Property Sector

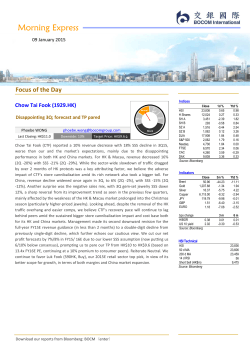

20 April 2015 Weekly Express HK Property Sector Property Sector MP UP China Property Sector UP OP MP OP All-round recovery to come in 2Q15 Focus chart: Jan-15 Jul-14 Oct-14 Jan-14 Apr-14 Jul-13 Oct-13 Jan-13 Apr-13 0 14 Apr 14 28 Apr 14 12 May 14 26 May 14 9 Jun 14 23 Jun 14 7 Jul 14 21 Jul 14 4 Aug 14 18 Aug 14 1 Sep 14 15 Sep 14 29 Sep 14 13 Oct 14 27 Oct 14 10 Nov 14 24 Nov 14 8 Dec 14 22 Dec 14 5 Jan 15 19 Jan 15 2 Feb 15 16 Feb 15 2 Mar 15 16 Mar 15 30 Mar 15 13 Apr 15 100 Jul-12 200 Oct-12 300 Jan-12 400 Apr-12 500 1st-tier cities New Commercial Home ASP MoM % 2nd-tier cities New Commercial Home ASP MoM % 3rd-tier cities New Commercial Home ASP MoM % Jul-11 600 (%) 3.0 2.5 2.0 1.5 1.0 0.5 0.0 -0.5 -1.0 -1.5 Oct-11 (No. of units) 700 Sector Weekly Performance China 70-city new home price MoM Jan-11 Apr-11 HK weekend primary market volume HSI HK Prop NAV discount (%) HIBOR (1W,%) Index 27,653 4,494 -35.7 0.0993 % WoW Total Return 1.4 -1.3 -0.9%pt -0.015%pt % YTD Total Return 17.7 15.6 HSCEI China Prop NAV discount (%) SHIBOR (1W,%) 14,537 3.9 14,635 4.0 -35.5 2.5%pt 2.8730 -0.097%pt 21.3 29.0 Source: Bloomberg,BOCOM Int'l estimate Source: Local news, Wind, BOCOM Int'l Upcoming Economic Releases Hong Kong property Buoyant sales but home prices under pressure. In less than a month, 2,276 flats in 3 major new projects (Twin Peaks, Hemera, and Peninsula East) were over 99% sold. The fast launch paces and undercutting ASP (even at latter batches) reflect developers’ cautious view towards the outlook of the property market. Going forward, we believe developers will remain conservative in pricing new launches, exerting great pressure on secondary home prices. The sector is trading at a 36% NAV discount. We continue to like landlords, with +ve rental reversion potential and catch-up in valuation, and reiterate Hysan (14 HK) as our top pick. China property Expect an all-round recovery in 2Q15. According to NBS, March new home prices st rose 0.2% MoM in 1 -tier cities and 12 out of 70 cities saw MoM price increase, compared with only 2 in February (Figure 11 and 12). Together with the volume rebound and continuous high take-up in March, the improved home price performance indicated that the supportive measures in the past 2 months have st nd greatly improved market sentiment. Going forward, we expect 1 /major 2 -tier cities to experience further recovery (in terms of volume and price) in 2Q15, with developers rolling out more new projects and ‘330’ policies gradually taking effect. Moreover, the wealth effect in the stock market may spill over to the property market, especially from upgraders’ demand. In fact, the sector leaders have beefed up marketing campaigns recently with various eye-catching news coming out from Vanke, Shimao, and Poly. Evergrande even announced unconditional sales cancellation to attract investors and hesitant end-users. Last week, the sector NAV discount narrowed further to 35.5% and we expect further upside for Shimao (813 HK), KWG (1813 HK), and CIFI (884 HK), which are currently trading at discounts of 42%~56% to NAV. We also believe Wanda (3699 HK, not rated) will continue catching up with other large-cap peers. Download our reports from Bloomberg: BOCM〈enter〉 Apr 21 HK Mar CPI Apr 23 Apr P HSBC China Manufacturing PMI Apr P Markit US Manufacturing PMI Source: Bloomberg Upcoming Company Events Apr 20 LANGHAM (1270 HK) AGM Apr 22 Shanghai Lujiazui (600663 CH) AGM COLI (688 HK) 1Q15 result Apr 24 CHINA NEW TOWN (CNTD SP) AGM Vanke (2202 HK) 1Q15 result Source: Bloomberg Luella Guo [email protected] Tel: (852) 2977 9211 Alfred Lau, CFA, FRM [email protected] Tel: (852) 2977 9235 Philip Tse, CFA, FRM [email protected] Tel: (852) 2977 9220 20 April 2015 Property Sector Part 1: Valuation Figure 1: Valuation of Hong Kong Property sector Company name Ticker HK Developers SHKP 16 HK Cheung Kong 1 HK Henderson Land 12 HK New World Dev 17 HK Sino Land 83 HK Wheelock 20 HK Kerry 683 HK Far East Consortium 35 HK K. Wah 173 HK Midland 1200 HK HK developers total / average ex-Cheung Kong HK Landlords Wharf Hang Lung Properties Hysan Swire Properties Great Eagle Total / average 4 HK 101 HK 14 HK 1972 HK 41 HK BOCOM rating 17 Apr price (HK$) Target price (HK$) Upside (%) Market —— P/E —— ———— P/B ———— —— Yield —— cap FY15E FY16E latest FY15E FY16E FY15E FY16E (HK$m) (x) (x) (x) (x) (x) (%) (%) Sell BUY Sell BUY BUY Neutral BUY BUY NR Neutral 125.80 164.50 59.20 9.66 13.30 41.50 30.50 3.23 4.58 3.50 105.50 170.40 47.60 10.90 14.40 39.20 30.60 3.60 N/A 3.90 -16.1 +3.6 -19.6 +12.8 +8.3 -5.5 +0.3 +11.5 N/A +11.4 361,426 381,009 177,620 85,910 80,954 84,322 44,069 6,181 12,765 2,513 1,234,257 853,248 16.2 12.5 19.0 14.3 15.1 9.2 13.4 5.8 14.2 -33.7 14.1 14.9 16.0 11.6 17.9 13.5 14.5 8.5 10.9 5.2 8.4 24.8 13.1 14.0 Neutral Buy Buy NR NR 55.85 23.60 34.90 24.20 28.35 54.90 25.10 43.60 N/A N/A -1.7 +6.4 +24.9 N/A N/A 169,283 105,853 37,129 141,570 18,609 472,445 14.5 17.9 15.8 19.5 10.9 16.3 13.2 17.5 14.8 18.8 9.9 15.4 0.82 0.97 0.75 0.52 0.71 0.44 0.55 0.68 0.51 1.88 0.74 0.67 0.55 0.80 0.55 0.68 0.36 0.62 BOCOM/ Consensus NAV (HK$) Prem/ —— ROE —— (disc) FY15E FY16E (%) (%) (%) — Net gearing — FY15E FY16E (%) (%) 0.79 0.95 0.71 0.51 0.69 0.42 0.53 0.63 0.59 1.92 0.72 0.65 0.77 0.90 0.68 0.50 0.67 0.40 0.49 0.58 0.55 1.80 0.69 0.63 2.7 2.3 2.0 4.3 4.1 2.7 2.6 5.3 3.3 2.7 2.9 2.7 2.4 2.1 4.3 4.2 2.8 2.8 5.9 3.3 2.8 2.8 3.0 175.85 227.80 81.90 19.76 24.00 93.80 68.10 9.39 9.63 n.a. (28.5) (27.8) (27.7) (51.1) (44.6) (55.8) (55.2) (65.6) (52.4) n.a. (36.3) (39.5) 5 8 4 4 5 5 5 11 3 10 5 8 4 4 5 5 5 11 7 11 11 16 15 22 Net cash 17 32 41 41 Net cash - 5 13 15 23 Net cash 13 32 35 16 Net cash - 0.54 0.79 0.54 0.67 0.36 0.60 0.52 0.76 0.52 0.66 0.35 0.59 3.6 3.3 3.6 2.7 2.5 3.2 4.0 3.3 3.8 2.8 2.7 3.4 98.90 35.86 67.00 35.04 62.05 (43.5) (34.2) (47.9) (30.9) (54.3) (39.2) 4 5 3 3 3 4 5 3 4 3 17 Net cash 4 17 33 16 Net cash 3 16 31 Source: Bloomberg consensus, BOCOM Int'l estimates Figure 2: Valuation of China Property sector ———— P/B ———— latest FY15E FY16E (x) (x) (x) Prem/ (disc) (%) 6.6 8.0 7.0 2.9 8.6 5.0 8.0 5.5 7.3 6.3 N/A 3.9 12.7 30.4 4.0 31.9 21.5 7.9 15.1 10.7 12.6 5.0 4.6 12.9 (54.2) (41.8) (55.1) (22.7) (57.0) (24.2) (43.6) (46.9) (45.4) (56.2) (72.1) (73.3) 11 17 6 13 13 9 13 2 15 22 17 14 10 17 7 13 13 10 11 2 16 22 N/A 16 69 69 65 55 106 56 96 39 54 71 61 26.8 73 68 66 59 88 59 85 45 46 64 N/A 21.5 2.4 5.9 6.1 3.2 N/A 3.4 4.4 2.6 2.3 N/A 15.1 3.8 4.4 5.2 12.2 7.0 4.0 3.3 4.3 5.6 28.8 7.5 5.3 17.0 5.2 5.7 5.1 12.9 10.8 31.0 6.6 12.9 9.7 2.1 5.6 2.0 20.4 100.0 4.1 (37.4) (28.1) (27.6) (79.8) (60.3) (42.2) (64.4) (59.9) (74.3) (76.3) (33.2) (82.6) (40.0) (62.3) (17.2) (4.5) (46.8) (36.3) (53.0) 18 10 17 15 N/A 1 10 4 17 2 17 23 5 11 18 12 20 11 18 10 17 15 N/A 2 10 5 18 2 18 23 4 12 19 20 20 13 20 117 49 52 N/A 84 81 95 55 N/A 58 45 25 81 55 N/A 27 55 61 65 2 104 35 35 N/A 86 66 81 35 N/A 32 19 N/A 80 52 N/A 28 54 52 55 —— Yield —— FY15E FY16E (%) (%) 3.7 4.3 1.9 2.1 1.3 1.5 1.3 1.5 2.4 2.7 0.7 1.4 1.3 1.3 2.1 2.5 Consensus NAV (Rmb) N/A N/A N/A N/A N/A N/A N/A Prem/ (disc) (%) N/A N/A N/A N/A N/A N/A N/A Ticker BOCOM rating 17 Apr price (HK$) Target price (HK$) Upside (%) Rated stocks Agile Property Shimao Property Yuexiu Property CR Land Guangzhou R&F Sino-Ocean Land Greentown SOHO China KWG Property CIFI Wuzhou CSC 3383 HK 813 HK 123 HK 1109 HK 2777 HK 3377 HK 3900 HK 410 HK 1813 HK 884 HK 1369 HK 1668 HK Neutral BUY LT Buy BUY Neutral Neutral SELL Neutral BUY BUY BUY BUY 5.82 17.70 1.80 24.65 9.24 5.99 8.52 5.69 6.90 2.19 1.29 3.44 6.36 22.80 2.21 27.11 10.75 5.49 7.51 6.43 8.22 2.50 2.08 4.25 9.3 28.8 22.8 10.0 16.3 (8.3) (11.9) 13.0 19.1 14.2 61.2 23.5 22,797 61,465 22,322 160,988 29,775 44,957 18,412 29,585 20,330 13,199 6,009 27,522 4.5 4.4 9.3 10.0 3.6 8.0 3.0 34.1 5.1 4.1 5.4 9.6 4.0 3.9 7.2 8.6 3.1 7.2 2.9 26.9 4.3 3.2 N/A 8.4 0.54 1.05 0.61 1.49 0.66 0.83 0.66 0.60 0.80 1.03 1.31 1.22 0.45 0.86 0.46 1.38 0.57 0.76 0.49 0.57 0.71 0.82 1.05 1.13 0.41 0.74 0.44 1.23 0.51 0.70 0.43 0.55 0.64 0.67 N/A 1.04 5.9 7.1 5.4 2.5 8.0 4.6 7.8 5.5 6.3 5.1 5.5 3.5 688 HK 3333 HK 2007 HK 960 HK 845 HK 272 HK 817 HK 119 HK 81 HK 754 HK 1638 HK 1918 HK 1224 HK 1777 HK 832 HK 1238 HK 2202 HK 3699 HK NR NR NR NR NR NR NR NR NR NR NR NR NR NR NR NR NR NR 29.95 4.71 3.78 12.32 1.05 2.25 2.95 4.59 4.34 7.97 1.56 8.63 1.69 1.26 2.11 1.69 19.52 53.20 N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A 244,811 69,389 76,930 71,589 8,182 18,004 26,751 16,806 9,905 17,884 8,011 29,211 4,374 7,254 5,139 6,755 204,104 240,855 1,242,175 632,272 9.0 8.1 6.1 7.4 5.3 33.3 7.3 11.3 4.5 19.0 1.9 5.0 6.5 5.3 3.1 2.5 8.4 10.1 7.2 6.0 7.9 7.4 5.4 6.7 9.3 12.8 6.5 10.0 3.7 14.2 1.6 4.3 7.0 4.5 2.5 1.3 7.3 8.1 6.3 5.3 1.84 1.07 1.08 1.20 0.42 0.38 0.81 0.56 0.81 0.32 0.35 1.43 0.30 0.61 0.64 0.29 1.95 1.25 1.06 0.77 1.56 0.67 0.96 1.05 0.42 0.33 0.72 0.51 0.67 0.32 0.27 1.09 0.28 0.51 0.52 N/A 1.63 1.11 0.90 0.65 1.35 0.64 0.85 0.93 0.41 0.32 0.67 0.49 0.57 0.31 0.23 0.90 0.27 0.46 0.45 N/A 1.39 1.00 0.81 0.59 2.1 5.7 5.4 2.9 N/A 2.5 3.9 2.3 1.9 N/A 13.9 3.3 4.4 4.8 10.0 4.8 3.5 2.7 3.9 5.0 Ticker BOCOM rating 000002 CH 600048 CH 600383 CH 000024 CH 000402 CH 600663 CH 600823 CH NR NR NR NR NR NR NR 17 Apr price (Rmb) 14.7 13.8 12.2 32.0 12.9 41.8 20.5 Target price (Rmb) N/A N/A N/A N/A N/A N/A N/A Target price (Rmb) N/A N/A N/A N/A N/A N/A N/A Non-rated stocks COLI Evergrande Country Garden Longfor Glorious Property Shui On Land Franshion Property Poly (HK) COGO Hopson Kaisa Sunac CC Land Fantasia Central China Powerlong Vanke-HK Wanda Commercial Total / average Ex-COLI/CR Land/Vanke Market —— P/E —— cap FY15E FY16E (HK$m) (x) (x) BOCOM/ Consensus NAV (HK$) Company name —— Yield —— FY15E FY16E (%) (%) —— ROE —— FY15E FY16E (%) (%) — Net gearing — FY15E FY16E (%) (%) A-shares Company name Vanke (A) Poly Real Estate Gemdale China Merchant Financial Street Shanghai Lujiazui Shanghai Shimao Total / average Market —— P/E —— cap FY15E FY16E (Rmb m) (x) (x) 163,147 7.9 6.8 148,555 9.9 8.5 54,841 11.9 10.6 75,339 14.8 12.7 38,468 11.0 10.3 66,630 47.2 37.3 24,070 10.6 9.7 571,050 10.9 9.5 ———— P/B ———— latest FY15E FY16E (x) (x) (x) 1.84 1.53 1.31 2.42 1.92 1.61 1.75 1.54 1.39 2.65 2.28 2.01 1.59 1.40 1.27 6.77 4.90 4.39 1.50 1.42 1.23 2.19 1.84 1.59 —— ROE —— FY15E FY16E (%) (%) 20 20 21 20 12 13 16 17 12 12 11 12 14 14 — Net gearing — FY15E FY16E (%) (%) 25 27 90 76 75 72 26 22 70 75 80 75 39 34 58 54 Source: Bloomberg consensus, BOCOM Int'l estimates *CSC NAV @HK$12.9 (or HK$9.0 if excluding new business) Download our reports from Bloomberg: BOCM〈enter〉 2 20 April 2015 Property Sector Part 2: Stock market HK Property Market HK developers slipped 1.3% WoW and HK landlords retreated 3.1% WoW, vs. a gain of 1.4% WoW in HSI. The sector NAV discount widened to 35.7% (from 34.8% in the previous week). Figure 3: Top 5 gainers and losers, 5D total return Figure 4: Top 5 gainers and losers, YTD total return Top 5 gainers & losers of YTD Total return (%) Top 5 gainers & losers of 5D Total return (%) Cheung Kong Yuexiu REIT HKL Wheelock Sunlight REIT HSI HK Prop HK Inv Hui Xian REIT Wharf New Century Hotel REIT Link REIT Midland Kerry HKL Champion REIT New Century Hotel REIT Regal REIT HSI HK Prop HK Inv Sunlight REIT Wheelock Fortune REIT Wharf Link REIT (6) (4) (2) 0 2 4 6 8 Source: Bloomberg consensus, BOCOM Int'l estimate (20) (10) 0 10 20 30 40 Source: Bloomberg consensus, BOCOM Int'l estimate Figure 5: Sector NAV discount NAV discount Average since 2009 +1 SD 40 30 20 10 0 (10) (20) (30) (40) (50) (60) (70) -1 SD Oct-04 Oct-05 Oct-06 Oct-07 Oct-08 Oct-09 Oct-10 Oct-11 Oct-98 Oct-99 Oct-00 Oct-01 Oct-02 Oct-03 Oct-92 Oct-93 Oct-94 Oct-95 Oct-96 Oct-97 Oct-88 Oct-89 Oct-90 Oct-91 NAV discount: 35.7% Oct-12 Oct-13 Oct-14 (%) Source: Bloomberg consensus, BOCOM Int'l estimate Download our reports from Bloomberg: BOCM〈enter〉 3 20 April 2015 Property Sector China Property Market China developers rose 4% WoW, slightly outperforming HSCEI by 0.1ppt. CIFI (884 HK), one of our top picks, surged 16% WoW. The sector NAV discount narrowed further to 35.5% (from 38% in the previous week). Figure 6: Top 5 gainers and losers, 5D total return Figure 7: Top 5 gainers and losers, YTD total return Top 5 gainers & losers of YTD Total return (%) Top 5 gainers & losers of 5D Total return (%) Beijing North Star Greenland (HK) China Merchant Cifi Holding Morden Proeprty CH Prop HSCEI COGO Wanda Hotel China South City Fantasia Renhe BCL Greenland (HK) SZI China Merchant Beijing North Star CH Prop HSCEI China SCE Wuzhou Glorious Zhong An Hydoo (20) 0 20 40 (30)(20)(10) 0 10 20 30 40 50 60 70 80 90 100110 60 Source: Bloomberg consensus, BOCOM Int'l estimates Source: Bloomberg consensus, BOCOM Int'l estimates Figure 8: Sector NAV discount (%) 100 80 60 40 20 0 -20 -40 -60 -80 -100 NAV discount Average since 2010 Max Min Jul-14 Jan-15 Jan-14 Jul-13 Jul-12 Jan-13 Jan-12 Jul-11 Jul-10 Jan-11 Jan-10 Jul-09 Jul-08 Jan-09 Jan-08 Jul-07 Jul-06 Jan-07 Jan-06 Jul-05 Jul-04 Jan-05 Jan-04 Jul-03 Jan-03 NAV discount: 35.5% Source: Bloomberg consensus, BOCOM Int'l estimates Download our reports from Bloomberg: BOCM〈enter〉 4 20 April 2015 Property Sector Part 3: Physical market HK Property Market The primary market continued to receive keen take-up with 432 units sold over the nd previous weekend, led by CK’s Hemera 2 batch (398 units, 100% sold). Dragged by the buoyant primary market, the secondary market volume stayed low, with only 6 transactions at 10 major housing estates during the previous weekend and 79 units at 50 major housing estates during the previous week. Figure 9: Weekend primary market sales volume Figure 10: Secondary market sales volume (No. of units) (No. of units) 700 80 600 70 (No. of units) Weekend: 10 major estates (LHS) Weekly: 50 major estates (RHS) 300 250 60 500 200 50 400 150 40 300 30 100 10 0 0 Source: Local news, BOCOM Int'l 100 50 0 14 Apr 13 12 May 13 9 Jun 13 7 Jul 13 4 Aug 13 1 Sep 13 29 Sep 13 27 Oct 13 24 Nov 13 22 Dec 13 19 Jan 14 16 Feb 14 16 Mar 14 13 Apr 14 11 May 14 8 Jun 14 6 Jul 14 3 Aug 14 31 Aug 14 28 Sep 14 26 Oct 14 23 Nov 14 21 Dec 14 18 Jan 15 15 Feb 15 15 Mar 15 12 Apr 15 20 14 Apr 14 28 Apr 14 12 May 14 26 May 14 9 Jun 14 23 Jun 14 7 Jul 14 21 Jul 14 4 Aug 14 18 Aug 14 1 Sep 14 15 Sep 14 29 Sep 14 13 Oct 14 27 Oct 14 10 Nov 14 24 Nov 14 8 Dec 14 22 Dec 14 5 Jan 15 19 Jan 15 2 Feb 15 16 Feb 15 2 Mar 15 16 Mar 15 30 Mar 15 13 Apr 15 200 Source: Local news, BOCOM Int'l China Property Market Both 10/30-city weekly volume rebounded last week, while developers were still restrained in new supply. In fact, 10-city net take-up has stayed over 80% (most of the time over 100%) every week in 2015. As a result, inventory kept edging down in the past few months. Last week, 10-city inventory absorption cycle dropped below 12 months to a 34-week low (last time it fell below 12 months was in Aug 2014). Figure 11: 70-city new home price MoM % (by tiers) (%) Figure 12: 70-city new home price MoM direction 1st-tier cities New Commercial Home ASP MoM % 2nd-tier cities New Commercial Home ASP MoM % 3rd-tier cities New Commercial Home ASP MoM % 3.0 2.5 2.0 1.5 1.0 0.5 0.0 -0.5 -1.0 -1.5 Increase (No. of cities) 2 7 4 6 9 10 4 4 18 20 Decrease 1 1 Flat 1 3 3 4 2 8 8 35 62 57 56 55 64 68 69 69 67 66 64 66 50 44 Source: Wind, BOCOM Int'l Download our reports from Bloomberg: BOCM〈enter〉 2 2 Jan-15 Feb-15 Mar-15 1 Dec-14 Nov-14 Oct-14 Sep-14 1 Aug-14 12 2 Jul-14 8 Jun-14 May-14 Apr-14 Mar-14 Feb-14 Jan-14 Jan-15 Jul-14 Oct-14 Jan-14 Apr-14 Jul-13 Oct-13 Jan-13 Apr-13 Oct-12 Jul-12 Jan-12 Apr-12 Oct-11 Jul-11 Apr-11 Jan-11 15 Source: Wind, BOCOM Int'l 5 20 April 2015 Property Sector (No of units) 80,000 30 cities weekly volume (LHS) (%) 4-wk momentum (RHS) 60 50 40 30 20 10 0 (10) (20) (30) 60,000 40,000 20,000 Source: Wind, BOCOM Int'l Source: Wind, BOCOM Int'l Figure 15: 10 cities’ inventory level Figure 16: 10 cities’ sales sentiment Source: Wind, BOCOM Int'l Download our reports from Bloomberg: BOCM〈enter〉 12 1.5 10 1.0 8 0.5 Apr-15 Jan-15 Feb-15 Mar-15 Dec-14 0.0 May-15 Jan-15 Sep-14 May-14 Jan-14 Sep-13 May-13 Total take-up< New supply Jan-13 (1.0) Sep-12 0 May-12 (0.5) Jan-12 2 Sep-11 4 May-11 6 Total take-up> New supply 2.0 Jan-11 14 10 cities Sales sentiment 2.5 Sep-10 (Months) 16 Jan-10 Absorption (RHS) May-10 10 cities Inventory (LHS) Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 (No of units) 900,000 800,000 700,000 600,000 500,000 400,000 300,000 200,000 100,000 0 Nov-14 Oct-14 Sep-14 Jul-14 Aug-14 Jun-14 May-14 Jan-14 Apr-14 0 Apr-15 Jan-15 Feb-15 Mar-15 Dec-14 Oct-14 Nov-14 90 75 60 45 30 15 0 (15) (30) (45) Sep-14 (%) 4-wk momentum (RHS) Jul-14 10 cities weekly volume (LHS) Aug-14 Jun-14 Apr-14 May-14 Feb-14 Mar-14 Jan-14 (No of units) 30,000 25,000 20,000 15,000 10,000 5,000 0 Figure 14: 30 cities’ volume and momentum Feb-14 Mar-14 Figure 13: 10 cities’ volume and momentum Source: Wind, BOCOM Int'l *Sales sentiment =0 indicates 100% net take-up (total take-up=new supply). Sales sentiment >0 indicates >100% net take-up (total take-up>new supply), and vice versa. We consider net take-up of 60%~80% (sales sentiment of -0.5~-0.2) to be healthy. 6 20 April 2015 Property Sector BOCOM International 11/F, ManYeeBuilding, 68 Des Voeux Road, Central, Hong Kong Main: + 852 3710 3328 Fax: + 852 3798 0133 Rating System Company Rating www.bocomgroup.com Sector Rating Buy: Expect more than 20% upside in 12 months LT Buy: Expect more than 20% upside but longer than 12 months Neutral: Expect low volatility Sell: Expect more than 20% downside in 12 months Outperform (“OP”): Expect more than 10% upside in 12 months Market perform (“MP”): Expect low volatility Underperform (“UP”): Expect more than 10% downside in 12 months Research Team Head of Research @bocomgroup.com Raymond CHENG, CFA, CPA, CA @bocomgroup.com (852) 2977 9393 raymond.cheng (852) 2977 9384 hao.hong (852) 2977 9212 yangqingli Fei WU (852) 2977 9392 fei.wu Shanshan LI, CFA (86) 10 8800 9788 - 8058 lishanshan Tony LIU (852) 2977 9390 xutong.liu Li WAN, CFA (86) 10 8800 9788 - 8051 Wanli Alfred LAU, CFA, FRM (852) 2977 9235 alfred.lau Philip TSE, CFA, FRM (852) 2977 9220 philip.tse Luella GUO (852) 2977 9211 luella.guo (86) 21 6065 3606 louis.sun (852) 2977 9209 lizhiwu (852) 2977 9216 miles.xie Geoffrey CHENG, CFA (852) 2977 9380 geoffrey.cheng Fay ZHOU (852) 2977 9381 fay.zhou (86) 21 6065 3675 wei.yao Strategy Economics Hao HONG, CFA Banks/Network Financials Qingli YANG (86) 10 8800 9788 - 8043 miaoxian.li Oil & Gas/ Gas Utilities Consumer Discretionary Property Phoebe WONG (852) 2977 9391 phoebe.wong Anita CHU (852) 2977 9205 anita.chu Consumer Staples Renewable Energy Summer WANG (852) 2977 9221 summer.wang Shawn WU (852) 2977 9386 shawn.wu (852) 2977 9387 milo.liu Jerry LI (852) 2977 9389 liwenbing Jennifer ZHANG (852) 2977 9250 yufan.zhang Yuan MA, PhD (86) 10 8800 9788 - 8039 yuan.ma Connie GU, CPA (86) 10 8800 9788 - 8045 conniegu (852) 2977 9243 jovi.li Healthcare Louis SUN Telecom & Small/ Mid-Caps Milo LIU Insurance & Brokerage Zhiwu LI Technology Internet Miles XIE Transportation & Industrial Metals & Mining Jovi LI Miaoxian LI Automobile Download our reports from Bloomberg: BOCM〈enter〉 Wei YAO 7 Property Sector 20 April 2015 Analyst Certification The authors of this report, hereby declare that: (i) all of the views expressed in this report accurately reflect their personal views about any and all of the subject securities or issuers; and (ii) no part of any of their compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report; (iii) no insider information/ non-public price-sensitive information in relation to the subject securities or issuers which may influence the recommendations were being received by the authors. The authors of this report further confirm that (i) neither they nor their respective associates (as defined in the Code of Conduct issued by the Hong Kong Securities and Futures Commission) have dealt in or traded in the stock(s) covered in this research report within 30 calendar days prior to the date of issue of the report; (ii)) neither they nor their respective associates serve as an officer of any of the Hong Kong listed companies covered in this report; and (iii) neither they nor their respective associates have any financial interests in the stock(s) covered in this report. Disclosure of relevant business relationships BOCOM International Securities Limited, and/or its associated companies, has investment banking relationship with Bank of Communications, Hanhua Financial Holding Co., Ltd., Central China Securities Company Limited, China New City Commercial Development Limited, China Shengmu Organic Milk Limited, Broad Greenstate International Company Limited, China National Culture Group Limited, Sichuan Development Holding Co. Ltd., AustarLifesciences Limited, BAIC Motor Corporation Limited, China Huinong Capital Group Limited, D&G Technology Holding Company Limited, Guolian Securities Co. Ltd., GF Securities Co. Ltd., PuraPharm Corporation Limited, Chiho-Tiande Group Limitedwithin the preceding 12 months. BOCOM International Holdings Company Limited currently holds more than 1% of the equity securities of Shanghai Fosun Pharmaceuticals Group Co. Ltd. BOCOM International Securities Limited currently holds more than 1% of the equity securities of SanmenxiaTianyuan Aluminum Company Limited. Disclaimer By accepting this report (which includes any attachment hereto), the recipient hereof represents and warrants that he is entitled to receive such report in accordance with the restrictions set forth below and agrees to be bound by the limitations contained herein. Any failure to comply with these limitations may constitute a violation of law. This report is strictly confidential and is for private circulation only to clients of BOCOM International Securities Ltd. This report is being supplied to you strictly on the basis that it will remain confidential. No part of this report may be (i) copied, photocopied, duplicated, stored or reproduced in any form by any means or (ii) redistributed or passed on, directly or indirectly, to any other person in whole or in part, for any purpose without the prior written consent of BOCOM International Securities Ltd. BOCOM International Securities Ltd, its affiliates and related companies, their directors, associates, connected parties and/or employees may own or have positions in securities of the company(ies) covered in this report or any securities related thereto and may from time to time add to or dispose of, or may be interested in, any such securities. Further, BOCOM International Securities Ltd, its affiliates and its related companies may do and seek to do business with the company(ies) covered in this report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking, advisory, underwriting, financing or other services for or relating to such company(ies) as well as solicit such investment, advisory, financing or other services from any entity mentioned in this report. In reviewing this report, an investor should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest. The information contained in this report is prepared from data and sources believed to be correct and reliable at the time of issue of this report. This report does not purport to contain all the information that a prospective investor may require and may be subject to late delivery, interruption and interception. BOCOM International Securities Ltd does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information and opinion contained in this report and accordingly, neither BOCOM International Securities Ltd nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof. This report is general in nature and has been prepared for information purposes only. It is intended for circulation amongst BOCOM International Securities Ltd’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. The information and opinions in this report are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, related investments or other financial instruments thereof. The views, recommendations, advice and opinions in this report may not necessarily reflect those of BOCOM International Securities Ltd or any of its affiliates, and are subject to change without notice. BOCOM International Securities Ltd has no obligation to update its opinion or the information in this report. Investors are advised to make their own independent evaluation of the information contained in this research report, consider their own individual investment objectives, financial situation and particular needs and consult their own professional and financial advisers as to the legal, business, financial, tax and other aspects before participating in any transaction in respect of the securities of company(ies) covered in this report. The securities of such company(ies) may not be eligible for sale in all jurisdictions or to all categories of investors. This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to any law, regulation, rule or other registration or licensing requirement. BOCOM International Securities Ltd is a wholly owned subsidiary of Bank of Communications Co Ltd. Download our reports from Bloomberg: BOCM〈enter〉 8

© Copyright 2026