Morning Express Focus of the Day Technology Sector

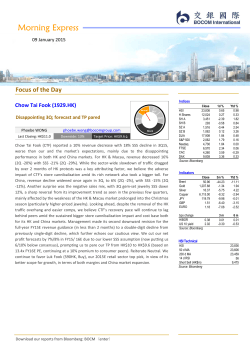

Morning Express 10 October 2014 Focus of the Day Indices Technology Sector SH-HK Stock Connect - High-quality HK-listed industry leaders will likely be favored Miles XIE [email protected] UP MP OP 1) High-quality industry leaders listed in Hong Kong with scarcity value will likely be favored by investors. 2) H-share listed technology stocks are generally more attractively valued than their A-share counterparts. Close HSI 23,535 H Shares 10,484 SH A 2,501 SH B 267 SZ A 1,416 SZ B 978 DJIA 16,659 S&P 500 1,928 Nasdaq 4,378 FTSE 6,432 CAC 4,141 DAX 9,005 Source: Bloomberg 1d % 1.17 0.85 0.28 -0.57 0.29 0.22 -1.97 -2.07 -2.02 -0.78 -0.64 0.11 Ytd % 0.98 -3.08 12.96 5.09 28.32 12.70 0.50 4.32 4.83 -4.70 -3.60 -5.73 Close 90.05 1,223.64 17.34 6,720.00 107.84 1.61 1.27 3m % -16.84 -8.39 -19.00 -5.68 -6.03 -5.90 -6.77 Ytd % -18.73 1.49 -10.94 -8.70 -2.35 -2.63 -7.68 bps change HIBOR 0.37 US 10 yield 2.31 Source: Bloomberg 3m -0.01 -0.22 6m 0.00 -0.33 Indicators Transportation Sector Weekly transportation news wrap Ian FENG [email protected] Weekly Aviation - IATA reiterated that both passenger and freight volume continued to show positive trend, based on August reported data. China logistics sector - The State Council published the Medium-to-Long Term Development Plan (2014-2020), in which we do not find too many new initiatives. China National Day holiday traffic performance - The estimated aviation and railway volume during the holiday period increased by single digits only. Brent Gold Silver Copper JPY GBP EURO HSI Technical HSI 50 d MA 200 d MA 14 d RSI Short Sell (HK$m) Source: Bloomberg 23,535 24,459 23,147 42 6,121 BOCOM Int'l Corporate Access 21 Oct Download our reports from Bloomberg: BOCM〈enter〉 Tasly Pharma Group (600535 CH) Morning Express 10 October 2014 Hang Seng Index (1 year) Geely Auto (175.HK) Neutral Sept sales strengthens our confidence in outlook 26,000 LT BUY SELL 25,000 BUY 24,000 23,000 22,000 Wei YAO Last Closing: HK$3.51 [email protected] Upside: +12.8% Stock 21,000 Target Price: HK$3.96↑ (1) Geely announced that it sold 39,019 vehicles in Sept, up 41.0% MoM and down 9.3% YoY. Sept MoM sales showed a significant rebound. (2) The New Emgrand contributed the most to the sales rebound. (3) Exports remained weak. (4) Optimization of product mix may continue. (5) Maintain LT-Buy and raise TP to HK$3.96. Overall, the sales growth of New Emgrand was the key to the stronger-than-expected sales in Sept, which contributed to the sales improvement and optimization of product mix. We expect the sales of New Emgrand to increase further ahead, while the energy-saving car subsidies could help sales recovery. Based on the latest sales data, we have made structural adjustments on the sales assumption of each product. We revise our FY14-16E earnings estimates. Our revised FY14/15/16E EPS estimates are RMB0.25/0.31/0.37, up -0.2%/0.9%/1.5%. The stronger-than-expected Sept sales could help improve the achievement of sales target this year. Coupled with the better potential sales and stronger confidence in earnings growth next year, we raise our TP to HK$3.96, equivalent to 10x FY15E PE. Maintain LT-Buy. Source: Company data, Bloomberg HS China Enterprise Index (1 year) 13,000 12,000 11,000 10,000 9,000 8,000 Source: Company data, Bloomberg Shanghai A-shares (1 year) 2,600 2,400 2,200 2,000 1,800 Source: Company data, Bloomberg Shenzhen A-shares (1 year) 1,400 1,300 1,200 1,100 1,000 900 800 Source: Company data, Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 10 October 2014 Shanghai-HK Stock Connect Technology Sector Miles Xie Technology Sector (852) 2977 9216 [email protected] High-quality HK-listed industry leaders will likely be favored Investment Summary 1. High-quality industry leaders listed in Hong Kong with scarcity value will likely be favored by investors. 2. H-share listed technology stocks are generally more attractively valued than their A-share counterparts. Sector Attributes % of index* 5 most representative stocks in the universe Valuation Sector average A Shares H Shares SSE 180 Index (3.07%) SSE 380 Index (5.71%) Sichuan Changhong (600839 CH) Sanan Optoelectronics (600703 CH) Hisense Electric (600060 CH) Jiangsu Changjiang Electronics (600584 CH) Qingdao Haier (600690 CH) Hang Seng Composite Large Cap Index (1.41%) Hang Seng Composite Mid Cap Index (4.57%) Lenovo (992 HK) SMIC (981 HK) AAC Tech (2018 HK) Digital China (861 HK) ASM Pacific (522 HK) A shares: 27.9x 2014E P/E H shares: 17.5x 2014E P/E, indicative of notable valuation discount Fundamental view Commonalities A new boom cycle for the global technology sector driven by mobile, smart devices and enhanced connectivity; Benefitting from huge demand from China; and Rising competitiveness and market position of the Chinese companies across the global industry chain Differences The A-share market (including Shenzhen Stock Exchange) has more technology stocks. A-share listed technology stocks are mainly private companies with smaller scales and higher valuations. A) Trading strategies Source: Factset, Company The H-share market has industry leaders with scarcity value, some of which possess global competitiveness. H-share listed technology stocks enjoy notable valuation advantage. Watch Qingdao Haier (600690.CH), given Its leadership in the China refrigerator and washing machine industries; and Foray into e-commerce with Alibaba *Approximate representations as of Sept 14, 2014. H) Buy Lenovo and SMIC, given: Lenovo is a leader in the global PC industry; and SMIC benefits directly from the rise of China’s semi-conductor industry. Valuation Summary Company Stock name ticker Rating TP (HK$) Lenovo 992.HK BUY 13.00 SMIC 981.HK BUY 2018.HK Digital China ASM Pacific CP ––––– EPS ––––– EPS Consensus –––––– P/E –––––– –––––– P/B –––––– FY14E FY14E FY15E FY14E FY15E (HK$/RMB) (RMB) (RMB) (RMB) (RMB) (x) (x) (x) (x) (%) 11.82 0.062 0.079 0.087 0.100 16.2 14.2 4.1 3.4 2.2 0.81 0.79 0.000 0.004 0.005 0.006 19.3 15.5 1.14 1.06 0.0 NEUTRAL 46.70 46.20 1.41 1.83 2.02 2.30 19.5 17.2 5.2 4.4 2.2 861.HK NEUTRAL 8.10 7.35 1.065 0.593 0.791 0.862 9.9 9.1 0.9 0.8 2.3 522.HK BUY 92.00 77.85 1.73 1.40 3.69 4.67 22.8 18.0 4.3 3.8 1.0 Sichuan Changhong 600839.CH NR NA 4.33 0.11 0.10 0.10 0.14 45.6 32.1 1.4 1.4 0.2 Sanan 600703.CH NR NA 14.80 0.72 0.68 0.68 0.94 22.6 16.4 2.9 2.6 1.2 Hisense 600060.CH NR NA 11.76 1.21 1.13 1.13 1.24 10.3 9.4 1.4 1.3 2.0 Jiangsu Changjiang 600584.CH NR NA 11.93 0.01 0.23 0.23 0.39 51.9 30.1 3.3 3.0 0.6 Qingdao Haier 600690.CH NR NA 16.78 1.53 1.69 1.69 1.97 9.3 8.0 2.3 1.9 3.4 AAC Tech FY15E Yield FY14E FY15E Source: Company, BOCOM Int’l estimates (H shares), Bloomberg consensus estimates (A shares) Download our reports from Bloomberg: BOCM 〈enter〉 1 10 October 2014 Transportation Weekly Transportation Transportation Sector Weekly transportation news wrap BDI moved below 1,000 due to continual weak demand for dry bulk commodities. th As of 8 October 2014, the Baltic Dry Index lost 6.1% WoW to 991, as the Baltic Capesize Index and Baltic Supramax Index declined 11.9% WoW and 5.0% WoW, th respectively. The Baltic Panamax Index broke rank to inch up 1.8% WoW as at 8 October 2014. In August, import volume of iron ore, according to National Bureau of Statistics, increased 8.5% YoY and that of thermal coal dropped 27.3% YoY. th th Compared with 30 Sept 2014, the Voyage Charter Index dropped 2.8% as at 8 October 2014. For the same period, the Time Charter Index declined 4.4% WoW. We may begin to see an acceleration of anchored container vessels, as compared with th th 30 Sept 2014, the number of anchored container vessels increased 14% as at 9 October 2014. 1-Year Sector Performance International aviation market continued to recover. The volume of air passengers travelling on the member airlines of IATA increased 5.9% YoY in August, a slight pick-up from 5.4% YoY increase in July. International passenger volume increased 6.7% YoY in August, better than the 4.5% YoY increase for domestic flights. IATA reiterated its positive view on the passenger volume growth for the full year, despite the concern of fast capacity expansion. Air freight volume of the member airlines of IATA increased 5.1% YoY in August, following a 6.1% YoY rise in July. Indeed, the air freight volume in August increased MoM due to the continual strength of world trade volume. IATA maintained that the growth trend in air freight volume remains positive, despite uncertainties such as political (Russia-Ukraine crisis) and economic risks. [email protected] Tel: (852) 29779381 Slow growth in passenger volume during National Day holiday. According to media reports from Xinhua News Agency, the number of aviation passengers during the first seven days of October increased by 5.7% YoY to 8.2m. The number of flights increased 13.1% YoY during the same period and the daily average of passengers broke above 1.25m. Load factor for flights using airports of popular tourist sites, such as Lhasa (Tibet) and Haikou (Hainan Island) was well above 85%. In the case of railway, the number of passengers reached 9.45m on the sixth day of the holiday, up 9.1% YoY. On the last day of the holiday, the number of passengers was estimated by the China Railway Corporation to be about 10.3m at the moment. For the whole holiday period, the China Railway Corporation projects a total number of 68m passengers transported by the railway system, according to the Xinhua News Agency. The State Council detailed the Medium-to-Long Term Plan for the development of the logistics industry between 2014 and 2020. In fact, we found most of the details in the plan are not much different from what we have described in our Transportation th Weekly dated 26 September 2014. However, there are some other concrete details in respect of the sub-segments of the logistics industry that the Chinese government encourages, viz. agricultural produce, manufacturing supply chain, natural resources logistics, city centre-rural area consumer products logistics, and e-fulfillment logistics. Similar to what we have lamented before, there is still a lack of strong incentives or policies to achieve the laid-out objectives. While share prices of some of the counters with strong logistics theme rallied, we are cautious if the momentum could sustain for a long while. Download our reports from Bloomberg: BOCM〈enter〉 Source: Bloomberg Ian Feng Geoffrey Cheng, CFA [email protected] Tel: (852)2977 9380 Morning Express 10 October 2014 Market Review Hong Kong stocks rose on Thursday, with the Hang Seng Index rising 271 points, or 1.2%, to 23,534. Telecoms led gains. China Mobile (941.HK) gained 3.3% and Unicom (762.HK) added 2.6%. Mainland developers rallied on rumors that Beijing may relax home purchase restriction. CR Land (1109.HK) rose 3.1%. COLI (688.HK) added 1.9%. Auto makers advanced. Great Wall Motor (2333.HK) rose 4.4% after announcing positive Sept operational data. Guangzhou Auto (2238.HK) rose 2.1%. US stocks slumped on Thursday. The S&P 500 fell 40.68 points, or 2.1%, to 1,928.21. The DJIA lost 334.97 points, or 2%, to 16,659.25, its worst one-day point plummet in more than a year. In Europe, the Stoxx Europe 600 fell 0.4% to end at 326.67. News Reaction CIRC liberalizes non-standardized investment restrictions on investment-linked insurance products. According to media reports, the China Insurance Regulatory Commission (CIRC) recently issued relevant documents to solicit industry views. It clearly emphasized that the investment products of investment-linked insurance may include the non-standardized debt assets without public trading market but having stable earnings expectations. China’s GDP exceeds US on PPP adjustment, IMF says. International Monetary Fund (IMF) released the World Economic Outlook Report, stating that in terms of PPP (Purchasing Power Parity), China gross domestic product (GDP) reached US$17.6tn this year, exceeding US$17.4tn of the US, and became the world’s largest economy. Global PC shipments show a less-than-expected 1.7% decline in Jul-Sept period. According to the report from the market researcher IDC, global PC shipments fell 1.7% YoY in the Jul-Sept period. This marked a decline for 10 consecutive quarters, but the decline was less than IDC’s estimate of 4.1%. The last quarter was the quarter with the least decline since early 2012. China resumes coal import tariffs from 15 Oct. The Ministry of Finance said on Thursday that it will remove the provisional zero import tax rate on anthracite, coking coal and other bituminous coal and resume the introduction of MFN rate of 3%-6% from 15 Oct 2014 onwards. ZTE (763.HK) gets 3 licenses for third-party payment services. ZTE announced that its subsidiary, Shenzhen Xun Chi pay Network Ltd, has obtained the permission for carrying out mobile payment, internet payment and digital TV payment business. It becomes the first third-payment institution in Mainland China to obtain three operating licenses all at once. Download our reports from Bloomberg: BOCM〈enter〉 Morning Express 10 October 2014 Economic releases for this week - USA Date Time - Event - Economic releases for this week - China Survey - Source: Bloomberg Prior - Date Time - Event - Survey - Source: Bloomberg BOCOM Research Latest Reports Data 09 Oct 2014 09 Oct 2014 08 Oct 2014 07 Oct 2014 07 Oct 2014 06 Oct 2014 06 Oct 2014 06 Oct 2014 30 Sep 2014 30 Sep 2014 30 Sep 2014 29 Sep 2014 29 Sep 2014 29 Sep 2014 29 Sep 2014 29 Sep 2014 25 Sep 2014 24 Sep 2014 23 Sep 2014 22 Sep 2014 Report SH-HK Stock Connect - Internet - A-share Internet stocks to gradually become more reasonably valued Intime (1833.HK) - 3Q14 SSS largely in-line; Maintain Buy SH-HK Stock Connect - Property - Going for the sector leaders Consumer Discretionary Sector - Protests' impact on HK retailers SH-HK Stock Connect - Transportation & Logistics - E-commerce logistics in the spotlight Strategy – Hong Kong Chasm SH-HK Stock Connect - China Steel - More eligible stocks to trade in sector; industry leaders to benefit China Property Sector - Mortgage easing and sales recovery produce short-term catalysts Container Shipping Sector - Weekly container shipping commentary SH-HK Stock Connect - China Consumer Staples - Dive for scarcity value SH-HK Stock Connect - A-share mindset to lift H-share valuation China Market Strategy - Two Diverging Trades Intime (1833.HK) - Acquired properties in Ningbo to expand its shopping mall operation; Reiterate Buy SH-HK Stock Connect - Brokerage - A good opportunity to buy the undervalued but high-quality brokers China Property Sector -Financing concerns on highly-geared and aggressive developers SH-HK Stock Connect - Insurance - SH-HK Stock Connect to spur the re-rating of A-share insurers Transportation Sector - Weekly transportation news wrap Energy Sector – Bocom Energy Weekly Container Shipping Sector - Weekly container shipping commentary China Market Strategy - Consolidation or Correction - Long Yield Still Holds the Key Source: Company data, BOCOM International Download our reports from Bloomberg: BOCM〈enter〉 Analyst Yuan MA, PhD, Connie GU, CPA Anita Chu Alfred Lau CFA, FRM, Toni Ho CFA, FRM Phoebe Wong Geoffrey Cheng, CFA, Yinan Feng Hao Hong, CFA Jovi Li Toni Ho, CFA, FRM, Alfred Lau, CFA, FRM Geoffrey Cheng Summer Wang, Shawn Wu Healthcare - Johnsun Sun, Milo Liu Hao Hong, CFA Anita Chu Jerry Li Toni Ho, CFA, FRM, Alfred Lau, CFA, FRM Jerry Li Ian Feng, Geoffrey Cheng, CFA Fei Wu, Tony Liu Geoffrey Cheng, CFA Hao Hong, CFA Prior - Morning Express 10 October 2014 Hang Seng Index Constituents Company name Cheung Kong Hang Lung Proper Hengan Intl China Shenhua-H Hang Seng Bk China Res Land Cosco Pac Ltd Henderson Land D Aia Group Ltd Hutchison Whampo Kunlun Energy Co Ind & Comm Bk-H China Merchant Want Want China Sun Hung Kai Pro New World Dev Belle Internatio China Coal Ene-H Swire Pacific-A Sands China Ltd Clp Hldgs Ltd Bank East Asia Ping An Insura-H Boc Hong Kong Ho China Life Ins-H Citic Pacific China Res Enterp Cathay Pac Air Hong Kg China Gs Tingyi Hldg Co Esprit Hldgs Bank Of Commun-H China Petroleu-H Hong Kong Exchng Bank Of China-H Wharf Hldg Li & Fung Ltd Hsbc Hldgs Plc Power Assets Hol Mtr Corp China Overseas Tencent Holdings China Unicom Hon Sino Land Co China Res Power Petrochina Co-H Cnooc Ltd China Const Ba-H China Mobile Lenovo Group Ltd Hang Seng Index BBG code 1 HK 101 HK 1044 HK 1088 HK 11 HK 1109 HK 1199 HK 12 HK 1299 HK 13 HK 135 HK 1398 HK 144 HK 151 HK 16 HK 17 HK 1880 HK 1898 HK 19 HK 1928 HK 2 HK 23 HK 2318 HK 2388 HK 2628 HK 267 HK 291 HK 293 HK 3 HK 322 HK 330 HK 3328 HK 386 HK 388 HK 3988 HK 4 HK 494 HK 5 HK 6 HK 66 HK 688 HK 700 HK 762 HK 83 HK 836 HK 857 HK 883 HK 939 HK 941 HK 992 HK Share price (HK$) 132.40 23.20 77.95 21.55 128.40 17.54 10.48 51.55 42.35 98.45 11.06 4.97 23.70 9.97 113.30 9.34 9.15 4.69 100.20 42.65 64.50 31.55 59.90 24.80 21.90 13.58 18.98 14.60 17.56 20.60 10.82 5.53 6.78 173.80 3.53 56.25 9.01 79.80 70.80 30.95 21.30 117.90 11.70 12.46 21.60 9.93 13.46 5.58 94.95 11.88 Mkt cap (HK$m) 306,660 104,058 95,629 395,683 245,481 102,280 30,798 154,647 510,109 419,729 89,281 1,610,610 60,365 131,564 309,174 80,931 77,173 74,160 148,067 344,014 162,956 74,043 441,280 262,205 576,706 338,187 45,811 57,434 184,655 115,421 21,020 406,716 786,401 203,002 964,616 170,445 75,327 1,528,366 151,106 180,128 174,106 1,103,999 279,773 74,955 103,608 1,816,083 600,955 1,391,186 1,935,035 125,804 5d chg (%) 3.5 5.0 2.1 -0.5 3.0 9.6 1.7 2.5 5.5 4.7 -1.3 2.7 -1.3 3.0 2.9 3.3 4.8 3.3 0.2 5.3 3.4 0.3 2.7 0.2 1.6 4.8 3.3 2.1 4.3 1.0 7.8 2.2 -0.3 4.0 1.4 1.9 2.2 0.3 3.1 1.8 6.6 2.1 0.9 3.8 3.1 -0.2 1.1 2.6 5.8 2.8 Ytd chg (%) 14.1 -5.3 -14.9 -11.9 2.1 -8.7 -1.5 28.1 8.9 -0.1 -19.0 -5.2 -16.3 -11.0 15.2 1.3 2.0 7.6 10.2 -31.8 5.2 -4.0 -13.8 -0.2 -9.7 14.5 -26.3 -11.0 8.6 -8.0 -27.6 1.1 7.1 34.4 -1.1 -5.1 9.8 -5.2 14.8 5.5 -2.3 19.2 0.9 17.5 17.5 16.8 -6.7 -4.6 18.1 26.0 23,534.5 14,436,860 2.6 1.0 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) 152.00 105.95 27.00 19.80 99.70 74.05 27.00 19.12 133.00 117.60 23.50 13.62 12.00 9.40 56.40 36.46 44.20 34.65 108.50 86.88 14.82 10.90 5.66 4.33 30.00 22.75 13.10 9.32 120.20 90.35 10.77 7.15 11.82 7.25 5.26 3.72 108.00 80.55 68.00 38.70 67.80 56.00 35.00 28.50 76.50 55.60 26.65 21.50 25.80 19.52 16.88 9.35 27.90 18.14 17.26 13.92 18.40 13.91 24.00 19.36 17.42 9.98 5.98 4.53 8.23 5.73 185.00 112.80 3.79 3.03 70.20 46.35 10.70 7.72 87.35 75.75 75.85 57.85 32.30 26.55 24.80 17.52 134.00 77.56 14.22 9.03 14.16 9.83 24.90 17.10 11.70 7.31 16.12 11.42 6.37 4.89 102.20 63.65 12.70 7.62 25,363.0 21,137.6 –––––––––– PE ––––––––––– 2013A 2014E 2015E (X) (X) (X) 7.1 8.6 8.9 13.6 17.6 16.6 26.4 25.1 20.8 7.9 8.4 8.3 14.7 14.2 13.2 6.7 8.9 7.6 13.5 11.4 10.7 8.6 16.2 16.4 26.7 20.8 18.0 8.9 12.4 11.5 14.1 13.4 12.0 5.1 5.0 4.7 13.7 14.2 12.9 24.3 23.8 20.7 9.1 14.8 13.8 7.0 10.8 10.4 13.6 13.8 13.2 35.6 30.9 22.1 11.5 14.3 13.4 16.8 15.7 13.5 18.1 15.4 15.1 10.6 11.4 10.7 11.9 10.6 9.2 11.4 10.7 9.7 18.2 15.0 12.7 9.6 10.2 8.0 25.0 33.4 26.3 19.5 17.2 11.7 26.6 24.6 22.7 23.6 29.2 23.9 98.4 32.6 21.6 5.0 5.0 4.7 9.3 8.9 8.4 43.9 38.7 29.7 4.7 4.7 4.4 7.2 14.3 12.6 11.6 17.6 15.3 13.1 11.3 10.3 2.4 17.4 17.5 12.1 17.4 16.0 7.0 7.5 6.6 42.7 36.1 27.1 18.6 17.2 14.6 8.3 14.0 13.8 8.9 8.4 7.7 10.9 10.4 9.8 8.6 8.3 7.8 4.9 4.8 4.5 13.0 13.6 13.7 18.5 18.2 15.0 10.3 10.8 10.0 Yield P/B (%) 2.7 3.2 2.4 5.3 4.3 2.6 2.9 2.0 1.1 2.4 2.1 N/A 3.2 2.7 3.0 4.4 1.1 2.2 3.6 4.1 4.0 3.5 1.5 4.1 1.7 2.0 1.3 1.8 1.9 1.4 0.6 N/A 4.5 2.0 7.0 3.1 5.3 4.8 3.6 3.0 2.3 0.2 1.7 4.0 3.5 4.1 4.2 N/A 3.3 2.0 (X) 0.8 0.8 5.8 1.2 2.2 1.2 0.9 0.6 2.3 1.0 1.8 1.0 0.9 9.0 0.7 0.5 2.4 0.6 0.7 8.5 1.8 1.1 1.8 1.6 2.0 0.6 0.9 0.9 3.6 5.2 1.2 0.7 1.1 9.1 0.8 0.6 2.0 1.0 1.2 1.1 1.5 12.4 1.0 0.7 1.5 1.2 1.3 1.0 1.8 4.9 3.6 1.4 Morning Express 10 October 2014 China Ent Index Constituents Company name Shandong Weig-H China Shenhua-H Sinopharm-H China Shipping-H Zoomlion Heavy-H Yanzhou Coal-H Agricultural-H New China Life-H Ind & Comm Bk-H Tsingtao Brew-H China Com Cons-H China Coal Ene-H China Minsheng-H Guangzhou Auto-H Ping An Insura-H Picc Property & Great Wall Mot-H Weichai Power-H Aluminum Corp-H China Pacific-H China Life Ins-H China Oilfield-H Zijin Mining-H China Natl Bdg-H Bank Of Commun-H Jiangxi Copper-H China Petroleu-H China Rail Gr-H China Merch Bk-H Bank Of China-H Dongfeng Motor-H Citic Securiti-H Haitong Securi-H China Telecom-H Air China Ltd-H Petrochina Co-H Huaneng Power-H Anhui Conch-H China Longyuan-H China Const Ba-H China Citic Bk-H Hang Seng China Ent Indx BBG code 1066 HK 1088 HK 1099 HK 1138 HK 1157 HK 1171 HK 1288 HK 1336 HK 1398 HK 168 HK 1800 HK 1898 HK 1988 HK 2238 HK 2318 HK 2328 HK 2333 HK 2338 HK 2600 HK 2601 HK 2628 HK 2883 HK 2899 HK 3323 HK 3328 HK 358 HK 386 HK 390 HK 3968 HK 3988 HK 489 HK 6030 HK 6837 HK 728 HK 753 HK 857 HK 902 HK 914 HK 916 HK 939 HK 998 HK Share price (HK$) Mkt cap (HK$m) 5d chg (%) Ytd chg (%) 7.51 21.55 27.60 4.90 4.52 6.36 3.51 27.45 4.97 56.80 5.63 4.69 7.39 7.70 59.90 14.74 31.70 28.60 3.34 27.90 21.90 20.05 1.95 7.15 5.53 13.00 6.78 4.23 13.60 3.53 12.82 18.80 12.50 4.70 5.00 9.93 8.77 25.35 7.58 5.58 4.86 33,617.55 395,683.34 70,884.90 21,107.06 45,699.52 45,720.03 1,034,522.56 93,311.01 1,610,609.79 72,286.61 96,584.12 74,160.21 271,470.60 62,135.45 441,280.38 200,524.98 114,909.29 53,159.78 60,943.70 233,052.25 576,705.69 108,397.73 62,193.09 38,603.04 406,715.96 54,648.16 786,400.98 85,936.00 335,252.97 964,615.78 110,458.66 188,873.72 124,139.24 380,382.16 65,630.11 1,816,082.64 113,833.47 121,323.96 60,915.83 1,391,186.18 256,448.39 -2.2 -0.5 -2.8 0.6 -0.2 -0.2 2.0 1.5 2.7 2.7 0.5 3.3 4.1 2.5 2.7 7.1 5.1 2.0 5.7 2.2 1.6 -2.2 3.2 1.6 2.2 1.7 -0.3 2.7 2.4 1.4 0.5 5.0 4.3 -1.3 1.8 -0.2 3.4 2.2 -0.1 2.6 3.2 -28.2 -11.9 24.0 -18.6 -37.6 -10.2 -7.9 5.6 -5.2 -13.3 -9.9 7.6 3.0 -9.2 -13.8 28.2 -25.9 -8.5 23.7 -8.2 -9.7 -16.6 17.5 -14.3 1.1 -7.1 7.1 5.8 -17.7 -1.1 5.6 -11.1 -7.4 19.9 -13.6 16.8 25.1 -11.8 -24.1 -4.6 15.4 11.2 27.0 30.0 6.3 8.0 8.7 4.1 29.6 5.7 68.3 6.7 5.3 8.2 10.9 76.5 15.0 51.9 35.5 3.9 33.5 25.8 26.0 2.2 9.1 6.0 15.4 8.2 4.7 17.6 3.8 15.2 21.7 14.5 5.2 6.3 11.7 9.7 35.7 10.3 6.4 5.3 6.8 19.1 19.7 4.0 4.4 4.9 3.0 20.6 4.3 53.5 4.9 3.7 5.9 6.7 55.6 9.8 26.1 25.8 2.5 23.6 19.5 17.2 1.6 6.7 4.5 11.6 5.7 3.0 12.1 3.0 9.6 13.7 9.5 3.1 4.2 7.3 6.1 24.2 7.3 4.9 3.6 61.6 7.9 21.8 N/A 14.9 6.7 5.1 11.3 5.1 30.6 5.6 35.6 4.4 12.4 11.9 14.8 9.4 8.6 N/A 18.7 18.2 9.2 15.7 4.9 5.0 10.0 9.3 7.2 4.7 4.7 6.5 22.5 22.4 16.1 18.5 10.9 8.5 8.7 24.7 4.9 4.4 25.0 8.4 19.8 41.6 11.0 19.7 4.9 11.0 5.0 29.6 5.4 30.9 4.1 9.6 10.6 12.9 8.7 9.5 N/A 17.2 15.0 9.2 15.1 5.1 5.0 13.3 8.9 6.8 4.7 4.7 6.6 22.2 18.2 16.0 15.3 10.4 7.9 8.9 16.7 4.8 4.3 10,484 4,195,801 1.7 -3.1 11,638.3 9,159.8 7.3 7.1 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) ––––––––––– PE ––––––––––– 2013A 2014E 2015E (X) (X) (X) Yield P/B (%) (X) 20.6 8.3 16.5 14.9 9.8 16.1 4.5 9.6 4.7 25.5 5.0 22.1 3.9 7.4 9.2 11.5 7.0 9.3 N/A 14.7 12.7 8.5 14.7 4.6 4.7 13.0 8.4 6.2 4.2 4.4 6.2 19.1 15.4 14.7 12.0 9.8 7.9 8.1 13.3 4.5 3.9 1.0 5.3 1.2 0.0 4.2 0.4 N/A 0.7 N/A N/A 4.2 2.2 2.7 3.0 1.5 1.9 3.3 1.1 N/A 1.8 1.7 2.7 N/A 2.8 N/A 4.9 4.5 2.0 5.8 7.0 1.8 N/A 1.2 2.6 1.1 4.1 5.5 1.7 0.8 N/A N/A 2.8 1.2 2.6 0.6 0.7 0.6 1.0 1.6 1.0 4.1 0.7 0.6 0.9 1.1 1.8 2.5 2.6 1.4 0.9 1.9 2.0 1.7 1.2 0.8 0.7 0.8 1.1 0.8 0.9 0.8 1.2 1.8 1.5 1.1 1.0 1.2 1.5 1.8 1.5 1.0 0.8 6.5 4.5 1.1 Morning Express 10 October 2014 BOCOM International 11/F, Man Yee Building, 68 Des Voeux Road, Central, Hong Kong Main: + 852 3710 3328 Fax: + 852 3798 0133 Rating System Company Rating www.bocomgroup.com Sector Rating Buy: Expect more than 20% upside in 12 months LT Buy: Expect more than 20% upside but longer than 12 months Neutral: Expect low volatility Sell: Expect more than 20% downside in 12 months Outperform (“OP”): Expect more than 10% upside in 12 months Market perform (“MP”): Expect low volatility Underperform (“UP”): Expect more than 10% downside in 12 months Research Team Head of Research @bocomgroup.com (852) 2977 9393 raymond.cheng (852) 2977 9384 hao.hong (852) 2977 9212 yangqingli Shanshan LI, CFA (86) 10 8800 9788 - 8058 lishanshan Li WAN, CFA (86) 10 8800 9788 - 8051 Wanli Raymond CHENG, CFA, CPA, CA Strategy Economics Hao HONG, CFA Banks Consumer Discretionary miaoxian.li Fei WU (852) 2977 9392 fei.wu Tony LIU (852) 2977 9390 xutong.liu Alfred LAU, CFA, FRM (852) 2977 9235 alfred.lau Toni HO, CFA, FRM (852) 2977 9220 toni.ho Luella GUO (852) 2977 9211 luella.guo (86) 21 6065 3606 louis.sun (852) 2977 9209 lizhiwu (852) 2977 9216 miles.xie Geoffrey CHENG, CFA (852) 2977 9380 geoffrey.cheng Ian FENG (852) 2977 9381 Yinan.feng (86) 21 6065 3675 wei.yao Property Phoebe WONG (852) 2977 9391 phoebe.wong Anita CHU (852) 2977 9205 anita.chu Consumer Staples Renewable Energy Summer WANG (852) 2977 9221 summer.wang Shawn WU (852) 2977 9386 shawn.wu Johnson SUN (852) 2977 9203 johnson.sun Milo LIU (852) 2977 9387 milo.liu (852) 2977 9389 liwenbing Healthcare Louis SUN Telecom & Small/ Mid-Caps Insurance Zhiwu LI Technology Internet Miles XIE Transportation & Industrial Yuan MA (86) 10 8800 9788 - 8039 yuan.ma Connie GU, CPA (86) 10 8800 9788 - 8045 conniegu (852) 2977 9243 jovi.li Metals & Mining Jovi LI (86) 10 8800 9788 - 8043 Miaoxian LI Oil & Gas/ Gas Utilities Qingli YANG Jerry LI @bocomgroup.com Automobile Download our reports from Bloomberg: BOCM〈enter〉 Wei YAO Morning Express 10 October 2014 Analyst Certification The authors of this report, hereby declare that: (i) all of the views expressed in this report accurately reflect their personal views about any and all of the subject securities or issuers; and (ii) no part of any of their compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report; (iii) no insider information/ non-public price-sensitive information in relation to the subject securities or issuers which may influence the recommendations were being received by the authors. The authors of this report further confirm that (i) neither they nor their respective associates (as defined in the Code of Conduct issued by the Hong Kong Securities and Futures Commission) have dealt in or traded in the stock(s) covered in this research report within 30 calendar days prior to the date of issue of the report; (ii)) neither they nor their respective associates serve as an officer of any of the Hong Kong listed companies covered in this report; and (iii) neither they nor their respective associates have any financial interests in the stock(s) covered in this report. Disclosure of relevant business relationships BOCOM International Securities Limited, and/or its associated companies, has investment banking relationship with Shunfeng Photovoltaic International Limited, China National Offshore Oil Corporation Limited, Hydoo International Holdings Limited, Jingrui Holdings Limited, Bank of Chongqing Co. Ltd., Huishang Bank Corporation Limited, Phoenix Healthcare Group Co. Ltd., China Cinda Asset Management Co. Ltd., Qinhuangdao Port Co. Ltd, Jintian Pharmaceutical Group Limited,Logan Property Holdings Company Limited, Nanjing Sinolife United Company Limited, Magnum Entertainment Group Holdings Limited, Bank of Communications, Harbin Bank Co., Ltd., Azure Orbit International Finance Limited, Hanhua Financial Holding Co., Ltd., Central China Securities Company Limited, China New City Commercial Development Limited, China Shengmu Organic Milk Limited, Broad Greenstate International Company Limited and China National Culture Group Limited within the preceding 12 months. BOCOM International Securities Limited currently holds more than 1% of the equity securities of Shanghai Fosun Pharmaceuticals Group Co. Ltd. Disclaimer By accepting this report (which includes any attachment hereto), the recipient hereof represents and warrants that he is entitled to receive such report in accordance with the restrictions set forth below and agrees to be bound by the limitations contained herein. Any failure to comply with these limitations may constitute a violation of law. This report is strictly confidential and is for private circulation only to clients of BOCOM International Securities Ltd. This report is being supplied to you strictly on the basis that it will remain confidential. No part of this report may be (i) copied, photocopied, duplicated, stored or reproduced in any form by any means or (ii) redistributed or passed on, directly or indirectly, to any other person in whole or in part, for any purpose without the prior written consent of BOCOM International Securities Ltd. BOCOM International Securities Ltd, its affiliates and related companies, their directors, associates, connected parties and/or employees may own or have positions in securities of the company(ies) covered in this report or any securities related thereto and may from time to time add to or dispose of, or may be interested in, any such securities. Further, BOCOM International Securities Ltd, its affiliates and its related companies may do and seek to do business with the company(ies) covered in this report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking, advisory, underwriting, financing or other services for or relating to such company(ies) as well as solicit such investment, advisory, financing or other services from any entity mentioned in this report. In reviewing this report, an investor should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest. The information contained in this report is prepared from data and sources believed to be correct and reliable at the time of issue of this report. This report does not purport to contain all the information that a prospective investor may require and may be subject to late delivery, interruption and interception. BOCOM International Securities Ltd does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information and opinion contained in this report and accordingly, neither BOCOM International Securities Ltd nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof. This report is general in nature and has been prepared for information purposes only. It is intended for circulation amongst BOCOM International Securities Ltd’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. The information and opinions in this report are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, related investments or other financial instruments thereof. The views, recommendations, advice and opinions in this report may not necessarily reflect those of BOCOM International Securities Ltd or any of its affiliates, and are subject to change without notice. BOCOM International Securities Ltd has no obligation to update its opinion or the information in this report. Investors are advised to make their own independent evaluation of the information contained in this research report, consider their own individual investment objectives, financial situation and particular needs and consult their own professional and financial advisers as to the legal, business, financial, tax and other aspects before participating in any transaction in respect of the securities of company(ies) covered in this report. The securities of such company(ies) may not be eligible for sale in all jurisdictions or to all categories of investors. This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to any law, regulation, rule or other registration or licensing requirement. BOCOM International Securities Ltd is a wholly owned subsidiary of Bank of Communications Co Ltd. Download our reports from Bloomberg: BOCM〈enter〉

© Copyright 2026