Daily Market Commentary

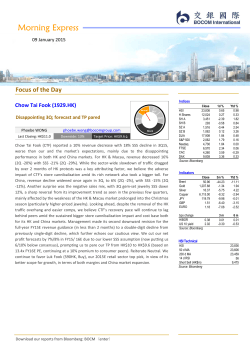

Morning Express 23 December 2014 Focus of the Day Indices Container Shipping Sector Weekly container shipping commentary Geoffrey CHENG, CFA [email protected] UP MP OP The Transpacific Stabilization Agreement (TSA) announced that member container lines should implement a combined rate hike of US$1,000/FEU from 15th January 2015. The SCFI declined 1.3% WoW for the week ended 19th December 2014. Freight rate on the Asia-Europe tradelane fell 9.1% WoW despite the high load factor and cancellation of voyages by carriers during the week. We maintain our MARKET PERFORM recommendation due to our cautious view on the sector. Close HSI 23,409 H Shares 11,744 SH A 3,277 SH B 285 SZ A 1,476 SZ B 1,002 DJIA 17,959 S&P 500 2,079 Nasdaq 4,781 FTSE 6,577 CAC 4,254 DAX 9,866 Source: Bloomberg 1d % 1.26 3.02 0.62 -2.58 -3.65 -0.98 0.87 0.38 0.34 0.48 0.30 0.81 Ytd % 0.44 8.58 47.98 12.18 33.69 15.38 8.34 12.45 14.48 -2.55 -0.97 3.28 Close 60.11 1,174.55 15.64 6,400.00 120.17 1.56 1.22 3m % -38.01 -3.99 -12.16 -6.36 -9.39 -4.95 -4.87 Ytd % -45.75 -2.58 -19.69 -13.04 -12.37 -5.93 -11.07 bps change HIBOR 0.39 US 10 yield 2.16 Source: Bloomberg 3m 0.02 -0.41 6m 0.02 -0.45 Indicators Brent Gold Silver Copper JPY GBP EURO HSI Technical HSI 50 d MA 200 d MA 14 d RSI Short Sell (HK$m) Source: Bloomberg 23,409 23,512 23,382 50 10,013 BOCOM Int'l Corporate Access 29 Dec China Everbright Bank (6818.HK) Download our reports from Bloomberg: BOCM〈enter〉 23 December 2014 Container Shipping Weekly Container Shipping Sector Container Shipping Sector UP Weekly container shipping commentary MP OP Container shipping companies - Valuation summary Company Name BBG code Sh. Price 22 Dec 14 Rating Target Price +/- –––––– PER –––––– 2013 2014E 2015E –––––– PBR –––––– 2013 2014E 2015E (LC) (LC) (%) (X) (X) (X) (X) (X) (X) China COSCO 1919 HK 3.88 NEUTRAL 3.10 (20.1) 133.8 N.A. 14.7 1.30 1.24 1.13 CSCL NOL 2866 HK NOL SP 2.38 NEUTRAL 0.79 SELL 2.1 0.73 (11.8) (7.6) N.A. N.A. 260.8 N.A. 13.0 28.3 0.91 0.72 0.85 0.87 0.80 0.84 OOIL 316 HK 44.8 BUY 50.5 12.7 76.4 10.9 11.2 0.80 0.76 0.72 SITC 1308 HK 4.37 NEUTRAL Source: Company, BOCOM Int’l estimates 4.03 (7.8) 12.9 11.3 8.8 1.95 1.76 1.56 News flow – TSA said GRI of US$400/FEU should be implemented in January. th Transpacific Stabilization Agreement (TSA) announced on 18 The December that The Transpacific Stabilization Agreement (TSA) announced that member container lines should implement a combined rate hike of US$1,000/FEU from 15th January 2015. The SCFI declined 1.3% WoW for the week ended 19th December 2014. Freight rate on the Asia-Europe tradelane fell 9.1% WoW despite the high load factor and cancellation of voyages by carriers during the week. We maintain our MARKET PERFORM recommendation due to our cautious view on the sector. th member container lines should implement a GRI of US$600/FEU from 15 January 2015 on Transpacific eastbound voyages. Simultaneously, container lines will also implement a Peak Season Surcharge (PSS) of US$400/FEU, effectively adding up to US$1,000/FEU for the coming round of recommended rate hike. Compared with the Asia-Europe tradelane, rate hike on the Transpacific tradelane should have a better chance to stick, in our view. To alleviate the pressure from declining freight th rates, carriers have also proposed rate hike for implementation on 15 January 2015 for Asia-Europe tradelane westbound voyages, roughly in the range of US$750 – 1,000/TEU. th Reality – SCFI teetered down 1.3% WoW for the week ended 19 December. The spot Shanghai Container Freight Index (SCFI) decreased 1.3% WoW to 1,120.33, due largely to the 9.1% WoW decline in freight rate to US$1,230/TEU on the Asia-Europe tradelane after the implementation of GRI the week before. This was despite the cancellation of voyages by carriers during the week, as well as a reported increase in load factor to over 90%. In contrast, freight rate on the Transpacific tradelane was essentially flat last week for cargoes heading West Coast destinations, but up 4.9% WoW for East Coast destinations as cargo owners put more containers through East Coast destinations to avoid congestion. Freight rates on all other routes were weak last week. We maintain our MARKET PERFORM recommendation. Share prices of the HK-listed container shipping companies trended down again last week and underperformed the rising benchmark indices. We maintain our cautious view and our MARKET PERFORM recommendation on the sector. Download our reports from Bloomberg: BOCM〈enter〉 Geoffrey Cheng, CFA [email protected] Tel: (852) 2977 9380 Morning Express 23 December 2014 Market Review Hong Kong stocks rallied on Monday. The Hang Seng Index gained 291 points, or 1.3%, to finish at 23,408 points. IPPs rose following media reports that the electricity reform plan has been submitted to the State Council. Huaneng Power (902.HK) gained 4.1%. Huadian Power (1071.HK) rose 4.6%. Datang Power (991.HK) added 3.9%. Oil companies rallied following the rebound of crude futures last Friday. PetroChina (857.HK) rose 4.1% and CNOOC (883.HK) jumped 4.9%. Mainland lenders posted sharp gains with CMB (3968.HK) jumping 7.7% and MSB (1988.HK) climbing 5.8%. Among stocks that fell, Haitong Securities (6837.HK) dropped 1.9% after announcing share placement. Peer CITIC Securities (6030.HK) dropped 3.1%. Hang Seng Index (1 year) 26,000 25,000 24,000 23,000 22,000 21,000 Source: Company data, Bloomberg HS China Enterprise Index (1 year) 13,000 12,000 11,000 US stocks finished with modest gains on Monday, with the main indexes rising for the fourth consecutive day. The S&P 500 added 7.9 points, or 0.4%, to 2,078.55, led by technology and telecom names. The DJIA increased 154.64 points, or 0.9%, to 17,959.44. European stocks rose. The Stoxx Europe 600 added 0.5% to finish at 341.97. 10,000 9,000 8,000 Source: Company data, Bloomberg News Reaction China to expand market pricing power of financial institutions on ample liquidity, PBOC says. Pan Gongsheng, deputy governor of the People’s Bank of China (PBOC), said China will accelerate the reform of the interest rate market and expand the scope of market pricing of the financial institutions in the next step. The PBOC has introduced the issuance of certificates of deposits among the financial institutions and it will launch the issuance of large-amount certificates of deposits for businesses and individuals. 11M14 SOEs profit growth slows to 4.5%, MOF says. The Ministry of Finance (MOF) announced that the total revenue and gross profit growth of the national state-owned and state-controlled enterprises slowed on a YoY basis for the first 11 months of the year. Transportation, steel and automobile industries achieved bigger profit growth on a YoY basis. State Council said to introduce power grid decentralization in electricity reform plan. The electricity reform plan was submitted to the State Council and the plan is likely to be announced shortly. The key idea of the electricity reform plan lies on power grid decentralization. With reference to the Shenzhen reform model, electricity will be traded between the demand and supply sides and the electricity reform will be promoted gradually. PBOC is gradually withdrawing from normal forex market intervention, Yi says. Yi Gang, vice president of the People’s Bank of China and head of the State Administration of Foreign Exchange, said the bilateral volatility of RMB has increased since the beginning of this year and the PBOC is gradually withdrawing from the normal foreign exchange market intervention. The RMB exchange rate could maintain its stability at a reasonable and balanced level. China Mobile (941.HK)’s Nov 4G customer adds hit new high of 16.78m. China Mobile announced that the 4G customer adds equaled 16.78m in Nov, hitting a new monthly high. The 4G customers reached 71.23m, above the yearly target of 70m. Download our reports from Bloomberg: BOCM〈enter〉 Shanghai A-shares (1 year) 3,500 3,000 2,500 2,000 Source: Company data, Bloomberg Shenzhen A-shares (1 year) 1,800 1,700 1,600 1,500 1,400 1,300 1,200 1,100 1,000 900 800 Source: Company data, Bloomberg Morning Express 23 December 2014 Economic releases for this week - USA Economic releases for this week - China Date Time Event Survey Prior 15-Dec 16-Dec 17-Dec 17-Dec 18-Dec 18-Dec Source: Bloomberg Industrial Production(MoM) Housing Starts(k) CPI (MoM) CPI ex food & energy (MoM) Initial jobless claims (k) Leading indicators 0.7% 1,035.0 -0.1% 0.1% 89.5 0.5% -0.1% 1,009.0 0.0% 0.2% 88.8 0.9% Date Time 16-Dec Event HSBC Manufacturing PMI Survey 49.8 Prior 50.0 Source: Bloomberg BOCOM Research Latest Reports Data 22 Dec 2014 19 Dec 2014 19 Dec 2014 17 Dec 2014 17 Dec 2014 17 Dec 2014 17 Dec 2014 17 Dec 2014 17 Dec 2014 17 Dec 2014 17 Dec 2014 17 Dec 2014 17 Dec 2014 17 Dec 2014 17 Dec 2014 Report AAC Technologies (2018.HK) - Takeaways from plant visit in Changzhou Alibaba (BABA.US) - “Double 12”, Alipay expands to offline payment Transportation Sector - Weekly transportation news wrap 2015 Outlook - Introducing 2015 Top Picks; A Bright New Beginning HK Property Sector - Downgrade to Market Perform; both prices and rents have overshot Hysan (14.HK) - More opportunities than challenges in 2015 New World Development (17.HK) - High earnings visibility Hang Lung Properties (101.HK) - Record profit in 2014E Kerry Properties (683.HK) - Expanding its recurring income base Auto (Outperform): Finding bright spots amid modest sector outlook Transportation (Container Shipping: Market Perform); (Aviation: Outperform); (Logistics: Outperform): Still challenging for container shipping; airlines to benefit from lower jet fuel prices Telecom & Small/Mid Cap (Market Perform): Opportunities from the expansion of Shanghai-Hong Kong Stock Connect Technology (Market Perform): The rise of Chinese power Steel (Market Perform): On the road to re-rating as sector bottoms out Renewable Energy (Outperform): Improving operating environment to lift profitability China Property (Outperform): Resetting market risk appetite 17 Dec 2014 17 Dec 2014 17 Dec 2014 17 Dec 2014 17 Dec 2014 Internet (Outperform): Penetration into traditional industries has just begun Insurance (Outperform): Sector bottomed out with re-rating on the horizon Healthcare (Outperform): Sustainable growth to continue Energy (Market Perform): Energy world under new crude price and Stock Connect environment Consumer Discretionary (Market Perform): Upgrade to Market Perform, but upside catalysts remain absent 17 Dec 2014 Source: Company data, BOCOM International Download our reports from Bloomberg: BOCM〈enter〉 Analyst Miles XIE Ma Yuan (Martina), Ph.D , Gu Xinyu (Connie), CPA Geoffrey Cheng, CFA Raymond Cheng, CFA, CPA, CA Alfred Lau, CFA, FRM Alfred Lau, CFA, FRM Alfred Lau, CFA, FRM Alfred Lau, CFA, FRM Alfred Lau, CFA, FRM Yao Wei Geoffrey Cheng, CFA Zhiwu LI Miles XIE Jovi Li Louis Sun Alfred Lau, CFA, FRM, Toni Ho, CFA, FRM, Luella Guo Yuan Ma Ph.D, Connie Gu, CPA Li Wenbing Johnson Sun, Milo Liu Fei Wu, Tony Liu Phoebe Wong, Anita Chu Morning Express 23 December 2014 Hang Seng Index Constituents Company name Cheung Kong Hang Lung Proper Hengan Intl China Shenhua-H Hang Seng Bk China Res Land Cosco Pac Ltd Henderson Land D Aia Group Ltd Hutchison Whampo Kunlun Energy Co Ind & Comm Bk-H China Merchant Want Want China Sun Hung Kai Pro New World Dev Belle Internatio China Coal Ene-H Swire Pacific-A Sands China Ltd Clp Hldgs Ltd Bank East Asia Ping An Insura-H Boc Hong Kong Ho China Life Ins-H Citic Pacific China Res Enterp Cathay Pac Air Hong Kg China Gs Tingyi Hldg Co Esprit Hldgs Bank Of Commun-H China Petroleu-H Hong Kong Exchng Bank Of China-H Wharf Hldg Li & Fung Ltd Hsbc Hldgs Plc Power Assets Hol Mtr Corp China Overseas Tencent Holdings China Unicom Hon Sino Land Co China Res Power Petrochina Co-H Cnooc Ltd China Const Ba-H China Mobile Lenovo Group Ltd Hang Seng Index BBG code 1 HK 101 HK 1044 HK 1088 HK 11 HK 1109 HK 1199 HK 12 HK 1299 HK 13 HK 135 HK 1398 HK 144 HK 151 HK 16 HK 17 HK 1880 HK 1898 HK 19 HK 1928 HK 2 HK 23 HK 2318 HK 2388 HK 2628 HK 267 HK 291 HK 293 HK 3 HK 322 HK 330 HK 3328 HK 386 HK 388 HK 3988 HK 4 HK 494 HK 5 HK 6 HK 66 HK 688 HK 700 HK 762 HK 83 HK 836 HK 857 HK 883 HK 939 HK 941 HK 992 HK Share price (HK$) 129.70 21.55 79.65 23.45 128.30 19.36 10.94 52.40 41.90 90.35 7.34 5.55 26.05 9.97 115.80 8.80 8.62 4.98 99.95 37.55 66.50 30.40 77.00 25.55 28.30 13.26 16.10 16.84 17.40 17.28 8.75 7.03 6.30 172.00 4.33 55.30 7.14 74.10 74.05 31.70 21.45 113.00 10.46 12.18 20.40 8.72 10.62 6.33 91.95 10.06 Mkt cap (HK$m) 300,407 96,658 97,522 496,758 245,289 112,892 32,168 157,218 504,690 385,196 59,251 2,036,554 66,750 131,564 326,901 76,252 72,703 104,679 145,145 302,913 168,009 71,344 679,789 270,135 874,327 330,218 38,984 66,246 182,910 96,832 16,999 564,783 883,577 200,913 1,312,463 167,566 59,693 1,423,875 158,042 184,643 175,332 1,058,615 250,341 73,862 97,860 2,275,924 474,156 1,600,683 1,875,336 111,753 5d chg (%) 0.4 0.9 0.8 3.8 1.4 -0.4 3.8 2.0 -1.8 2.6 2.7 5.5 0.6 0.0 2.9 -0.6 6.2 1.4 -0.1 -8.0 2.5 1.7 6.2 -0.6 6.2 -0.7 2.9 -2.4 -0.3 1.6 -4.4 7.0 4.5 -0.8 5.9 0.2 -9.7 0.0 -0.8 1.1 -4.7 1.0 2.5 -1.3 1.7 5.7 4.7 5.1 3.4 -4.7 Ytd chg (%) 11.8 -12.0 -13.0 -4.1 2.1 0.7 2.8 30.3 7.7 -8.3 -46.3 5.9 -8.0 -11.0 17.7 -4.5 -0.4 14.2 10.0 -39.9 8.5 -7.5 10.9 2.8 16.7 11.8 -37.5 2.7 7.6 -22.9 -41.4 28.5 -0.5 33.0 21.3 -6.7 -13.0 -11.9 20.1 8.0 -1.6 14.2 -9.8 14.9 11.0 2.6 -26.4 8.2 14.4 6.7 23,408.6 14,449,504 1.7 0.4 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) 152.00 105.95 26.45 19.80 93.00 74.05 24.80 19.12 133.00 117.60 20.60 13.62 11.92 9.40 56.40 36.46 45.65 34.65 108.50 86.00 14.18 6.88 5.69 4.33 28.75 22.75 13.10 9.32 120.20 90.35 10.48 7.15 10.00 7.00 5.44 3.72 108.00 80.55 68.00 36.90 68.35 56.00 34.45 28.50 77.35 55.60 27.95 21.50 28.80 19.72 16.88 9.35 26.40 15.12 18.00 13.56 18.90 13.91 23.25 16.02 16.60 8.60 7.13 4.53 8.23 5.73 189.00 112.80 4.35 3.03 63.45 46.35 10.70 7.06 86.40 71.95 76.50 57.85 32.30 26.55 24.60 17.52 134.90 92.56 14.22 9.03 14.16 9.83 24.90 17.10 11.70 7.31 15.88 9.72 6.42 4.89 102.20 63.65 12.70 7.62 25,363.0 21,137.6 –––––––––– PE ––––––––––– 2013A 2014E 2015E (X) (X) (X) 7.0 8.4 8.8 12.7 13.9 15.4 27.0 25.7 21.4 8.7 9.4 9.3 14.7 14.4 13.2 7.4 10.0 8.6 14.0 12.4 11.1 8.8 16.8 16.5 26.5 20.4 18.0 8.2 11.3 10.9 9.3 9.4 8.7 5.6 5.6 5.4 15.1 15.5 14.0 24.3 24.3 20.7 9.3 14.9 13.9 6.6 10.3 9.8 N/A 12.9 12.3 38.4 61.4 35.0 11.4 14.3 13.4 14.8 14.8 14.2 18.6 15.9 15.6 10.2 10.9 10.6 15.5 13.4 12.4 11.7 11.0 10.0 23.9 19.1 16.3 9.4 9.4 8.0 21.2 68.5 42.3 22.5 19.2 11.9 26.3 24.8 23.0 29.9 27.2 22.1 80.1 49.7 26.4 6.5 6.4 6.1 8.6 9.3 10.2 42.8 39.3 29.4 5.8 5.8 5.4 7.0 14.1 12.4 9.2 14.6 12.6 12.0 10.8 10.2 2.5 10.6 18.2 12.4 17.8 16.4 7.0 7.6 6.6 38.2 35.4 26.8 15.9 15.4 13.4 8.2 13.9 13.4 8.4 8.1 7.5 9.7 10.4 11.2 6.8 7.3 8.8 5.6 5.5 5.2 12.8 13.6 13.5 15.0 16.2 14.1 9.9 11.0 10.4 Yield P/B (%) 2.7 3.5 2.3 4.8 4.3 2.3 2.8 1.9 1.1 2.6 3.1 N/A 3.0 2.7 2.9 4.7 N/A 2.0 3.6 4.6 3.9 3.7 1.1 4.0 1.3 2.0 1.6 1.5 1.9 1.6 0.8 N/A 4.8 2.1 5.6 3.2 6.6 5.1 3.5 2.9 2.3 0.2 1.9 4.1 3.7 4.6 5.4 5.9 3.4 2.4 (X) 0.8 0.8 5.9 1.3 2.2 1.3 0.9 0.6 2.3 0.9 1.2 1.1 1.0 9.0 0.8 0.5 2.3 0.6 0.7 7.4 1.8 1.1 2.4 1.6 2.7 0.5 0.8 1.1 3.6 4.1 1.0 0.9 1.0 9.7 1.0 0.6 1.6 0.9 1.3 1.2 1.5 11.3 0.9 0.7 1.5 1.1 1.0 1.1 1.8 4.4 3.6 1.3 Morning Express 23 December 2014 China Ent Index Constituents Company name Shandong Weig-H China Shenhua-H Sinopharm-H China Shipping-H Zoomlion Heavy-H Yanzhou Coal-H Agricultural-H New China Life-H Ind & Comm Bk-H Tsingtao Brew-H China Com Cons-H China Coal Ene-H China Minsheng-H Guangzhou Auto-H Ping An Insura-H Picc Property & Great Wall Mot-H Weichai Power-H Aluminum Corp-H China Pacific-H China Life Ins-H China Oilfield-H Zijin Mining-H China Natl Bdg-H Bank Of Commun-H Jiangxi Copper-H China Petroleu-H China Rail Gr-H China Merch Bk-H Bank Of China-H Dongfeng Motor-H Citic Securiti-H Haitong Securi-H China Telecom-H Air China Ltd-H Petrochina Co-H Huaneng Power-H Anhui Conch-H China Longyuan-H China Const Ba-H China Citic Bk-H Hang Seng China Ent Indx BBG code 1066 HK 1088 HK 1099 HK 1138 HK 1157 HK 1171 HK 1288 HK 1336 HK 1398 HK 168 HK 1800 HK 1898 HK 1988 HK 2238 HK 2318 HK 2328 HK 2333 HK 2338 HK 2600 HK 2601 HK 2628 HK 2883 HK 2899 HK 3323 HK 3328 HK 358 HK 386 HK 390 HK 3968 HK 3988 HK 489 HK 6030 HK 6837 HK 728 HK 753 HK 857 HK 902 HK 914 HK 916 HK 939 HK 998 HK Share price (HK$) Mkt cap (HK$m) 5d chg (%) Ytd chg (%) 6.24 23.45 27.25 5.18 5.85 6.55 3.80 35.75 5.55 52.50 9.52 4.98 9.71 7.13 77.00 15.76 40.85 33.65 3.63 35.50 28.30 13.56 2.19 7.30 7.03 13.64 6.30 6.42 18.74 4.33 10.86 27.90 18.24 4.57 6.21 8.72 10.76 26.55 7.83 6.33 6.03 27,932.56 496,757.84 75,403.34 31,482.93 61,037.28 63,287.14 1,422,264.99 146,456.55 2,036,554.42 69,087.32 234,642.72 104,679.11 422,590.70 61,004.55 679,789.23 233,697.33 141,353.01 67,364.17 90,540.92 310,355.27 874,326.66 101,238.57 83,743.35 39,412.89 564,783.40 67,759.61 883,576.65 215,011.57 481,431.60 1,312,462.74 93,571.07 410,030.50 249,233.20 369,860.94 113,141.24 2,275,923.97 163,564.90 132,964.10 62,924.93 1,600,682.86 384,563.50 -0.3 3.8 0.0 -0.6 8.5 3.0 3.5 5.0 5.5 -4.1 11.3 1.4 11.0 2.4 6.2 4.9 2.1 7.3 8.0 6.9 6.2 9.7 3.8 -1.1 7.0 0.4 4.5 6.3 11.5 5.9 -3.0 -3.1 -3.7 4.1 -1.6 5.7 9.5 -2.0 -3.2 5.1 6.2 -40.3 -4.1 22.5 -14.0 -19.2 -7.5 -0.3 37.5 5.9 -19.9 52.3 14.2 35.3 -15.9 10.9 42.4 -4.6 7.7 34.4 16.8 16.7 -43.6 31.9 -12.5 28.5 -2.6 -0.5 60.5 13.4 21.3 -10.5 31.9 35.1 16.6 7.3 2.6 53.5 -7.7 -21.6 8.2 43.2 11.2 24.8 34.5 6.3 7.4 7.3 3.9 38.2 5.7 66.8 10.0 5.4 9.9 9.9 77.4 16.2 44.3 34.9 3.9 37.3 28.8 24.5 2.3 8.4 7.1 15.2 8.2 6.6 18.9 4.4 15.2 34.0 23.2 5.2 6.7 11.7 11.6 35.7 10.3 6.4 6.2 5.8 19.1 19.7 4.0 3.5 4.9 3.0 21.1 4.3 52.0 4.9 3.7 5.9 6.7 55.6 9.4 26.1 25.8 2.5 23.6 19.7 11.7 1.6 6.7 4.5 11.6 5.7 3.0 12.1 3.0 9.6 13.7 9.5 3.1 4.2 7.3 6.1 24.0 7.1 4.9 3.6 73.2 8.7 21.9 N/A 19.5 7.0 5.5 14.9 5.6 28.6 9.6 38.4 5.9 11.7 15.5 16.8 12.3 10.3 N/A 24.1 23.9 6.3 17.9 5.1 6.5 10.6 8.6 11.0 6.5 5.8 5.6 31.0 33.2 15.9 23.3 9.7 10.5 9.3 25.9 5.6 5.5 22.4 9.4 19.8 51.3 21.9 16.6 5.3 12.7 5.6 27.6 9.1 61.4 5.6 10.7 13.4 14.1 12.3 11.5 N/A 21.8 19.1 6.6 15.8 5.5 6.4 13.6 9.3 10.4 6.5 5.8 5.9 29.0 22.0 16.0 18.2 10.4 9.8 9.7 20.1 5.5 5.5 11,744 4,816,810 4.7 8.6 11,950.0 9,159.8 8.2 8.2 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) ––––––––––– PE ––––––––––– 2013A 2014E 2015E (X) (X) (X) Yield P/B (%) (X) 18.6 9.3 16.6 14.6 17.1 17.4 5.0 11.5 5.4 24.3 8.4 35.0 5.3 8.3 12.4 13.0 9.5 11.6 N/A 18.2 16.3 7.0 16.0 5.1 6.1 13.8 10.2 9.4 5.9 5.4 5.5 24.1 17.6 14.5 11.6 11.2 9.4 9.0 14.3 5.2 5.1 1.2 4.8 1.2 0.0 3.2 0.4 N/A 0.5 N/A N/A 2.5 2.0 2.0 3.1 1.1 1.7 2.5 0.9 N/A 1.4 1.3 4.0 N/A 2.7 N/A 4.6 4.8 1.3 4.1 5.6 2.1 N/A 0.8 2.6 0.9 4.6 4.4 1.6 0.8 5.9 N/A 2.4 1.3 2.6 0.7 0.9 0.6 1.0 2.1 1.1 3.6 1.3 0.6 1.2 1.1 2.4 2.8 3.4 1.7 1.0 2.4 2.7 1.2 1.4 0.9 0.9 0.9 1.0 1.2 1.3 1.0 1.1 2.7 2.2 1.0 1.2 1.1 1.9 1.9 1.6 1.1 0.9 7.7 3.9 1.2 Morning Express 23 December 2014 BOCOM International 11/F, Man Yee Building, 68 Des Voeux Road, Central, Hong Kong Main: + 852 3710 3328 Fax: + 852 3798 0133 Rating System Company Rating www.bocomgroup.com Sector Rating Buy: Expect more than 20% upside in 12 months LT Buy: Expect more than 20% upside but longer than 12 months Neutral: Expect low volatility Sell: Expect more than 20% downside in 12 months Outperform (“OP”): Expect more than 10% upside in 12 months Market perform (“MP”): Expect low volatility Underperform (“UP”): Expect more than 10% downside in 12 months Research Team Head of Research @bocomgroup.com (852) 2977 9393 raymond.cheng (852) 2977 9384 hao.hong (852) 2977 9212 yangqingli Shanshan LI, CFA (86) 10 8800 9788 - 8058 lishanshan Li WAN, CFA (86) 10 8800 9788 - 8051 Wanli Raymond CHENG, CFA, CPA, CA Strategy Economics Hao HONG, CFA Banks/Network Financials Qingli YANG miaoxian.li Fei WU (852) 2977 9392 fei.wu Tony LIU (852) 2977 9390 xutong.liu Property Phoebe WONG (852) 2977 9391 phoebe.wong Anita CHU (852) 2977 9205 anita.chu Summer WANG (852) 2977 9221 summer.wang Shawn WU (852) 2977 9386 shawn.wu (852) 2977 9387 milo.liu (852) 2977 9389 liwenbing Consumer Staples Alfred LAU, CFA, FRM (852) 2977 9235 alfred.lau Luella GUO (852) 2977 9211 luella.guo (86) 21 6065 3606 louis.sun (852) 2977 9209 lizhiwu (852) 2977 9216 miles.xie Geoffrey CHENG, CFA (852) 2977 9380 geoffrey.cheng Fay ZHOU (852) 2977 9381 fay.zhou (86) 21 6065 3675 wei.yao Renewable Energy Healthcare Louis SUN Telecom & Small/ Mid-Caps Milo LIU Insurance & Brokerage Zhiwu LI Technology Internet Miles XIE Transportation & Industrial Yuan MA, PhD (86) 10 8800 9788 - 8039 yuan.ma Connie GU, CPA (86) 10 8800 9788 - 8045 conniegu (852) 2977 9243 jovi.li Metals & Mining Jovi LI (86) 10 8800 9788 - 8043 Miaoxian LI Oil & Gas/ Gas Utilities Consumer Discretionary Jerry LI @bocomgroup.com Automobile Download our reports from Bloomberg: BOCM〈enter〉 Wei YAO Morning Express 23 December 2014 Analyst Certification The authors of this report, hereby declare that: (i) all of the views expressed in this report accurately reflect their personal views about any and all of the subject securities or issuers; and (ii) no part of any of their compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report; (iii) no insider information/ non-public price-sensitive information in relation to the subject securities or issuers which may influence the recommendations were being received by the authors. The authors of this report further confirm that (i) neither they nor their respective associates (as defined in the Code of Conduct issued by the Hong Kong Securities and Futures Commission) have dealt in or traded in the stock(s) covered in this research report within 30 calendar days prior to the date of issue of the report; (ii)) neither they nor their respective associates serve as an officer of any of the Hong Kong listed companies covered in this report; and (iii) neither they nor their respective associates have any financial interests in the stock(s) covered in this report. Disclosure of relevant business relationships BOCOM International Securities Limited, and/or its associated companies, has investment banking relationship with Nanjing Sinolife United Company Limited, Magnum Entertainment Group Holdings Limited, Bank of Communications, Harbin Bank Co., Ltd., Azure Orbit International Finance Limited, Hanhua Financial Holding Co., Ltd., Central China Securities Company Limited, China New City Commercial Development Limited, China Shengmu Organic Milk Limited, Broad Greenstate International Company Limited, China National Culture Group Limited, Sichuan Development Holding Co. Ltd. and Austar Lifesciences Limited within the preceding 12 months. BOCOM International Holdings Company Limited currently holds more than 1% of the equity securities of Shanghai Fosun Pharmaceuticals Group Co. Ltd. BOCOM International Securities Limited currently holds more than 1% of the equity securities of Sanmenxia Tianyuan Aluminum Company Limited. Disclaimer By accepting this report (which includes any attachment hereto), the recipient hereof represents and warrants that he is entitled to receive such report in accordance with the restrictions set forth below and agrees to be bound by the limitations contained herein. Any failure to comply with these limitations may constitute a violation of law. This report is strictly confidential and is for private circulation only to clients of BOCOM International Securities Ltd. This report is being supplied to you strictly on the basis that it will remain confidential. No part of this report may be (i) copied, photocopied, duplicated, stored or reproduced in any form by any means or (ii) redistributed or passed on, directly or indirectly, to any other person in whole or in part, for any purpose without the prior written consent of BOCOM International Securities Ltd. BOCOM International Securities Ltd, its affiliates and related companies, their directors, associates, connected parties and/or employees may own or have positions in securities of the company(ies) covered in this report or any securities related thereto and may from time to time add to or dispose of, or may be interested in, any such securities. Further, BOCOM International Securities Ltd, its affiliates and its related companies may do and seek to do business with the company(ies) covered in this report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking, advisory, underwriting, financing or other services for or relating to such company(ies) as well as solicit such investment, advisory, financing or other services from any entity mentioned in this report. In reviewing this report, an investor should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest. The information contained in this report is prepared from data and sources believed to be correct and reliable at the time of issue of this report. This report does not purport to contain all the information that a prospective investor may require and may be subject to late delivery, interruption and interception. BOCOM International Securities Ltd does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information and opinion contained in this report and accordingly, neither BOCOM International Securities Ltd nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof. This report is general in nature and has been prepared for information purposes only. It is intended for circulation amongst BOCOM International Securities Ltd’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. The information and opinions in this report are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, related investments or other financial instruments thereof. The views, recommendations, advice and opinions in this report may not necessarily reflect those of BOCOM International Securities Ltd or any of its affiliates, and are subject to change without notice. BOCOM International Securities Ltd has no obligation to update its opinion or the information in this report. Investors are advised to make their own independent evaluation of the information contained in this research report, consider their own individual investment objectives, financial situation and particular needs and consult their own professional and financial advisers as to the legal, business, financial, tax and other aspects before participating in any transaction in respect of the securities of company(ies) covered in this report. The securities of such company(ies) may not be eligible for sale in all jurisdictions or to all categories of investors. This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to any law, regulation, rule or other registration or licensing requirement. BOCOM International Securities Ltd is a wholly owned subsidiary of Bank of Communications Co Ltd. Download our reports from Bloomberg: BOCM〈enter〉

© Copyright 2026