and/or its associated companies, has investment banking relationship with Bank of Chongqing Co. Ltd., Huishang Bank Corporation Limited, Phoenix Healthcare Group Co. Ltd., China Cinda Asset Management Co. Ltd., Qinhuangdao Port Co. Ltd, Jintian Pharmaceutical Group Limited, Logan Property Holdings Company Limited, Nanjing Sinolife United Company Limited, Magnum Entertainment Group Holdings Limited, Bank of Communications, Harbin Bank Co., Ltd., Azure Orbit International Finance Limited, Hanhua Financial Holding Co., Ltd., Central China Securities Company Limited, China New City Commercial Development Limited, China Shengmu Organic Milk Limited, Broad Greenstate International Company Limited, China National Culture Group Limited and Sichuan Development (Holding) Co. Ltd. within the preceding 12 months. BOCOM International Holdings Company Limited currently holds more than 1% of the equity securities of Shanghai Fosun Pharmaceuticals Group Co. Ltd. BOCOM International Securities Limited currently holds more than 1% of the equity securities of Sanmenxia Tianyuan Aluminum Company Limited. Disclaimer By accepting this report (which includes any attachment hereto), the recipient hereof represents and warrants that he is entitled to receive such report in accordance with the restrictions set forth below and agrees to be bound by the limitations contained herein. Any failure to comply with these limitations may constitute a violation of law. This report is strictly confidential and is for private circulation only to clients of BOCOM International Securities Ltd. This report is being supplied to you strictly on the basis that it will remain confidential. No part of this report may be (i) copied, photocopied, duplicated, stored or reproduced in any form by any means or (ii) redistributed or passed on, directly or indirectly, to any other person in whole or in part, for any purpose without the prior written consent of BOCOM International Securities Ltd. BOCOM International Securities Ltd, its affiliates and related companies, their directors, associates, connected parties and/or employees may own or have positions in securities of the company(ies) covered in this report or any securities related thereto and may from time to time add to or dispose of, or may be interested in, any such securities. Further, BOCOM International Securities Ltd, its affiliates and its related companies may do and seek to do business with the company(ies) covered in this report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking, advisory, underwriting, financing or other services for or relating to such company(ies) as well as solicit such investment, advisory, financing or other services from any entity mentioned in this report. In reviewing this report, an investor should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest. The information contained in this report is prepared from data and sources believed to be correct and reliable at the time of issue of this report. This report does not purport to contain all the information that a prospective investor may require and may be subject to late delivery, interruption and interception. BOCOM International Securities Ltd does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information and opinion contained in this report and accordingly, neither BOCOM International Securities Ltd nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof. This report is general in nature and has been prepared for information purposes only. It is intended for circulation amongst BOCOM International Securities Ltd’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. The information and opinions in this report are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, related investments or other financial instruments thereof. The views, recommendations, advice and opinions in this report may not necessarily reflect those of BOCOM International Securities Ltd or any of its affiliates, and are subject to change without notice. BOCOM International Securities Ltd has no obligation to update its opinion or the information in this report. Investors are advised to make their own independent evaluation of the information contained in this research report, consider their own individual investment objectives, financial situation and particular needs and consult their own professional and financial advisers as to the legal, business, financial, tax and other aspects before participating in any transaction in respect of the securities of company(ies) covered in this report. The securities of such company(ies) may not be eligible for sale in all jurisdictions or to all categories of investors. This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to any law, regulation, rule or other registration or licensing requirement. BOCOM International Securities Ltd is a wholly owned subsidiary of Bank of Communications Co Ltd. Download our reports from Bloomberg: BOCM〈enter〉

© Copyright 2026