Morning Express Focus of the Day Harbin Bank (6138.HK)

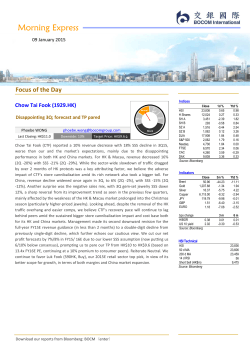

Morning Express 21 November 2014 Focus of the Day Indices Harbin Bank (6138.HK) Neutral A leading microcredit bank with international and strategic vision Qingli YANG Last Closing: HK$2.86 [email protected] Upside: +6.6% LT BUY BUY SELL Stock Target Price: HK$3.05 Harbin Bank has been forward looking in strategic vision, as one of the first commercial banks to establish microcredit and rural financial business strategies in China. The bank has a diversified shareholding structure. Its stable shareholding structure, experienced and stable management and unique market-driven business model enable the bank to formulate and implement consistent strategies. Close HSI 23,350 H Shares 10,379 SH A 2,568 SH B 264 SZ A 1,405 SZ B 962 DJIA 17,719 S&P 500 2,053 Nasdaq 4,702 FTSE 6,679 CAC 4,234 DAX 9,484 Source: Bloomberg 1d % -0.10 -0.01 0.07 0.17 -0.21 -0.26 0.19 0.20 0.56 -0.26 -0.75 0.12 Ytd % 0.19 -4.04 15.97 4.11 27.27 10.79 6.89 11.06 12.58 -1.04 -1.44 -0.71 Close 79.33 1,193.18 16.25 6,685.00 118.25 1.57 1.25 3m % -22.44 -6.55 -16.43 -2.66 -12.18 -5.35 -5.54 Ytd % -28.40 -1.03 -16.53 -9.17 -10.94 -5.22 -8.72 bps change HIBOR 0.37 US 10 yield 2.34 Source: Bloomberg 3m 0.01 -0.07 6m 0.01 -0.19 Indicators The bank is a pioneer in microcredit loans in China, with greater exposure to microcredit loans than its listed peers. Microcredit loans feature high pricing levels and sound asset quality. It also has distinct competitive edges in geographical coverage, rural finance and Russian businesses. Its retail banking business also commands an advantage with notable growth potential. Asset quality improved notably from 2007 to 2012. In 2013, the amount of overdue loans increased rapidly. The high interest spread between loans and deposits, low loan-to-deposit ratio and low leverage ratio provide upside in profitability. Brent Gold Silver Copper JPY GBP EURO We initiate coverage at Neutral with a TP of HK$3.05. HSI Technical ChinaSoft Int'l (354.HK) NDR takeaways-revenue growth to be maintained and upside potential in gross margin Yuan MA [email protected] Last Closing: HK$2.69 Not Rated We invited ChinaSoft Int’l (354.HK)’s COO Mr. Fu Kun and General Manager of Corporate Development Ms Lin Shanshan for an NDR in Hong Kong upon 3Q14 to share the latest developments of the company. Huawei estimated that by 2017, the market scale of its outsourced business will reach RMB10.5 bn, growth of more than 300% as compared with 2014. The company, being one of the most trusted suppliers of Huawei, will also be given greater room for growth in the business. JF platform will be opened for testing on 12 Dec and i its business model will encompass profitability enhancement to revenue Download our reports from Bloomberg: BOCM〈enter〉 HSI 50 d MA 200 d MA 14 d RSI Short Sell (HK$m) Source: Bloomberg 23,350 23,645 23,242 42 6,523 Morning Express 21 November 2014 source expansion, such as extending its customer base to small and micro enterprises, mission undertaking and commissioning, as well as ad revenue and online payment of interest revenue from collected funds. In respect of the cloud business, other than its existing business, Aliyun has entered into framework agreements with the E-government clouds of seven provinces. These agreements will be implemented next year. The company is confident in maintaining its 2014 growth rate next year. It will also enhance its gross profit margin through JF platform. The management anticipates the gross profit margin to inch up by 1 to 2 ppts. Hang Seng Index (1 year) Internet Sector HS China Enterprise Index (1 year) 24,000 23,000 22,000 21,000 Source: Company data, Bloomberg 12,000 11,000 Integration of contents and hardware-Xiaomi to invest in iQiyi [email protected] 10,000 9,000 UP MP OP Xiaomi took important steps in content development. After Chen Dan from Sina joined the company, the company spent US$1 bn in content development and invested in Youku and Tudou. We believe that Xiaomi will have more investment and tie-ups in terms of content development such as video production. iQiyi’s investment logic is to integrate contents with hardware. Xiaomi is undeniably the ideal partner then. Future opportunities of mergers and acquisitions have become rare as the internet video industry has been basically developed. In the long run, industry integration will help forge alliance, alleviate the problems of high content cost and bandwidth cost and bring relief to the pressure on industry profit margin. In the mid to short term, upon Xiaomi’s share subscription, iQiyi will mainly use the proceeds to invest in its own content and purchased content. The contents of iQiyi will be integrated with Xiaomi’s channels. Going forward, if the mobile users of Xiaomi can align well with the traffic and contents of iQiyi, it will bring the most ideal return on investment, in our view. China Macro Comments on November HSBC flash China PMI Miaoxian LI 25,000 13,000 MIT-Martina Internet Talk: Yuan MA 26,000 [email protected] Economics 1) The flash reading of HSBC’s November China PMI came in at 50, lower than 50.4 in October. The decline could be due to the temporary negative impact from China’s measures to create the so-called “APEC blue” during the APEC summit. Therefore, the November PMI might have exaggerated the downward pressure on the economy. 2) Decline of Output dragged headline PMI. The Output index fell 1.2 ppts MoM, dragging the headline figure by 0.3 ppt. However, the New Orders index rebounded 0.2 ppt MoM, which was driven by domestic orders, possibly spurred by the recovery of the property market and accelerated infrastructure investment. Therefore, we believe the decline of Output reflected, rather than a deterioration of demand, short-term factors such as production halts during APEC. Download our reports from Bloomberg: BOCM〈enter〉 8,000 Source: Company data, Bloomberg Shanghai A-shares (1 year) 2,600 2,400 2,200 2,000 1,800 Source: Company data, Bloomberg Shenzhen A-shares (1 year) 1,500 1,400 1,300 1,200 1,100 1,000 900 800 Source: Company data, Bloomberg Morning Express 21 November 2014 3) Market’s speculation of RRR cut is based on unsound reasoning. Some market participants believe that the statement of “higher flexibility in LDR” from the Executive Meeting of the State Council implied an extension of the definition of general deposits and a reduction of RRR. However, the official press release did not mention any extension of definition – it was market speculation. There are many ways to introduce higher flexibility to LDR, such as simply raising the LDR ceiling, which would not involve an RRR cut. Transportation Sector Weekly transportation news wrap Ian FENG [email protected] Weekly In terms of sector, we highlight some notable updates for the transportation industry this week as follows: Global dry bulk market: Baltic Dry Bulk Index (BDI) started to rise this week due to the increase of BCI. BDI may maintain an upward trend in the fourth quarter, as it is the traditional peak season for the shipping industry. Import and export: In October, total China iron ore imports recorded a decline of 12.4% MoM due to a decrease in demand. China coal imports fell for the fourth consecutive month on a YoY basis. Railway: China Railway Group (390.HK) won bids for 14 projects, with a total contract value of RMB24.2 billion. Logistics: State Council issued Opinions on Promoting the Development of Domestic Trade Circulation, boding well for the logistics industry. Download our reports from Bloomberg: BOCM〈enter〉 21 November 2014 Last Closing: HK$2.86 Upside: +6.6% Target Price: HK$3.05 Banking Sector Harbin Bank (6138.HK) UP MP OP A leading microcredit bank with international and strategic vision Initiation of coverage Financial Highlights RMB mn Revenue Operating profit Net profit attributable to equity holders of the parent YoY EPS (RMB) YoY PE PB DPS Dividend yield Source: Company, BOCOM Int’l 2012 7,711 3,849 2,864 2013 8,544 4,447 3,350 2014E 10,544 5,457 4,059 2015E 12,646 6,569 4,917 2016E 14,887 7,934 5,938 54.5% 0.17 4.9% 5.96 1.02 0.02 1.00% 7.0% 0.17 -0.6% 5.56 0.94 0.06 2.70% 21.1% 0.14 -19.3% 6.12 0.84 0.07 3.27% 21.1% 0.15 6.4% 5.05 0.74 0.09 3.96% 20.8% 0.15 5.3% 4.18 0.64 0.11 4.78% Neutral LT BUY BUY SELL Harbin Bank has been forward looking in strategic vision. As of 31 Dec 2013, Harbin Bank was the second largest commercial bank in Heilongjiang Province and the largest commercial bank in Harbin. The bank has had long-term strategic vision as it launched the microcredit business (a strategy in line with the global banking trend of focusing on smaller customers and retail businesses) in as early as 2001, much earlier than its domestic counterparts. Meanwhile, the bank, having launched rural financial services in 2005, is one of the pioneering commercial banks to establish microcredit and rural financial business strategies in China. Harbin Bank has a diversified shareholding structure. As of 30 Jun 2014, Harbin Economic Development, the largest shareholder of the bank, held a 19.65% stake in the bank, while other shareholders owned less than 7% each. The shareholding structure has been relatively stable. The experienced and stable management team and the unique, market-driven business model ensure consistency in its business strategies. The bank’s core strategy is to become “a first-class domestic and internationally renowned microcredit bank”. Pioneer in microcredit loans. Harbin Bank was the first commercial bank in the PRC to commence the microcredit businesses, comprising small enterprise loans, loans to farmers and personal consumption loans. It has established the unique microcredit brand of “Just-for-you”. The business has managed to expand rapidly, thanks to a sophisticated management model. As of 30 Jun 2014, Harbin Bank’s microcredit loans (excluding personal consumption loans and loans to farmers) accounted for 46.1% of its total loans, a much higher ratio than its listed peers. Microcredit loans feature both high pricing levels and sound asset quality. The bank has established a microcredit R&D centre and financial IT system with proprietary intellectual property rights. It not only replicates its microcredit loan management model to the branches in other regions, but also exports microcredit know-how to peers. Stock Harbin Bank has been forward looking in strategic vision, as one of the first commercial banks to establish microcredit and rural financial business strategies in China. The bank has a diversified shareholding structure. Its stable shareholding structure, experienced and stable management and unique market-driven business model enable the bank to formulate and implement consistent strategies. The bank is a pioneer in microcredit loans in China, with greater exposure to microcredit loans than its listed peers. Microcredit loans feature high pricing levels and sound asset quality. It also has distinct competitive edges in geographical coverage, rural finance and Russian businesses. Its retail banking business also commands an advantage with notable growth potential. Asset quality improved notably from 2007 to 2012. In 2013, the amount of overdue loans increased rapidly. The high interest spread between loans and deposits, low loan-to-deposit ratio and low leverage ratio provide upside in profitability. We initiate coverage at Neutral with a TP of HK$3.05. Stock data 3.20 2.66 31 3,024 1 -2.05 N/A 2.91 N/A 44.83 52w High (HK$) 52w Low (HK$) Market cap (HK$m) Issued shares (m) Avg daily vol (m) 1-mth change (%) YTD change (%) 50d MA (HK$) 200d MA (HK$) 14-day RSI Source: Bloomberg 1-year performance chart 15% 哈尔滨银行 恒指H股指数 10% 5% 0% -5% The bank enjoys outstanding competitive edges in regional coverage, rural financial services and Russian businesses. Harbin Bank was one of the first city commercial banks approved to establish and operate a cross-regional operating network outside their home provinces. Harbin Bank is also one of the city commercial banks with the broadest regional coverage and the most comprehensive branch network outside their home provinces. As of 31 Dec 2012, it was one of the city commercial banks with the largest number of village and township banks in China. As of 30 Jun 2014, the number of outlets of Harbin Bank outstripped that of its listed peers, which gave the bank an edge in this respect whilst enabling the bank to establish a more Download our reports from Bloomberg: BOCM〈enter〉 -10% Source: Bloomberg Yang Qingli [email protected] Tel: (852) 2977 9212 Wan Li CFA [email protected] Tel: (8610) 8800 9788 - 8051 Li Shanshan CFA [email protected] Tel: (8610) 8800 9788 - 8058 21 November 2014 Transportation Weekly Transportation Transportation Sector Weekly transportation news wrap th The global dry bulk market started rising this week. As of 19 November 2014, the Baltic Dry Bulk Index (BDI) declined by 1.6% WoW to 1,306. However, it should be th noted that BDI has already reversed course since Monday, 17 November after the th fall since 10 November, largely due to the pickup of BCI, in our view. Yet, BCI still reported a decline of 3.2% WoW, to 3,127 this week. BPI reached 1,055, with a drop of 6.9% WoW and 22% YoY. BSI also reversed its downward trend, reaching 904, an increase of 3.6% WoW. BDI may recover in the fourth quarter, in our view, as it is the traditional peak season for dry bulk shipping. China iron ore and coal imports saw a declining trend. In October, total China iron ore imports were $6,568 million, down by 24.7% YoY and 12.4% on a MoM basis. China iron ore imports reached 79.4 million tonnes, an increase of 17% YoY, but a decline of 6.3% MoM, mainly driven by a decrease in demand and price, in our view. Although iron ore imports fell in October, it is still staying at a relatively high level. Demand for iron ore remained low, partly due to seasonality, in our view. Likewise, China coal imports amounted to 20.1 million tonnes, a slump by 17.4% YoY and 4.9% MoM, marking the fourth consecutive month of decline on a YoY basis. Total coal imports could trend lower ahead due to NDRC’s requirement of reducing 50 million tonnes of coal imports this year. China Railway won bids for a total contract value of RMB24.2 billion. China Railway Group (390 HK) won bids for a total of 14 projects including railway and highway projects, with a total contract value of RMB24.2 billion. The subsidiaries of China Railway, China Railway No.1 Engineering Group, China Railway No.5 Engineering Group, and China Railway No.3 Engineering Group won the bids for the station-front projects of the Huaihua-Shaoyang-Hengyang rail line, with a duration of 1,552 calendar days. According to the results announcement for 3Q14, new contract value of railway projects amounted to RMB157.8 billion for China Railway Group, up 16.3% YoY, outperforming other businesses. State Council issued the Opinions on Promoting the Development of Domestic th Trade Distribution, which should benefit the logistics industry. On 16 November 2014, State Council issued the Opinions on Promoting the Development of Domestic Trade Distribution. One of the key areas of development mentioned in the document is the development of the modern logistics industry. Some of the proposed development areas of the modern logistics industry include equipment standardization, provision of sophisticated 3PL services, e-logistics and express delivery services, cold-chain logistics and agricultural produce logistics. Development of the logistics industry optimizes trade circulation by reducing circulation cost, improving the intermediate process, and increasing consumption, according to the Opinions. The newly released Opinions should be positive for the development of China’s logistics industry, in our view. Download our reports from Bloomberg: BOCM〈enter〉 1-Year Sector Performance 20% Sector performance HSI Index performance 15% 10% 5% 0% -5% -10% -15% Nov-13 Feb-14 May-14 Aug-14 Source: Bloomberg Ian Feng [email protected] Tel: (852) 29779381 Geoffrey Cheng, CFA [email protected] Tel: (852)2977 9380 Oct-14 Morning Express 21 November 2014 Market Review Hong Kong stocks fell for the fourth straight day. The Hang Seng Index finished Thursday down 23 points, or 0.1%, at 23,459, after the HSBC flash China PMI for November came in at a six-month low of 50. CR Land (1109.HK) lost 1.6% as the worst blue-chip performer. Other companies under the CR group also fell. CRE (291.HK) dropped 1.2%. CR Power (836.HK) fell 1.5%. HKEx (388.HK) extended loss to the fifth consecutive session, as usage of quota of SH-HK Stock Connect remained low. However, brokers rebounded. CITIC Securities (6030.HK) rose 2.9% and Haitong (6837.HK) gained 2.4%. CNOOC (883.HK) rose 2% after new discovery in South China Sea. Anton Oil (3337.HK) soared 17%. US stocks finished higher on Thursday. The S&P 500 rose 4 points, or 0.2%, to 2,052.75. The DJIA gained 33.27 points, or 0.2%, to 17,719. European stocks closed lower following disappointing eurozone PMI. The Stoxx Europe 600 dropped 0.3% to 338.28. News Reaction The State Council: to support the development of small and micro enterprises and to implement preferential fiscal, taxation and financial policies. The State Council of the PRC issued ten opinions relating to policies in support of the sound development of small and micro enterprises on Thursday, in which it was specified that preferential policies will be implemented to support fiscal, taxation, employment and finance. On the premise that regulations will be tightened, great efforts will be made to encourage qualified private capital to form financial institutions such as medium-to-small banks in accordance with laws. China adjusted its classification standards of urban planning to five categories and seven grades in line with the need of urbanization. The State Council of the PRC issued a notification relating to the adjustment of the classification standards of urban planning. According to the new classification standards of urban planning, statistics will be conducted based on permanent population of the urban area. Cities will be classified into five categories and seven grades so as to facilitate a better population and city classification management in line with the new requirements of urbanization. National Bureau of Statistics of the PRC: completion and commencement of production of the phase I of the national petroleum reserve project. According to the National Bureau of Statistics of the PRC, the national petroleum reserve project (phase I) includes four national petroleum reserve bases at Zhoushan, Zhenhai, Dalian and Huangdou. The total reserve capacity of the bases is 16.4 million cubic meters and the crude oil reserve is 12.43 million tonnes. MIIT confirmed, for the first time, that the salt franchise system will be cancelled. As reported by CCTV, MIIT had, for the first time, confirmed that China will cancel the salt franchise system to give way to the voluntary operation and fair competitions of salt companies. Shanghai set to complete full 4G coverage by the end of next year. As disclosed by Liu Jian, the deputy head of the Shanghai Municipal Commission of Economy and Informatisation, 4G coverage will span across Shanghai by the end of 2015. To deepen the coverage, such as facilitating more in-depth coverage in more densely populated Download our reports from Bloomberg: BOCM〈enter〉 Morning Express 21 November 2014 regions such as airports, high-speed train stations and regions with higher subway passenger traffic will be the major task for 2016, with an aim to enhance the quality of the network. As planned, Shanghai seeks to achieve full 4G coverage by 2016. Download our reports from Bloomberg: BOCM〈enter〉 Morning Express 21 November 2014 Economic releases for this week - USA Economic releases for this week - China Date Time Event Survey Prior 17-Nov 18-Nov 18-Nov 19-Nov 20-Nov 20-Nov 20-Nov 20-Nov - Industrial Production(MoM) PPI(MoM) PPI ex food & energy (MoM) Housing Starts(k) CPI (MoM) Initial jobless claims (k) Existing Home sales (m) Leading indicators - -0.1% 0.1% 1,025.0 -0.1% 5.15 0.6% - 50.4 -0.1% 0.0% 1,017.0 0.1% 290.0 5.17 0.8% - Source: Bloomberg Date Time 20-Nov Event HSBC Manufacturing PMI Survey - Prior 50.4 Source: Bloomberg BOCOM Research Latest Reports Data 20 Nov 2014 19 Nov 2014 19 Nov 2014 19 Nov 2014 18 Nov 2014 18 Nov 2014 18 Nov 2014 18 Nov 2014 17 Nov 2014 17 Nov 2014 17 Nov 2014 17 Nov 2014 17 Nov 2014 14 Nov 2014 14 Nov 2014 14 Nov 2014 14 Nov 2014 13 Nov 2014 13 Nov 2014 12 Nov 2014 Report Baidu (BIDU.US) - MIT-Martina Internet Talk: Acquiring Kuaiqian to make up the short board in mobile payment China Market Strategy - SH-HK Connect: D.O.A.? Sa Sa (178.HK) - Downgrade to Neutral on unexciting near term outlook Energy Sector - Fei Wu, Tony Liu Container Shipping Sector - Weekly container shipping commentary Tingyi (322.HK) - Shifting from a volume story to a margin story Kingsoft (3888.HK) - MIT-Martina Internet Talk: Takeaways from 3Q14 NDR --The Next Breakthrough Tencent (700.HK) - MIT-Martina Internet Talk: Can Weixin Phone Book become the next super Aapp? China Market Strategy - SH-HK Connect: Breaking New Grounds Property Sector - HK/China property weekly - 14th November 2014 China Resources Enterprise (291.HK) - Poorer-than-expected 3Q; profit warning to continue; dividend may cease Sina (SINA.US) - Weibo ad to drive revenue in the short term; vertical portal is the long-term objective Alibaba Group (BABA.US) - "Double 11"--Mobilization and globalization were the highlights; mobile payment played an important role Energy Sector - Bocom Energy Weekly Netease (NTES.US) - 3Q top-line beat on fast-growing eCommerce and ad revenue Transportation Sector - IWeekly transportation news wrap Insurance Sector - Recommend buying undervalued insurance stocks on re-rating potential driven by visible growth Tencent (700.HK) - 3Q top-line missed; opportunity in performance based ad SH-HK Stock Connect - Rebalancing the A/H valuation gap and searching for overlooked names China Property Sector - Constrained valuation amid sales recovery Source: Company data, BOCOM International Download our reports from Bloomberg: BOCM〈enter〉 Analyst Ma Yuan (Martina), Ph.D, Gu Xinyu (Connie), CPA Hao Hong, CFA Phoebe Wong Bocom Energy Weekly Geoffrey Cheng, CFA Summer WANG Ma Yuan (Martina), Ph.D, Gu Xinyu (Connie), CPA Ma Yuan (Martina), Ph.D, Gu Xinyu (Connie), CPA Hong Hao, CFA Luella Guo, Alfred Lau, CFA, FRM, Toni Ho, CFA, FRM Phoebe Wong Ma Yuan (Martina), Ph.D, Gu Xinyu (Connie), CPA Ma Yuan (Martina), Ph.D, Gu Xinyu (Connie), CPA Fei Wu, Tony Liu Ma Yuan (Martina), Ph.D, Gu Xinyu (Connie), CPA an Feng, Geoffrey Cheng, CFA Li Wenbing Ma Yuan (Martina), Ph.D, Gu Xinyu (Connie), CPA Energy Sector - Fei Wu, Xutong Liu Toni Ho, CFA, FRM, Alfred Lau, CFA, FRM Morning Express 21 November 2014 Hang Seng Index Constituents Company name Cheung Kong Hang Lung Proper Hengan Intl China Shenhua-H Hang Seng Bk China Res Land Cosco Pac Ltd Henderson Land D Aia Group Ltd Hutchison Whampo Kunlun Energy Co Ind & Comm Bk-H China Merchant Want Want China Sun Hung Kai Pro New World Dev Belle Internatio China Coal Ene-H Swire Pacific-A Sands China Ltd Clp Hldgs Ltd Bank East Asia Ping An Insura-H Boc Hong Kong Ho China Life Ins-H Citic Pacific China Res Enterp Cathay Pac Air Hong Kg China Gs Tingyi Hldg Co Esprit Hldgs Bank Of Commun-H China Petroleu-H Hong Kong Exchng Bank Of China-H Wharf Hldg Li & Fung Ltd Hsbc Hldgs Plc Power Assets Hol Mtr Corp China Overseas Tencent Holdings China Unicom Hon Sino Land Co China Res Power Petrochina Co-H Cnooc Ltd China Const Ba-H China Mobile Lenovo Group Ltd Hang Seng Index BBG code 1 HK 101 HK 1044 HK 1088 HK 11 HK 1109 HK 1199 HK 12 HK 1299 HK 13 HK 135 HK 1398 HK 144 HK 151 HK 16 HK 17 HK 1880 HK 1898 HK 19 HK 1928 HK 2 HK 23 HK 2318 HK 2388 HK 2628 HK 267 HK 291 HK 293 HK 3 HK 322 HK 330 HK 3328 HK 386 HK 388 HK 3988 HK 4 HK 494 HK 5 HK 6 HK 66 HK 688 HK 700 HK 762 HK 83 HK 836 HK 857 HK 883 HK 939 HK 941 HK 992 HK Share price (HK$) 137.80 22.50 82.70 20.10 129.00 16.78 10.52 51.20 43.80 98.15 8.44 4.94 25.55 10.20 112.40 9.55 9.52 4.69 102.60 44.80 66.15 32.20 58.20 26.60 22.80 12.88 15.58 15.18 18.34 18.52 10.02 5.72 6.23 165.80 3.71 55.00 8.77 76.85 72.55 31.15 20.35 125.70 11.30 12.50 20.45 8.54 11.48 5.58 93.75 10.36 Mkt cap (HK$m) 319,167 100,919 101,257 379,163 246,628 97,848 30,933 153,617 527,576 418,450 68,131 1,661,983 65,086 134,599 317,259 82,751 80,294 74,409 150,061 361,387 167,125 75,569 442,157 281,236 609,099 320,755 37,725 59,716 192,792 103,781 19,467 417,905 747,133 193,663 1,034,434 166,657 73,321 1,474,646 154,841 181,380 166,340 1,177,472 270,226 75,196 98,092 1,760,597 512,553 1,392,173 1,911,528 115,086 5d chg (%) -0.9 -2.6 0.9 -4.7 -1.5 -2.0 -0.6 -1.0 -2.8 0.1 -9.5 -3.3 0.4 0.0 -2.9 0.1 -3.2 -5.6 -1.5 -4.5 -2.7 0.2 -3.9 -3.1 -2.1 -5.3 -7.7 -3.4 -0.9 -3.6 -1.2 -4.2 -3.9 -11.4 -3.9 -1.7 -5.6 -1.7 -4.5 0.2 -5.6 -2.9 0.0 -3.7 -4.2 -3.3 -2.0 -3.3 -1.5 -3.0 Ytd chg (%) 18.8 -8.2 -9.7 -17.8 2.6 -12.7 -1.1 27.3 12.6 -0.4 -38.2 -5.7 -9.7 -8.9 14.3 3.6 6.1 7.6 12.9 -28.3 7.9 -2.0 -16.2 7.0 -6.0 8.6 -39.5 -7.4 13.5 -17.3 -32.9 4.6 -1.6 28.2 3.9 -7.3 6.9 -8.7 17.7 6.1 -6.7 27.1 -2.6 17.9 11.3 0.5 -20.4 -4.6 16.6 9.9 23,349.6 14,340,750 -2.8 0.2 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) 152.00 105.95 27.00 19.80 99.35 74.05 27.00 19.12 133.00 117.60 21.80 13.62 11.92 9.40 56.40 36.46 45.65 34.65 108.50 88.66 14.82 8.38 5.66 4.33 29.80 22.75 13.10 9.32 120.20 90.35 10.48 7.15 10.36 7.25 5.26 3.72 108.00 80.55 68.00 38.70 68.35 56.00 35.00 28.50 76.50 55.60 27.95 21.50 25.80 19.72 16.88 9.35 27.90 15.48 17.26 13.56 18.90 13.91 23.65 17.82 17.22 9.28 6.04 4.53 8.23 5.73 189.00 112.80 3.90 3.03 66.10 46.35 10.70 7.72 87.35 75.75 76.50 57.85 32.30 26.55 24.50 17.52 134.90 82.64 14.22 9.03 14.16 9.83 24.90 17.10 11.70 7.31 16.06 11.22 6.35 4.89 102.20 63.65 12.70 7.62 25,363.0 21,137.6 –––––––––– PE ––––––––––– 2013A 2014E 2015E (X) (X) (X) 7.4 9.0 9.3 13.2 16.1 15.9 28.0 26.6 22.1 7.3 7.9 7.8 14.8 14.4 13.3 6.4 8.6 7.2 13.5 11.9 10.6 8.6 16.5 16.2 27.7 21.5 18.7 8.9 12.0 11.5 10.7 10.7 9.8 4.9 5.0 4.7 14.8 15.3 13.9 24.9 24.4 21.2 9.0 14.5 13.5 7.2 10.9 10.6 14.1 13.8 13.2 35.6 42.6 26.5 11.7 15.0 13.6 17.6 17.2 15.7 18.5 15.8 15.5 10.8 11.6 11.0 11.5 9.9 8.8 12.2 11.4 10.4 19.0 15.5 13.2 9.1 9.1 7.7 20.5 60.9 39.0 20.3 17.6 12.0 27.7 25.7 23.8 32.1 28.4 23.0 91.7 32.1 20.4 5.2 5.1 4.9 8.4 8.8 8.8 41.2 37.9 28.1 4.9 4.9 4.6 7.0 14.0 12.4 11.3 17.4 14.9 12.4 11.0 10.2 2.5 17.5 17.9 12.2 17.5 16.1 6.7 7.2 6.2 41.8 38.8 29.6 16.9 16.5 14.3 8.4 14.2 13.7 8.4 8.0 7.4 9.4 9.6 9.3 7.3 7.5 7.8 4.8 4.8 4.5 12.8 13.6 13.6 15.4 16.7 13.8 10.1 10.8 10.1 Yield P/B (%) 2.6 3.3 2.2 5.7 4.3 2.7 2.9 2.0 1.0 2.4 2.7 N/A 3.0 2.6 3.0 4.3 1.1 2.2 3.5 3.9 3.9 3.4 1.5 3.8 1.7 2.1 1.6 1.7 1.8 1.5 0.7 N/A 4.9 2.1 6.7 3.2 5.4 4.9 3.5 3.0 2.4 0.2 1.8 4.0 3.7 4.7 5.0 6.8 3.4 2.3 (X) 0.8 0.8 6.1 1.1 2.3 1.1 0.9 0.6 2.4 1.0 1.3 1.0 1.0 9.2 0.7 0.5 2.5 0.6 0.7 8.9 1.8 1.1 1.8 1.7 2.1 0.5 0.7 1.0 3.8 4.4 1.2 0.7 1.0 9.4 0.8 0.6 2.0 1.0 1.3 1.2 1.4 12.4 0.9 0.7 1.5 1.1 1.1 0.9 1.8 4.5 3.7 1.3 Morning Express 21 November 2014 China Ent Index Constituents Company name Shandong Weig-H China Shenhua-H Sinopharm-H China Shipping-H Zoomlion Heavy-H Yanzhou Coal-H Agricultural-H New China Life-H Ind & Comm Bk-H Tsingtao Brew-H China Com Cons-H China Coal Ene-H China Minsheng-H Guangzhou Auto-H Ping An Insura-H Picc Property & Great Wall Mot-H Weichai Power-H Aluminum Corp-H China Pacific-H China Life Ins-H China Oilfield-H Zijin Mining-H China Natl Bdg-H Bank Of Commun-H Jiangxi Copper-H China Petroleu-H China Rail Gr-H China Merch Bk-H Bank Of China-H Dongfeng Motor-H Citic Securiti-H Haitong Securi-H China Telecom-H Air China Ltd-H Petrochina Co-H Huaneng Power-H Anhui Conch-H China Longyuan-H China Const Ba-H China Citic Bk-H Hang Seng China Ent Indx BBG code 1066 HK 1088 HK 1099 HK 1138 HK 1157 HK 1171 HK 1288 HK 1336 HK 1398 HK 168 HK 1800 HK 1898 HK 1988 HK 2238 HK 2318 HK 2328 HK 2333 HK 2338 HK 2600 HK 2601 HK 2628 HK 2883 HK 2899 HK 3323 HK 3328 HK 358 HK 386 HK 390 HK 3968 HK 3988 HK 489 HK 6030 HK 6837 HK 728 HK 753 HK 857 HK 902 HK 914 HK 916 HK 939 HK 998 HK Share price (HK$) Mkt cap (HK$m) 5d chg (%) Ytd chg (%) 7.02 20.10 31.30 4.89 4.27 6.24 3.47 30.30 4.94 54.00 6.97 4.69 7.67 7.14 58.20 13.62 35.75 28.75 3.29 28.35 22.80 14.64 1.99 7.16 5.72 13.12 6.23 5.06 14.52 3.71 11.08 19.44 13.58 4.72 5.26 8.54 8.56 24.15 8.19 5.58 5.08 31,424.13 379,162.73 80,387.58 22,753.55 45,592.30 45,382.73 1,052,187.82 109,874.09 1,661,983.32 69,317.83 125,886.54 74,408.64 274,165.34 57,756.54 442,157.05 190,460.92 117,567.11 53,455.36 59,790.79 241,590.78 609,099.03 90,076.64 63,442.56 38,657.03 417,905.09 54,799.53 747,133.24 115,198.01 343,215.74 1,034,434.30 95,466.61 204,749.11 139,612.86 382,000.78 75,352.24 1,760,596.66 116,635.18 116,854.61 65,818.03 1,392,172.90 276,338.31 -10.8 -4.7 -5.3 -10.8 -9.1 -12.5 -3.6 -5.9 -3.3 -1.6 -1.6 -5.6 -4.6 -6.7 -3.9 -2.2 -3.6 -5.6 -7.8 -4.7 -2.1 -8.4 -9.1 -2.5 -4.2 -5.5 -3.9 -1.4 -2.7 -3.9 -1.1 -5.2 -7.1 -6.3 -4.9 -3.3 -5.7 -4.2 -3.0 -3.3 -7.5 -32.9 -17.8 40.7 -18.8 -41.0 -11.9 -8.9 16.5 -5.7 -17.6 11.5 7.6 6.9 -15.8 -16.2 23.1 -16.5 -8.0 21.9 -6.7 -6.0 -39.1 19.9 -14.1 4.6 -6.3 -1.6 26.5 -12.1 3.9 -8.7 -8.1 0.6 20.4 -9.2 0.5 22.1 -16.0 -18.0 -4.6 20.7 11.2 27.0 34.5 6.3 8.0 8.7 4.1 32.8 5.7 68.3 7.2 5.3 8.1 10.8 76.5 14.4 48.5 35.5 3.9 33.5 25.8 24.7 2.3 9.1 6.0 15.3 8.2 5.3 17.4 3.9 15.2 21.7 15.2 5.2 6.3 11.7 9.7 35.7 10.3 6.4 5.5 6.9 19.1 19.7 4.0 3.5 4.9 3.0 21.1 4.3 53.1 4.9 3.7 5.9 6.7 55.6 9.4 26.1 25.8 2.5 23.6 19.7 14.0 1.6 6.7 4.5 11.6 5.7 3.0 12.1 3.0 9.6 13.7 9.5 3.1 4.2 7.3 6.1 24.1 7.1 4.9 3.6 81.1 7.3 24.7 N/A 14.1 6.6 5.0 12.5 4.9 29.0 6.9 35.6 4.6 11.5 11.5 13.7 10.6 8.7 N/A 19.0 19.0 6.7 16.0 4.9 5.2 10.1 8.4 8.6 5.0 4.9 5.6 21.3 24.4 16.2 19.4 9.4 8.2 8.3 26.7 4.8 4.6 24.3 7.9 22.5 45.4 13.7 16.4 4.8 10.8 5.0 28.0 6.6 42.6 4.3 10.2 9.9 12.1 10.5 9.6 N/A 17.1 15.5 6.9 14.3 5.3 5.1 13.0 8.8 8.2 5.0 4.9 5.9 22.3 18.5 16.2 16.4 9.6 7.7 8.6 20.0 4.8 4.5 10,379 4,185,214 -3.9 -4.0 11,638.3 9,159.8 7.2 7.1 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) ––––––––––– PE ––––––––––– 2013A 2014E 2015E (X) (X) (X) Yield P/B (%) (X) 19.9 7.8 18.7 13.9 11.1 15.7 4.5 9.8 4.7 24.6 6.1 26.5 4.1 7.8 8.8 11.1 8.2 9.4 N/A 14.5 13.2 6.9 14.2 4.9 4.9 13.2 8.8 7.4 4.5 4.6 5.6 19.4 15.9 14.6 11.6 9.3 7.5 8.0 14.7 4.5 4.2 1.1 5.7 1.1 0.0 4.4 0.4 N/A 0.6 N/A N/A 3.4 2.2 2.6 3.2 1.5 2.1 2.9 1.1 N/A 1.8 1.7 3.7 N/A 2.8 N/A 4.8 4.9 1.7 5.4 6.7 2.1 N/A 1.1 2.5 1.1 4.7 5.6 1.8 0.7 6.8 N/A 2.6 1.1 2.9 0.6 0.6 0.6 0.9 1.7 1.0 3.7 0.9 0.6 0.9 1.1 1.8 2.3 2.9 1.4 0.9 1.9 2.1 1.2 1.3 0.8 0.7 0.8 1.0 1.0 1.0 0.8 1.1 1.8 1.6 1.1 1.0 1.1 1.5 1.7 1.6 0.9 0.8 6.5 4.5 1.1 Morning Express 21 November 2014 BOCOM International 11/F, Man Yee Building, 68 Des Voeux Road, Central, Hong Kong Main: + 852 3710 3328 Fax: + 852 3798 0133 Rating System Company Rating www.bocomgroup.com Sector Rating Buy: Expect more than 20% upside in 12 months LT Buy: Expect more than 20% upside but longer than 12 months Neutral: Expect low volatility Sell: Expect more than 20% downside in 12 months Outperform (“OP”): Expect more than 10% upside in 12 months Market perform (“MP”): Expect low volatility Underperform (“UP”): Expect more than 10% downside in 12 months Research Team Head of Research @bocomgroup.com (852) 2977 9393 raymond.cheng (852) 2977 9384 hao.hong (852) 2977 9212 yangqingli Shanshan LI, CFA (86) 10 8800 9788 - 8058 lishanshan Li WAN, CFA (86) 10 8800 9788 - 8051 Wanli Raymond CHENG, CFA, CPA, CA Strategy Economics Hao HONG, CFA Banks/Network Financials Qingli YANG miaoxian.li Fei WU (852) 2977 9392 fei.wu Tony LIU (852) 2977 9390 xutong.liu Alfred LAU, CFA, FRM (852) 2977 9235 alfred.lau Toni HO, CFA, FRM (852) 2977 9220 toni.ho Luella GUO (852) 2977 9211 luella.guo (86) 21 6065 3606 louis.sun (852) 2977 9209 lizhiwu (852) 2977 9216 miles.xie Geoffrey CHENG, CFA (852) 2977 9380 geoffrey.cheng Ian FENG (852) 2977 9381 Yinan.feng (86) 21 6065 3675 wei.yao Property Phoebe WONG (852) 2977 9391 phoebe.wong Anita CHU (852) 2977 9205 anita.chu Consumer Staples Renewable Energy Summer WANG (852) 2977 9221 summer.wang Shawn WU (852) 2977 9386 shawn.wu Johnson SUN (852) 2977 9203 johnson.sun Milo LIU (852) 2977 9387 milo.liu (852) 2977 9389 liwenbing Healthcare Louis SUN Telecom & Small/ Mid-Caps Insurance & Brokerage Zhiwu LI Technology Internet Miles XIE Transportation & Industrial Yuan MA (86) 10 8800 9788 - 8039 yuan.ma Connie GU, CPA (86) 10 8800 9788 - 8045 conniegu (852) 2977 9243 jovi.li Metals & Mining Jovi LI (86) 10 8800 9788 - 8043 Miaoxian LI Oil & Gas/ Gas Utilities Consumer Discretionary Jerry LI @bocomgroup.com Automobile Download our reports from Bloomberg: BOCM〈enter〉 Wei YAO Morning Express 21 November 2014 Analyst Certification The authors of this report, hereby declare that: (i) all of the views expressed in this report accurately reflect their personal views about any and all of the subject securities or issuers; and (ii) no part of any of their compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report; (iii) no insider information/ non-public price-sensitive information in relation to the subject securities or issuers which may influence the recommendations were being received by the authors. The authors of this report further confirm that (i) neither they nor their respective associates (as defined in the Code of Conduct issued by the Hong Kong Securities and Futures Commission) have dealt in or traded in the stock(s) covered in this research report within 30 calendar days prior to the date of issue of the report; (ii)) neither they nor their respective associates serve as an officer of any of the Hong Kong listed companies covered in this report; and (iii) neither they nor their respective associates have any financial interests in the stock(s) covered in this report. Disclosure of relevant business relationships BOCOM International Securities Limited, and/or its associated companies, has investment banking relationship with Bank of Chongqing Co. Ltd., Huishang Bank Corporation Limited, Phoenix Healthcare Group Co. Ltd., China Cinda Asset Management Co. Ltd., Qinhuangdao Port Co. Ltd, Jintian Pharmaceutical Group Limited, Logan Property Holdings Company Limited, Nanjing Sinolife United Company Limited, Magnum Entertainment Group Holdings Limited, Bank of Communications, Harbin Bank Co., Ltd., Azure Orbit International Finance Limited, Hanhua Financial Holding Co., Ltd., Central China Securities Company Limited, China New City Commercial Development Limited, China Shengmu Organic Milk Limited, Broad Greenstate International Company Limited, China National Culture Group Limited and Sichuan Development (Holding) Co. Ltd. within the preceding 12 months. BOCOM International Holdings Company Limited currently holds more than 1% of the equity securities of Shanghai Fosun Pharmaceuticals Group Co. Ltd. BOCOM International Securities Limited currently holds more than 1% of the equity securities of Sanmenxia Tianyuan Aluminum Company Limited. Disclaimer By accepting this report (which includes any attachment hereto), the recipient hereof represents and warrants that he is entitled to receive such report in accordance with the restrictions set forth below and agrees to be bound by the limitations contained herein. Any failure to comply with these limitations may constitute a violation of law. This report is strictly confidential and is for private circulation only to clients of BOCOM International Securities Ltd. This report is being supplied to you strictly on the basis that it will remain confidential. No part of this report may be (i) copied, photocopied, duplicated, stored or reproduced in any form by any means or (ii) redistributed or passed on, directly or indirectly, to any other person in whole or in part, for any purpose without the prior written consent of BOCOM International Securities Ltd. BOCOM International Securities Ltd, its affiliates and related companies, their directors, associates, connected parties and/or employees may own or have positions in securities of the company(ies) covered in this report or any securities related thereto and may from time to time add to or dispose of, or may be interested in, any such securities. Further, BOCOM International Securities Ltd, its affiliates and its related companies may do and seek to do business with the company(ies) covered in this report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking, advisory, underwriting, financing or other services for or relating to such company(ies) as well as solicit such investment, advisory, financing or other services from any entity mentioned in this report. In reviewing this report, an investor should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest. The information contained in this report is prepared from data and sources believed to be correct and reliable at the time of issue of this report. This report does not purport to contain all the information that a prospective investor may require and may be subject to late delivery, interruption and interception. BOCOM International Securities Ltd does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information and opinion contained in this report and accordingly, neither BOCOM International Securities Ltd nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof. This report is general in nature and has been prepared for information purposes only. It is intended for circulation amongst BOCOM International Securities Ltd’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. The information and opinions in this report are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, related investments or other financial instruments thereof. The views, recommendations, advice and opinions in this report may not necessarily reflect those of BOCOM International Securities Ltd or any of its affiliates, and are subject to change without notice. BOCOM International Securities Ltd has no obligation to update its opinion or the information in this report. Investors are advised to make their own independent evaluation of the information contained in this research report, consider their own individual investment objectives, financial situation and particular needs and consult their own professional and financial advisers as to the legal, business, financial, tax and other aspects before participating in any transaction in respect of the securities of company(ies) covered in this report. The securities of such company(ies) may not be eligible for sale in all jurisdictions or to all categories of investors. This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to any law, regulation, rule or other registration or licensing requirement. BOCOM International Securities Ltd is a wholly owned subsidiary of Bank of Communications Co Ltd. Download our reports from Bloomberg: BOCM〈enter〉

© Copyright 2026