Document 368803

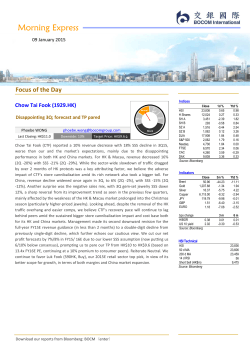

Morning Express 22 October 2014 Focus of the Day Indices Renewable Energy Sector China wind power operators on an upward path Louis SUN [email protected] MP UP OP The China wind power industry has great potential. Hurdles to industry development are being removed. Industry leaders enjoy greater potential. Issues to watch: on-grid tariff cut for wind power and other policies critical to the industry. Close HSI 23,089 H Shares 10,276 SH A 2,449 SH B 259 SZ A 1,390 SZ B 968 DJIA 16,615 S&P 500 1,941 Nasdaq 4,419 FTSE 6,372 CAC 4,081 DAX 8,887 Source: Bloomberg 1d % 0.08 -0.19 -0.72 -0.96 -0.76 -0.62 1.31 1.96 2.40 1.68 2.25 1.94 Ytd % -0.93 -4.99 10.61 2.26 25.95 11.48 0.23 5.03 5.82 -5.58 -5.00 -6.96 Close 86.22 1,248.87 17.52 6,669.00 107.00 1.61 1.27 3m % -19.93 -4.41 -16.37 -5.07 -5.18 -5.59 -5.60 Ytd % -22.18 3.58 -10.01 -9.39 -1.58 -2.69 -7.50 bps change HIBOR 0.38 US 10 yield 2.22 Source: Bloomberg 3m 0.00 -0.24 6m 0.01 -0.49 Indicators Top pick: Huaneng Renewables This is the summary translation extracted from the Chinese report entitled “中国风电运营行业步入上升通道” dated October 22, 2014. Huaneng Renewables (958.HK) Neutral High-quality assets and stronger growth potential Louis SUN Last Closing: K$2.55 [email protected] Upside: +26.7% LT BUY BUY SELL Stock Target Price: HK$3.23 Accelerating capacity growth and improving profitability; Efficient operation and sound financial structure; Initiate at Buy. This is the summary translation extracted from the Chinese report entitled “华能新能源:资产质量优良,具备更大的 成长潜力” dated October 22, 2014. Download our reports from Bloomberg: BOCM〈enter〉 Brent Gold Silver Copper JPY GBP EURO HSI Technical HSI 50 d MA 200 d MA 14 d RSI Short Sell (HK$m) Source: Bloomberg 23,089 24,212 23,148 39 4,945 Morning Express 22 October 2014 Hang Seng Index (1 year) China Longyuan (916.HK) Neutral The leading Chinese wind power operator with steady growth and long-term investment value 26,000 LT BUY SELL 25,000 BUY 24,000 23,000 22,000 Louis SUN Last Closing: HK$7.57 [email protected] Upside: 2.5% 21,000 Stock Target Price: HK$7.76 Source: Company data, Bloomberg Unshakable leadership in the wind power market. Apart from onshore wind, Longyuan has an edge in offshore wind power and overseas market development. HS China Enterprise Index (1 year) 13,000 12,000 Initiate at LT-Buy. 11,000 This is the summary translation extracted from the Chinese report entitled “龙源电力:中国风电运营行业领头羊,发 展稳健,具备长期投资价值” dated October 22, 2014. 10,000 9,000 8,000 Source: Company data, Bloomberg Datang Renewables (1798.HK) Neutral Excessively high gearing weighs on its ability to expand Louis SUN Last closing: HK$1.04 [email protected] Upside: +5.8% LT BUY BUY SELL Shanghai A-shares (1 year) 2,600 2,400 Stock 2,200 Target Price: HK$1.10 2,000 Capacity expansion may re-accelerate. 1,800 Financial risk of excessive gearing. Source: Company data, Bloomberg Initiate coverage at Neutral. This is the summary translation extracted from the Chinese report entitled “大唐新能源:负债率过高,扩张能力承压” dated October 22, 2014. China Macro Deflation risk is manageable Miaoxian LI [email protected] Economics China’s GDP growth slowed to 7.3% YoY in the third quarter. Nevertheless, the industrial output gap remains near zero, suggesting a state of full employment. Therefore, we believe the deflation risk of China is manageable and a full-scale monetary easing is unlikely. However, we believe the PBoC will continue to inject liquidity through targeted easing in view of the continued capital outflow from emerging markets. Download our reports from Bloomberg: BOCM〈enter〉 Shenzhen A-shares (1 year) 1,500 1,400 1,300 1,200 1,100 1,000 900 800 Source: Company data, Bloomberg Morning Express 22 October 2014 OOIL (316.HK) Neutral Company update - concerns over cargo cost hike and port congestion ahead Geoffrey CHENG, CFA Last Closing: HK$42.25 BUY SELL [email protected] Upside: +19.5% LT BUY Stock Target Price: HK$50.50→ We have visited OOIL lately. Management said the load factors of its vessels on the major East-West tradelanes rebounded in a robust manner after the National Day holidays of mainland China. Despite the high expectation at the start of the year, volume growth on the Transpacific tradelanes headhaul voyages was 4.9% YoY only Y-T-August. Overcapacity remains the major overhang for the industry. While the continual weakness of bunker price will be positive for the industry overall, OOIL is concerned about the rising cargo cost as well as port congestion. We maintain our BUY recommendation and earnings forecast at the moment. Tiangong International (826.HK) Neutral Four new products and technologies passed evaluation Zhiwu LI Last Closing: HK$2.08 [email protected] Upside: +73.1% LT BUY BUY SELL Stock Target Price: HK$3.60→ Event: Tiangong International (826.HK) announced that four of its new products and technologies self-developed and joint-developed with scientific research institutes have successfully passed evaluation by industry experts and authorities. The “New Product and Technology Evaluation Meeting” was jointly organized by the Jiangsu Economic and Information Technology Commission and the Zhenjiang Science and Technology Bureau, and jointly hosted by the Zhenjiang Economic and Information Technology Commission and the Zhenjiang Science and Technology Bureau. Experts and professors from the Jiangsu Metallurgy Association, Jiangsu Metal Society, Central Iron & Steel Research Institute, Nanjing University, and Nanjing University of Aeronautics and Astronautics, along with representatives from the Information Technology Commission and technicians from the company, attended the meeting. Attendees evaluated and unanimously approved the four products, including “Rare earth M42 Bi-metal Blade Material”, “Rare Earth High Sulphur Content High Speed Steel”, “High Strength & Wear Resistant Cold-Work Die Steel For Precision Moulding”, and “High Tropism Hot-Work Die Steel For Precision Moulding”. Comments: 1) All four products are world-class advanced technologies. “Rare earth M42 Bi-metal Blade Material” and “Rare Earth High Sulphur Content High Speed Steel” are high-speed steel products, while “High Strength & Wear Resistant Cold-Work Die Steel For Precision Moulding” and “High Tropism Hot-Work Die Steel For Precision Moulding” are die steel products. The fact that they passed the evaluation reflects Tiangong’s world-class advanced technologies and technological leadership in China. Download our reports from Bloomberg: BOCM〈enter〉 Morning Express 22 October 2014 2) Import substitution is likely. China’s demand for high-end special steel remains largely satisfied by imports. After years of R&D and product mix optimization, Tiangong has become a manufacturer of high value-added products. The four products passed evaluation by industry experts after trial production. This suggests mass production could start soon and Tiangong’s products could substitute imported ones. 3) Maintain “Buy”. Die steel is Tiangong’s major product category. Although it has had a dominant market share in China in die steel, there is still room for improving the added value of products. Maintain Buy rating and TP of HK$3.6. China Mobile (941.HK) Neutral Lowest quarterly profit in six years Zhiwu LI Last Closing: HK$91.2 SELL [email protected] Upside: +12.5% LT BUY BUY Stock Target Price: HK$102.6→ 1) In 1-3Q 2014, revenue increased 3.9% YoY to RMB481.235bn; EBITDA fell 5.0% YoY to RMB176.338bn; and net profit dropped 9.7% YoY to RMB82.602bn; 3) In the third quarter, revenue dropped 2.1% YoY to RMB156.45bn, while net profit fell 12.5% YoY to RMB24.86bn, the lowest quarterly profit since 2009; 3) ARPU was RMB63 in 1-3Q, down 4.5% from the same period last year and 1.6% from 1H14; 4) Monthly addition of 4G users exceeded 10 million for the first time. China Mobile added 11.381mn 4G users in September, up 24.6% MoM; 5) The VAT reform and interconnection settlement continue to affect the company’s revenue and expense structures. We maintain “LT-Buy” rating and TP of HK$102.6. Energy Sector Bocom Energy Weekly Fei WU [email protected] UP MP OP In the energy world, the attention continues to be on the low crude oil price - although Saudi Arabia had decided not to cut production and thus gain market share. Brent futures did bounce up from its four-year low on Oct 16 (up US$2.40/bbl) on EIA's news announcement of a tight gasoline inventory, which dropped to the lowest level since Nov 2012. NDRC also adjusted down gasoline and diesel prices by approximately 4% on Oct 17. The company implication so far has been reflected in CNPC's statement that it would be difficult to reach its profit target this year. Download our reports from Bloomberg: BOCM〈enter〉 22 October 2014 Sector Report Renewable Energy Sector Renewable Energy Sector MP UP China wind power operators on an upward path OP Valuation summary Company name Stock Rating TP ticker (RMB) Huaneng Renew 958 HK CP EPS EPS consensus –––– P/E –––– –––– P/B –––– Yield 10/20 FY14E FY15E FY14E FY15E FY14E FY15E FY14E FY15E FY14E (RMB) (RMB) Buy 3.23 2.55 China Longyuan 916 HK LT Buy 7.76 Datang Renew 1798 HK Neutral 1.10 (RMB) (RMB) (RMB) (x) (x) (x) (x) (%) 18.5 10.3 1.2 1.1 1.1 0.109 0.196 0.133 0.185 7.57 0.292 0.383 0.361 0.453 20.5 15.6 1.5 1.4 1.0 1.04 -0.004 0.056 0.031 0.059 -205.9 14.7 0.6 0.6 0.0 Key points: The China wind power industry has great potential. Hurdles to industry development are being removed. Source: Companies, BOCOM Int’l estimates China wind power industry has great potential. The China wind power industry has grown rapidly in recent years. Cumulative installed capacity surged from 12GW in 2008 to 91.4GW in 2013, and is expected to exceed 120GW by the end of 2015 and 200GW by the end of 2020. Pursuant to government planning, the minimum quota of wind power consumption will increase from 248.3bn kWh to 446.6bn kWh in 2020, with a 5-year CAGR of 12.5%. By 2020, China targets to have wind power provide at least 5.3% of total power consumption, still way below the levels of the developed countries. Given China’s rich wind resources, we expect the ratio to exceed 10% before 2030. Improving industry environment. Rapid installed capacity growth and inadequate grid capacity are the biggest industry hurdles. Installing new capacity at regions without power curtailment is a short-term solution. Ultra-high voltage transmission lines and renewable energy quota system are better longer-term solutions. We expect both capacity and turbine utilization hours to improve starting next year, a trend that we expect to last several years. Meanwhile, falling market interest rates should benefit the highly leveraged players in the long run. Industry leaders enjoy greater potential. Issues to watch: on-grid tariff cut for wind power and other policies critical to the industry. Top pick: Huaneng Renewables Sector valuation (X) FY14E weighted avg P/E FY15E weighted avg P/E FY14E weighted avg P/B Source: Company, BOCOM Int’l 15.5 10.5 1.1 1-year sector performance HSI 新能源行业 50% 40% 30% 20% Favor the leaders. Industry concentration has declined due to the entry of small/ medium-sized players. However, the larger companies have advantages in project reserves, efficiency, offshore wind power and overseas market development in the long term. Thus, we expect industry concentration to increase starting from the early th part of the 13 Five-Year Plan period (i.e. 2016). Risk factors: China targets to achieve grid parity for wind power in 2020. The potential wind tariff adjustment may lower the expected investment return on new capacity. However, falling power generation costs and increased power grid capacity to take up wind power should offset the decline in on-grid tariffs. Top pick: Huaneng Renewables. We have compared the operational data and financial indicators of the stocks under our coverage, and taken their share price movements into consideration. We initiate coverage on Huaneng Renewables at Buy with a TP of HK$3.23, corresponding to 13x 2015E P/E, in light of its better asset quality, management efficiency, and growth outlook. We initiate coverage on Longyuan at LT-Buy with a TP of HK$7.76, and recommend adding on pullback, given its technological advantage and stronger financials. We initiate Datang Renewables at Neutral with a TP of HK$1.10, as we think it will need more time to improve profitability and lower its financial risks. This is the summary translation extracted from the Chinese report entitled “中国风电运营行业步入上升通道” dated October 22, 2014. Download our reports from Bloomberg: BOCM〈enter〉 10% 0% -10% -20% -30% Jun-13 Sep-13 Dec-13 Mar-14 Source: Bloomberg Louis Sun [email protected] Tel: (86) 21 6065 3606 Jun-14 22 October 2014 Last Closing: K$2.55 Upside: +26.7% Target Price: HK$3.23 Renewable Energy Sector Huaneng Renewables (958.HK) UP High-quality assets and stronger growth potential MP OP Initiation of coverage Financial highlights Revenue (RMB m) Change (%) Net profit (RMB m) Change (%) Basic EPS (RMB) Change (%) Vs. consensus (%) P/E (x) BVPS (RMB) P/B (x) DPS (RMB) Yield (%) Source: Company, BOCOM Int’l 2012 4,027 26.0 558 -45.5 0.066 -45.5 2013 5,798 44.0 888 59.1 0.098 48.8 30 1.40 1.4 0.01 0.3 20 1.54 1.3 0.02 1.0 2014E 6,608 14.0 980 10.4 0.109 10.4 -18.4 18.5 1.62 1.2 0.02 1.1 2015E 8,965 35.7 1,768 80.4 0.196 80.4 5.9 10.3 1.78 1.1 0.04 1.9 2016E 10,789 20.3 2,429 37.4 0.269 37.4 16.0 7.5 1.99 1.0 0.05 2.7 Neutral LT BUY BUY SELL Stock Accelerating capacity growth and improving profitability; Capacity growth is accelerating. Huaneng Renewables is likely to accelerate capacity Efficient operation and sound financial structure; expansion in 2014 back to the high level in 2010, after it slowed its investment pace for three consecutive years. We expect it to add about 2GW of installed capacity to ~8.5GW by end-2014. Morever, with 546.5MW of new projects approved in 1H14, Initiate at Buy new capacity is likely to commence operation much earlier than scheduled in 2015. Much of the new capacity is located in regions without power curtailment, and 92% of the 1.9GW of projects included in China’s fourth batch of approved wind power projects early this year are located in non-curtailed areas. The increase of quality projects paves way for its earnings enhancement in the next few years. Stock data Competitive advantages. Huaneng Renewables has the highest profitability among the three major wind power operators, indicative of its good project resources and management capability. With a moderate debt ratio and smooth financing channels, capital is unlikely to be a hurdle to its future development, in our view. Short-term catalysts and risk factors. Anticipated new policies in renewable energy quota and full purchase of renewable energy should offer compensation for wind operators in regions with severe power curtailment. A short-term risk factor to watch is whether wind resources will improve in 2H14. 52w High (HK$) 52w Low (HK$ Market cap (HK$m) Issued shares (m) Avg daily vol (m) 1-mth change (%) YTD change (%) 50d MA (HK$) 200d MA (HK$) 14-day RSI Source: Bloomberg 3.87 2.16 23,024 9,029.215 21.75 -7.61 -31.45 2.75 2.85 41.64 1-year performance chart HSI Forecasts and rating. Our EPS forecasts for 14/15/16 are RMB0.109/0.196/0.269, up 35% 10.4/80.4/37.4% YoY. We are optimistic that Huaneng Renewables will achieve high 15% growth, and the stock is undervalued. We initiate coverage at Buy with a TP of -5% 958.HK 25% 5% -15% HK$3.23, representing 13x 2015E P/E. -25% Oct-13 This is the summary translation extracted from the Chinese report entitled “华能新能源:资产质量优良,具备 更大的成长潜力” dated October 22, 2014. Jan-14 Apr-14 Jul-14 Source: Bloomberg Louis Sun [email protected] Tel: (86) 21 6065 3606 Download our reports from Bloomberg: BOCM〈enter〉 Oct-14 22 October 2014 Last Closing: HK$7.57 Upside: 2.5% Target Price: HK$7.76 Renewable Energy Sector China Longyuan (916.HK) UP The leading Chinese wind power operator with steady growth and long-term investment value MP OP Initiation of coverage Financial highlights Revenue (RMB m) Change (%) Net profit (RMB m) Change (%) Basic EPS (RMB ) Change (%) Vs. consensus (%) P/E (x) BVPS (RMB) P/B (x) DPS (RMB) Yield (%) Source: Company, BOCOM Int’l 2012 17,288 4.2 2,593 0.6 0.323 -6.6 2013 19,123 10.6 2,049 -21.0 0.255 -21.0 19 3.66 1.6 0.01 0.1 23 3.85 1.55 0.05 0.8 2014E 18,830 -1.5 2,347 14.5 0.292 14.5 -19.1 20.5 4.08 1.46 0.06 1.0 2015E 21,262 12.9 3,079 31.2 0.383 31.2 -15.4 15.60 4.39 1.36 0.077 1.3 2016E 23,406 10.1 3,758 22.0 0.468 22.0 -12.1 12.8 4.76 1.3 0.09 1.6 Neutral LT BUY SELL BUY Stock Unshakable leadership in the wind power market. Solidified market leadership. Longyuan has maintained steady growth in recent years while Apart from onshore wind, Longyuan has an edge in offshore wind power and overseas market development. the other major wind operators have vastly slowed their capacity growth. This has not only consolidated its market leadership but also paved way for sustained growth. We expect the company to maintain high investment in the next few years, with installed capacity reaching 17.2GW by end-2016, up 44.1% from 11.9GW in 2013. Longyuan also has 5.3GW of approved Initiate at LT-Buy. projects with investment yet to be made and 9.6GW of projects included in the national plan. Aggregate project reserves amount to 68.5GW. Solid financials and risk resistance. Unlike its highly leveraged peers, Longyuan has kept its net gearing within 60%. Its sound capital structure helps maintain the stability of the business Stock data operation and provide war chest for continued future expansion. and full purchase of renewable energy should offer compensation for wind operators in regions 52w High (HK$) 52w Low (HK$ Market cap (HK$m) Issued shares (m) Avg daily vol (m) 1-mth change (%) YTD change (%) 50d MA (HK$) 200d MA (HK$) 14-day RSI Source: Bloomberg with severe power curtailment. A short-term risk factor to watch is whether wind resources will 1-year performance chart Competitive advantages. Longyuan is the domestic leader in technology R&D, project quality control, financing expense control and emerging market development. Apart from onshore wind, the company has an edge in offshore wind power and overseas market development. Short-term catalysts and risk factors. Anticipated new policies in renewable energy quota improve in 2H14. 10.32 7.12 60,835 8,036.389 15.49 -5.61 -24.22 8.05 8.55 29.45 HSI 916.HK 30% Forecasts and rating. Our EPS forecasts for 14/15/16 are RMB0.292/0.383/0.468, up 14.5/31.2/22.0% YoY. While Longyuan is fairly valued, its strong comprehensive advantages should give it more opportunities in the ever-changing environment. Therefore, we initiate coverage at LT-Buy with a TP of HK$7.76, representing 16x 2015E P/E. 20% 10% 0% -10% -20% Oct-13 Jan-14 Apr-14 Jul-14 Source: Bloomberg This is the summary translation extracted from the Chinese report entitled “龙源电力:中国风电运营行业领头 羊,发展稳健,具备长期投资价值” dated October 22, 2014. Download our reports from Bloomberg: BOCM〈enter〉 Louis Sun [email protected] Tel: (86) 21 6065 3606 Oct-14 22 October 2014 Last closing: HK$1.04 Upside: +5.8% Target Price: HK$1.10 Renewable Energy Sector Datang Renewables (1798.HK) UP Excessively high gearing weighs on its ability to expand MP OP Initiation of coverage Financial highlights Revenue (RMB m) Change (%) Net profit (RMB m) Change (%) Basic EPS (RMB) Change (%) Vs. Consensus (%) P/E (x) BVPS (RMB) P/B (x) DPS (RMB) Yield (%) Source: Company, BOCOM Int’l 2012 4,368 14.1 112 -84.6 0.015 -84.6 2013 5,630 28.9 237 110.9 0.033 110.9 53 1.21 0.7 0.01 0.9 25 1.28 0.64 0.00 0.4 2014E 5,581 -0.9 -29 -112.3 -0.004 -112.3 -112.9 -205.9 1.27 0.64 0.00 0.0 2015E 6,869 23.1 405 -1497.2 0.056 -1497.2 -5.6 14.74 1.32 0.62 0.011 1.4 2016E 7,659 11.5 585 44.5 0.080 44.5 23.8 10.2 1.38 0.6 0.02 2.0 Capacity expansion may re-accelerate. After years of rapid development, the company’s capacity expansion has slowed significantly since 2012. New capacity only amounted to 497MW in 2012 and 50MW in 2013. Insufficient wind power consumption at the project sites was the main reason for the slowdown in investment. The company will accelerate investment in regions without power curtailment in 2014. New capacity is expected to reach 700MW this year, and the company will maintain a relatively high level of investment in the foreseeable future. Neutral LT BUY BUY SELL Stock Capacity expansion may re-accelerate. Financial risk of excessive gearing. Initiate coverage at Neutral. Ample project reserves with bright outlook. As of June 2014, the company had 1.06GW of projects under construction. Controlling installed capacity that has started operation amounted to 5.72GW, and approved capacity totaled 10.7GW. The capacity pending approval but included in the national planning reached 1.24GW and total project reserves reached 97GW by the end of 2013, which is enough for years of development. Meanwhile, 73.4% of projects with total capacity of 4.96GW included in the national planning are located in regions without power curtailment. The operation commencement of these projects will greatly optimize the company’s asset quality. Financial pressure has affected the speed of expansion. The rapid expansion in the early stage and over-reliance on bank borrowings have resulted in a high gearing ratio. Meanwhile, an excessive number of wind power projects under operation are located in regions with severe power curtailment in northern China. Its poor profitability has dampened the stock valuation, impairing its ability to do direct financing in the equity market. We believe private placement to the major shareholders is an ideal way of improving capital structure. Short-term catalysts and risk factors. Anticipated new policies in renewable energy quota and full purchase of renewable energy should offer compensation for wind operators in regions with severe power curtailment. Whether Datang Renewables, among the worst hit by curtailment, will receive more compensation remains to be seen. A short-term risk factor to watch is if wind resources will improve in 2H14. Forecasts and rating. Our EPS forecasts for FY14/15/16E are RMB-0.004/0.056/0.08. The low profitability and excessive gearing are unlikely to improve notably in the short term, but its rich project reserves and the improving business environment may offer a turning point. Therefore, we initiate coverage at Neutral with a TP of HK$1.10, equivalent to 0.66x FY15E P/B. This is the summary translation extracted from the Chinese report entitled “大唐新能源:负债率过高,扩张能 力承压” dated October 22, 2014. Download our reports from Bloomberg: BOCM〈enter〉 Stock Data 52w High (HK$) 52w Low (HK$) Market cap (HK$ m) Issued shares (m) Avg daily vol (m) 1-mth change (%) YTD change (%) 50d MA (HK$) 200d MA (HK$) 14-day RSI Source: Bloomberg 1.77 0.98 7,565 7,273.701 2.88 -6.31 -36.59 1.15 1.25 35.1 1-year performance chart HSI 80% 70% 60% 50% 40% 30% 20% 10% 0% -10% -20% -30% Aug-13 Nov-13 3800.HK Feb-14 May-14 Source: Bloomberg Louis Sun [email protected] Tel: (86) 21 6065 3606 Aug-14 22 October 2014 Last Closing: HK$42.25 Upside: +19.5% Target Price: HK$50.50→ Container Shipping Sector OOIL (316.HK) UP MP Company update - concerns over cargo cost hike and port congestion ahead OP Financial Highlights Y/E 31 Dec Revenue (US$m) YoY growth Net profit (US$m) YoY growth EPS (US$) BVPS (US$) PB (x) 2012 6,459 7.4 296.4 63.2 0.474 11.4 0.75 2013 6,232 (3.5) 47.0 (84.1) 0.075 72.1 0.76 2014E 6,737 8.1 330.9 603.4 0.529 11.0 0.70 2015E 7,280 8.1 321.4 (2.9) 0.514 11.3 0.67 2016E 7,960 9.3 431.1 34.1 0.689 7.8 0.63 Neutral LT BUY BUY SELL Stock Source: Company, BOCOM Int’l estimate Cautiously positive for 2H14. We have visited OOIL recently and below are some of our key findings. Headhaul load factors on the vessels of OOIL plying the major East-West tradelanes rebounded in the third week of October after the expected weakness in the first and second weeks of the month due to the National Day holidays in mainland China. In 1H14, roundtrip load factor of OOIL’s shipping operation rose 5.0% ppts on a YoY basis to 77%. OOIL continues to exercise stringent revenue management in order to sustain its margin performance (9.8% GPM in 1H14 vs. 6.7% in 1H13). Hence, the continual volume decline of westbound waste paper/plastics shipment from North America west coast ports does not affect OOIL much (waste paper accounts for 2% of cargo volume for OOIL westbound volume) while those carriers relying on them for revenue will likely be affected, given waste paper/plastics represent the two largest cargo items heading Far East for the overall industry. Shipping volume disappointing on Transpacific route. In the first eight months of the year, industry shipping volume on Transpacific eastbound headhaul voyages rose 4.9% YoY, while the growth rate in July and August decelerated (2.6% YoY and 3.1% YoY, respectively). OOIL shares our concern that the base-rate guidelines advocated by the Transpacific Stabilization Agreement (TSA) for adoption next year may not be implemented by all container shipping companies. For Asia-Europe westbound headhaul voyages, industry cargo volume increased 8.2% YoY in the first eight months, while growth rate also decelerated in July and August. The weak freight rate performance of Asia-Europe tradelanes was probably due to the overhang of continual capacity expansion ahead, in our view. According to Alphaliner, capacity on the Asia-Europe tradelane rose only 2.6% YoY for July and August in aggregate. Newbuilding delivery of the industry could reach 1.82m TEU capacity next year, up from an estimated 1.59m TEU this year. We have visited OOIL lately. Management said the load factors of its vessels on the major East-West tradelanes rebounded in a robust manner after the National Day holidays of mainland China. Despite the high expectation at the start of the year, volume growth on the Transpacific tradelanes headhaul voyages was 4.9% YoY only Y-T-August. Overcapacity remains the major overhang for the industry. While the continual weakness of bunker price will be positive for the industry overall, OOIL is concerned about the rising cargo cost as well as port congestion. We maintain our BUY recommendation and earnings forecast at the moment. Stock data 52w High 52w Low Market cap (HK$m) Issued shares (m) Avg daily vol (m) 1-mth change㧔%㧕 YTD change㧔%㧕 50d MA 200d MA 14-day RSI Source: Company data, Bloomberg 48.30 32.05 26,439.8 625.8 31.5 (9.91) 8.5 45.4 39.7 39.5 1 Year Performance chart (HK$) 65 OOIL Rel to MSCI HK 60 125 55 115 50 105 45 40 95 35 We maintain our BUY recommendation. A continual weakness of bunker price, as a result of crude oil price weakness, would augur well for the container shipping industry. However, OOIL said the rising intermodal cost poses the biggest challenge for its cost containment exercise. Global port congestion poses another secular challenge ahead, according to OOIL. OOIL will release its 3Q14 operating data at the end of this week. Download our reports from Bloomberg: BOCMτenterυ 85 30 25 Oct-13 75 Dec-13 Mar-14 May-14 Aug-14 Source: Company data, Bloomberg Geoffrey Cheng, CFA [email protected] Tel: (852) 2977 9380 Oct-14 22 October 2014 Energy Weekly Energy Sector Bocom Energy Weekly MP UP Sector news around the block OP This week’s energy updates: NDRC oil product prices adjusted down (Oct 17, 2014). NDRC’s latest product price adjustment on Oct 17 saw gasoline and diesel prices adjusted down Rmb300/tonne and Rmb290/tonne (Rmb0.22/liter and Rmb0.25/liter), decreasing 3.8% and 4.1%, respectively. Prices have been cut six times since June 23; gasoline and diesel prices dropped 1080 and 1040 Rmb/tonne. NDRC oil product prices were adjusted down on Oct 17, for the sixth consecutive time. CNPC may have trouble meeting profit target amidst oil slump. CNPC’s trouble in meeting profit target amidst crude oil price slump. China’s biggest oil and gas producer said it might have difficulty in meeting its profit targets this year because of crude oil’s slump this month. CNPC also denied reports that Shell would cut investment in Sichuan shale gas projects that CNPC takes part in. CNPC said it was not informed that its Dutch partner would downsize the investment in their jointly explored shale gas projects. Saudi Arabia and OPEC not cutting production to gain market share. Some said that by refusing to lower production significantly and by cutting export prices, Saudi Arabia has started a price war with cheaper cost of production and huge foreign exchange reserve on its side. Lower oil price resulted from the supply side: a high shale gas production from the US and sustained output from Libya and Iraq, as well as the demand side: sluggish economic growth in Europe and Asia. Crude jumped from a four-year low on US gasoline inventory tightness. Saudi Arabia and OPEC are not cutting supplies. Brent Crude Price USD/bbl Brent 120 115 110 105 100 95 Crude price jumped from a four-year low on EIA’s announcement of US gasoline inventory tightness. After reaching a four-year low level of US$82.93 on Oct 16, Brent futures jumped on EIA’s news of a tight gasoline inventory. Data showed that gasoline inventory reduced by 3.99m barrels in the previous week, the lowest point since Nov 2012. Brent has gained US$2.40/bbl since then to close at US$86.16/bbl. Price HSI Shanghai S&P 500 HSI Index SHCOMP Index SPX Index 85 80 75 Oct-13 Dec-13 Feb-14 Apr-14 Jun-14 Aug-14 Source: Company data, Bloomberg WTI Crude Price Share price performance & commodities Perfo rman ce Last O&G PetroChina 857 HK Equity Sinopec 386 HK Equity CNOOC 883 HK Equity Gas Utility Hong Kong China Gas 3 HK Equity ENN Energy 2688 HK Equity China Resource Gas 1193 HK Equity Tianlun Gas 1600 HK Equity Chem Shanghai Petrochemical338 HK Equity Oil Services COSL 2883 HK Equity Hilong 1623 HK Equity Comm odities Brent EUCRBREN Index WTI USCRWTIC Index PGCRDUBA Index Dubai Cinta APCRCNTA Index Henry hub NGUSHHUB Index Index 90 1-D 1-Week 1-mth 3-mth 1H 2014 chg(%) chg( % ) chg(% ) chg(%) chg (%) 1-yr YTD chg(%) chg(%) USD/bbl WTI 120 115 110 9.36 6.51 12.48 -0.4 -0.8 -0.5 -1.5 -2.1 -0.3 -11.0 -7.7 -11.5 -7.9 -9.8 -7.3 15.2 16.7 -3.5 3.5 4.8 -21.9 10.1 2.8 -13.5 105 100 17.86 54.05 22.50 9.15 0.4 1.0 -1.1 1.7 -0.1 0.2 -2.6 -0.5 3.1 -0.6 2.3 5.5 6.3 -4.4 -7.6 -8.4 -4.6 -2.9 -9.6 25.7 7.9 17.6 10.3 31.7 10.5 -5.8 -16.7 24.3 80 2.51 -2.7 -0.4 -8.1 8.2 -3.1 29.8 12.6 18.42 2.68 -0.3 -0.4 -3.4 -17.8 -11.9 -31.5 -5.0 -33.0 -22.5 -42.0 -11.7 -45.9 -23.4 -59.6 84.8 82.7 84.1 83.2 3.7 0.6 -0.1 -1.1 -1.0 -1.9 -0.3 -3.5 -3.6 -2.7 -5.7 -12.5 -10.5 -11.8 -12.0 -5.4 -20.4 -19.8 -19.0 -20.7 -6.6 1.1 13.1 -2.4 0.4 3.5 -23.0 -18.0 -21.1 -23.9 -1.8 -23.5 -16.0 -22.0 -24.2 -16.0 23089 2340 1904 0.1 -0.7 0.9 -5.0 0.4 -5.3 -1.3 13.9 -3.5 -1.5 5.0 9.1 -0.9 10.6 3.0 0.2 -0.8 1.6 Source: BOCOM Int’l, Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 -0.5 -3.2 10.9 95 90 85 75 Oct-13 Dec-13 Feb-14 Apr-14 Jun-14 Aug-14 Source: Company data, Bloomberg Fei Wu [email protected] Tel: (852) 2977 9392 Tony Liu [email protected] Tel: (852) 2977 9390 Morning Express 22 October 2014 Market Review Hong Kong stocks finished a volatile session largely flat. The Hang Seng Index edged up 0.08% to close at 23,088.58, after rising as much as 161 points. Hong Kong developers led gains. Sino Land (83.HK) rose 2.25% as the best blue-chip gainer. SHKP (16.HK) added 1.3%. New World Development (17.HK) edged up 0.7%. Renewable energy stocks rose as market anticipates supportive policies for the sector. Singyes (750.HK) rose 2%. GCL New Energy (451.HK) jumped 11% before trading halted. China Mobile (941.HK) fell 1.8% as net profit dropped 9.7% in the first three quarters. China Telecom (728.HK) fell 1%. US stocks gained. The S&P 500 climbed 37.2 points, or 2%, to 1,941.28. The DJIA added 215 points, or 1.3%, to 16,614.81. Shares of Apple rose 2.7% after the company reported a 13% rise in profit. European stocks rose following media reports that the ECB may buy corporate bonds to further stimulate the region’s economy. The Stoxx Europe 600 gained 2.1% to 323.74. News Reaction China 3Q GDP grew at the slowest pace in 5 and a half years, dragged by property market correction and a high base. However, a recovery and a steady and fast growth are expected in 4Q as the relevant policies take effect. Ministry of Finance (MOF): fiscal income increased only 6.3% YoY in September; expenditure grew 9.1%. MOF announced that China’s fiscal income increased 6.3% YoY to RMB995.3bn, continuing the slow growth in August. According to the MOF, the slow growth of central fiscal income was mainly due to increased export tax rebate, and the weak growth of domestic VAT tax and import taxes. Local fiscal income grew at a similar pace as August, but lower than the same period last year, mainly dragged by a slowdown in property related taxes, among others. Fiscal expenditure increased 9.1% YoY to RMB1.4trn in September. China property investments increased 12.5% YoY in Jan-Sept; construction starts decreased 9.3%. National Bureau of Statistics said on Tuesday that investments in property development increased 12.5% YoY in Jan-Sept, lower than 13.2% in the first eight months. Construction starts (in terms of area) dropped 9.3% YoY in Jan-Sept. Sales of commodity housing fell 8.6% YoY in terms of area and 8.9% in terms of value. Ministry of Commerce (MOC) to simplify M&A procedures for cost-savings of companies and banks. The MOC will expedite the review and approval procedures for both domestic and overseas M&A deals. This will not only reduce legal costs of companies but also indicate the future direction of the ministry. China to announce detailed rules of Environmental Protection Law. The new Environmental Protection Law, said to be“the toughest ever”, will come into force on 1 Jan 2015. The Ministry of Environmental Protection has started the drafting of 54 sets of supporting document as well as related rules and regulations. Download our reports from Bloomberg: BOCM〈enter〉 Morning Express 22 October 2014 Economic releases for this week - USA Date Time 22-Oct 22-Oct 23-Oct 23-Oct 24-Oct Source: Bloomberg Event CPI (MoM) CPI ex food & energy (MoM) Initial jobless claims (k) Leading indicators New Home sales (k) Economic releases for this week - China Survey 0.0% 0.2% 0.7% 470.0 Prior -0.2% 0.0% 264.0 0.2% 504.0 Date Time 23-Oct Event HSBC China Manufacturing PMI Survey 50.2 Source: Bloomberg BOCOM Research Latest Reports Data 21 Oct 2014 20 Oct 2014 20 Oct 2014 20 Oct 2014 17 Oct 2014 16 Oct 2014 16 Oct 2014 16 Oct 2014 16 Oct 2014 14 Oct 2014 14 Oct 2014 14 Oct 2014 14 Oct 2014 14 Oct 2014 13 Oct 2014 13 Oct 2014 13 Oct 2014 10 Oct 2014 10 Oct 2014 09 Oct 2014 Report Container Shipping Sector - Weekly container shipping commentary China Market Strategy - A Great Shift in Monetary Policy Daphne (210.HK) - 3Q SSS improved but mainly on low base; margin and inventory pressure lingers Huishang Bank (3698.HK) - A prominent player in central China riding on national strategy BOCOM Int'l - Transportation Sector - Weekly transportation news wrap Luk Fook Holdings (590.HK) –Eased 2Q SSS pressure; China’s Golden Week sales better than expected Chow Tai Fook (1929.HK) –Narrowed 2Q sales decline, but catalyst remains absent SITC (1308.HK) –Company update – 3Q14 could be affected by lower freight rate BOCOM Research – Energy Sector –Bocom Energy Weekly Brokerage Sector - Raising mainland brokers’ estimates ahead of anticipated strong 3Q Telecom & Small/Mid-Cap Sector - Eyeing on the opportunities arising from valuation recovery of the high-quality small/mid-caps China Property Sector - Contracted sales rebounded, but valuation remains constrained Container Shipping Sector - Weekly container shipping commentary Anta (2020 HK) - Another good set of SSS and trade fair results; TP upped China Market Strategy - The Dollar in Question Agile Property (3383.HK) - Downgrade to “Sell” on heightened company-specific risks Auto Sector - SH-HK Stock Connect - Eligible stocks are mainly mid-caps favored by investors Transportation Sector - Weekly transportation news wrap SH-HK Stock Connect - Technology - High-quality HK-listed industry leaders will likely be favored SH-HK Stock Connect - Internet - A-share Internet stocks to gradually become more reasonably valued Source: Company data, BOCOM International Download our reports from Bloomberg: BOCM〈enter〉 Analyst Geoffrey Cheng, CFA Hong Hao, CFA Phoebe Wong Yang Qingli, Wan Li, CFA, Li Shanshan, CFA Geoffrey Cheng, CFA, Ian Feng Phoebe Wong Phoebe Wong Geoffrey Cheng, CFA Fei Wu, Tony Liu Jerry Li Zhiwu Li Toni Ho, CFA, FRM, Alfred Lau, CFA, FRM Geoffrey Cheng Phoebe Wong Hao Hong, CFA Toni Ho, CFA, FRM, Alfred Lau, CFA, FRM Wei Yao Ian Feng, Geoffrey Cheng, CFA Miles Xie Yuan MA, PhD, Connie GU, CPA Prior 50.2 Morning Express 22 October 2014 Hang Seng Index Constituents Company name Cheung Kong Hang Lung Proper Hengan Intl China Shenhua-H Hang Seng Bk China Res Land Cosco Pac Ltd Henderson Land D Aia Group Ltd Hutchison Whampo Kunlun Energy Co Ind & Comm Bk-H China Merchant Want Want China Sun Hung Kai Pro New World Dev Belle Internatio China Coal Ene-H Swire Pacific-A Sands China Ltd Clp Hldgs Ltd Bank East Asia Ping An Insura-H Boc Hong Kong Ho China Life Ins-H Citic Pacific China Res Enterp Cathay Pac Air Hong Kg China Gs Tingyi Hldg Co Esprit Hldgs Bank Of Commun-H China Petroleu-H Hong Kong Exchng Bank Of China-H Wharf Hldg Li & Fung Ltd Hsbc Hldgs Plc Power Assets Hol Mtr Corp China Overseas Tencent Holdings China Unicom Hon Sino Land Co China Res Power Petrochina Co-H Cnooc Ltd China Const Ba-H China Mobile Lenovo Group Ltd Hang Seng Index BBG code 1 HK 101 HK 1044 HK 1088 HK 11 HK 1109 HK 1199 HK 12 HK 1299 HK 13 HK 135 HK 1398 HK 144 HK 151 HK 16 HK 17 HK 1880 HK 1898 HK 19 HK 1928 HK 2 HK 23 HK 2318 HK 2388 HK 2628 HK 267 HK 291 HK 293 HK 3 HK 322 HK 330 HK 3328 HK 386 HK 388 HK 3988 HK 4 HK 494 HK 5 HK 6 HK 66 HK 688 HK 700 HK 762 HK 83 HK 836 HK 857 HK 883 HK 939 HK 941 HK 992 HK Share price (HK$) 130.00 22.75 79.00 21.00 128.10 17.90 10.24 51.95 41.15 96.35 10.18 4.93 23.70 9.52 113.10 9.42 8.65 4.62 100.60 44.80 65.55 31.10 59.00 25.00 21.60 13.54 18.52 13.78 17.86 19.40 10.02 5.47 6.51 172.90 3.52 55.05 9.33 77.75 72.35 30.30 21.50 115.40 11.32 12.70 20.80 9.36 12.48 5.53 91.20 11.14 Mkt cap (HK$m) 301,101 102,040 96,917 381,198 244,907 104,379 30,093 155,847 495,657 410,776 82,177 1,605,018 60,365 125,626 308,628 81,624 72,956 72,307 146,992 361,375 165,609 72,987 433,029 264,320 561,188 337,191 44,700 54,208 187,809 108,697 19,466 400,860 758,182 201,951 957,034 166,809 78,003 1,491,851 154,414 176,345 175,740 1,080,834 270,686 76,399 99,770 1,772,915 557,200 1,378,853 1,858,612 117,968 5d chg (%) -0.8 -0.7 1.3 -1.9 0.1 0.4 -1.5 1.2 -0.5 -0.4 -2.1 0.8 -1.3 -1.8 -0.3 1.7 -0.6 -2.1 0.6 8.3 1.3 -0.2 1.1 0.0 0.7 2.9 -1.9 -0.9 -0.1 2.3 -4.8 0.7 -2.1 1.2 0.6 -0.4 3.4 -1.1 0.3 -0.8 1.9 1.8 -1.2 2.4 0.0 -1.5 -0.3 0.7 -1.7 3.5 Ytd chg (%) 12.1 -7.1 -13.8 -14.1 1.9 -6.9 -3.8 29.1 5.8 -2.3 -25.5 -5.9 -16.3 -15.0 15.0 2.2 -3.6 6.0 10.7 -28.3 6.9 -5.3 -15.0 0.6 -10.9 14.2 -28.1 -16.0 10.5 -13.4 -32.9 0.0 2.8 33.7 -1.4 -7.2 13.7 -7.6 17.4 3.2 -1.4 16.7 -2.4 19.8 13.2 10.1 -13.5 -5.5 13.4 18.1 23,088.6 14,162,973 0.2 -0.9 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) 152.00 105.95 27.00 19.80 99.70 74.05 27.00 19.12 133.00 117.60 22.90 13.62 11.92 9.40 56.40 36.46 44.20 34.65 108.50 86.88 14.82 10.06 5.66 4.33 29.80 22.75 13.10 9.32 120.20 90.35 10.48 7.15 11.56 7.25 5.26 3.72 108.00 80.55 68.00 38.70 67.80 56.00 35.00 28.50 76.50 55.60 26.65 21.50 25.80 19.52 16.88 9.35 27.90 18.14 17.26 13.56 18.40 13.91 24.00 17.82 17.42 9.91 5.98 4.53 8.23 5.73 185.00 112.80 3.79 3.03 70.20 46.35 10.70 7.72 87.35 75.75 75.85 57.85 32.30 26.55 24.60 17.52 134.00 77.56 14.22 9.03 14.16 9.83 24.90 17.10 11.70 7.31 16.10 11.42 6.37 4.89 102.20 63.65 12.70 7.62 25,363.0 21,137.6 –––––––––– PE ––––––––––– 2013A 2014E 2015E (X) (X) (X) 7.0 8.5 8.8 13.4 17.3 16.3 26.7 25.4 21.1 7.7 8.2 8.1 14.7 14.2 13.2 6.8 9.1 7.7 13.1 11.8 10.5 8.7 16.4 16.5 26.0 20.2 17.6 8.7 12.2 11.3 12.9 12.6 11.2 5.0 5.0 4.7 13.7 14.1 12.8 23.2 22.7 19.8 9.1 14.8 13.8 7.1 10.9 10.4 12.8 13.1 12.4 35.1 35.4 23.5 11.5 14.4 13.4 17.6 16.8 15.0 18.4 15.7 15.4 10.5 11.2 10.6 11.7 10.5 9.2 11.5 10.8 9.8 17.9 14.7 12.6 9.6 9.2 7.9 24.4 33.9 27.3 18.4 16.1 10.9 27.0 25.0 23.1 22.2 27.5 22.5 91.7 31.7 20.4 5.0 4.9 4.7 8.8 8.8 8.4 43.7 38.5 29.3 4.7 4.7 4.4 7.0 14.0 12.3 12.0 18.2 15.8 12.7 11.0 10.1 2.5 17.7 17.8 11.9 17.0 15.6 7.0 7.6 6.6 41.8 34.7 26.2 18.0 16.2 13.9 8.5 14.2 14.1 8.6 8.1 7.5 10.3 10.0 9.4 7.9 7.8 7.5 4.9 4.7 4.4 12.5 13.1 13.0 17.4 17.7 14.4 10.1 10.6 9.8 Yield P/B (%) 2.7 3.3 2.3 5.5 4.3 2.5 3.0 1.9 1.1 2.4 2.3 N/A 3.2 2.8 3.0 4.4 1.2 2.2 3.6 3.9 4.0 3.6 1.5 4.0 1.8 2.0 1.3 1.9 1.8 1.5 0.7 N/A 4.7 2.1 7.1 3.2 5.1 4.9 3.6 3.0 2.3 0.2 1.8 3.9 3.6 4.3 4.6 N/A 3.5 2.2 (X) 0.8 0.8 5.9 1.2 2.2 1.2 0.8 0.6 2.3 1.0 1.6 1.0 0.9 8.6 0.7 0.5 2.3 0.6 0.7 8.9 1.8 1.1 1.8 1.6 2.0 0.6 0.9 0.9 3.7 4.9 1.2 0.7 1.0 9.1 0.8 0.6 2.1 1.0 1.3 1.1 1.5 12.2 1.0 0.7 1.5 1.2 1.2 1.0 1.8 4.6 3.7 1.3 Morning Express 22 October 2014 China Ent Index Constituents Company name Shandong Weig-H China Shenhua-H Sinopharm-H China Shipping-H Zoomlion Heavy-H Yanzhou Coal-H Agricultural-H New China Life-H Ind & Comm Bk-H Tsingtao Brew-H China Com Cons-H China Coal Ene-H China Minsheng-H Guangzhou Auto-H Ping An Insura-H Picc Property & Great Wall Mot-H Weichai Power-H Aluminum Corp-H China Pacific-H China Life Ins-H China Oilfield-H Zijin Mining-H China Natl Bdg-H Bank Of Commun-H Jiangxi Copper-H China Petroleu-H China Rail Gr-H China Merch Bk-H Bank Of China-H Dongfeng Motor-H Citic Securiti-H Haitong Securi-H China Telecom-H Air China Ltd-H Petrochina Co-H Huaneng Power-H Anhui Conch-H China Longyuan-H China Const Ba-H China Citic Bk-H Hang Seng China Ent Indx BBG code 1066 HK 1088 HK 1099 HK 1138 HK 1157 HK 1171 HK 1288 HK 1336 HK 1398 HK 168 HK 1800 HK 1898 HK 1988 HK 2238 HK 2318 HK 2328 HK 2333 HK 2338 HK 2600 HK 2601 HK 2628 HK 2883 HK 2899 HK 3323 HK 3328 HK 358 HK 386 HK 390 HK 3968 HK 3988 HK 489 HK 6030 HK 6837 HK 728 HK 753 HK 857 HK 902 HK 914 HK 916 HK 939 HK 998 HK Share price (HK$) Mkt cap (HK$m) 5d chg (%) Ytd chg (%) 7.40 21.00 29.40 4.56 3.86 6.15 3.46 26.60 4.93 55.95 5.53 4.62 7.40 7.37 59.00 13.54 31.45 28.00 3.14 27.25 21.60 18.42 1.91 7.03 5.47 12.78 6.51 4.25 13.36 3.52 12.14 18.62 12.72 4.73 4.62 9.36 8.65 25.15 7.66 5.53 4.84 33,125.15 381,198.29 75,507.83 19,853.76 43,604.12 44,781.06 1,022,778.77 92,764.11 1,605,017.61 70,990.66 92,793.39 72,306.94 265,589.07 59,205.91 433,029.03 184,200.02 110,435.11 51,758.90 57,777.42 226,791.69 561,188.06 101,095.37 62,613.16 37,955.15 400,860.04 52,908.92 758,182.16 86,307.94 332,345.72 957,033.74 104,599.70 186,218.49 124,065.34 382,810.13 66,640.15 1,772,914.92 111,497.94 118,470.91 61,558.74 1,378,852.63 259,981.06 -0.8 -1.9 9.7 -1.5 -9.0 -2.4 0.6 -0.7 0.8 1.4 1.1 -2.1 2.5 -0.3 1.1 -3.6 -0.8 -0.4 -1.3 -0.2 0.7 -3.4 -1.0 0.7 0.7 -0.6 -2.1 3.9 0.3 0.6 -3.0 4.5 6.0 1.5 -2.9 -1.5 -2.8 2.4 3.8 0.7 2.1 -29.3 -14.1 32.1 -24.3 -46.7 -13.1 -9.2 2.3 -5.9 -14.6 -11.5 6.0 3.1 -13.1 -15.0 17.7 -26.5 -10.4 16.3 -10.4 -10.9 -23.4 15.1 -15.7 0.0 -8.7 2.8 6.3 -19.1 -1.4 0.0 -12.0 -5.8 20.7 -20.2 10.1 23.4 -12.5 -23.3 -5.5 15.0 11.2 27.0 30.0 6.3 8.0 8.7 4.1 29.6 5.7 68.3 6.7 5.3 8.2 10.9 76.5 15.0 51.9 35.5 3.9 33.5 25.8 26.0 2.2 9.1 6.0 15.4 8.2 4.7 17.6 3.8 15.2 21.7 14.5 5.2 6.3 11.7 9.7 35.7 10.3 6.4 5.3 6.8 19.1 19.7 4.0 3.9 4.9 3.0 20.6 4.3 53.1 4.9 3.7 5.9 6.7 55.6 9.8 26.1 25.8 2.5 23.6 19.5 17.2 1.6 6.7 4.5 11.6 5.7 3.0 12.1 3.0 9.6 13.7 9.5 3.1 4.2 7.3 6.1 24.2 7.1 4.9 3.6 60.6 7.7 23.2 N/A 12.7 6.5 5.0 10.9 5.0 30.1 5.5 35.1 4.4 11.9 11.7 13.6 9.3 8.4 N/A 18.2 17.9 8.5 15.4 4.8 5.0 9.8 8.8 7.2 4.6 4.7 6.1 22.2 22.8 16.2 17.1 10.3 8.3 8.7 24.9 4.9 4.4 24.6 8.2 21.1 34.6 9.9 19.0 4.8 10.7 5.0 29.1 5.3 35.4 4.1 9.3 10.5 11.8 8.7 9.4 N/A 16.7 14.7 8.4 14.8 5.1 4.9 13.4 8.8 6.8 4.6 4.7 6.3 21.8 18.3 16.0 14.1 10.0 7.8 8.9 16.7 4.7 4.3 10,276 4,126,796 0.2 -5.0 11,638.3 9,159.8 7.2 7.0 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) ––––––––––– PE ––––––––––– 2013A 2014E 2015E (X) (X) (X) Yield P/B (%) (X) 20.3 8.1 17.6 13.0 8.4 15.6 4.4 9.3 4.7 25.1 4.9 23.5 3.9 7.2 9.2 10.5 7.0 9.2 N/A 14.3 12.6 7.8 14.8 4.7 4.7 13.2 8.4 6.2 4.2 4.4 5.8 18.8 15.4 14.6 10.5 9.4 7.6 8.3 13.3 4.4 3.9 1.1 5.5 1.1 0.0 4.9 0.4 N/A 0.7 N/A N/A 4.3 2.2 2.7 3.1 1.5 2.1 3.3 1.1 N/A 1.9 1.8 3.0 N/A 2.9 N/A 5.0 4.7 2.0 5.9 7.1 1.9 N/A 1.2 2.5 1.2 4.3 5.6 1.8 0.8 N/A N/A 2.8 1.2 2.7 0.6 0.6 0.6 1.0 1.5 1.0 4.0 0.7 0.6 0.9 1.1 1.8 2.3 2.6 1.4 0.8 1.8 2.0 1.6 1.2 0.8 0.7 0.8 1.0 0.8 0.9 0.8 1.2 1.8 1.5 1.1 0.9 1.2 1.5 1.8 1.5 1.0 0.7 6.4 4.6 1.1 Morning Express 22 October 2014 BOCOM International 11/F, Man Yee Building, 68 Des Voeux Road, Central, Hong Kong Main: + 852 3710 3328 Fax: + 852 3798 0133 Rating System Company Rating www.bocomgroup.com Sector Rating Buy: Expect more than 20% upside in 12 months LT Buy: Expect more than 20% upside but longer than 12 months Neutral: Expect low volatility Sell: Expect more than 20% downside in 12 months Outperform (“OP”): Expect more than 10% upside in 12 months Market perform (“MP”): Expect low volatility Underperform (“UP”): Expect more than 10% downside in 12 months Research Team Head of Research @bocomgroup.com (852) 2977 9393 raymond.cheng (852) 2977 9384 hao.hong (852) 2977 9212 yangqingli Shanshan LI, CFA (86) 10 8800 9788 - 8058 lishanshan Li WAN, CFA (86) 10 8800 9788 - 8051 Wanli Raymond CHENG, CFA, CPA, CA Strategy Economics Hao HONG, CFA Banks Consumer Discretionary miaoxian.li Fei WU (852) 2977 9392 fei.wu Tony LIU (852) 2977 9390 xutong.liu Alfred LAU, CFA, FRM (852) 2977 9235 alfred.lau Toni HO, CFA, FRM (852) 2977 9220 toni.ho Luella GUO (852) 2977 9211 luella.guo (86) 21 6065 3606 louis.sun (852) 2977 9209 lizhiwu (852) 2977 9216 miles.xie Geoffrey CHENG, CFA (852) 2977 9380 geoffrey.cheng Ian FENG (852) 2977 9381 Yinan.feng (86) 21 6065 3675 wei.yao Property Phoebe WONG (852) 2977 9391 phoebe.wong Anita CHU (852) 2977 9205 anita.chu Consumer Staples Renewable Energy Summer WANG (852) 2977 9221 summer.wang Shawn WU (852) 2977 9386 shawn.wu Johnson SUN (852) 2977 9203 johnson.sun Milo LIU (852) 2977 9387 milo.liu (852) 2977 9389 liwenbing Healthcare Louis SUN Telecom & Small/ Mid-Caps Insurance Zhiwu LI Technology Internet Miles XIE Transportation & Industrial Yuan MA (86) 10 8800 9788 - 8039 yuan.ma Connie GU, CPA (86) 10 8800 9788 - 8045 conniegu (852) 2977 9243 jovi.li Metals & Mining Jovi LI (86) 10 8800 9788 - 8043 Miaoxian LI Oil & Gas/ Gas Utilities Qingli YANG Jerry LI @bocomgroup.com Automobile Download our reports from Bloomberg: BOCM〈enter〉 Wei YAO Morning Express 22 October 2014 Analyst Certification The authors of this report, hereby declare that: (i) all of the views expressed in this report accurately reflect their personal views about any and all of the subject securities or issuers; and (ii) no part of any of their compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report; (iii) no insider information/ non-public price-sensitive information in relation to the subject securities or issuers which may influence the recommendations were being received by the authors. The authors of this report further confirm that (i) neither they nor their respective associates (as defined in the Code of Conduct issued by the Hong Kong Securities and Futures Commission) have dealt in or traded in the stock(s) covered in this research report within 30 calendar days prior to the date of issue of the report; (ii)) neither they nor their respective associates serve as an officer of any of the Hong Kong listed companies covered in this report; and (iii) neither they nor their respective associates have any financial interests in the stock(s) covered in this report. Disclosure of relevant business relationships BOCOM International Securities Limited, and/or its associated companies, has investment banking relationship with Bank of Chongqing Co. Ltd., Huishang Bank Corporation Limited, Phoenix Healthcare Group Co. Ltd., China Cinda Asset Management Co. Ltd., Qinhuangdao Port Co. Ltd, Jintian Pharmaceutical Group Limited, Logan Property Holdings Company Limited, Nanjing Sinolife United Company Limited, Magnum Entertainment Group Holdings Limited, Bank of Communications, Harbin Bank Co., Ltd., Azure Orbit International Finance Limited, Hanhua Financial Holding Co., Ltd., Central China Securities Company Limited, China New City Commercial Development Limited, China Shengmu Organic Milk Limited, Broad Greenstate International Company Limited, China National Culture Group Limited and Sichuan Development (Holding) Co. Ltd. within the preceding 12 months. BOCOM International Holdings Company Limited currently holds more than 1% of the equity securities of Shanghai Fosun Pharmaceuticals Group Co. Ltd. BOCOM International Securities Limited currently holds more than 1% of the equity securities of Sanmenxia Tianyuan Aluminum Company Limited. Disclaimer By accepting this report (which includes any attachment hereto), the recipient hereof represents and warrants that he is entitled to receive such report in accordance with the restrictions set forth below and agrees to be bound by the limitations contained herein. Any failure to comply with these limitations may constitute a violation of law. This report is strictly confidential and is for private circulation only to clients of BOCOM International Securities Ltd. This report is being supplied to you strictly on the basis that it will remain confidential. No part of this report may be (i) copied, photocopied, duplicated, stored or reproduced in any form by any means or (ii) redistributed or passed on, directly or indirectly, to any other person in whole or in part, for any purpose without the prior written consent of BOCOM International Securities Ltd. BOCOM International Securities Ltd, its affiliates and related companies, their directors, associates, connected parties and/or employees may own or have positions in securities of the company(ies) covered in this report or any securities related thereto and may from time to time add to or dispose of, or may be interested in, any such securities. Further, BOCOM International Securities Ltd, its affiliates and its related companies may do and seek to do business with the company(ies) covered in this report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking, advisory, underwriting, financing or other services for or relating to such company(ies) as well as solicit such investment, advisory, financing or other services from any entity mentioned in this report. In reviewing this report, an investor should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest. The information contained in this report is prepared from data and sources believed to be correct and reliable at the time of issue of this report. This report does not purport to contain all the information that a prospective investor may require and may be subject to late delivery, interruption and interception. BOCOM International Securities Ltd does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information and opinion contained in this report and accordingly, neither BOCOM International Securities Ltd nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof. This report is general in nature and has been prepared for information purposes only. It is intended for circulation amongst BOCOM International Securities Ltd’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. The information and opinions in this report are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, related investments or other financial instruments thereof. The views, recommendations, advice and opinions in this report may not necessarily reflect those of BOCOM International Securities Ltd or any of its affiliates, and are subject to change without notice. BOCOM International Securities Ltd has no obligation to update its opinion or the information in this report. Investors are advised to make their own independent evaluation of the information contained in this research report, consider their own individual investment objectives, financial situation and particular needs and consult their own professional and financial advisers as to the legal, business, financial, tax and other aspects before participating in any transaction in respect of the securities of company(ies) covered in this report. The securities of such company(ies) may not be eligible for sale in all jurisdictions or to all categories of investors. This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to any law, regulation, rule or other registration or licensing requirement. BOCOM International Securities Ltd is a wholly owned subsidiary of Bank of Communications Co Ltd. Download our reports from Bloomberg: BOCM〈enter〉

© Copyright 2026