Daily Market Commentary

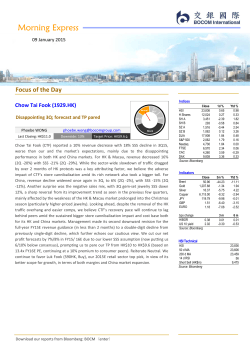

Morning Express 20 January 2015 Focus of the Day Indices Energy Sector Lower oil erodes benefit of higher Special Upstream Levy threshold; New crude oil price forecast spells caution and leads to downgrade Fei WU [email protected] MP UP OP Although the lowering of the Special Upstream Levy threshold to US$65/bbl at the start of 2015 spelled good news to the upstream players, CNOOC and PetroChina (net profit forecasts up 18% and 14%, respectively), the recent sharp oil price drop has eroded the benefits. We adjust our 2015/16 Brent forecasts down to US$55/60/bbl reflective of the new supply and demand dynamics, and at this level, upstream struggles to be profitable. The recent cost breakeven level stands at US$50-60/bbl for oil companies. We also adjust down company earnings and downgrade CNOOC to SELL. We maintain LT-BUY on Sinopec as it is the least affected given its downstream-heavy operation and its reform from the marketing segment listing in 2015. Jiangnan Group (1366.HK) Neutral Commentary of State Grid’s planned investment of RMB420.2 bn in 2015 Zhiwu LI Last Closing: HK$1.43 [email protected] Upside: +88.8% LT BUY BUY SELL 1d % -1.51 -4.98 -7.72 -3.91 -3.39 -3.53 1.10 1.34 1.39 0.54 0.35 0.73 Ytd % 0.57 -4.25 -3.66 -3.07 0.93 0.64 -1.75 -1.92 -2.15 0.30 2.86 4.45 Close 48.84 1,276.27 17.70 5,715.00 117.70 1.51 1.16 3m % -43.31 2.35 1.50 -12.77 -9.13 -6.66 -9.41 Ytd % -14.81 7.71 12.70 -9.29 1.77 -3.13 -4.15 bps change HIBOR 0.38 US 10 yield 1.84 Source: Bloomberg 3m 0.01 -0.35 6m 0.01 -0.64 Indicators Brent Gold Silver Copper JPY GBP EURO Stock Target Price: HK$2.70→ Event: As reported by the media, State Grid had convened an annual work conference recently, which it indicated plans to invest RMB420.2 bn in 2015, mainly for the purpose of ultra-high voltage (UHV) and power grid connection. This year, in particular, it plans to approve the commencement of construction of ‘‘six cross-sectioned and eight straight grids’’ which involves a total of 14 lines, which will surpass the plan of ‘‘six cross-sectioned and four straight grids’’ in 2014. Comments: 1) The amount of investment in 2015 surged by 24% YoY. The planned investment of RMB420.2 bn for 2015 was a record high, representing a significant growth of 24% as compared with approximately RMB338.5 bn in 2014. Download our reports from Bloomberg: BOCM〈enter〉 Close HSI 23,738 H Shares 11,476 SH A 3,265 SH B 282 SZ A 1,492 SZ B 1,035 DJIA 17,512 S&P 500 2,019 Nasdaq 4,634 FTSE 6,586 CAC 4,395 DAX 10,242 Source: Bloomberg HSI Technical HSI 50 d MA 200 d MA 14 d RSI Short Sell (HK$m) Source: Bloomberg BOCOM Int'l Corporate Access 22 Jan SAIC Motor (600104 CH) 23,738 23,646 23,544 50 15,632 Morning Express 20 January 2015 2) UHV construction has been launched rapidly in a massive scale. UHV and power grid connection is the main theme of investment in 2015. In terms of planning, the company approves to commence construction of ‘‘two cross-sectioned and one straight grids’’ in Q11, ‘‘three straight grids’’ in Q2 and ‘‘four cross-sectioned and four straight grids’’ in 2H. Besides, it plans to complete the feasibility study of ‘‘one cross-sectioned and four straight grids’’ by the end of the year, and will commence the preliminary construction of four international UHV DC grids. The rapid launch of massive UHV construction meets our expectation. 3) We maintain Buy for Jiangnan Group (1366.HK). As the most profitable company in China’s cable industry, Jiangnan Group (1366.HK) will benefit substantially from the growth in the scale of investment of power grids. At present, given its unparalleled strength in terms of the supply of UHV cables, as well as the fact that it will fully benefit from the opportunities arising from the exponential growth of the UHV market once upon completion of the acquisition of a UHV cable company, we maintain Buy and a TP of HK$2.7. Hang Seng Index (1 year) 26,000 25,000 24,000 23,000 22,000 21,000 Source: Company data, Bloomberg HS China Enterprise Index (1 year) 13,000 12,000 11,000 10,000 9,000 8,000 Source: Company data, Bloomberg Container Shipping Sector Weekly container shipping commentary Geoffrey CHENG, CFA [email protected] Shanghai A-shares (1 year) 4,000 UP MP OP 3,500 3,000 There are exporters calling for speeding up the vessels by the shipping operators as the justification for slow streaming on high bunker price vanished. SCFI rose 4.8% WoW as the freight rate on the major East-West tradelanes moved up on the back of demand pick-up. To benefit from t the robust pre-Lunar New Year demand, shipping operators are proposing new GRI for February implementation. We maintain our MARKET PERFORM recommendation. The correction of A share market and the oil price rebound caused the underperformance of the HK-listed container shipping companies. 2,500 2,000 Source: Company data, Bloomberg Shenzhen A-shares (1 year) 1,800 1,700 1,600 1,500 1,400 1,300 1,200 1,100 1,000 900 800 Source: Company data, Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 20 January 2015 Energy Sector Energy Sector MP UP OP Lower oil erodes benefit of higher Special Upstream Levy threshold; New crude oil price forecast spells caution and leads to downgrade Valuation summary Company Stock name ticker PetroChina 857 HK Sinopec 386 HK CNOOC 883 HK COSL 2883 HK Shanghai 338 HK Petrochem Rating Neutral LT-BUY SELL BUY BUY TP CP –––– EPS –––– EPS Consensus –––– P/E –––– –––– P/B –––– FY14E FY15E FY14E FY15E FY14E FY15E FY14E FY15E (HK$) (HK$) (RMB) (RMB) (RMB) (RMB) (x) (x) (x) (x) (%) 7.00 6.00 8.20 15.00 3.00 8.72 6.19 10.42 13.44 2.32 0.50 0.58 1.22 1.98 0.05 0.10 0.41 0.27 2.12 0.13 0.69 0.56 1.19 1.67 0.07 0.68 0.53 1.09 1.64 0.12 13.8 8.3 6.7 5.3 36.4 66.7 11.9 30.3 5.0 13.6 1.0 0.8 0.9 1.1 1.1 1.0 0.8 0.8 1.0 1.0 3.26 3.36 3.88 3.74 0.82 The Special Upstream Levy threshold was lowered, benefiting PetroChina and CNOOC the most. Sharp oil price drop erodes benefit from threshold change. Brent forecasts are adjusted to US$55/bbl in 2015 and US$60/bbl in 2016. Brokers are slow to downgrade forecast. A shares defied fundamentals and shot up since Stock Connect, but the two markets are not likely to converge in the short term. We remain cautious. Downgrade CNOOC to SELL. Maintain Neutral on PetroChina and LT-BUY on Sinopec. Yield FY14E Source: Company, BOCOM Int’l estimates China increases Special Upstream Levy (SUL) threshold starting Jan 2015. China’s Ministry of Finance lifted the threshold for upstream oil’s SUL from US$55/bbl to US$65/bbl starting Jan 1. This is the second change in three years, following the previous threshold adjustment from US$40/bbl to US$55/bbl in Nov 2011. Following the same incremental tax system, the tax brackets are set from 20% to 40%, where a 5% increase in the upstream tax bracket corresponds to every US$5/bbl increase in oil price. At the first threshold of US$65, a 20% upstream levy would be applied in 2015. (Before 2015, a 30% levy was applied and prior to Nov 2011, a 40% levy was applied). As a % of per barrel upstream revenue at US$65, the current scheme in 2015, the Nov 2011 and Mar 2006 schemes would fetch 1.4%, 5.4%, and 13.6% of the realized per barrel revenue, respectively. CNOOC and PetroChina are the biggest winners of the threshold change… The three companies in total are expected to bring in Rmb93.9bn in upstream levy in 2014. With the US$65/bbl threshold, however, the companies would see an 85% YoY reduction in the tax in 2015 to Rmb14.3bn. This equates to a lift of 18% and 14% in 2015 net profit for CNOOC and PetroChina, respectively. Sinopec, the more dominant downstream player, should see a 7% lift in bottom-line as a result. … However, the recent sharp oil price drop erodes benefit from levy threshold. We adjust our 2015 and 2016 Brent forecasts down to US$55/bbl and US$60/bbl. The recent oil price drop reflected the new reality of lower oil prices and a major recovery is not in sight given the current global demand slowdown coupled with the increasing supply growth from the US and sustained OPEC production. We adjust our forecasts down from US$80/bbl and US$85/bbl in 2015 and 2016 to US$55/bbl and US$60. Currently, among the 45 brokers, the mean oil forecasts for 2015 and 2016 are US$75 and US$85/bbl, respectively, but we believe the downgrading trend has only started as over 10 brokers still have forecasts sitting at above US$90/bbl while the seven adjustments in 2015 averaged US$60/bbl. At this level, though the Special Upstream Levy would not kick in, the upstream E&P would be mostly wiped away (cost per barrel is between US$50-60/bbl in recent years). This would lead to an 80% and 72% reduction in 2015 EPS for PetroChina and CNOOC, respectively, while shaving 32% from Sinopec’s 2015 earnings. Post-announcement reactions were wildly different for A and H shares. While rebalancing opportunity exists, we flag caution and downgrade CNOOC to SELL. Since the announcement on Dec 25, 2014, the A-share oils PetroChina and Sinopec saw shares rising 25% and 9.7%, respectively, against SSE Index’s 5.3%, while the companies’ H-share counterparts stayed flat with PetroChina, Sinopec and CNOOC’s shares moving 1.9%, 0.3%, and -0.9%, respectively. Instead of the gap between A and H shares narrowing since the start of the Stock Connect Program, the shares acted irregularly with PetroChina’s A-share premium rising to 34%. We lower our earnings and target prices for the three oils and base them on long-term oil price of US$70 and SoTP. Despite the exuberant reaction on the A-share market, H-shares have performed based on fundamentals in the past and the early days of the Stock Connect did not seem to have an indication that the market differences would converge in the short-term. We remain cautious and downgrade our recommendation for CNOOC to Sell. We maintain our LT-BUY on Sinopec as it is the least affected given its downstream-heavy operation and its reform from marketing segment listing in 2015. Download our reports from Bloomberg: BOCM〈enter〉 One year (Relative sector performance) 40% HSI Oil&Gas 30% Gas Utility(Covered companies) Oil service(Covered companies) 20% 10% 0% -10% Jan-2014 -20% Mar-2014 May-2014 Jul-2014 Sep-2014 -30% -40% -50% -60% -70% Source: Company data, Bloomberg Fei Wu [email protected] Tel: (852) 2977 9392 Tony Liu [email protected] Tel: (852) 2977 9390 Nov-2014 Jan-2015 20 January 2015 Container Shipping Weekly Container Shipping Sector Container Shipping Sector UP Weekly container shipping commentary MP OP Container shipping companies - Valuation summary Company Name BBG code Sh. Price 19 Jan15 Rating Target Price +/- –––––– PER –––––– 2013 2014E 2015E –––––– PBR –––––– 2013 2014E 2015E (LC) (LC) (%) (X) (X) (X) (X) (X) (X) China COSCO 1919 HK 3.92 NEUTRAL 3.10 (20.9) 135.2 N.A. 14.9 1.25 1.26 1.14 CSCL NOL 2866 HK NOL SP 2.38 NEUTRAL 0.97 SELL 2.1 0.73 (11.8) (24.7) N.A. N.A. 260.9 N.A. 13.0 34.8 0.91 0.89 0.86 1.06 0.80 1.03 OOIL 316 HK 47.7 BUY 50.5 5.9 81.4 11.6 11.9 0.86 0.80 0.77 SITC 1308 HK 4.19 LT BUY Source: Company, BOCOM Int’l estimates 4.78 14.1 12.4 10.9 8.0 1.87 1.69 1.48 News flow – New debate on slow steaming. The container shipping industry has revived the debate on the merits of slow-steaming in view of the recent slump of crude oil and bunker prices. There are exporters calling for speeding up the vessels by the shipping operators as the justification for slow steaming on high bunker prices vanished. SCFI rose 4.8% WoW as the freight rates on the major East-West tradelanes moved up on the back of demand pick-up. To benefit from the robust pre-Lunar New Year demand, shipping operators are proposing new GRI for February implementation. We maintain our MARKET PERFORM recommendation. The correction of the A share market and the oil price rebound had caused the underperformance of the HK-listed container shipping companies. Exporters are hoping for faster voyages as bunker prices come down and since slow steaming was originally introduced partly to solve the problem of heightened bunker prices. However, shipping operators want to stay put as slow steaming helps absorb excess capacity which could only be solved by Geoffrey Cheng, CFA massive lay-up. [email protected] Tel: (852) 2977 9380 Exporters also want to see more port coverage for the headhaul voyage, which is not possible under the practice of slow steaming. Other than the absorption of surplus capacity, the other reason that shipping operators could not speed up is because either old vessels have been modified for slow steaming or new vessels are just not equipped to navigate above 22-23 knots (currently average slow steaming speed at about 18 knots). Reality – SCFI rebounded last week. th For the week ended 16 January, the SCFI rose 4.8% WoW on the back of freight rate increase on the major East-West tradelanes, as a result of successful implementation of the January GRI (General Rate Increase). Freight rate on the Asia-Europe tradelane (Europe base ports) crawled back up above US$1,000/TEU to US$1,008/TEU, up 3.4%. On the Transpacific tradelane, freight rate reached back above US$2,000/FEU to US$2,089/FEU for West Coast destinations, up 8.2% YoY. Shipping operators are deliberating February GRI to be implemented before the Lunar New Year to capture the potential strong demand. We maintain our MARKET PERFORM recommendation. The double whammy of A share index selloff and oil price rebound on Monday depressed the share prices of the HK-listed container shipping companies, which underperformed for the week th ended 19 January. We maintain our MARKET PERFORM recommendation on the sector. Download our reports from Bloomberg: BOCM〈enter〉 Morning Express 20 January 2015 Market Review Hong Kong stocks slumped on Monday. The Hang Seng Index slumped 365.03 points, or 1.51%, to 23,738.49. Brokers and financials led declines as CSRC cracked down on margin trading. Ping An (2318.HK) dropped 8.04% and China Life (2628.HK) slumped 6.77%. CITIC Securities (6030.HK) and Haitong Securities (6837.HK) both plummeted 16.5%. Guotai Junan (1788.HK) fell 9.5%. Liquidity rotated into defensive names. Link REIT (823.HK) rose 2.15% as the best blue-chip gainer, followed by HK & China Gas (3.HK) which added 1.47%. US stocks were closed for a holiday. European stocks rose, lifted by prospects of QE from the ECB. The Stoxx Europe 600 rose 0.2% to 353.18. News Reaction Xiao Gan: to promote the business development of wealth management between Mainland and Hong Kong. As stated by Xiao Gang, Chairman of CSRC on Monday, China will further promote the reconciliation between funds of Mainland and Hong Kong, improve the regimes of QRII and RQFII as well as QDII, in a bid to support and facilitate the business development of wealth management business across the border in 2015 in 2015. SHCOMP dropped by 6.3% in early trading, with market sentiment dampened by across-the-board decline in financial stocks under unfavorable news. SHCOMP of China’s stock market slumped by 6.3% in early trading and the index opened low, affected by the unfavorable news in weekend. Brokerage and insurance stocks were almost down by their limit. According to analysts, the valuation of the financial sector had basically been recovered and the regulatory requirements helped facilitate the correction of the sector. In the meantime, the unfavorable news was a blow to the buoyant capital investment in the future. It was rumored that the parent company of Lenovo (992.HK) intends to go listing in 2H15, with an attempt to raise proceeds up to US$3 bn. According to insiders, the parent company of Lenovo Group, i.e. Legend Holdings, plan to conduct IPO in Hong Kong in 2H15, with an attempt to raise proceeds up to US$3 bn. CICC and UBS AG are coordinating with the company for the IPO plan. Wanda Group’s operating revenue up increased 30% and its income and profit from the service industry are expected to surpass that of the property industry in the future. Wanda Group, China’s large property and commercial group recorded an increase in revenue by 30% in 2014, representing the nine consecutive increase of more than 30% in revenue on a MOM basis. In the meantime, Wanda Group will promote business transformation and the company will focus on the service industry. In the future, the company’s income and profit from the service industry will surpass that of the property business in the future. Xiaomi agreed to acquire 3% equity interest of Kingsoft from Tencent. According to the document submitted by Kingsoft on Monday, China’s mobile manufacturer Xiaomi had agreed to acquire approximately 3% equity interest of Kingsoft from Tencent at a cost of HK$527 mn (equivalent to US$67.99 mn). Download our reports from Bloomberg: BOCM〈enter〉 Morning Express 20 January 2015 Economic releases for this week - USA Date Time 21-Jan 22-Jan 23-Jan 23-Jan Source: Bloomberg Event MBA mortgage applications Initial jobless claims (k) Existing Home sales (m) Leading indicators Economic releases for this week - China Survey 5.05 0.4% Prior 49.1% 316.0 4.93 0.6% Date Time 20-Jan 20-Jan 20-Jan 23-Jan Source: Bloomberg Event Retail sales (YoY) Industrial production(YoY) GDP YTD (YoY) HSBC Manufacturing PMI Survey 11.8% 7.4% 7.3% - BOCOM Research Latest Reports Data 19 Jan 2015 19 Jan 2015 19 Jan 2015 16 Jan 2015 16 Jan 2015 15 Jan 2015 14 Jan 2015 13 Jan 2015 13 Jan 2015 12 Jan 2015 12 Jan 2015 12 Jan 2015 12 Jan 2015 Report China South City Holdings Limited (1668.HK) - Slowdown in property sales, but new businesses still on track Property Sector - HK/China Property Weekly 20150116 China Market Strategy – Margin Destruction. But Is 4,200 possible? Insurance Sector - Don't miss the insurance bull market in 2015 Transportation Sector - Weekly transportation news wrap Luk Fook Holdings (590.HK) - Continued to lead the sector recovery in 3Q Energy Sector - Bocom Energy Weekly Container Shipping Sector – Weekly container shipping commentary Sa Sa (178.HK) - Weak 3Q; subdued near-term outlook remains Property Sector - HK/China Property Weekly 20140109 Cheung Kong (1.HK) - Major restructuring to unlock value China Resources Land (1109.HK) - Taking a breather Summer Breeze「夏天小语」 - Cyclical margin expansion is not Want Want's lifebelt Analyst Alfred Lau, CFA, FRM Luella Guo, Alfred Lau, CFA, FRM Hao Hong, CFA Li Wenbing Geoffrey Cheng, CFA, Fay Zhou Phoebe Wong Fei Wu, Tony Liu Geoffrey Cheng, CFA Phoebe Wong Luella Guo, Alfred Lau, CFA, FRM Alfred Lau, CFA, FRM Alfred Lau, CFA, FRM Summer Wang 08 Jan 2015 08 Jan 2015 07 Jan 2015 06 Jan 2015 02 Jan 2015 31 Dec 2014 30 Dec 2014 30 Dec 2014 Chow Tai Fook (1929.HK) - Disappointing 3Q; forecast and TP pared Transportation Sector - Weekly transportation news wrap Energy Sector – Bocom Energy Weekly Container Shipping Sector - Weekly container shipping commentary Transportation Sector - Weekly transportation news wrap SITC (1308.HK) – Company update – management positive on 2015 outlook Container Shipping Sector – Weekly container shipping commentary Insurance Sector – Sector re-rating has started; add to undervalued insurance stocks Phoebe Wong Geoffrey Cheng, CFA, Fay Zhou Fei Wu, Tony Liu Geoffrey Cheng, CFA Geoffrey Cheng, CFA, Fay Zhou Geoffrey Cheng, CFA Geoffrey Cheng, CFA Li Wenbing Source: Company data, BOCOM International Download our reports from Bloomberg: BOCM〈enter〉 Prior 11.7% 7.2% 7.4% 49.6 Morning Express 20 January 2015 Hang Seng Index Constituents Company name Cheung Kong Hang Lung Proper Hengan Intl China Shenhua-H Hang Seng Bk China Res Land Cosco Pac Ltd Henderson Land D Aia Group Ltd Hutchison Whampo Kunlun Energy Co Ind & Comm Bk-H China Merchant Want Want China Sun Hung Kai Pro New World Dev Belle Internatio China Coal Ene-H Swire Pacific-A Sands China Ltd Clp Hldgs Ltd Bank East Asia Ping An Insura-H Boc Hong Kong Ho China Life Ins-H Citic Pacific China Res Enterp Cathay Pac Air Hong Kg China Gs Tingyi Hldg Co Esprit Hldgs Bank Of Commun-H China Petroleu-H Hong Kong Exchng Bank Of China-H Wharf Hldg Li & Fung Ltd Hsbc Hldgs Plc Power Assets Hol Mtr Corp China Overseas Tencent Holdings China Unicom Hon Sino Land Co China Res Power Petrochina Co-H Cnooc Ltd China Const Ba-H China Mobile Lenovo Group Ltd Hang Seng Index BBG code 1 HK 101 HK 1044 HK 1088 HK 11 HK 1109 HK 1199 HK 12 HK 1299 HK 13 HK 135 HK 1398 HK 144 HK 151 HK 16 HK 17 HK 1880 HK 1898 HK 19 HK 1928 HK 2 HK 23 HK 2318 HK 2388 HK 2628 HK 267 HK 291 HK 293 HK 3 HK 322 HK 330 HK 3328 HK 386 HK 388 HK 3988 HK 4 HK 494 HK 5 HK 6 HK 66 HK 688 HK 700 HK 762 HK 83 HK 836 HK 857 HK 883 HK 939 HK 941 HK 992 HK Share price (HK$) 140.30 21.20 81.95 21.40 130.70 20.05 11.00 52.45 44.85 97.50 7.61 5.45 25.75 9.87 119.60 8.89 9.14 4.39 103.30 35.55 68.50 30.80 81.20 26.10 29.60 13.32 15.54 16.92 17.90 17.44 8.63 6.35 6.06 174.70 4.18 59.25 7.25 69.95 78.95 33.25 23.70 123.00 11.64 12.34 20.55 8.50 10.56 6.14 97.00 10.30 Mkt cap (HK$m) 324,958 95,089 100,338 473,657 249,878 116,916 32,345 157,368 540,224 415,679 61,431 2,015,090 65,988 130,245 337,654 79,062 77,089 89,991 149,437 286,807 173,062 72,283 777,935 275,950 1,079,679 331,712 37,628 66,561 188,166 97,730 16,766 539,760 875,949 204,079 1,494,588 179,535 60,613 1,344,181 168,500 193,732 193,723 1,152,593 278,743 74,830 98,585 2,487,644 471,477 1,547,652 1,984,010 114,419 5d chg (%) -2.0 0.0 1.9 -4.9 2.0 -8.7 -0.2 -1.9 4.3 -0.9 0.5 -4.0 -0.8 -1.3 0.1 -2.8 2.8 -7.0 2.0 -2.7 2.0 -1.3 -1.6 0.0 -2.6 -2.8 -1.5 -3.2 2.2 -1.9 -4.5 -5.8 -2.4 -2.2 -4.8 -2.9 0.4 -1.6 3.8 1.1 -2.3 -3.2 4.9 -0.2 2.5 -3.1 -0.8 -4.1 2.3 -4.3 Ytd chg (%) 7.7 -2.5 1.1 -6.8 1.2 -2.0 -0.2 -3.4 3.9 9.2 3.8 -3.7 -1.3 -3.4 1.1 -0.3 4.8 -9.7 2.3 -6.8 1.9 -1.4 2.7 0.6 -2.8 0.8 -4.3 0.1 0.8 -1.6 -7.0 -12.3 -3.0 1.7 -4.3 5.8 -0.1 -5.5 4.9 4.6 2.8 9.3 11.9 -1.4 2.8 -1.2 1.1 -3.6 7.2 1.0 23,738.5 14,689,226 -1.2 0.6 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) 152.00 105.95 26.45 19.80 90.50 74.05 24.40 19.12 133.00 117.60 23.60 13.62 11.92 9.40 56.40 36.46 45.65 34.65 108.50 85.90 14.18 6.88 5.90 4.33 28.60 22.75 13.10 9.32 124.00 90.35 10.48 7.15 10.00 7.00 5.44 3.72 108.00 80.55 68.00 34.50 68.50 56.00 34.45 28.50 88.70 55.60 27.95 21.50 32.00 19.72 16.88 9.35 24.55 15.12 18.00 13.56 18.90 13.91 23.25 16.02 16.60 8.60 7.36 4.53 8.23 5.74 189.00 112.80 4.52 3.03 63.45 46.35 10.70 7.06 86.15 69.75 79.60 57.85 33.60 26.55 26.70 17.52 134.90 93.00 14.22 9.03 14.16 9.83 24.90 17.56 11.70 7.31 15.88 9.72 6.62 4.89 102.20 63.65 12.70 7.62 25,363.0 21,137.6 –––––––––– PE ––––––––––– 2014A 2015E 2016E (X) (X) (X) 7.5 9.2 9.6 12.5 13.9 15.3 27.7 26.7 22.2 7.9 8.7 8.6 15.0 14.9 13.4 7.6 10.4 8.9 14.1 12.6 11.2 8.8 16.8 16.4 28.3 21.8 19.2 8.8 11.6 12.1 9.7 9.9 9.5 5.5 5.5 5.3 14.9 15.3 13.9 24.1 24.5 20.9 9.6 15.3 14.4 6.7 10.6 9.8 N/A 13.6 13.0 33.9 55.0 31.5 11.8 14.8 13.7 14.0 14.2 14.6 19.2 16.3 16.1 10.4 11.2 10.9 16.3 13.9 12.8 12.0 11.2 10.2 25.0 19.0 16.3 9.4 8.5 7.3 20.4 73.6 45.2 22.6 19.1 11.8 27.1 25.6 23.8 30.2 27.8 22.5 79.0 51.1 26.7 5.9 5.8 5.6 8.3 9.1 11.7 43.5 39.7 29.7 5.6 5.6 5.3 7.5 15.2 13.4 9.3 15.1 12.8 11.3 10.2 9.7 2.7 18.9 18.9 13.0 18.5 17.6 7.7 8.4 7.3 41.6 38.6 29.4 17.7 17.1 15.2 8.3 14.0 13.6 8.5 8.2 7.5 9.5 10.3 13.7 6.8 7.3 10.4 5.4 5.3 5.0 13.5 14.4 14.3 15.3 17.5 15.3 10.1 10.9 9.8 Yield P/B (%) 2.5 3.5 2.3 5.3 4.2 2.2 2.8 1.9 1.0 2.4 3.0 N/A 3.0 2.7 2.8 4.6 N/A 2.3 3.5 4.9 3.8 3.6 1.1 3.9 1.3 2.0 1.6 1.5 1.8 1.6 0.8 N/A 4.9 2.0 5.8 3.0 6.5 5.4 3.3 2.8 2.1 0.2 1.7 4.1 3.6 4.7 5.4 6.1 3.2 2.3 (X) 0.9 0.8 6.1 1.2 2.3 1.4 0.9 0.6 2.5 1.0 1.2 1.1 1.0 8.9 0.8 0.5 2.4 0.5 0.7 7.1 1.9 1.1 2.5 1.6 2.8 0.6 0.7 1.1 3.7 4.1 1.0 0.8 1.0 9.9 0.9 0.6 1.6 0.9 1.4 1.2 1.6 12.4 1.0 0.7 1.5 1.1 1.0 1.0 1.9 4.5 3.7 1.3 Morning Express 20 January 2015 China Ent Index Constituents Company name Shandong Weig-H China Shenhua-H Sinopharm-H China Shipping-H Zoomlion Heavy-H Yanzhou Coal-H Agricultural-H New China Life-H Ind & Comm Bk-H Tsingtao Brew-H China Com Cons-H China Coal Ene-H China Minsheng-H Guangzhou Auto-H Ping An Insura-H Picc Property & Great Wall Mot-H Weichai Power-H Aluminum Corp-H China Pacific-H China Life Ins-H China Oilfield-H Zijin Mining-H China Natl Bdg-H Bank Of Commun-H Jiangxi Copper-H China Petroleu-H China Rail Gr-H China Merch Bk-H Bank Of China-H Dongfeng Motor-H Citic Securiti-H Haitong Securi-H China Telecom-H Air China Ltd-H Petrochina Co-H Huaneng Power-H Anhui Conch-H China Longyuan-H China Const Ba-H China Citic Bk-H Hang Seng China Ent Indx BBG code 1066 HK 1088 HK 1099 HK 1138 HK 1157 HK 1171 HK 1288 HK 1336 HK 1398 HK 168 HK 1800 HK 1898 HK 1988 HK 2238 HK 2318 HK 2328 HK 2333 HK 2338 HK 2600 HK 2601 HK 2628 HK 2883 HK 2899 HK 3323 HK 3328 HK 358 HK 386 HK 390 HK 3968 HK 3988 HK 489 HK 6030 HK 6837 HK 728 HK 753 HK 857 HK 902 HK 914 HK 916 HK 939 HK 998 HK Share price (HK$) Mkt cap (HK$m) 5d chg (%) Ytd chg (%) 5.82 21.40 27.60 5.63 5.17 6.19 3.78 44.65 5.45 51.95 8.82 4.39 9.58 6.71 81.20 14.36 40.15 30.65 3.69 35.45 29.60 13.34 2.40 7.46 6.35 12.60 6.06 5.69 17.16 4.18 11.16 23.60 15.36 4.22 6.39 8.50 10.88 27.50 8.38 6.14 5.63 26,052.49 473,657.38 76,371.82 28,347.46 54,003.86 60,147.07 1,417,015.64 182,969.16 2,015,090.44 69,048.13 212,955.89 89,990.74 378,138.08 56,990.10 777,935.38 212,937.42 140,155.49 63,511.39 77,349.77 336,224.62 1,079,678.83 92,003.06 84,917.45 40,276.74 539,760.27 59,944.61 875,949.28 187,306.18 454,861.52 1,494,588.01 96,155.90 390,952.09 231,963.12 341,534.59 111,244.60 2,487,644.15 143,926.17 134,275.06 67,344.94 1,547,652.50 365,669.03 0.7 -4.9 -6.4 -2.6 -10.4 -5.8 -5.7 9.7 -4.0 -2.4 -9.7 -7.0 -7.2 -6.5 -1.6 -4.8 -4.3 -4.1 -6.6 -7.4 -2.6 -2.8 -0.4 -4.5 -5.8 -8.0 -2.4 -8.1 -7.4 -4.8 -3.1 -18.1 -18.2 -4.7 -9.7 -3.1 2.4 -6.1 -1.6 -4.1 -4.7 -7.0 -6.8 0.5 5.8 -12.5 -5.8 -3.6 14.0 -3.7 -1.2 -5.5 -9.7 -6.1 -5.0 2.7 -4.8 -9.0 -6.3 2.8 -10.0 -2.8 -0.9 9.1 -1.1 -12.3 -5.3 -3.0 -10.8 -11.8 -4.3 1.6 -19.2 -21.3 -7.0 1.9 -1.2 3.8 -5.3 3.8 -3.6 -9.5 10.5 24.4 34.5 6.3 6.8 7.3 4.1 45.3 5.9 64.0 10.2 5.4 10.7 9.9 88.7 16.2 44.9 34.9 4.3 40.9 32.0 24.4 2.5 8.4 7.4 15.2 8.2 6.7 20.0 4.5 15.2 34.0 23.2 5.2 7.4 11.7 11.6 35.7 10.3 6.6 6.3 11,476 4,696,080 -4.5 -4.2 12,400.4 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) ––––––––––– PE ––––––––––– 2014A 2015E 2016E Yield P/B (X) (X) (X) (%) (X) 5.7 19.1 19.7 4.0 3.5 4.9 3.0 21.1 4.3 50.4 4.9 3.7 5.9 6.6 55.6 9.4 26.1 25.8 2.5 23.6 19.7 11.7 1.6 6.7 4.5 11.6 5.7 3.0 12.1 3.0 9.6 13.7 9.5 3.1 4.2 7.3 6.1 24.0 7.1 4.9 3.6 68.3 7.9 22.1 N/A 17.3 6.6 5.5 18.7 5.5 28.3 8.9 33.9 5.8 11.0 16.3 14.8 12.1 9.4 N/A 24.1 25.0 6.2 19.6 5.2 5.9 9.8 8.3 9.8 6.0 5.6 5.7 26.3 28.0 14.7 24.0 9.5 10.6 9.6 27.7 5.4 5.2 20.9 8.7 20.1 53.2 19.6 15.0 5.3 15.5 5.5 27.4 8.4 55.0 5.5 10.2 13.9 12.6 12.1 10.1 N/A 21.5 19.0 6.5 16.9 5.7 5.8 12.1 9.1 9.3 6.0 5.6 6.1 23.2 17.7 14.9 18.7 10.3 10.0 10.0 21.8 5.3 5.2 17.4 8.6 16.9 15.2 15.1 18.2 5.0 13.9 5.3 24.2 7.7 31.5 5.2 7.9 12.8 11.6 9.2 10.5 N/A 17.9 16.3 7.2 17.4 5.3 5.6 12.8 11.7 8.3 5.4 5.3 5.8 18.6 13.9 13.4 11.0 13.7 9.4 9.3 15.2 5.0 4.9 1.3 5.3 1.2 0.0 3.6 0.4 N/A 0.4 N/A N/A 2.7 2.3 2.1 3.3 1.1 1.9 2.5 1.0 N/A 1.4 1.3 4.0 N/A 2.7 N/A 4.9 4.9 1.4 4.5 5.8 2.0 N/A 1.0 2.8 0.9 4.7 4.4 1.6 0.7 6.1 N/A 2.2 1.2 2.6 0.7 0.8 0.6 1.0 2.6 1.1 3.6 1.2 0.5 1.2 1.0 2.5 2.5 3.3 1.6 1.0 2.4 2.8 1.2 1.5 0.9 0.8 0.8 1.0 1.1 1.2 0.9 1.1 2.2 1.9 1.0 1.3 1.1 1.9 2.0 1.7 1.0 0.8 9,159.8 8.1 7.7 6.9 4.1 1.2 Morning Express 20 January 2015 BOCOM International 11/F, Man Yee Building, 68 Des Voeux Road, Central, Hong Kong Main: + 852 3710 3328 Fax: + 852 3798 0133 Rating System Company Rating www.bocomgroup.com Sector Rating Buy: Expect more than 20% upside in 12 months LT Buy: Expect more than 20% upside but longer than 12 months Neutral: Expect low volatility Sell: Expect more than 20% downside in 12 months Outperform (“OP”): Expect more than 10% upside in 12 months Market perform (“MP”): Expect low volatility Underperform (“UP”): Expect more than 10% downside in 12 months Research Team Head of Research @bocomgroup.com Raymond CHENG, CFA, CPA, CA (852) 2977 9393 raymond.cheng (852) 2977 9384 hao.hong (852) 2977 9212 yangqingli Shanshan LI, CFA (86) 10 8800 9788 - 8058 lishanshan Li WAN, CFA (86) 10 8800 9788 - 8051 Wanli Strategy Economics Hao HONG, CFA Banks/Network Financials Qingli YANG (86) 10 8800 9788 - 8043 miaoxian.li Fei WU (852) 2977 9392 fei.wu Tony LIU (852) 2977 9390 xutong.liu Property Phoebe WONG (852) 2977 9391 phoebe.wong Anita CHU (852) 2977 9205 anita.chu Summer WANG (852) 2977 9221 summer.wang Shawn WU (852) 2977 9386 shawn.wu (852) 2977 9387 milo.liu (852) 2977 9389 liwenbing Consumer Staples Alfred LAU, CFA, FRM (852) 2977 9235 alfred.lau Luella GUO (852) 2977 9211 luella.guo (86) 21 6065 3606 louis.sun (852) 2977 9209 lizhiwu (852) 2977 9216 miles.xie Geoffrey CHENG, CFA (852) 2977 9380 geoffrey.cheng Fay ZHOU (852) 2977 9381 fay.zhou (86) 21 6065 3675 wei.yao Renewable Energy Healthcare Louis SUN Telecom & Small/ Mid-Caps Milo LIU Insurance & Brokerage Zhiwu LI Technology Internet Miles XIE Transportation & Industrial Yuan MA, PhD (86) 10 8800 9788 - 8039 yuan.ma Connie GU, CPA (86) 10 8800 9788 - 8045 conniegu (852) 2977 9243 jovi.li Metals & Mining Jovi LI Miaoxian LI Oil & Gas/ Gas Utilities Consumer Discretionary Jerry LI @bocomgroup.com Automobile Download our reports from Bloomberg: BOCM〈enter〉 Wei YAO Morning Express 20 January 2015 Analyst Certification The authors of this report, hereby declare that: (i) all of the views expressed in this report accurately reflect their personal views about any and all of the subject securities or issuers; and (ii) no part of any of their compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report; (iii) no insider information/ non-public price-sensitive information in relation to the subject securities or issuers which may influence the recommendations were being received by the authors. The authors of this report further confirm that (i) neither they nor their respective associates (as defined in the Code of Conduct issued by the Hong Kong Securities and Futures Commission) have dealt in or traded in the stock(s) covered in this research report within 30 calendar days prior to the date of issue of the report; (ii)) neither they nor their respective associates serve as an officer of any of the Hong Kong listed companies covered in this report; and (iii) neither they nor their respective associates have any financial interests in the stock(s) covered in this report. Disclosure of relevant business relationships BOCOM International Securities Limited, and/or its associated companies, has investment banking relationship with Bank of Communications, Harbin Bank Co., Ltd., Azure Orbit International Finance Limited, Hanhua Financial Holding Co., Ltd., Central China Securities Company Limited, China New City Commercial Development Limited, China Shengmu Organic Milk Limited, Broad Greenstate International Company Limited, China National Culture Group Limited, Sichuan Development Holding Co. Ltd., Austar Lifesciences Limited and BAIC Motor Corporation Limited within the preceding 12 months. BOCOM International Holdings Company Limited currently holds more than 1% of the equity securities of Shanghai Fosun Pharmaceuticals Group Co. Ltd. BOCOM International Securities Limited currently holds more than 1% of the equity securities of Sanmenxia Tianyuan Aluminum Company Limited. Disclaimer By accepting this report (which includes any attachment hereto), the recipient hereof represents and warrants that he is entitled to receive such report in accordance with the restrictions set forth below and agrees to be bound by the limitations contained herein. Any failure to comply with these limitations may constitute a violation of law. This report is strictly confidential and is for private circulation only to clients of BOCOM International Securities Ltd. This report is being supplied to you strictly on the basis that it will remain confidential. No part of this report may be (i) copied, photocopied, duplicated, stored or reproduced in any form by any means or (ii) redistributed or passed on, directly or indirectly, to any other person in whole or in part, for any purpose without the prior written consent of BOCOM International Securities Ltd. BOCOM International Securities Ltd, its affiliates and related companies, their directors, associates, connected parties and/or employees may own or have positions in securities of the company(ies) covered in this report or any securities related thereto and may from time to time add to or dispose of, or may be interested in, any such securities. Further, BOCOM International Securities Ltd, its affiliates and its related companies may do and seek to do business with the company(ies) covered in this report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking, advisory, underwriting, financing or other services for or relating to such company(ies) as well as solicit such investment, advisory, financing or other services from any entity mentioned in this report. In reviewing this report, an investor should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest. The information contained in this report is prepared from data and sources believed to be correct and reliable at the time of issue of this report. This report does not purport to contain all the information that a prospective investor may require and may be subject to late delivery, interruption and interception. BOCOM International Securities Ltd does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information and opinion contained in this report and accordingly, neither BOCOM International Securities Ltd nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof. This report is general in nature and has been prepared for information purposes only. It is intended for circulation amongst BOCOM International Securities Ltd’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. The information and opinions in this report are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, related investments or other financial instruments thereof. The views, recommendations, advice and opinions in this report may not necessarily reflect those of BOCOM International Securities Ltd or any of its affiliates, and are subject to change without notice. BOCOM International Securities Ltd has no obligation to update its opinion or the information in this report. Investors are advised to make their own independent evaluation of the information contained in this research report, consider their own individual investment objectives, financial situation and particular needs and consult their own professional and financial advisers as to the legal, business, financial, tax and other aspects before participating in any transaction in respect of the securities of company(ies) covered in this report. The securities of such company(ies) may not be eligible for sale in all jurisdictions or to all categories of investors. This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to any law, regulation, rule or other registration or licensing requirement. BOCOM International Securities Ltd is a wholly owned subsidiary of Bank of Communications Co Ltd. Download our reports from Bloomberg: BOCM〈enter〉

© Copyright 2026