Daily Market Commentary

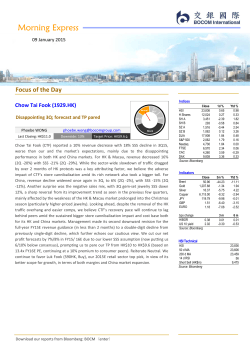

Morning Express 09 April 2015 Focus of the Day Indices China Macro March economic data preview Miaoxian LI [email protected] Economics Despite the seasonal rebound in the CFLP PMI in March, we believe economic growth continued to decelerate in March, while the 1Q GDP growth rate is likely to decline to 7%. As the effect of CNY in boosting prices weakens, we expect a small decline in March CPI. Nevertheless, we think CPI is unlikely to see negative growth given the labor market is still stable. Given the economy continued to face downside pressure in 1Q or even early April, and a lack of downward momentum in financing costs in the real economy, we expect further monetary easing in China going forward. HKEx (388.HK) Neutral Acceleration in market linkage and deep discount spurred turnover growth in the HK stock market Li WAN, CFA Last Closing: HK$220.0 [email protected] Upside: +13.05% LT BUY SELL BUY Stock Close HSI 26,237 H Shares 13,397 SH A 4,188 SH B 316 SZ A 2,207 SZ B 1,179 DJIA 17,903 S&P 500 2,082 Nasdaq 4,951 FTSE 6,937 CAC 5,137 DAX 12,036 Source: Bloomberg 1d % 3.80 5.79 0.85 0.04 -0.71 -0.02 0.15 0.27 0.83 -0.35 -0.28 -0.72 Ytd % 11.15 11.78 23.55 8.58 49.25 14.59 0.45 1.12 4.53 5.66 20.22 22.75 Close 55.55 1,201.75 16.49 6,010.00 120.13 1.49 1.08 3m % N/A -1.70 -0.10 -1.54 -1.36 -1.87 -8.96 Ytd % N/A 1.43 4.99 -4.60 -0.29 -4.50 -10.89 bps change HIBOR 0.39 US 10 yield 1.91 Source: Bloomberg 3m 0.00 -0.04 6m 0.01 -0.41 Indicators Brent Gold Silver Copper JPY GBP EURO Target Price: HK$248.7↑ th Shares of HKEx closed at HK$220 on 8 April, the highest since 2008. Turnover on the Main Board also hit a historical high of HK$250bn. We attribute the rally to the share price gap and valuation difference between the A-share and H-share markets, which continued to attract mainland investors, and the lifting of restriction on institutional investors investing in HK shares in late March. We believe these factors will continue to attract fund flow into the HK stock market, making HK shares an important part of the offshore portfolios of mainland retail and institutional investors. Instead of the turnover under Shanghai-Hong Kong Stock Connect, a more important issue to watch is the potential expansion of market linkage and how such expectation may stimulate turnover in the HK stock market. Moreover, LME will start to make a meaningful profit contribution to HKEx in 2015, while the expectation of the delayed US rate hike and a slowdown in USD appreciation will also benefit the HK market. We raise our 2015-16E ADT forecasts and lift our 15-16E earnings forecasts by 6.4%/6.0%. We lift our TP from HK$195.3 to HK$248.7 (40x 15E P/E). The stock is trading at 35.1x/10.6x 15E PE/PB. Maintain LT Buy. Download our reports from Bloomberg: BOCM enter HSI Technical HSI 50 d MA 200 d MA 14 d RSI Short Sell (HK$m) Source: Bloomberg BOCOM Int'l Corporate Access 14 Apr 24 Apr Austar (6118.HK) Shunfeng (1165.HK) 26,237 24,569 24,028 81 20,526 Morning Express 09 April 2015 Hang Seng Index (1 year) 26,000 25,000 Banking Sector 24,000 Benefiting from favorable factors such as the loosening of offshore investment by onshore mutual funds and insurance funds 23,000 22,000 21,000 Li WAN, CFA [email protected] UP MP OP Source: Company data, Bloomberg Event: HSCI surged by 3.80% on 8 Apr, during which the performance of the banking stocks exceeded that of the large caps. The stock prices of China Everbright Bank, China Cinda, Bank of Chongqing, China CITIC Bank and Chongqing Rural Commercial Bank surged by 10.93%, 12.29%, 8.15% , 6.87% and 6.51%, respectively. HS China Enterprise Index (1 year) 13,000 12,000 11,000 10,000 9,000 Comments: 8,000 The catalysts of the sector boom mainly came from the promulgation of the Guidance for Public Securities Investment Fund in Transactions through SH-HK Stock Connect ( ) by CSRC and the promulgation of CIRC’s Notification of Adjustments to the Policies Relating to Foreign Investments of Insurance Funds’’ ( ) by CIRC, coupled with favorable factors such as the weaker dollar and the A share boom. CSRC’s guidance and CIRC’s notification directly benefited mid-to-large blue chips with greater discount in H share prices and lower valuation, as well as stocks which have not yet been listed in the A share market and are rather rare to the domestic institutions. The former refer to banks trading at higher discount rates in H share, particularly China CITIC Bank (at a discount rate of 53.7%) and China Everbright Bank (at a discount rate of 34.6%), while the latter refer to China Cinda and Hanhua Financial Holding which are not yet listed in the A share market, as well as Chongqing Rural Commercial Bank and Bank of Chongqing which are not yet listed in the A share market and are trading at lower valuations as compared with comparable banks in the Mainland. Source: Company data, Bloomberg Shanghai A-shares (1 year) 4,000 3,500 3,000 2,500 2,000 Source: Company data, Bloomberg Shenzhen A-shares (1 year) 2,200 2,000 We maintain Outperform for the banking sector and Buy for Chongqing Rural Commercial Bank, China Cinda and China Everbright Bank. 1,800 1,600 1,400 1,200 Hanhua Financial Holding is trading at a higher PE of 10.23x. Given the company’s dividend rate of 5.26%, which is not low, and a PB of 0.87x, which is not high, we maintain LT-Buy. Download our reports from Bloomberg: BOCM enter 1,000 Source: Company data, Bloomberg Morning Express 09 April 2015 Baidu (BIDU.US) Neutral MIT-the Martina Internet Talk: Comments on withdrawal of ads by Putian: unlikely to maintain the status growth; short-term revenue growth impact Yuan MA Last Closing: US$203.87 LT BUY BUY SELL Stock [email protected] Upside: +14% Target Price: US$232.00↓ Event: The Putian Healthcare Industry Chamber of Commerce announced on 25 March and at its member meeting on 4 April to stop placing ads on Baidu. As a result, Baidu’s share price dropped 2.7% on 25 March and fluctuated downward in that week. Baidu’s shares tumbled 2.4% on 6 April, when Qihoo’s share price rose 3.8%. On 7 April, Baidu said that it will not compromise in the face of malignant tactics of rivals. The incident is the result of the long-term struggle between Baidu and the Putian line of hospitals. Also, while Baidu has not disclosed the exact proportion of healthcare ads since the CCTV show, market participants generally believe that healthcare ads form an important part of Baidu’s ads, and was a major area where Qihoo attacked Baidu. The status quo is unlikely to be maintained because neither party has the incentive to do so. Given the important position of Baidu in terms of traffic and the diverse views among the Putian member hospitals, a division within Putian is likely. One possible outcome could be Baidu making implicit compromise with some of the Putian hospitals. Or it may simply be left unsettled. We expect the event to decrease Baidu’s 2Q15 revenue by 6% and our forecast 2Q15 QoQ/YoY revenue growth from 27%/38% to 19%/29%. We lower our 2015E revenue forecast by 1% and 2015E revenue growth forecast from 41% to 39%. We also trim our 2015E EPS estimate from US$7.2 to US$7.0, and lower our TP from US$236 to US$232. Intime (1833.HK) Neutral 1Q positive SSS in line; maintain Buy Anita CHU Last Closing: HK$7.12 BUY SELL [email protected] Upside: +8% LT BUY Stock Target Price: HK$7.70↑ Intime posted 1% SSS growth in 1Q, in line with our and the market’s expectations. SSS turned positive in 1Q, following the SSS decline in the past three quarters (-4%/-4%/-7% in 4Q/3Q/2Q14), which we attribute to the stronger promotional effort during the CNY in Feb, the gradual sales improvement in the renovated stores and SSS growth in younger stores. Further, it is worth noting that the company’s rental income more than doubled (+114% YoY) in 1Q, which was mainly due to the increased sales contribution from the shopping malls (more leased area). Looking ahead, Intime plans to operate more commercial properties in order to facilitate its expansion plan of the shopping mall business. Following the 7 new shopping malls in FY14, the company plans to open 3 more Download our reports from Bloomberg: BOCM enter Morning Express 09 April 2015 shopping malls in FY15E. As such, we expect the revenue contribution from rental income to increase in FY15-16E. We fine-tune our earnings forecasts to reflect the slightly slower-than-expected store expansion. Based on our new estimates, we expect Intime’s core net profit growth to be 5%/9% in FY15/16E. Due to the higher sector valuation benchmark, we revise up our TP to HK$7.7, based on 17x FY15E P/E (a 20% premium to the retail sector average given its strategic cooperation with Alibaba, ongoing O2O story and above-peers’ earnings growth). Maintain Buy. Geely Auto (175.HK) Neutral High sales target achievement rate in 1Q15 Wei YAO Last Closing: HK$4.2 BUY SELL [email protected] Upside: +19% LT BUY Stock Target Price: HK$5.0↑ (1) Geely sold 48,500 vehicles in Mar, up 46.4% MoM and 39.5% YoY. Jan-Mar sales jumped 56.8% YoY to 140,500 units. 1Q15 sales completed 31.2% of the full-year sales target. The high sales target achievement rate in Jan-Mar period showed the strong sales performance and the low market expectations. (2) Domestic sales remained the major sales area. (3) New products sales were robust. (4) The overall product mix showed the optimization features. (5) The new product launch schedule is clear. (6) Maintain Buy. Overall, the strong Mar and 1Q15 sales were mainly due to the robust new product sales and a low base, and we believe the strong growth could be sustained. Apart from the sales of traditional vehicles and new products, new energy vehicle development, auto finance business progress and the cooperation with Volvo are the key long-term highlights. Given the strong sales performance, we slightly revise our FY15/16E sales assumptions and raise our earnings estimates. Our revised FY15/16E EPS are RMB0.29/0.37, up 1.7%/1.5%. Owing to the EPS revisions and the higher valuation potentially enjoyed by the company as the subject under the SH-HK Stock Connect and the leader of self-developed brands, we lift our TP to HK$5.0, equivalent to FY15/16E 12x PE. Maintain Buy. Container Shipping Sector Weekly container shipping commentary Geoffrey CHENG, CFA [email protected] UP MP OP News of ordering 20,000-TEU ultra large container vessels dominated the headlines of industry reports. The Shanghai Container Freight Index continued to weaken last week while the container shipping companies postponed their proposed freight rate hikes. The A-H arbitrage buying triggered a big rally on 8th April. We maintain our Market Perform recommendation at the moment. Download our reports from Bloomberg: BOCM enter Morning Express 09 April 2015 Renewable Energy Sector Highlights: Global wind power installed capacity will maintain stable growth; Australia terminated the anti-dumping investigations against Chinese PV products; The decline in polisilicon raw material prices narrowed this week Louis SUN [email protected] UP MP OP 1) According to the Global Wind Energy Council (GWEC) statistics, global wind power installed capacity market resumed growth momentum in 2014 after experiencing the sluggish environment for some time. The newly-installed wind power capacity jumped 44.2% YoY to 51.5GW in 2014. In particular, the newly-installed wind power capacity in China reached 23.2GW, accounting for 45.1% of the total global nd rd newly-installed capacity. Germany and the US were the 2 and 3 biggest markets, with the newly-installed capacity of 5.3GW and 4.9GW, respectively. The Council expected the global newly-installed capacity to reach 53.5GW in 2015 and maintain stable growth in the next few years. China will continue to lead the market growth, while India, Latin America and other markets may grow rapidly. 2) After the 11-month investigation, the Australian Anti-Dumping Committee released the preliminary ruling at its official website on 8 Apr, which proposed to terminate the anti-dumping investigation against the imported PV panels from China. Australia accounts for 5% of China’s PV product export markets at present. The tax levy will affect exports of nearly US$400m. The Ministry of Commerce hoped the final decision of the Australian authorities could benefit the development of PV industry th of the two countries. Australia is the 4 region imposing anti-dumping and countervailing allegations on Chinese PV products after the EU, the US and Canada. Once the Australia levies anti-dumping duties, it will pose a demonstrative effect on China’s PV industry and increase the difficulties of exporting PV products from China. 3) PV product prices have been falling since Dec 2014. The prices of polysilicon raw materials/polysilicon wafers/solar cells/battery modules were -0.83%/-0.36%/-1%/-0.51% this week. The product prices were -18.6%/-6.6%/-8.9%/-6.0% compared with the peak level in early Dec 2014. The fall in polysilicon prices narrowed this week after reporting over 2% decline over the past 4 weeks. We expect PV product prices to start to recover in May. Download our reports from Bloomberg: BOCM enter 09 April 2015 Last Closing: HK$7.12 Upside: +8% Target Price: HK$7.70↑ Consumer Discretionary Sector Intime (1833.HK) UP 1Q positive SSS in line; Maintain Buy MP OP Financial Highlights Revenue (RMBm) Revenue growth (%) Net profit (RMBm) Net profit growth (%) Net profit vs consensus (+/-%) Core net profit (RMBm) Core net profit growth % Core EPS (RMB) P/E (x) DPS (RMB) Yield (%) FY12 FY13 FY14 FY15E FY16E 3,907 25 973 18 na 819 12 0.41 14.1 0.19 3.3 4,510 15 1,594 64 na 939 15 0.47 12.1 0.21 3.7 5,251 16 1,121 -30 na 756 -20 0.36 15.6 0.22 3.9 5,829 11 1,223 9 25 791 5 0.35 16.1 0.22 3.9 6,412 10 1,292 6 26 862 9 0.38 14.5 0.23 4.1 Neutral LT BUY BUY SELL Stock Note: Intime restated the FY13 figures. Source: Company data and BOCOM Int’l estimates Intime posted 1% SSS growth in 1Q, in line with our and the market’s expectations. SSS turned positive in 1Q, following the SSS decline in the past three quarters (-4%/-4%/-7% in 4Q/3Q/2Q14), which we attribute to the stronger promotional effort during the CNY in Feb, the gradual sales improvement in the renovated stores and SSS growth in younger stores. Further, it is worth noting that the company’s rental income more than doubled (+114% YoY) in 1Q, which was mainly due to the increased sales contribution from the shopping malls (more leased area). Stock data 52w High (HK$) 8.50 52w Low (HK$) 4.20 Market cap (HK$m) 15,469 Issued shares (m) 2,172 Avg daily vol (m) 23.1 1-mth change (%) 48.0 YTD change (%) 26.7 50d MA (HK$) 4.8 200d MA (HK$) 6.2 14-day RSI 85.2 Source: Company data, Bloomberg Looking ahead, Intime plans to operate more commercial properties in order to facilitate its expansion plan of the shopping mall business. Following the 7 new 1 Year Performance chart shopping malls in FY14, the company plans to open 3 more shopping malls in FY15E. HSI As such, we expect the revenue contribution from rental income to increase in 10% FY15-16E. We fine-tune our earnings forecasts to reflect the slightly -1 0% 1833.HK 0% -2 0% slower-than-expected store expansion. Based on our new estimates, we expect Intime’s core net profit growth to be 5%/9% in FY15/16E. Due to the higher sector valuation benchmark, we revise up our TP to HK$7.7, based on 17x FY15E P/E (a -3 0% -4 0% -5 0% Apr-14 Aug-14 Nov-1 4 Source: Company data, Bloomberg 20% premium to the retail sector average given its strategic cooperation with Alibaba, ongoing O2O story and above-peers’ earnings growth). Maintain Buy. Anita Chu [email protected] Tel: (852) 2977 9205 Phoebe Wong [email protected] Tel: (852) 2977 9391 Download our reports from Bloomberg: BOCM〈enter〉 Mar-15 09 April 2015 Container Shipping Weekly Container Shipping Sector Container Shipping Sector UP Weekly container shipping commentary MP OP Container shipping companies - Valuation summary Company Name BBG code Sh. Price 8 Apr 15 Rating Target Price +/- –––––– PER –––––– 2013 2014 2015E –––––– PBR –––––– 2013 2014 2015E (LC) (LC) (%) (X) (X) (X) (X) (X) (X) China COSCO 1919 HK 4.88 NEUTRAL 3.10 (36.5) 168.5 165.6 18.5 1.64 1.64 1.42 CSCL NOL 2866 HK NOL SP 3.02 NEUTRAL 1.01 NEUTRAL 2.1 0.94 (30.5) (6.9) N.A. N.A. 25.6 N.A. 16.6 36.2 1.16 0.92 1.11 1.21 1.02 1.07 OOIL 316 HK BUY 53.3 8.4 83.8 14.6 9.8 0.88 0.85 0.82 SITC 1308 HK 4.48 LT BUY Source: Company, BOCOM Int’l estimates 4.78 6.7 13.2 12.3 8.5 1.87 1.76 1.58 49.15 News flow – Rush for ultra-large container vessels. Notwithstanding the weak News of ordering 20,000-TEU ultra large container vessels dominated the headlines of industry reports. The Shanghai Container Freight Index continued to weaken last week while the container shipping companies postponed their proposed freight rate hikes. The A-H arbitrage buying triggered a big rally on 8th April. We maintain our Market Perform recommendation at the moment. confidence amongst the industry incumbents as revealed in the recent survey done by Moore Stephens, news of container shipping companies including CGM CMA and OOIL ordering 20,000-TEU ultra-large container vessels for delivery in 2017 had dominated the headline of the industry newspapers. In addition to these companies, MOL ordered 20,000-TEU vessels in March and Imabari Shipping of Japan Geoffrey Cheng, CFA had already revealed at the start of the year that an unidentified carrier has ordered [email protected] Tel: (852) 2977 9380 20,000-TEU vessels for delivery in 2018. Mitigating the impact from lower freight rates is the oft-quoted reason for ordering these vessels, which could reduce unit cost further. Reality – no sign of relief for the decline of SCFI. As a result of weak demand, the container shipping companies postponed the proposed freight rate hike on the East-West tradelane. As a result, the spot Shanghai Container Freight Index (SCFI) continued to spiral down, losing another 5.1% WoW. Freight rate on the Transpacific tradelane was down 3.9% WoW for USWC destinations while freight rate for the Asia-Europe tradelane tumbled 12.8% WoW. Meanwhile, in anticipation of demand recovery ahead, the Transpacific Stabilization Agreement advocated the st implementation of minimum market rate from 1 May (US$2050/FEU via California ports and US$4100/FEU for US East ports). Industry analysts expressed reservation as to whether the rate hike can be implemented in full, given the current market conditions. We maintain our MARKET PERFORM recommendation. The A-H market arbitrage buying spree after the long Easter holidays triggered a major rally on Wednesday, notwithstanding a lack of obvious improvement of market fundamentals. updating the earnings models of our coverage. We are For the time being, we maintain our Market Perform recommendation. Download our reports from Bloomberg: BOCM〈enter〉 Morning Express 09 April 2015 Market Review Hong Kong stocks skyrocketed on Monday. The Hang Seng Index soared 971 points, or 3.8%, to close at 26,236. Total turnover also hit a record high of HK$252.4 billion. HKEx (388.HK) surged 12.2% as the top blue-chip performer, as the daily quota for southbound trading under Shanghai-Hong Kong Stock Connect was used up for the first time. Brokerage names also rallied. Haitong (6837.HK) soared 19%. CITIC Securities (6030.HK) jumped 14%. Mainland financials advanced. China Life (2628.HK) leapt 6.9%. Ping An (2318.HK) rose 4.4%. Cinda (1359.HK) gained 12%. US and European stocks finished with moderate gains on Wednesday. The S&P 500 rose 5.57 points, or 0.3%, to 2,081.90. The DJIA added 27.09 points, or 0.2%, to 17,902.51. The Stoxx Europe 600 rose 0.1% to 404.66. News Reaction Southbound Trading turnover hits new high, HKEx (388.HK) says. HKEx said several indicators of Shanghai-HK Stock Connect set historical highs this morning. The turnover of the program reached HK$15.044bn (approximately RMB12bn). The quota used for Southbound Trading amounted to RMB7.814bn, accounting for 74% of the daily quota (RMB10.5bn). The half-day total turnover of Northbound and Southbound Trading reached RMB20bn. The turnover of Southbound Trading exceeded that of Northbound Trading for the first time since the launch of Shanghai-HK Stock Connect. The turnover of Southbound Trading this morning accounted for about 5.6% of the total turnover of the HK stock market. The half-day total turnover of the HK stock market hit HK$133bn on the first trading day after the Easter Holidays. China’s 2014 daily investment in urban railway construction exceeds RMB780m; up 33% YoY. According to the information obtained at the 2015 China’s International Railway Transportation Exhibition, China invested a total of RMB285.7bn in about 3,300km railway transportation projects in 36 cities, equivalent to a daily investment of over RMB780m, up 33% YoY. NDRC sets 2015 target price for cotton in Xinjiang at RMB19,100/tonne. The National Development and Reform Commission (NDRC) announced the trial of cotton target price reform remained effective in Xinjiang this year and the 2015 target price for cotton in Xinjiang was set at RMB19,100 per tonne, after taking into account the costs and benefits of cotton production and market demand and supply. GOME Online targets to become industry’s top 3 operators in 2015; platform sales exceed RMB30bn. GOME Online announced the launch of 4.18 anniversary big sales, offering cash gifts with a total value of RMB4bn. Meanwhile, GOME Online targeted to establish a sales platform with transaction volume of RMB30bn, becoming the top 3 operators in the industry. China Life (2628.HK) and Ping An (2318.HK) said to invest in Boston property project. China Life and Ping An will invest in the US commercial real estate by purchasing a majority interest in a US$500m project in Boston, according to the informed sources. The project is located at Boston’s famous harbour area and occupies a large part of the Pier #4 area. Download our reports from Bloomberg: BOCM enter Morning Express 09 April 2015 Economic releases for this week - USA Date Time Event 7-Apr Consumer Credit(US$ bn) 8-Apr MBA mortgage applications Source: Bloomberg Economic releases for this week - China Survey 13.50 - Prior 11.56 4.6% Date Time Event - - Survey - Prior - Source: Bloomberg BOCOM Research Latest Reports Data 1 Apr 2015 1 Apr 2015 1 Apr 2015 1 Apr 2015 1 Apr 2015 1 Apr 2015 31 Mar 2015 31 Mar 2015 Report COSL (2883.HK) – Q4 oil price hurt earnings but valuation attractive Parkson (3368.HK) – 1Q15E profit warning; no turnaround in sight; reiterate Sell Digital China (861.HK) – System business back to positive growth in the fourth quarter ENN Energy (2688.HK) –Normalized net profit up 21%; healthy growth for 2015; BUY HK retail Sector – Jan-Feb retail sales trended lower as slowdown of Chinese tourist arrivals continued The United Labs (3933.HK) - Revitalized earnings growth; Upgrade to BUY China Property Sector - Nationwide policies to support sector re-rating Property Sector – HK/China property weekly 20150327 31 Mar 2015 31 Mar 2015 30 Mar 2015 30 Mar 2015 30 Mar 2015 30 Mar 2015 30 Mar 2015 30 Mar 2015 30 Mar 2015 30 Mar 2015 27 Mar 2015 27 Mar 2015 China Southern Airlines (1055 HK) - FY2014 results review - Strong pickup in 2H14 Prada (1913.HK) – Challenges remain; reiterate Sell China Resource Gas (1193.HK) – New projects, volume and price all aligned for a take-off; BUY Shineway (2877.HK) - FY14 revenue missed; upcoming M&As to serve as re-rating catalysts Lijun Int'l (2005.HK) - FY14 results missed on slower tendering; Upbeat 2015E guidance Shanghai Pharma (2607.HK) - Favorable FY14 results largely in line; Reiterate "BUY" CNOOC (883.HK) - Cost reduction delivered upside surprise but can't save 2015 Mengniu (2319 HK) –Take profit at HK$40.00 first Air China (753.HK) – FY14 result review – Strong quarter above market expectation China Market Strategy - One-Belt-One-Road and A New World Order NetDragon (777.HK) – Positive on game and online education businesses; lift TP to HK$16.3 PetroChina (857.HK) - Cost saving in E&P but uncertainty still ahead - Maintain Neutral Source: Company data, BOCOM International Download our reports from Bloomberg: BOCM enter Analyst Fei Wu, Tony Liu Anita Chu Miles XIE Fei Wu, Tony Liu Phoebe Wong Milo Liu Philip Tse, CFA, FRM, Alfred Lau, CFA, FRM Luella Guo, Alfred Lau, CFA, FRM, Philip Tse, CFA, FRM Geoffrey Cheng, CFA Phoebe Wong Fei Wu, Tong Liu Milo Liu Milo Liu Milo Liu Fei Wu, Tong Liu Summer Wang Geoffrey Cheng, CFA Hao Hong, CFA Ma Yuan (Martina), Ph.D, Gu Xinyu (Connie), CPA Fei Wu, Tong Liu Morning Express 09 April 2015 Hang Seng Index Constituents Company name CKH HOLDINGS CLP HOLDINGS HONG KG CHINA GS WHARF HLDG HSBC HLDGS PLC POWER ASSETS HANG SENG BANK HENDERSON LAND D HUTCHISON SHK PPT NEW WORLD DEV SWIRE PACIFIC-A BANK EAST ASIA GALAXY ENTERTAIN MTR CORP SINO LAND HANG LUNG PPT KUNLUN ENERGY CHINA MER HOLD WANT WANT CHINA CITIC CHINA RES ENTERP CATHAY PAC AIR TINGYI SINOPEC CORP-H HKEX LI & FUNG LTD CHINA OVERSEAS TENCENT CHINA UNICOM LINK REIT CHINA RES POWER PETROCHINA-H CNOOC CCB-H CHINA MOBILE LENOVO GROUP HENGAN INTL CHINA SHENHUA-H CHINA RES LAND COSCO PAC LTD AIA ICBC-H BELLE INTL SANDS CHINA LTD PING AN-H BOC HONG KONG HO CHINA LIFE-H BANKCOMM-H BANK OF CHINA-H Hang Seng Index BBG code 1 HK 2 HK 3 HK 4 HK 5 HK 6 HK 11 HK 12 HK 13 HK 16 HK 17 HK 19 HK 23 HK 27 HK 66 HK 83 HK 101 HK 135 HK 144 HK 151 HK 267 HK 291 HK 293 HK 322 HK 386 HK 388 HK 494 HK 688 HK 700 HK 762 HK 823 HK 836 HK 857 HK 883 HK 939 HK 941 HK 992 HK 1044 HK 1088 HK 1109 HK 1199 HK 1299 HK 1398 HK 1880 HK 1928 HK 2318 HK 2388 HK 2628 HK 3328 HK 3988 HK Share price (HK$) 157.30 14.42 154.50 109.60 98.85 20.85 68.25 56.00 123.00 38.30 12.86 33.40 15.20 18.84 23.75 10.02 66.75 9.30 31.40 38.65 220.00 7.74 27.65 13.56 9.32 11.80 11.68 11.20 51.75 6.05 10.02 34.60 97.25 28.35 37.35 7.05 4.84 18.26 56.25 76.90 141.30 107.10 106.80 22.75 9.28 18.84 17.30 6.41 20.65 6.89 Mkt cap (HK$m) 364,333 359,106 1,448,162 2,244,056 121,033 501,986 1,315,649 168,019 353,250 223,407 77,984 85,686 36,805 74,114 155,107 84,511 168,641 82,709 82,054 164,337 257,028 64,709 226,010 324,722 2,726,813 526,840 129,749 32,933 623,337 2,222,396 84,511 279,161 919,673 299,738 1,338,097 574,334 1,597,303 191,951 170,495 164,125 270,143 456,607 156,560 102,041 122,114 74,114 96,951 968,016 99,073 1,732,688 5d chg (%) 0.0 9.9 8.9 9.7 9.4 10.8 1.3 3.9 2.2 5.5 2.9 15.2 1.1 6.2 8.4 14.4 -0.4 4.4 2.3 7.8 23.0 4.3 10.8 17.7 11.8 12.4 5.4 11.6 5.9 10.0 14.4 7.1 6.6 0.5 15.6 10.5 12.0 2.5 4.9 -1.2 0.5 -0.2 2.4 6.3 14.9 6.2 2.5 6.3 6.4 9.2 Ytd chg (%) 20.7 9.1 37.3 21.1 22.0 -9.2 -7.8 3.1 4.0 20.4 2.7 28.0 -6.4 11.5 16.1 14.9 -0.7 4.3 0.5 -11.5 28.1 6.6 20.0 30.4 8.4 13.0 14.5 1.6 19.9 6.9 14.9 -9.3 22.9 9.2 22.7 -2.6 10.8 2.8 0.4 2.2 9.4 20.0 5.7 4.6 -9.2 11.5 -2.4 2.6 3.3 8.2 26,237 16,281,840 7.1 11.1 Source: Bloomberg Download our reports from Bloomberg: BOCM enter –––– 52-week –––– Hi Lo (HK$) (HK$) 162.00 123.20 16.88 12.60 155.00 93.00 109.80 68.60 99.80 74.05 24.40 18.62 84.40 64.35 57.20 40.46 129.40 93.65 38.55 28.30 14.16 10.82 33.45 22.75 24.55 14.04 18.88 13.56 23.90 13.62 10.04 7.26 69.85 60.05 10.48 7.77 34.45 29.00 71.79 32.80 220.00 130.20 10.70 7.06 27.70 17.66 14.22 9.98 11.70 7.93 15.88 9.72 12.70 8.17 11.92 9.97 51.85 36.70 6.05 4.56 10.04 7.26 65.20 29.50 97.95 55.60 28.55 22.05 37.40 19.72 7.36 4.75 4.85 3.36 18.90 15.47 63.90 49.50 82.80 65.10 148.40 123.20 109.50 85.90 108.00 88.50 26.45 20.90 13.10 7.69 18.88 13.56 23.25 16.02 8.23 5.90 24.90 18.02 6.90 5.25 26,247.6 21,680.3 –––––––––– PE ––––––––––– 2014A 2015E 2016E (X) (X) (X) 6.8 11.0 10.6 6.9 6.5 5.9 59.7 37.2 28.7 16.3 15.7 15.1 31.0 26.3 22.7 8.6 9.9 9.1 12.8 10.5 10.0 10.0 17.6 17.2 11.1 16.1 14.6 14.2 21.6 21.3 10.1 15.1 14.5 20.9 17.8 16.1 N/A 73.4 33.1 23.5 11.2 9.9 9.4 10.8 9.3 N/A 14.9 14.4 15.0 15.7 14.8 7.0 11.3 10.4 11.0 12.3 11.4 16.0 18.4 16.6 49.5 37.7 33.1 15.1 15.1 13.1 8.2 8.4 7.2 21.5 18.4 15.9 12.8 22.6 14.1 7.0 17.5 10.5 17.9 18.6 15.2 14.4 12.1 11.3 23.0 21.5 19.3 6.1 6.0 5.7 N/A 14.9 14.4 14.1 17.2 15.9 15.7 14.6 13.3 12.2 11.1 10.1 26.3 20.0 17.2 6.4 6.5 6.4 6.3 6.3 5.9 26.8 24.8 23.2 4.7 14.1 12.8 2.7 18.4 18.7 17.9 14.1 13.9 6.8 13.7 11.9 14.5 14.9 13.5 8.7 15.8 16.4 25.5 21.8 20.0 23.5 11.2 9.9 31.2 24.8 21.7 12.9 17.7 11.9 10.6 8.1 7.9 6.1 5.7 5.4 11.0 12.5 11.4 Yield P/B (%) 2.3 1.5 0.2 2.6 2.0 4.4 5.6 2.0 2.7 2.1 3.9 2.3 1.8 1.9 2.1 N/A 3.9 4.5 3.5 0.0 1.8 4.4 2.0 1.8 3.4 4.8 2.1 2.8 1.0 N/A N/A 5.8 1.0 4.0 1.3 N/A 4.9 1.9 3.2 3.5 4.0 2.3 3.7 3.3 2.0 1.9 1.6 8.6 3.8 5.5 (X) 0.9 0.9 14.5 2.1 6.9 1.1 0.9 0.7 0.8 1.4 0.7 1.3 0.8 1.4 1.4 2.6 1.9 0.5 1.1 4.3 12.1 3.2 1.7 1.1 1.2 1.1 4.0 0.9 2.6 1.1 2.6 5.6 2.4 1.7 3.0 0.9 1.0 3.6 0.6 1.3 1.9 1.1 0.7 0.8 7.7 1.4 4.1 1.0 1.4 1.1 3.2 1.4 Morning Express 09 April 2015 China Ent Index Constituents Company name TSINGTAO BREW-H JIANGXI COPPER-H SINOPEC CORP-H CHINA RAIL GR-H DONGFENG MOTOR-H CHINA TELECOM-H AIR CHINA LTD-H PETROCHINA-H HUANENG POWER-H ANHUI CONCH-H CHINA LONGYUAN-H CCB-H CITIC BANK-H SHANDONG WEIG-H CHINA SHENHUA-H SINOPHARM-H BYD CO LTD-H ABC-H NEW CHINA LIFE-H PICC GROUP-H CHINA CINDA-H ICBC-H CHINA COM CONS-H CHINA COAL ENE-H MINSHENG BANK-H CHINA VANKE-H GUANGZHOU AUTO-H PING AN-H PICC P&C-H GREAT WALL MOT-H WEICHAI POWER-H GREAT WALL MOT-H CHINA PACIFIC-H CHINA LIFE-H CHINA OILFIELD-H CHINA NATL BDG-H BANKCOMM-H CM BANK-H BANK OF CHINA-H CITIC SEC-H HAITONG SECURI-H Hang Seng China Ent Indx BBG code Share price (HK$) Mkt cap (HK$m) 5d chg (%) Ytd chg (%) (X) (X) 168 HK 358 HK 386 HK 390 HK 489 HK 728 HK 753 HK 857 HK 902 HK 914 HK 916 HK 939 HK 998 HK 1066 HK 1088 HK 1099 HK 1211 HK 1288 HK 1336 HK 1339 HK 1359 HK 1398 HK 1800 HK 1898 HK 1988 HK 2202 HK 2238 HK 2318 HK 2328 HK 2333 HK 2338 HK 2333 HK 2601 HK 2628 HK 2883 HK 3323 HK 3328 HK 3968 HK 3988 HK 6030 HK 6837 HK 54.75 17.08 6.41 9.66 13.50 5.66 9.33 9.32 9.62 30.90 9.32 6.89 6.38 7.01 20.85 34.60 47.50 3.99 50.50 4.32 4.57 6.05 14.54 5.00 9.97 18.82 8.34 97.25 16.68 58.05 31.85 58.05 40.50 37.35 16.38 8.48 7.05 19.72 4.84 34.15 23.75 74,312 81,114 968,016 322,673 116,318 458,077 153,487 2,726,813 149,456 159,510 74,899 1,732,688 407,386 31,379 501,986 95,741 156,317 1,522,044 201,012 183,272 165,693 2,222,396 351,235 103,526 414,179 192,579 74,091 919,673 247,340 198,661 77,632 198,661 392,342 1,338,097 116,528 45,784 574,334 494,044 1,597,303 483,630 316,239 5.9 28.2 6.3 42.5 12.9 17.4 34.4 11.8 9.6 8.2 14.8 9.2 13.1 7.8 10.8 16.9 29.1 6.1 25.9 10.2 23.8 10.0 45.8 24.4 9.0 5.7 18.1 6.6 6.0 12.1 15.6 12.1 13.9 15.6 34.5 12.9 10.5 7.1 12.0 26.0 32.2 4.1 28.4 2.6 51.4 23.0 24.7 48.8 8.4 -8.2 6.4 15.5 8.2 2.6 12.0 -9.2 26.0 56.5 1.8 29.0 19.0 20.9 6.9 55.8 2.9 -2.3 8.8 18.1 22.9 10.6 31.6 -2.6 31.6 2.8 22.7 21.7 12.5 -2.6 1.3 10.8 17.0 21.7 64.0 17.2 8.2 9.7 15.2 5.7 9.4 11.7 11.6 35.1 9.3 6.9 6.4 8.9 24.4 34.7 57.8 4.1 51.5 4.3 4.6 6.1 14.7 5.4 10.7 20.4 9.9 98.0 17.1 60.0 34.9 60.0 42.0 37.4 23.4 8.5 7.4 20.0 4.9 34.2 23.8 47.5 11.9 5.9 3.4 10.0 3.4 4.2 7.9 7.5 24.0 7.1 5.3 4.4 5.7 18.6 19.7 18.7 3.2 22.1 2.9 3.3 4.6 5.0 3.8 6.2 12.8 6.6 55.6 9.7 26.1 26.0 26.1 23.6 19.7 11.1 6.7 4.8 13.1 3.4 15.1 10.5 29.8 16.1 12.9 15.9 7.2 20.6 24.0 12.8 10.1 11.9 23.4 6.1 5.9 23.2 8.6 25.0 211.3 5.8 19.7 11.2 11.1 6.1 13.4 60.6 6.1 10.5 13.4 15.7 12.8 17.6 10.2 17.6 26.5 26.3 8.3 6.1 6.4 7.1 6.3 26.5 23.6 26.9 18.1 17.7 14.0 7.2 18.2 13.0 22.6 8.5 11.4 17.0 5.7 5.7 20.6 9.9 21.7 155.2 5.4 15.6 11.3 8.6 6.0 12.3 129.1 5.7 8.6 10.6 14.6 12.4 12.5 11.7 12.5 20.6 20.0 13.0 6.6 6.5 6.4 6.3 24.6 19.7 13,397 5,413,984 12.6 11.8 13,398.8 9,620.4 9.5 9.3 8.4 Source: Bloomberg Download our reports from Bloomberg: BOCM enter –––– 52-week –––– Hi Lo (HK$) (HK$) ––––––––––– PE ––––––––––– 2014A 2015E 2016E Yield P/B (X) (%) (X) 24.2 16.4 11.9 12.7 6.6 15.9 11.4 14.1 8.7 10.5 14.7 5.4 5.2 18.2 9.1 17.8 47.7 5.2 13.3 9.8 7.1 5.7 11.0 51.3 5.2 7.4 8.8 13.3 11.0 10.3 10.4 10.3 17.7 17.2 11.6 6.4 6.4 5.8 5.9 20.5 16.7 N/A N/A 8.6 1.0 1.9 1.7 0.7 3.4 4.9 2.6 0.8 5.5 N/A 1.2 4.4 1.1 0.0 N/A 0.5 0.3 2.7 N/A 1.5 0.6 2.3 3.3 2.4 1.0 2.0 N/A 1.0 N/A 1.5 1.3 3.7 2.4 N/A 4.2 4.9 N/A 1.3 3.8 1.0 1.0 1.7 1.3 1.3 1.8 1.2 1.6 2.0 1.8 1.1 0.9 2.6 1.1 2.8 3.7 1.0 2.6 1.6 1.4 1.1 1.7 0.6 1.1 1.9 1.2 2.4 2.3 4.2 1.6 4.2 2.5 3.0 1.3 0.9 0.9 1.3 1.0 3.0 2.7 3.3 1.4 Morning Express 09 April 2015 BOCOM International 11/F, Man Yee Building, 68 Des Voeux Road, Central, Hong Kong Main: + 852 3710 3328 Fax: + 852 3798 0133 Rating System Company Rating www.bocomgroup.com Sector Rating Buy: Expect more than 20% upside in 12 months LT Buy: Expect more than 20% upside but longer than 12 months Neutral: Expect low volatility Sell: Expect more than 20% downside in 12 months Outperform (“OP”): Expect more than 10% upside in 12 months Market perform (“MP”): Expect low volatility Underperform (“UP”): Expect more than 10% downside in 12 months Research Team Head of Research @bocomgroup.com Raymond CHENG, CFA, CPA, CA (852) 2977 9393 @bocomgroup.com raymond.cheng Strategy Economics Hao HONG, CFA Miaoxian LI (852) 2977 9384 hao.hong (852) 2977 9212 yangqingli Fei WU (852) 2977 9392 fei.wu Shanshan LI, CFA (86) 10 8800 9788 - 8058 lishanshan Tony LIU (852) 2977 9390 xutong.liu Li WAN, CFA (86) 10 8800 9788 - 8051 Wanli Alfred LAU, CFA, FRM (852) 2977 9235 alfred.lau Philip TSE, CFA, FRM (852) 2977 9220 philip.tse Luella GUO (852) 2977 9211 luella.guo (86) 21 6065 3606 louis.sun (852) 2977 9209 lizhiwu (852) 2977 9216 miles.xie Geoffrey CHENG, CFA (852) 2977 9380 geoffrey.cheng Fay ZHOU (852) 2977 9381 fay.zhou (86) 21 6065 3675 wei.yao Banks/Network Financials Qingli YANG miaoxian.li Oil & Gas/ Gas Utilities Consumer Discretionary Property Phoebe WONG (852) 2977 9391 phoebe.wong Anita CHU (852) 2977 9205 anita.chu Consumer Staples Renewable Energy Summer WANG (852) 2977 9221 summer.wang Shawn WU (852) 2977 9386 shawn.wu (852) 2977 9387 milo.liu Healthcare Louis SUN Telecom & Small/ Mid-Caps Milo LIU Insurance & Brokerage Zhiwu LI Technology Jerry LI (852) 2977 9389 liwenbing Jennifer ZHANG (852) 2977 9250 yufan.zhang Yuan MA, PhD (86) 10 8800 9788 - 8039 yuan.ma Connie GU, CPA (86) 10 8800 9788 - 8045 conniegu (852) 2977 9243 jovi.li Internet Miles XIE Transportation & Industrial Metals & Mining Jovi LI (86) 10 8800 9788 - 8043 Automobile Download our reports from Bloomberg: BOCM enter Wei YAO Morning Express 09 April 2015 Analyst Certification The authors of this report, hereby declare that: (i) all of the views expressed in this report accurately reflect their personal views about any and all of the subject securities or issuers; and (ii) no part of any of their compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report; (iii) no insider information/ non-public price-sensitive information in relation to the subject securities or issuers which may influence the recommendations were being received by the authors. The authors of this report further confirm that (i) neither they nor their respective associates (as defined in the Code of Conduct issued by the Hong Kong Securities and Futures Commission) have dealt in or traded in the stock(s) covered in this research report within 30 calendar days prior to the date of issue of the report; (ii)) neither they nor their respective associates serve as an officer of any of the Hong Kong listed companies covered in this report; and (iii) neither they nor their respective associates have any financial interests in the stock(s) covered in this report. Disclosure of relevant business relationships BOCOM International Securities Limited, and/or its associated companies, has investment banking relationship with Bank of Communications, Hanhua Financial Holding Co., Ltd., Central China Securities Company Limited, China New City Commercial Development Limited, China Shengmu Organic Milk Limited, Broad Greenstate International Company Limited, China National Culture Group Limited, Sichuan Development Holding Co. Ltd., Austar Lifesciences Limited, BAIC Motor Corporation Limited, China Huinong Capital Group Limited, D&G Technology Holding Company Limited, Guolian Securities Co. Ltd., GF Securities Co. Ltd., PuraPharm Corporation Limited, Chiho-Tiande Group Limited within the preceding 12 months. BOCOM International Holdings Company Limited currently holds more than 1% of the equity securities of Shanghai Fosun Pharmaceuticals Group Co. Ltd. BOCOM International Securities Limited currently holds more than 1% of the equity securities of Sanmenxia Tianyuan Aluminum Company Limited. Disclaimer By accepting this report (which includes any attachment hereto), the recipient hereof represents and warrants that he is entitled to receive such report in accordance with the restrictions set forth below and agrees to be bound by the limitations contained herein. Any failure to comply with these limitations may constitute a violation of law. This report is strictly confidential and is for private circulation only to clients of BOCOM International Securities Ltd. This report is being supplied to you strictly on the basis that it will remain confidential. No part of this report may be (i) copied, photocopied, duplicated, stored or reproduced in any form by any means or (ii) redistributed or passed on, directly or indirectly, to any other person in whole or in part, for any purpose without the prior written consent of BOCOM International Securities Ltd. BOCOM International Securities Ltd, its affiliates and related companies, their directors, associates, connected parties and/or employees may own or have positions in securities of the company(ies) covered in this report or any securities related thereto and may from time to time add to or dispose of, or may be interested in, any such securities. Further, BOCOM International Securities Ltd, its affiliates and its related companies may do and seek to do business with the company(ies) covered in this report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking, advisory, underwriting, financing or other services for or relating to such company(ies) as well as solicit such investment, advisory, financing or other services from any entity mentioned in this report. In reviewing this report, an investor should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest. The information contained in this report is prepared from data and sources believed to be correct and reliable at the time of issue of this report. This report does not purport to contain all the information that a prospective investor may require and may be subject to late delivery, interruption and interception. BOCOM International Securities Ltd does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information and opinion contained in this report and accordingly, neither BOCOM International Securities Ltd nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof. This report is general in nature and has been prepared for information purposes only. It is intended for circulation amongst BOCOM International Securities Ltd’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. The information and opinions in this report are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, related investments or other financial instruments thereof. The views, recommendations, advice and opinions in this report may not necessarily reflect those of BOCOM International Securities Ltd or any of its affiliates, and are subject to change without notice. BOCOM International Securities Ltd has no obligation to update its opinion or the information in this report. Investors are advised to make their own independent evaluation of the information contained in this research report, consider their own individual investment objectives, financial situation and particular needs and consult their own professional and financial advisers as to the legal, business, financial, tax and other aspects before participating in any transaction in respect of the securities of company(ies) covered in this report. The securities of such company(ies) may not be eligible for sale in all jurisdictions or to all categories of investors. This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to any law, regulation, rule or other registration or licensing requirement. BOCOM International Securities Ltd is a wholly owned subsidiary of Bank of Communications Co Ltd. Download our reports from Bloomberg: BOCM enter

© Copyright 2026