Morning Express Focus of the Day China Macro

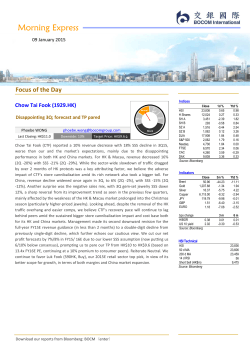

Morning Express 16 October 2014 Focus of the Day Indices China Macro Interest rate liberalization changes the implication of “interest rate cuts” Miaoxian LI [email protected] Economics China’s Sept CPI rose 1.6% YoY, hitting a record low in the year. CPI is unlikely to rise significantly ahead as the government has refused to implement strong stimulus amid economic slowdown. Therefore, we trim our 2014 CPI estimate from 2.5% to 2.2%. Lower inflation may not necessarily trigger a cut in the savings and lending benchmark rates as expected by the market, as the central bank may prefer to regulate the money market rate following the promotion of interest rate liberalization. The implication of “interest rate cuts” is changing. Close HSI 23,140 H Shares 10,285 SH A 2,485 SH B 264 SZ A 1,412 SZ B 968 DJIA 16,142 S&P 500 1,862 Nasdaq 4,215 FTSE 6,212 CAC 3,940 DAX 8,572 Source: Bloomberg 1d % 0.40 0.29 0.60 0.64 0.40 1.04 -1.06 -0.81 -0.28 -2.83 -3.63 -2.87 Ytd % -0.71 -4.91 12.22 3.91 27.89 11.54 -2.62 0.76 0.93 -7.96 -8.29 -10.26 Close 83.34 1,241.24 17.47 6,641.00 105.88 1.60 1.28 3m % -21.27 -4.46 -15.87 -6.86 -3.98 -6.65 -5.13 Ytd % -24.78 2.95 -10.25 -9.77 -0.54 -3.38 -6.64 bps change HIBOR 0.38 US 10 yield 2.14 Source: Bloomberg 3m -0.01 -0.45 6m 0.00 -0.55 Indicators Luk Fook Holdings (590.HK) Neutral Eased 2Q SSS pressure; China’s Golden Week sales better than expected Phoebe WONG Last Closing: HK$22.75 [email protected] Upside: 5% LT BUY BUY SELL Stock Target Price: HK$24 LF reported a 21% SSS decline in 2Q15 (in line), considerably easing from -54% in 1Q15, mainly due to the lessened high base effect due to last year’s gold rush, with HK & Macau -20% (vs. 1Q -54%) and China -30% (vs. 1Q -52%). Both gold and gem-set jewelry sales saw sequential improvement, with gold products’ SSS decline narrowing to 27% (1Q -65%) in HK & Macau and to 38% (1Q -59%) in China, while HK & Macau gem-set jewelry decline narrowed to 7% from 20% in 1Q and China growth accelerated to 14% from 5% in 1Q. For the Golden Week, the SSS results were better than our expectation, with HK & Macau +3% notwithstanding the protests. We attribute it partly to the fact that Luk Fook’s store network skews more towards the non-tourist areas than peers. China was more encouraging, +28%, with both gold products and gem-set jewelry selling well, +29%/+28%. Looking into 2H, despite easier comps, we believe the sustained sluggish HK consumer environment will continue to be the key overhang on the stock. The prolonged protests which have dampened Chinese tourist arrivals and local consumer sentiment are set to cloud the market’s near-term earnings visibility, though LF’s rising China market contribution on its ongoing store expansion through the asset-light licensed store business model helps to partly offset the impact. Maintain Neutral and target price of HK$24 (based on 9x FY15E PE, a 10% discount to peers). Download our reports from Bloomberg: BOCM〈enter〉 Brent Gold Silver Copper JPY GBP EURO HSI Technical HSI 50 d MA 200 d MA 14 d RSI Short Sell (HK$m) Source: Bloomberg 23,140 24,334 23,148 38 6,037 BOCOM Int'l Corporate Access 17 Oct 21 Oct Fudan Zhangjiang (1349.HK) Tasly Pharma Group (600535 CH) Morning Express 16 October 2014 Chow Tai Fook (1929.HK) Neutral Narrowed 2Q sales decline, but catalyst remains absent Phoebe WONG Last Closing: HK$10.44 BUY SELL [email protected] Upside: 1% LT BUY Stock Target Price: HK$10.50→ Chow Tai Fook (CTF) reported a 10% revenue decline in 2Q15 (in line), narrowing considerably from -32% in 1Q as the high base effect due to last year’s gold rush diminished. The decline was mainly led by 20% SSS decline (partly offset by 12% new store growth). HK & Macau revenue decreased 20% (1Q -43%) with SSS -29% (1Q15 -50%), while the China market continued to fare better with revenue decline narrowing to 2% (1Q -24%) and SSS -12% (1Q15 -28%). That said, the sales mix improvement pace turned stagnant sequentially, with SSS of gem-set jewelry at flat (vs. 2% growth in 1Q) and gold products dropping 33% (1Q -56%). Gem-set jewelry sales contribution remained stable at 28% of the group’s revenue (same as 1Q) and that of gold products dropped 1ppt to 49% of revenue from 50% in 1Q. Looking into 2H, we believe the prolonged HK protests which have dampened Chinese tourist arrivals and local consumer sentiment will post near-term uncertainty to its HK earnings visibility, though its ongoing expansion of the better growing China market helps to mitigate the adverse impact. With the stock trading at PE of 13.8x/12.4x Mar-FY15E/16E (vs. sector average of 11.9x/9.4x), CTF’s valuation premium is fairly priced in, in our view. Reiterate Neutral and TP of HK$10.5 (based on 13.9x FY15E PE, continuing at a 10% premium to the major consumer discretionary peers). SITC International Holdings Co Ltd (1308.HK) Neutral Company update – 3Q14 could be affected by lower freight rate Geoffrey CHENG, CFA Last Closing: HK$3.96 BUY SELL [email protected] Upside: 1.8% LT BUY Stock Target Price: HK$4.03 While the margin performance would improve in 3Q14 due to cost reduction as a result of yen depreciation, we are concerned that the freight rate during the period could likely be flat compared with 1H14. We maintain our view of a single-digit growth in container shipping volume this year. The two new ships received in 4Q14 as well as the eight new deliveries next year will underpin faster container volume growth next year, in our view. We downgrade our rating to NEUTRAL due to valuation and limited upside to our target price. The 3Q14 results will be released on 29th October. We downgrade our rating to NEUTRAL due to valuation and limited upside to our target price. The 3Q14 result will be released on 29th October. Energy Sector Bocom Energy Weekly Fei WU [email protected] UP MP OP This week in the energy world, Brent dropped to its lowest level since 2010 and PetroChina received Rmb1.421bn in government subsidies in 1H14. Download our reports from Bloomberg: BOCM〈enter〉 16 October 2014 Last Closing: HK$22.75 Upside: +5% Target Price: HK$24.00→ Consumer Discretionary Sector Luk Fook Holdings (590.HK) UP MP OP Eased 2Q SSS pressure; China’s Golden Week sales better than expected Financial Highlights Y/E March FY12 Revenue (HK$m) 11,907 Revenue growth (%) 47 Net profit (HK$m) 1,334 EPS (HK$) 2.43 vs Consensus (+/-%) N/A Net profit growth (%) 54 PER (x) 9.4 DPS (HK$) 0.96 Yield (%) 4.2 Source: Company, BOCOM Int’l estimates FY13 13,412 13 1,243 2.11 N/A -7 10.8 0.86 3.8 FY14 19,215 43 1,865 3.17 N/A 50 7.2 1.27 5.6 FY15E 17,351 -10 1,573 2.67 -3 -16 8.5 1.07 4.7 FY16E 19,928 15 1,856 3.15 3 18 7.2 1.26 5.5 LF reported a 21% SSS decline in 2Q15 (in line), considerably easing from -54% in 1Q15, mainly due to the lessened high base effect due to last year’s gold rush, with HK & Macau -20% (vs. 1Q -54%) and China -30% (vs. 1Q -52%). Both gold and gem-set jewelry sales saw sequential improvement, with gold products’ SSS decline narrowing to 27% (1Q -65%) in HK & Macau and to 38% (1Q -59%) in China, while HK & Macau gem-set jewelry decline narrowed to 7% from 20% in 1Q and China growth accelerated to 14% from 5% in 1Q. For the Golden Week, the SSS results were better than our expectation, with HK & Macau +3% notwithstanding the protests. We attribute it partly to the fact that Luk Fook’s store network skews more towards the non-tourist areas than peers. China was more encouraging, +28%, with both gold products and gem-set jewelry selling well, +29%/+28%. Looking into 2H, despite easier comps, we believe the sustained sluggish HK consumer environment will continue to be the key overhang on the stock. The prolonged protests which have dampened Chinese tourist arrivals and local consumer sentiment are set to cloud the market’s near-term earnings visibility, though LF’s rising China market contribution on its ongoing store expansion through the asset-light licensed store business model helps to partly offset the impact. Maintain Neutral and target price of HK$24 (based on 9x FY15E PE, a 10% discount to peers). Store expansion largely on track. 65 new stores (net) were opened in 1H15 (including 64 in China and 1 in HK), bringing the group’s total number of stores to 1,333, largely in line with our expectation (representing 38% of our full-year FY15E estimate). 64 net new stores were added in China (franchised +65, self operated -1), bringing the total number of China stores to 1,272, including 1,190 licensed stores and 82 self-operated stores. For HK, 1 was net added (to 46), while Macau and overseas stores remained unchanged at 10 and 5, respectively. We maintain our new store forecast of 173/175 in FY14/15E, representing 14%/12% YOY growth. Figure 1: SSS growth trend by market 120 100 80 60 40 20 0 -20 China (%) (%) 140 41 29 13 46 1 25 0 -40 -60 -2 14 Stock Stock data 52w High 52w Low Market cap (HK$m) Issued shares (m) Avg daily vol (m) 1-mth change (%) YTD change (%) 50d MA 200d MA 14-day RSI Source: Company data, Bloomberg 34.00 19.26 13,402 589 1.0 -3.8 -22.9 23.87 24.24 43.50 1 Year Performance chart 40% HSI 590.HK 30% 20% 10% 0% -10% -20% -30% Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Source: Company data, Bloomberg Phoebe Wong [email protected] Tel: (852) 2977 9391 Gold & platinum Gem-set jewellery 134 110 66 86 BUY SELL Figure 2: Group’s SSS growth trend by product HK & Macau 115 66 LT BUY Neutral 80 36 33 50 58 23 19 20 1 -20 6 -12 -52 -54 -30 -10 11 -40 Download our reports from Bloomberg: BOCM〈enter〉 -19 -6 -28 -15 -65 -70 1Q14 2Q14 1H11 1H12 1H13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 Source: Company data -4 -2 Source: Company data 3Q14 4Q14 1Q15 2Q15 16 October 2014 Last Closing: HK$10.44 Upside: +1% Target Price: HK$10.50→ Consumer Discretionary Sector Chow Tai Fook (1929.HK) UP MP OP Narrowed 2Q sales decline, but catalyst remains absent Financial Highlights March yr ended FY12 FY13 FY14 FY15E FY16E Revenue (HK$m) 56,571 Revenue growth (%) 61 Net profit (HK$m) 6,341 EPS (HK$) 0.685 vs Consensus (+/-%) n/a EPS growth (%) n/a PER (x) 15.2 DPS (HK$) 0.100 Yield (%) 1.0 Source: Company data, BOCOM Int’l estimates 57,434 2 5,505 0.551 n/a (20) 19.0 0.220 2.1 77,407 35 7,272 0.727 n/a 32 14.4 0.360 3.4 80,324 4 7,545 0.754 1 4 13.8 0.373 3.6 89,748 12 8,413 0.841 (4) 12 12.4 0.416 4.0 Neutral LT BUY BUY SELL Stock Chow Tai Fook (CTF) reported a 10% revenue decline in 2Q15 (in line), narrowing considerably from -32% in 1Q as the high base effect due to last year’s gold rush diminished. The decline was mainly led by 20% SSS decline (partly offset by 12% new store growth). HK & Macau revenue decreased 20% (1Q -43%) with SSS -29% (1Q15 -50%), while the China market continued to fare better with revenue decline narrowing to 2% (1Q -24%) and SSS -12% (1Q15 -28%). That said, the sales mix improvement pace turned stagnant sequentially, with SSS of gem-set jewelry at flat (vs. 2% growth in 1Q) and gold products dropping 33% (1Q -56%). Gem-set jewelry sales contribution remained stable at 28% of the group’s revenue (same as 1Q) and that of gold products dropped 1ppt to 49% of revenue from 50% in 1Q. Looking into 2H, we believe the prolonged HK protests which have dampened Chinese tourist arrivals and local consumer sentiment will post near-term uncertainty to its HK earnings visibility, though its ongoing expansion of the better growing China market helps to mitigate the adverse impact. With the stock trading at PE of 13.8x/12.4x Mar-FY15E/16E (vs. sector average of 11.9x/9.4x), CTF’s valuation premium is fairly priced in, in our view. Reiterate Neutral and TP of HK$10.5 (based on 13.9x FY15E PE, continuing at a 10% premium to the major consumer discretionary peers). Stock data 52w High 14.48 52w Low 9.50 Market cap (HK$m) 104,400 Issued shares (m) 10,000 Avg daily vol (m) 5.43 1-mth change(%) -5.8 YTD change(%) -9.7 50d MA 10.95 200d MA 11.54 14-day RSI 40.20 Source: Company data, Bloomberg Performance chart HSI 30% 1929.HK 20% 10% 0% -10% Store expansion on track. CTF added 104 net new stores in 1H15, including 97 in China; and 7 in HK, Macau & other Asian markets, bringing the total number of stores to 2,181 (+12% YOY), in line with our expectation (52% of our full-year estimate). We maintain our FY14E/15E new store forecast of 200/180 (+10%/+8%). -20% Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Source: Company data, Bloomberg Phoebe Wong [email protected] Tel: (852) 2977 9391 Figure 1: Group’s SSS growth Figure 2: SSS growth by market 48% 80% 50% 67% 60% 30% 18% 40% 11% 26% 14% 4% 10% 20% -10% -20% 12% 0% 7% -20% -9% -40% -30% 15% 31% -28% -40% -50% -60% -50% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 Source: Company data Download our reports from Bloomberg: BOCM〈enter〉 1Q14 2Q14 Source: Company data 3Q14 4Q14 1Q15 -12% China HK, Macau & -29% other Asian markets 2Q15 16 October 2014 Last Closing: HK$3.96 Upside: 1.8% Target Price: HK$4.03→ SITC (1308.HK) Container Shipping Sector UP MP OP Company update – 3Q14 could be affected by lower freight rate Financial Highlights Y/E 31 Dec Revenue (US$m) YoY growth Net profit (US$m) YoY growth EPS (US$) BVPS (US$) PER (x) PBR (x) Source: Company, BOCOM Int’l estimates 2012 2013 2014E 2015E 2016E 1,212 11.51 83.9 (10.3) 0.032 0.269 15.7 1.89 1,267 4.53 112.4 33.95 0.043 0.287 11. 7 1.77 1,352 6.66 127.8 13.65 0.049 0.318 10.3 1.60 1,511 11.74 165.4 29.49 0.064 0.360 7.9 1.41 1,638 8.44 195.3 18.07 0.076 0.407 6.71 1.25 Yen depreciation and competition could drag 3Q earnings. Management of SITC said that the freight rate and margin performance in 3Q14 was stable when compared with 1H14. In respect of the revenue performance of its container shipping segment in 3Q14, management said the freight rate stabilized in September with mild recovery while the weak yen in August and September offset the recovery to a certain extent. Yet, the yen depreciation could benefit SITC in terms of margin performance as expenses denominated in yen would report slower growth. We believe volume handled in 3Q14 could have grown by a single-digit rate, as SITC did not receive any new vessel during the 9-month period. We maintain our view of faster earnings growth next year. SITC will receive two new vessels in 4Q14, while another eight vessels will be delivered next year. Management said the new vessels will accrue cost benefits to SITC, mainly due to savings in charterhire expenses. We forecast a 10% YoY increase in container volume handled by SITC next year, higher than our forecast 7.0% YoY growth this year. Meanwhile, SITC continues to expand its shipping network for cargo canvassing, with new calling ports added in Thailand and the Philippines, as well as increased frequencies to Singapore. Logistics network expansion for improved door-to-door services. SITC said that there is no plan to enter express delivery-type logistics services (effectively e-fulfillment logistics) at the moment though the company continues to expand its door-to-door service capacity around the region. For example, the company acquired two warehouses at Qingdao (Shandong province) and Tianjin in 1H14. SITC is seeking similar facilities in South East Asia, such as Thailand and Vietnam. We downgrade to NEUTRAL recommendation. We have made minor revisions to our earnings forecast, which we outline in Figure 1. SITC has outperformed the benchmark in the past month. With limited upside to our target price, we downgrade the counter to NEUTRAL and wait for more information from 3Q14 th results to be released on 29 October. Neutral LT BUY BUY SELL Stock While the margin performance would improve in 3Q14 due to cost reduction as a result of yen depreciation, we are concerned that the freight rate during the period could likely be flat compared with 1H14. We maintain our view of a single-digit growth in container shipping volume this year. The two new ships received in 4Q14 as well as the eight new deliveries next year will underpin faster container volume growth next year, in our view. We downgrade our rating to NEUTRAL due to valuation and limited upside to our target price. The 3Q14 results will be released on 29th October. Stock data 52w High (HK$) 52w Low (HK$) Market cap (HK$m) Issued shares (m) Avg daily vol (m) 1-mth change(%) YTD change(%) 50d MA (HK$) 200d MA (HK$) 14-day RSI Source: Company data, Bloomberg 1 Year Performance chart (HK$) 4.2 3.8 3.4 3.0 2.6 2.2 1.8 Oct-13 SITC (LHS) Rel to MSCI CN (RHS) 150 130 110 90 Jan-14 Apr-14 Jul-14 Source: Company data, Bloomberg Geoffrey Cheng, CFA [email protected] Tel: (852) 2977 9380 Download our reports from Bloomberg: BOCM〈enter〉 4.19 2.72 10,243.6 2586.8 1.89 3.7 16.1 3.684 3.507 55.4 Oct-14 16 October 2014 Energy Weekly Energy Sector Bocom Energy Weekly MP UP OP Sector news around the block PetroChina gained Rmb1.421bn government subsidies in 1H 2014. Xinhua news agency This week’s energy updates: released a report saying 60% of government subsidies in 1H 2014 went to state-owned PetroChina received Rmb1.421bn in enterprises. Among all, PetroChina listed on top with Rmb1.421bn. PetroChina said the government subsidies in 1H14. government grants included the refund of import value-added tax relating to the import of natural gas in the interim report. Brent dropped to the lowest level since 2010. Brent crude price dropped to the lowest since 2010. Brent has dropped more than 20% in 2H this year and reached the lowest since 2010 on Monday after key OPEC member Saudi signaled they would keep high output. Also, Kuwait's oil minister said OPEC is unlikely to cut production to support prices and Iran has changed course and said it can live with lower prices. China’s 13th five-year energy plan meeting China’s 13th Five-year energy plan to focus on cleanliness and efficiency. Most provinces in China are working on their 13th five-year plans under guidance from the central government, and the targets for the next five years focus more on ecology. By 2020, total coal consumption in the primary energy mix may be set to drop under 62% and the capacity of natural gas transmission is expected to reach 480bn cubic meters. In the meantime, China’s new coal tax policy will be implemented on Dec 1, setting coal Brent Crude Price USD/bbl resource tax between 2% and 10%. Also, the government will raise tax rate for natural gas and crude oil from 5% to 6%. 120 Brent 115 110 105 100 Share price performance & commodities Performance O&G PetroChina Sinopec CNOOC Gas Utility Hong Kong China Gas ENN Energy China Resource Gas Last Price 1-yr YTD chg(%) chg(%) 90 85 80 Oct-13 857 HK Equity 386 HK Equity 883 HK Equity 9.50 6.65 12.52 -0.7 -0.3 -3.1 -5.8 -1.8 -7.4 -9.9 -15.7 -12.4 -4.9 -7.8 -6.3 15.2 16.7 -3.5 6.6 7.3 -21.0 11.8 5.1 -13.2 3 HK Equity 2688 HK Equity 1193 HK Equity 17.88 53.95 23.10 0.9 2.1 2.0 5.4 1.4 1.1 0.9 -3.7 3.1 5.7 -2.9 -2.1 -4.6 -2.9 -9.6 7.4 18.6 10.5 10.6 -5.9 -14.4 9.20 -2.4 -1.1 2.2 -3.7 25.7 29.8 25.0 2.52 -1.6 -8.4 -7.0 8.6 -3.1 26.0 13.0 19.06 3.26 -1.1 0.3 -8.8 -6.9 -11.1 -16.2 -5.2 -24.7 -22.5 -42.0 -7.5 -32.6 -20.7 -50.9 88.0 85.7 0.2 -0.1 -3.3 -5.1 -8.7 -7.1 -17.2 -15.0 1.1 13.1 -20.6 -16.0 -20.6 -12.9 88.1 85.5 3.9 0.5 -1.4 0.4 -3.2 -5.6 -0.3 -8.9 -10.2 1.8 -16.4 -18.4 -5.2 -2.4 0.4 3.5 -18.7 -23.2 4.0 -18.3 -22.1 -10.9 23048 2359 1875 -0.4 -0.3 -1.6 Tianlun Gas 1600 HK Equity Chem Shanghai Petrochemical338 HK Equity Oil Services COSL 2883 HK Equity Hilong 1623 HK Equity Comm odities Brent EUCRBREN Index WTI USCRWTIC Index Dubai Cinta Henry hub Index HSI Shanghai S&P 500 95 1-D 1-Week 1-mth 3-mth 1H 2014 chg(%) chg( %) chg(% ) chg(%) chg (%) PGCRDUBA Index APCRCNTA Index NGUSHHUB Index HSI Index SHCOMP Index SPX Index Dec-13 Feb-14 Apr-14 Jun-14 Aug-14 Source: Company data, Bloomberg WTI Crude Price USD/bbl WTI 120 115 110 105 100 95 90 85 80 -1.6 -0.2 -4.6 -6.3 1.2 -5.6 -1.3 14.2 -5.2 -0.5 -3.2 10.9 -0.7 5.4 9.6 -1.1 11.5 1.4 Oct-13 Dec-13 Feb-14 Apr-14 Fei Wu [email protected] Tel: (852) 2977 9392 Source: BOCOM Int’l, Bloomberg Tony Liu [email protected] Tel: (852) 2977 9390 Download our reports from Bloomberg: BOCM〈enter〉 Jun-14 Aug-14 Source: Company data, Bloomberg Morning Express 16 October 2014 Market Review Hang Seng Index (1 year) 26,000 Hong Kong stocks rose on Wednesday. The Hang Seng Index gained 92.08 points, or 0.40%, to 23,140.05. Lenovo (992.HK) rose 3.16% as the best blue-chip performer, followed by New World Development (17.HK) which finished up 2.92% after the developer won the Tai Wai site. Casino operators rallied. Sands China (1928.HK) added 2.2% while Galaxy Entertainment (27.HK) increased 2.6%. Central China Securities (1375.HK) jumped 21.72% after receiving approval to conduct SH-HK Stock Connect business. Peer Haitong Securities (6837.HK) also rose 1.7%. Airlines rose amid recent oil price decline and expectation of policies to bolster the sector. CSA (1055.HK) rose 5.49%. CEA (670.HK) jumped 6.2%. US stocks saw heavy intra-day losses on Wednesday but managed to pare declines at close. The S&P 500 fell 9.8% at one point but closed down 15.21 points, or 0.8%, to 1,862.49. The DJIA fell as much as 460 points but finished down 173.45 points, or 1.1%, at 16,141.74. European stocks plummeted on Wednesday. The Stoxx Europe 600 fell 3.2% to 311.36. 25,000 24,000 23,000 22,000 21,000 Source: Company data, Bloomberg HS China Enterprise Index (1 year) 13,000 12,000 11,000 10,000 9,000 8,000 News Reaction Trust investment of insurance funds account for small share of total assets with mounting potential risks, CIRC says. The overall size of the trust investment of insurance funds has accounted for a small percentage of the total assets in the industry, and the risks are manageable as the investment is mainly comprised of the high credit rating AAA-grade products, but the potential risks are mounting, China Insurance Regulatory Commission (CIRC) said on Wednesday. Source: Company data, Bloomberg Shanghai A-shares (1 year) 2,600 2,400 2,200 2,000 1,800 Brokers have to pass three-year capital replenishment plan by 2014, Zhang says. Zhang Yujun, assistant to CSRC chairman, stressed that securities companies must fully understand the importance of capital replenishment mechanism. According to the relevant requirements, brokers have to pass the three-year capital replenishment plan approved by the board of directors in the year. They have to replenish the capital at least once within three years and establish the capital replenishment and management mechanism. China and EU resolves telecom trade dispute. China and the EU have found the way to end the long-standing dispute over Chinese telecom equipment exports, resolving one of the biggest disputes between the two major trading partners, EU Trade Commissioner Karel de Gucht said on Tuesday. PetroChina and CNOOC said to jointly invest in Shenzhen LNG project. CNOOC, which plans to establish a RMB10bn LNG project in Shenzhen, has proposed joint investment with PetroChina and other shareholders in Shenzhen LNG Phase II Project to achieve mixed ownership, Guangdong’s insiders said. GCL-Poly (3800.HK) to announce capacity expansion plan soon. GCL-Poly will announce capacity expansion plan in the short term, including the cost-saving new “silane fluidized-bed technology”, GCL-Poly’s CFO Yang Wenzhong said before the shareholders’ meeting. The new technology is expected to add 25,000-tonne capacity each year and the company targets to complete the capacity expansion plan in one year. Download our reports from Bloomberg: BOCM〈enter〉 Source: Company data, Bloomberg Shenzhen A-shares (1 year) 1,500 1,400 1,300 1,200 1,100 1,000 900 800 Source: Company data, Bloomberg Morning Express 16 October 2014 Economic releases for this week - USA Date Time 15-Oct 15-Oct 15-Oct 16-Oct 16-Oct 17-Oct 17-Oct Source: Bloomberg Event MBA mortgage applications PPI(MoM) PPI ex food & energy (MoM) Initial jobless claims (k) Industrial Production Housing Starts(k) U of Michigan confidence Economic releases for this week - China Survey 0.1% 0.1% 0.4% 1,002.0 84.2 Prior 3.8% 0.0% 0.1% 287.0 -0.1% 956.0 84.6 Date Time 13-Oct 15-Oct 15-Oct Event Trade balance (US$ bn) CPI (YoY) PPI (YoY) Survey 41.1 -14.0% -1.5% Source: Bloomberg BOCOM Research Latest Reports Data 14 Oct 2014 14 Oct 2014 14 Oct 2014 14 Oct 2014 14 Oct 2014 13 Oct 2014 13 Oct 2014 13 Oct 2014 10 Oct 2014 10 Oct 2014 09 Oct 2014 09 Oct 2014 08 Oct 2014 07 Oct 2014 07 Oct 2014 06 Oct 2014 06 Oct 2014 06 Oct 2014 30 Sep 2014 30 Sep 2014 Report Brokerage Sector - Raising mainland brokers’ estimates ahead of anticipated strong 3Q Telecom & Small/Mid-Cap Sector - Eyeing on the opportunities arising from valuation recovery of the high-quality small/mid-caps China Property Sector - Contracted sales rebounded, but valuation remains constrained Container Shipping Sector - Weekly container shipping commentary Anta (2020 HK) - Another good set of SSS and trade fair results; TP upped China Market Strategy - The Dollar in Question Agile Property (3383.HK) - Downgrade to “Sell” on heightened company-specific risks Auto Sector - SH-HK Stock Connect - Eligible stocks are mainly mid-caps favored by investors Transportation Sector - Weekly transportation news wrap SH-HK Stock Connect - Technology - High-quality HK-listed industry leaders will likely be favored SH-HK Stock Connect - Internet - A-share Internet stocks to gradually become more reasonably valued Intime (1833.HK) - 3Q14 SSS largely in-line; Maintain Buy SH-HK Stock Connect - Property - Going for the sector leaders Consumer Discretionary Sector - Protests' impact on HK retailers SH-HK Stock Connect - Transportation & Logistics - E-commerce logistics in the spotlight Strategy – Hong Kong Chasm SH-HK Stock Connect - China Steel - More eligible stocks to trade in sector; industry leaders to benefit China Property Sector - Mortgage easing and sales recovery produce short-term catalysts Container Shipping Sector - Weekly container shipping commentary SH-HK Stock Connect - China Consumer Staples - Dive for scarcity value Source: Company data, BOCOM International Download our reports from Bloomberg: BOCM〈enter〉 Analyst Jerry Li Zhiwu Li Toni Ho, CFA, FRM, Alfred Lau, CFA, FRM Geoffrey Cheng Phoebe Wong Hao Hong, CFA Toni Ho, CFA, FRM, Alfred Lau, CFA, FRM Wei Yao Ian Feng, Geoffrey Cheng, CFA Miles Xie Yuan MA, PhD, Connie GU, CPA Anita Chu Alfred Lau CFA, FRM, Toni Ho CFA, FRM Phoebe Wong Geoffrey Cheng, CFA, Yinan Feng Hao Hong, CFA Jovi Li Toni Ho, CFA, FRM, Alfred Lau, CFA, FRM Geoffrey Cheng Summer Wang, Shawn Wu Prior 49.8 -14.0% -1.2% Morning Express 16 October 2014 Hang Seng Index Constituents Company name Cheung Kong Hang Lung Proper Hengan Intl China Shenhua-H Hang Seng Bk China Res Land Cosco Pac Ltd Henderson Land D Aia Group Ltd Hutchison Whampo Kunlun Energy Co Ind & Comm Bk-H China Merchant Want Want China Sun Hung Kai Pro New World Dev Belle Internatio China Coal Ene-H Swire Pacific-A Sands China Ltd Clp Hldgs Ltd Bank East Asia Ping An Insura-H Boc Hong Kong Ho China Life Ins-H Citic Pacific China Res Enterp Cathay Pac Air Hong Kg China Gs Tingyi Hldg Co Esprit Hldgs Bank Of Commun-H China Petroleu-H Hong Kong Exchng Bank Of China-H Wharf Hldg Li & Fung Ltd Hsbc Hldgs Plc Power Assets Hol Mtr Corp China Overseas Tencent Holdings China Unicom Hon Sino Land Co China Res Power Petrochina Co-H Cnooc Ltd China Const Ba-H China Mobile Lenovo Group Ltd Hang Seng Index BBG code 1 HK 101 HK 1044 HK 1088 HK 11 HK 1109 HK 1199 HK 12 HK 1299 HK 13 HK 135 HK 1398 HK 144 HK 151 HK 16 HK 17 HK 1880 HK 1898 HK 19 HK 1928 HK 2 HK 23 HK 2318 HK 2388 HK 2628 HK 267 HK 291 HK 293 HK 3 HK 322 HK 330 HK 3328 HK 386 HK 388 HK 3988 HK 4 HK 494 HK 5 HK 6 HK 66 HK 688 HK 700 HK 762 HK 83 HK 836 HK 857 HK 883 HK 939 HK 941 HK 992 HK Share price (HK$) 131.70 23.35 78.40 21.00 128.40 17.94 10.40 52.30 41.80 95.70 10.24 4.93 24.20 9.72 115.00 9.53 8.74 4.73 100.30 42.25 65.20 31.50 58.45 24.95 21.50 13.18 18.70 13.98 17.94 18.42 10.34 5.48 6.63 172.50 3.53 55.25 9.14 78.60 72.45 30.75 21.30 114.40 11.58 12.40 20.95 9.32 12.26 5.56 92.55 11.10 Mkt cap (HK$m) 305,039 104,731 96,181 388,201 245,481 104,612 30,563 156,897 503,486 408,005 82,661 1,600,519 61,638 128,265 313,813 82,578 73,715 74,444 147,739 340,806 164,725 73,926 433,428 263,791 566,906 328,226 45,135 54,995 188,651 103,206 20,087 401,999 769,908 201,483 957,223 167,415 76,414 1,508,161 154,627 178,964 174,106 1,071,468 276,903 74,594 100,490 1,784,879 547,378 1,386,017 1,886,125 117,544 5d chg (%) 0.8 2.0 2.1 -2.8 0.8 5.4 0.6 1.9 1.6 -2.1 -7.9 0.0 3.4 -1.5 3.6 2.4 -0.3 4.0 0.6 0.2 2.0 0.2 -1.1 2.0 -1.6 -2.1 -1.8 -3.9 5.7 -11.2 -2.3 -0.2 -1.5 -0.5 0.9 -1.6 2.5 -0.7 3.6 -1.0 1.9 -3.5 1.6 0.8 -0.7 -5.7 -8.1 1.3 0.7 -6.9 Ytd chg (%) 13.5 -4.7 -14.4 -14.1 2.1 -6.7 -2.3 30.0 7.5 -2.9 -25.0 -5.9 -14.5 -13.2 16.9 3.4 -2.6 8.5 10.3 -32.4 6.4 -4.1 -15.8 0.4 -11.3 11.1 -27.4 -14.8 11.0 -17.8 -30.8 0.2 4.7 33.4 -1.1 -6.8 11.4 -6.6 17.5 4.8 -2.3 15.6 -0.2 17.0 14.0 9.6 -15.0 -5.0 15.1 17.7 23,140.1 14,128,492 -0.5 -0.7 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) 152.00 105.95 27.00 19.80 99.70 74.05 27.00 19.12 133.00 117.60 23.50 13.62 11.92 9.40 56.40 36.46 44.20 34.65 108.50 86.88 14.82 10.12 5.66 4.33 29.80 22.75 13.10 9.32 120.20 90.35 10.62 7.15 11.82 7.25 5.26 3.72 108.00 80.55 68.00 38.70 67.80 56.00 35.00 28.50 76.50 55.60 26.65 21.50 25.80 19.52 16.88 9.35 27.90 18.14 17.26 13.90 18.40 13.91 24.00 17.82 17.42 9.98 5.98 4.53 8.23 5.73 185.00 112.80 3.79 3.03 70.20 46.35 10.70 7.72 87.35 75.75 75.85 57.85 32.30 26.55 24.80 17.52 134.00 77.56 14.22 9.03 14.16 9.83 24.90 17.10 11.70 7.31 16.12 11.42 6.37 4.89 102.20 63.65 12.70 7.62 25,363.0 21,137.6 –––––––––– PE ––––––––––– 2013A 2014E 2015E (X) (X) (X) 7.1 8.6 8.9 13.7 17.7 16.7 26.5 25.2 20.9 7.7 8.2 8.1 14.7 14.2 13.2 6.8 9.1 7.7 13.4 12.0 10.6 8.8 16.5 16.6 26.4 20.4 17.8 8.7 12.1 11.2 13.0 12.6 11.2 5.1 5.0 4.7 14.0 14.4 13.1 23.7 23.2 20.2 9.2 15.0 14.0 7.1 11.0 10.6 13.0 13.2 12.6 35.9 34.0 22.2 11.5 14.3 13.4 16.6 15.5 13.7 18.3 15.6 15.3 10.6 11.3 10.7 11.6 10.4 9.0 11.4 10.8 9.7 17.9 14.7 12.5 9.3 9.0 7.7 24.6 34.2 27.6 18.7 16.5 11.2 27.1 25.1 23.2 21.1 26.1 21.4 94.6 32.7 21.1 5.0 4.9 4.7 9.1 8.8 8.3 43.6 38.4 29.4 4.7 4.7 4.4 7.0 14.1 12.3 11.7 17.9 15.5 12.9 11.1 10.2 2.5 17.8 17.9 12.1 17.3 15.8 7.0 7.5 6.6 41.4 35.0 26.3 18.4 16.8 14.4 8.3 13.9 13.8 8.6 8.2 7.5 10.2 9.8 9.2 7.8 7.6 7.2 4.9 4.7 4.5 12.7 13.3 13.3 17.3 17.7 14.3 10.1 10.6 9.8 Yield P/B (%) 2.7 3.2 2.4 5.5 4.3 2.5 2.9 1.9 1.1 2.5 2.2 N/A 3.2 2.8 2.9 4.3 1.2 2.2 3.6 4.1 4.0 3.5 1.5 4.0 1.8 2.0 1.3 1.9 1.8 1.5 0.7 N/A 4.6 2.1 7.0 3.2 5.2 4.8 3.5 3.0 2.3 0.2 1.7 4.0 3.6 4.3 4.7 N/A 3.4 2.2 (X) 0.8 0.8 5.8 1.2 2.2 1.2 0.8 0.6 2.3 1.0 1.6 1.0 1.0 8.7 0.8 0.5 2.3 0.6 0.7 8.4 1.8 1.1 1.8 1.6 2.0 0.5 0.9 0.9 3.7 4.7 1.2 0.7 1.0 9.1 0.8 0.6 2.1 1.0 1.3 1.1 1.5 12.1 1.0 0.7 1.5 1.1 1.2 1.0 1.8 4.6 3.7 1.3 Morning Express 16 October 2014 China Ent Index Constituents Company name Shandong Weig-H China Shenhua-H Sinopharm-H China Shipping-H Zoomlion Heavy-H Yanzhou Coal-H Agricultural-H New China Life-H Ind & Comm Bk-H Tsingtao Brew-H China Com Cons-H China Coal Ene-H China Minsheng-H Guangzhou Auto-H Ping An Insura-H Picc Property & Great Wall Mot-H Weichai Power-H Aluminum Corp-H China Pacific-H China Life Ins-H China Oilfield-H Zijin Mining-H China Natl Bdg-H Bank Of Commun-H Jiangxi Copper-H China Petroleu-H China Rail Gr-H China Merch Bk-H Bank Of China-H Dongfeng Motor-H Citic Securiti-H Haitong Securi-H China Telecom-H Air China Ltd-H Petrochina Co-H Huaneng Power-H Anhui Conch-H China Longyuan-H China Const Ba-H China Citic Bk-H Hang Seng China Ent Indx BBG code 1066 HK 1088 HK 1099 HK 1138 HK 1157 HK 1171 HK 1288 HK 1336 HK 1398 HK 168 HK 1800 HK 1898 HK 1988 HK 2238 HK 2318 HK 2328 HK 2333 HK 2338 HK 2600 HK 2601 HK 2628 HK 2883 HK 2899 HK 3323 HK 3328 HK 358 HK 386 HK 390 HK 3968 HK 3988 HK 489 HK 6030 HK 6837 HK 728 HK 753 HK 857 HK 902 HK 914 HK 916 HK 939 HK 998 HK Share price (HK$) Mkt cap (HK$m) 5d chg (%) Ytd chg (%) 7.50 21.00 28.05 4.58 3.98 6.33 3.46 27.10 4.93 54.85 5.50 4.73 7.31 7.30 58.45 14.06 31.45 27.75 3.16 27.40 21.50 18.86 1.93 7.04 5.48 13.04 6.63 4.11 13.42 3.53 12.30 18.24 12.20 4.69 4.89 9.32 8.76 24.75 7.35 5.56 4.76 33,572.79 388,201.07 72,040.63 20,853.48 44,374.00 46,637.61 1,025,606.33 92,135.34 1,600,518.80 70,254.19 93,485.99 74,444.10 265,442.11 59,970.89 433,427.95 191,274.17 111,605.12 52,251.54 59,752.07 229,129.23 566,905.52 105,348.23 62,479.80 38,009.14 401,999.46 54,890.04 769,908.48 84,570.50 333,662.20 957,223.42 105,978.28 187,602.77 123,391.51 379,572.81 68,906.21 1,784,879.27 112,607.61 118,981.05 59,067.46 1,386,017.01 257,395.71 0.1 -2.8 2.4 -4.8 -11.8 0.2 -0.6 -0.9 0.0 -2.7 -0.9 4.0 0.1 -3.2 -1.1 -4.1 3.6 -1.6 -4.2 -1.3 -1.6 -6.6 1.6 -2.4 -0.2 1.6 -1.5 -1.4 -0.3 0.9 -2.4 -2.6 -0.7 0.2 -2.6 -5.7 -0.6 -0.4 -3.3 1.3 -1.0 -28.3 -14.1 26.1 -23.9 -45.0 -10.6 -9.2 4.2 -5.9 -16.3 -12.0 8.5 1.9 -13.9 -15.8 22.3 -26.5 -11.2 17.0 -9.9 -11.3 -21.6 16.3 -15.6 0.2 -6.9 4.7 2.8 -18.8 -1.1 1.3 -13.8 -9.6 19.6 -15.5 9.6 25.0 -13.9 -26.4 -5.0 13.1 11.2 27.0 30.0 6.3 8.0 8.7 4.1 29.6 5.7 68.3 6.7 5.3 8.2 10.9 76.5 15.0 51.9 35.5 3.9 33.5 25.8 26.0 2.2 9.1 6.0 15.4 8.2 4.7 17.6 3.8 15.2 21.7 14.5 5.2 6.3 11.7 9.7 35.7 10.3 6.4 5.3 6.8 19.1 19.7 4.0 4.0 4.9 3.0 20.6 4.3 53.5 4.9 3.7 5.9 6.7 55.6 9.8 26.1 25.8 2.5 23.6 19.5 17.2 1.6 6.7 4.5 11.6 5.7 3.0 12.1 3.0 9.6 13.7 9.5 3.1 4.2 7.3 6.1 24.2 7.2 4.9 3.6 61.5 7.7 22.2 N/A 13.1 6.7 5.0 11.2 5.1 29.5 5.5 35.9 4.4 11.8 11.6 14.1 9.3 8.4 N/A 18.3 17.9 8.7 15.5 4.8 5.0 10.0 9.1 7.0 4.6 4.7 6.2 21.8 21.9 16.1 18.1 10.2 8.4 8.5 23.9 4.9 4.3 25.0 8.2 20.1 38.9 10.2 19.6 4.8 10.9 5.0 28.6 5.3 34.0 4.1 9.1 10.4 12.3 8.7 9.3 N/A 16.8 14.7 8.6 15.0 5.1 4.9 13.6 8.8 6.6 4.7 4.7 6.3 21.4 17.5 15.9 14.9 9.8 7.9 8.8 16.1 4.7 4.2 10,285 4,109,947 -1.1 -4.9 11,638.3 9,159.8 7.2 7.0 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) ––––––––––– PE ––––––––––– 2013A 2014E 2015E (X) (X) (X) Yield P/B (%) (X) 20.6 8.1 16.8 13.9 8.7 16.0 4.4 9.5 4.7 24.7 4.9 22.2 3.8 7.1 9.0 11.0 7.0 9.1 N/A 14.4 12.5 8.0 15.0 4.8 4.7 13.2 8.3 6.0 4.2 4.4 5.9 18.5 14.8 14.6 11.6 9.2 7.9 8.0 12.8 4.5 3.9 1.0 5.5 1.2 0.0 4.8 0.4 N/A 0.7 N/A N/A 4.3 2.2 2.7 3.1 1.5 2.0 3.3 1.1 N/A 1.8 1.8 2.9 N/A 2.9 N/A 4.9 4.6 2.0 5.8 7.0 1.9 N/A 1.2 2.6 1.2 4.3 5.5 1.8 0.8 N/A N/A 2.8 1.2 2.6 0.6 0.6 0.6 1.0 1.5 1.0 4.0 0.7 0.6 0.9 1.1 1.8 2.4 2.6 1.4 0.8 1.8 2.0 1.6 1.2 0.8 0.7 0.8 1.0 0.8 0.9 0.8 1.2 1.8 1.5 1.1 0.9 1.1 1.5 1.7 1.5 1.0 0.7 6.4 4.6 1.1 Morning Express 16 October 2014 BOCOM International 11/F, Man Yee Building, 68 Des Voeux Road, Central, Hong Kong Main: + 852 3710 3328 Fax: + 852 3798 0133 Rating System Company Rating www.bocomgroup.com Sector Rating Buy: Expect more than 20% upside in 12 months LT Buy: Expect more than 20% upside but longer than 12 months Neutral: Expect low volatility Sell: Expect more than 20% downside in 12 months Outperform (“OP”): Expect more than 10% upside in 12 months Market perform (“MP”): Expect low volatility Underperform (“UP”): Expect more than 10% downside in 12 months Research Team Head of Research @bocomgroup.com (852) 2977 9393 raymond.cheng (852) 2977 9384 hao.hong (852) 2977 9212 yangqingli Shanshan LI, CFA (86) 10 8800 9788 - 8058 lishanshan Li WAN, CFA (86) 10 8800 9788 - 8051 Wanli Raymond CHENG, CFA, CPA, CA Strategy Economics Hao HONG, CFA Banks Consumer Discretionary miaoxian.li Fei WU (852) 2977 9392 fei.wu Tony LIU (852) 2977 9390 xutong.liu Alfred LAU, CFA, FRM (852) 2977 9235 alfred.lau Toni HO, CFA, FRM (852) 2977 9220 toni.ho Luella GUO (852) 2977 9211 luella.guo (86) 21 6065 3606 louis.sun (852) 2977 9209 lizhiwu (852) 2977 9216 miles.xie Geoffrey CHENG, CFA (852) 2977 9380 geoffrey.cheng Ian FENG (852) 2977 9381 Yinan.feng (86) 21 6065 3675 wei.yao Property Phoebe WONG (852) 2977 9391 phoebe.wong Anita CHU (852) 2977 9205 anita.chu Consumer Staples Renewable Energy Summer WANG (852) 2977 9221 summer.wang Shawn WU (852) 2977 9386 shawn.wu Johnson SUN (852) 2977 9203 johnson.sun Milo LIU (852) 2977 9387 milo.liu (852) 2977 9389 liwenbing Healthcare Louis SUN Telecom & Small/ Mid-Caps Insurance Zhiwu LI Technology Internet Miles XIE Transportation & Industrial Yuan MA (86) 10 8800 9788 - 8039 yuan.ma Connie GU, CPA (86) 10 8800 9788 - 8045 conniegu (852) 2977 9243 jovi.li Metals & Mining Jovi LI (86) 10 8800 9788 - 8043 Miaoxian LI Oil & Gas/ Gas Utilities Qingli YANG Jerry LI @bocomgroup.com Automobile Download our reports from Bloomberg: BOCM〈enter〉 Wei YAO Morning Express 16 October 2014 Analyst Certification The authors of this report, hereby declare that: (i) all of the views expressed in this report accurately reflect their personal views about any and all of the subject securities or issuers; and (ii) no part of any of their compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report; (iii) no insider information/ non-public price-sensitive information in relation to the subject securities or issuers which may influence the recommendations were being received by the authors. The authors of this report further confirm that (i) neither they nor their respective associates (as defined in the Code of Conduct issued by the Hong Kong Securities and Futures Commission) have dealt in or traded in the stock(s) covered in this research report within 30 calendar days prior to the date of issue of the report; (ii)) neither they nor their respective associates serve as an officer of any of the Hong Kong listed companies covered in this report; and (iii) neither they nor their respective associates have any financial interests in the stock(s) covered in this report. Disclosure of relevant business relationships BOCOM International Securities Limited, and/or its associated companies, has investment banking relationship with Bank of Chongqing Co. Ltd., Huishang Bank Corporation Limited, Phoenix Healthcare Group Co. Ltd., China Cinda Asset Management Co. Ltd., Qinhuangdao Port Co. Ltd, Jintian Pharmaceutical Group Limited, Logan Property Holdings Company Limited, Nanjing Sinolife United Company Limited, Magnum Entertainment Group Holdings Limited, Bank of Communications, Harbin Bank Co., Ltd., Azure Orbit International Finance Limited, Hanhua Financial Holding Co., Ltd., Central China Securities Company Limited, China New City Commercial Development Limited, China Shengmu Organic Milk Limited, Broad Greenstate International Company Limited, China National Culture Group Limited and Sichuan Development Holding Co. Ltd. within the preceding 12 months. BOCOM International Securities Limited currently holds more than 1% of the equity securities of Shanghai Fosun Pharmaceuticals Group Co. Ltd. Disclaimer By accepting this report (which includes any attachment hereto), the recipient hereof represents and warrants that he is entitled to receive such report in accordance with the restrictions set forth below and agrees to be bound by the limitations contained herein. Any failure to comply with these limitations may constitute a violation of law. This report is strictly confidential and is for private circulation only to clients of BOCOM International Securities Ltd. This report is being supplied to you strictly on the basis that it will remain confidential. No part of this report may be (i) copied, photocopied, duplicated, stored or reproduced in any form by any means or (ii) redistributed or passed on, directly or indirectly, to any other person in whole or in part, for any purpose without the prior written consent of BOCOM International Securities Ltd. BOCOM International Securities Ltd, its affiliates and related companies, their directors, associates, connected parties and/or employees may own or have positions in securities of the company(ies) covered in this report or any securities related thereto and may from time to time add to or dispose of, or may be interested in, any such securities. Further, BOCOM International Securities Ltd, its affiliates and its related companies may do and seek to do business with the company(ies) covered in this report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking, advisory, underwriting, financing or other services for or relating to such company(ies) as well as solicit such investment, advisory, financing or other services from any entity mentioned in this report. In reviewing this report, an investor should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest. The information contained in this report is prepared from data and sources believed to be correct and reliable at the time of issue of this report. This report does not purport to contain all the information that a prospective investor may require and may be subject to late delivery, interruption and interception. BOCOM International Securities Ltd does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information and opinion contained in this report and accordingly, neither BOCOM International Securities Ltd nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof. This report is general in nature and has been prepared for information purposes only. It is intended for circulation amongst BOCOM International Securities Ltd’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. The information and opinions in this report are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, related investments or other financial instruments thereof. The views, recommendations, advice and opinions in this report may not necessarily reflect those of BOCOM International Securities Ltd or any of its affiliates, and are subject to change without notice. BOCOM International Securities Ltd has no obligation to update its opinion or the information in this report. Investors are advised to make their own independent evaluation of the information contained in this research report, consider their own individual investment objectives, financial situation and particular needs and consult their own professional and financial advisers as to the legal, business, financial, tax and other aspects before participating in any transaction in respect of the securities of company(ies) covered in this report. The securities of such company(ies) may not be eligible for sale in all jurisdictions or to all categories of investors. This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to any law, regulation, rule or other registration or licensing requirement. BOCOM International Securities Ltd is a wholly owned subsidiary of Bank of Communications Co Ltd. Download our reports from Bloomberg: BOCM〈enter〉

© Copyright 2026