Document 371869

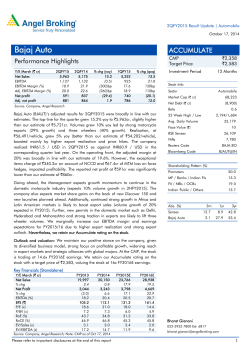

2QFY2015 Result Update | Agrichemical October 22, 2014 United Phosphorus BUY Performance Highlights CMP Target Price Y/E March (` cr) Investment Period 12 Months 2QFY2015 1QFY2015 % chg (qoq) 2QFY2014 2,618 2720 (3.8) 2269 15.4 62 52 18.1 91 (32.2) 1323 1401 (5.5) 1106 19.6 Sector Operating profit 436 486 (10.3) 363 20.1 Adj. net profit Market Cap (` cr) 14,005 178 263 (32.2) 170 4.5 Net Debt (` cr) 1,113 Net sales Other income Gross profit % chg (yoy) `327 `424 Source: Company, Angel Research Stock Info Agrichemical Beta United Phosphorus Ltd (UPL) posted a good set of numbers for 2QFY2015. For the quarter, the company posted sales of `2,618cr V/s `2,269cr in 2QFY2014, registering a yoy growth of 15.4%. The OPM for the quarter stood at 16.7% V/s 16.0% in 2QFY2014, mainly driven by a higher GPM of 50.5% (V/s 48.7% in 2QFY2014). The expansion in the OPM was lower than the expansion in the GPM owing to the 24.4% rise in other expenditure. This along with a lower other income, which dipped by 32.2% yoy, led the Adj. net profit to come in at `178cr V/s `171cr in 2QFY2014, ie a yoy growth of 4.5%. We maintain our Buy recommendation on the stock with a target price of `424. Robust numbers: UPL posted a good set of numbers for 2QFY2015. For the quarter, the company posted sales of `2,618cr V/s `2,269cr in 2QFY2014, registering a yoy growth of 15.4%. The OPM for the quarter stood at 16.7% V/s 16.0% in 2QFY2014, mainly driven by a higher GPM of 50.5% (V/s 48.7% in 2QFY2014). The expansion in the OPM was lower than the expansion in the GPM owing to the 24.4% rise in other expenditure. This along with a lower other income, which dipped by 32.2% yoy, led the Adj. net profit to come in at `178cr V/s `171cr in 2QFY2014, ie a yoy growth of 4.5%. The reported net profit during the quarter came in at `166cr V/s `155cr in 2QFY2014, a yoy growth of 7.4%. 0.9 52 Week High / Low 388/149 Avg. Daily Volume 247876 Face Value (`) 2 BSE Sensex 26,576 Nifty 7,928 Reuters Code UNPO.BO Bloomberg Code UNTP@IN Shareholding Pattern (%) Promoters 29.8 MF / Banks / Indian Fls 14.7 FII / NRIs / OCBs 48.0 Indian Public / Others 7.5 Abs. (%) 3m 1yr 3yr Sensex 3.3 27.2 58.3 UPL 0.6 107.6 128.2 Outlook and valuation: We expect UPL to post a CAGR of 13.5% and 23.2% in its sales and PAT respectively, over FY2014-16. At the current valuation of 9.2x FY2016E EPS, the stock is attractively valued. Hence, we maintain our Buy recommendation on the stock with a target price of `424. Key financials (Consolidated) Y/E March (` cr) Total revenue % chg Adj. profit FY2013 FY2014 FY2015E FY2016E 9,010 10,580 11,850 13,627 19.6 17.4 12.0 15.0 754 998 1,282 1,515 % chg 34.3 32.4 28.5 18.1 EBITDA (%) 16.0 17.3 17.3 17.3 EPS (`) 17.0 23.3 29.9 35.3 P/E (x) 19.2 14.0 10.9 9.2 3.1 2.7 2.2 1.8 P/BV (x) RoE (%) 17.1 20.2 22.2 21.7 RoCE (%) 14.4 17.7 19.6 20.1 EV/Sales (x) 0.9 0.8 0.7 0.5 EV/EBITDA (x) 5.9 4.4 3.9 3.0 Source: Company, Angel Research; Note: CMP as of October 21, 2014 Please refer to important disclosures at the end of this report Sarabjit Kour Nangra +91-22-3935 7800 ext. 6806 [email protected] 1 United Phosphorus | 2QFY2015 Result Update Exhibit 1: 2QFY2015 Performance (Consolidated) Y/E March (` cr) Net sales Other income 2QFY2015 1QFY2015 % chg (qoq) 2QFY2014 % chg (yoy) 1HFY2015 1HFY2014 % chg 2,618 2,720 (3.8) 2,269 15.4 5,338 4,679 14.1 62 52 18.1 91 (32.2) 114 163 (30.1) Total income 2,679 2,773 (3.4) 2,360 13.5 5,452 4,842 12.6 Gross profit 1323 1401 (5.5) 1106 19.6 2723 2290 18.9 Gross margin (%) 50.5 51.5 51.0 48.9 Operating profit 436 486 922 775 Operating margin (%) 16.7 17.9 Financial cost 140 116 Depreciation 109 103 PBT 248 319 Provision for taxation 48.7 (10.3) 363 20.1 16.0 19.0 17.3 16.6 121 15.9 257 257 5.6 97 12.5 213 183 16.1 (22.1) 236 5.2 567 498 13.8 20.6 46 88 (47.7) 58 (20.4) 134 126 6.7 PAT Before Exc. And MI 202 231 (12.3) 178 13.6 432 372 16.2 Minority Income/ ( Exp.) 29 (12) 12 17 7 Income from Associate/ (Exp) 10 10 9 20 9 Extra ordinary Income/( Exp.) 17 (36) Reported PAT 166 289 (42.5) 155 20 7.4 Adjusted PAT 178 263 (32.2) 170 4.5 EPS (`) 4.2 6.1 3.9 (19) 20 455 367 23.8 439 353 24.4 10.2 8.0 Source: Company, Angel Research Double digit top-line growth; mainly driven by ROW, Europe and Latin America For the quarter, the company posted sales of `2,618cr V/s `2,269cr in 2QFY2014, registering a yoy growth of 15.4%. The growth was aided by volume growth of 15% and price appreciation of 2%. The company suffered on back of a 2% decline in the exchange rate. In terms of geographies, RoW posted a robust growth during the quarter, posting a 29.0% yoy growth. Europe, on the other hand grew by 27.0% yoy, while Latin America grew by 20.0% yoy. The geographies which posted moderate growth or de-growth were India and the US. India grew by only 8.0% yoy, while the US degrew by 11% yoy. In India, after initial low market sentiments due to drought expectations, a few sprays were lost and the market grew marginally over last year. The US market de-grew due to softening of commodity prices, leading to reduced input intensification. The company expects 2HFY2015 to be good on back of new product introductions. October 22, 2014 2 United Phosphorus | 2QFY2015 Result Update Exhibit 2: Sales Break-up (Marketwise) 100% 795 80% 1,019 1,250 1,287 1,369 900 60% 498 326 316 40% 638 484 387 518 502 381 20% 944 797 686 532 342 0% 2QFY2014 3QFY2014 4QFY2014 North America India 1QFY2015 EU 2QFY2015 RoW Source: Company Exhibit 3: Sales performance 3,000 2,400 20 3,296 3,300 2,700 Exhibit 4: Growth break-up 2,720 2,605 2,618 2,269 10 2,100 1,800 (%) (` cr) 15 15 1,500 5 1,200 900 2 0 600 300 (2) (5) 2QFY2014 3QFY2014 4QFY2014 1QFY2015 Exchange impact 2QFY2015 Source: Company, Angel Research Realisation Volume Source: Company, Angel Research Exhibit 5: Volume and realisation break-up (yoy) 40 35 30 (%) 25 20 15 15 12 10 10 5 1 5 2 6 6 3 2 0 2QFY2014 3QFY2014 Realisation 4QFY2014 1QFY2015 2QFY2015 Volume Source: Company, Angel Research October 22, 2014 3 United Phosphorus | 2QFY2015 Result Update EBITDA margin improves yoy The company posted an OPM of 16.7% V/s 16.0% in 2QFY2014, mainly driven by a GPM of 50.5% (V/s 48.7% in 2QFY2014). The expansion in the OPM was lower than the expansion in the GPM on back of a 24.4% rise in other expenditure. Exhibit 6: EBITDA margin trend 20.0 19.0 19.1 (%) 18.0 17.9 17.0 16.7 16.0 16.0 16.2 15.0 2QFY2014 3QFY2014 4QFY2014 1QFY2015 2QFY2015 Source: Company, Angel Research Adj net profit grew 4.5% yoy Other income during the period dipped by 32.2% yoy. The Adj. net profit came in at `178cr V/s `171cr in 2QFY2014, a yoy growth of 4.5%. The reported net profit during the quarter came in at `166cr V/s `155cr in 2QFY2014, a yoy growth of 7.4%. Exhibit 7: Adjusted PAT trend 450 50 401 400 45 40 350 255 35 263 30 250 200 178 170 150 25 (%) (` cr) 300 20 15 100 10 50 5 0 0 2QFY2014 3QFY2014 4QFY2014 Adj PAT 1QFY2015 2QFY2015 % YoY Source: Company, Angel Research October 22, 2014 4 United Phosphorus | 2QFY2015 Result Update Invvestment arguments Innovators dominant in the off-patent space; Generic firms in a sweet spot The global agrichem industry, valued at US$40bn (CY2008), is dominated by the top six innovators, viz Bayer, Syngenta, Monsanto, BASF, DuPont and Dow, which enjoy a large market share of the patented (28%) and off-patent (32%) market. The top six innovators enjoy a large share of the off-patent market due to high entry barriers for pure generic players. Thus, one-third of the total pie worth US$13bn, which is controlled by the top six innovators through proprietary offpatent products, provides a high-growth opportunity for larger integrated generic players such as UPL. Generic segment’s market share to increase Generic players have been garnering a high market share, increasing from 32% levels in 1998 to 40% by 2006-end. The industry registered a CAGR of 3% over 1998-2006, while generic players outpaced the industry with a CAGR of 6%. Going ahead, given the opportunities and a drop in the rate of new molecule introduction by innovators, we expect generic players to continue to outpace the industry’s growth and increase their market share in the overall pie. Historically, global agrichem players have been logging in-line growth with global GDP. Going ahead, over CY2013-14, the global economy is expected to grow by 3-4%. Assuming this trend plays out in terms of growth for the agrichem industry and the same rate of genericisation occurs, the agrichemical generic industry could log in 6-8% yoy growth during the period and garner a market share of 44-45%. A global generic play UPL figures among the top five global generic agrichemical players with presence across major markets including the US, EU, Latin America and India. Given the high entry barriers by way of high investments, entry of new players is restricted. Thus, amidst this scenario and on account of having a low-cost base, we believe UPL enjoys an edge over competition and is placed in a sweet spot to leverage the upcoming opportunities in the global generic space. October 22, 2014 5 United Phosphorus | 2QFY2015 Result Update Outlook and valuation Over the last few years, the global agriculture sector has been rejuvenating/reviving on the back of rising food prices. Food security is also a top priority for most governments; reducing food loss is one of the easiest ways to boost food inventory. Hence, we believe agrichemical companies would continue to do well in the wake of heightened food security risks, and strong demand is likely to be witnessed across the world. Overall, we expect the global agrichemical industry to perform well from here on. However, generics are expected to register a healthy growth due to a) increasing penetration and wresting market share from innovators and b) patent expiries worth US$3bn–4bn during 2009-14. We estimate UPL to post a 13.5% and 23.2% CAGR in sales and PAT, respectively, over FY2014-16. The stock is trading at an attractive valuation of 9.2x FY2016E EPS. Hence, we maintain our Buy recommendation on the stock with a target price of `424. Exhibit 8: Key assumption FY2015E FY2016E Sales growth 12.0 15.0 EBITDA margin 17.3 17.3 Tax rate 20.0 20.0 Source: Company, Angel Research Exhibit 9: P/E band 450 400 350 (`) 300 250 200 150 100 50 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 0 Price 6x 8x 10x 12x 14x Source: Company, Angel Research Exhibit 10: Peer valuation Company Rallis Reco Neutral United Phosphorus Buy Mcap CMP TP (` cr) (`) (`) 4,376 225 - 14,004 327 424 Upside P/E (x) EV/Sales (x) EV/EBITDA (x) RoE (%) CAGR (%) (%) FY15E FY16E FY15E FY16E FY15E FY16E FY15E FY16E Sales PAT - 24.9 21.4 1.8 1.5 12.8 10.7 22.6 22.3 16.4 15.9 29.7 10.9 9.2 0.7 0.5 3.9 3.0 22.2 21.7 13.5 23.2 Source: Company, Angel Research, Bloomberg October 22, 2014 6 United Phosphorus | 2QFY2015 Result Update Company background United Phosphorus (UPL) is a global generic crop protection, chemicals and seeds company. The company is fully backward and forward integrated by taking advantage of the consolidation opportunities within the agrochemical industry. UPL is the largest Indian agrochemical company and had revenue of about `10,580cr for year ended March 2014. Profit & Loss Statement (Consolidated) Y/E March (` cr) Net Sales 5,650 7,534 111 137 5,761 7,671 8.9 33.2 19.9 17.1 Total Expenditure 4,708 6,328 7,568 Net Raw Materials Other operating income Total operating income % chg 9,010 10,580 FY2016E 11,850 13,627 191 191 191 9,195 10,771 12,040 13,818 11.8 14.8 8,751 9,796 11,265 184 2,902 4,058 4,687 5,441 6,094 7,008 Other Mfg costs 514 590 741 828 1,138 1,308 Personnel 515 686 853 946 1,060 1,219 Other 778 994 1,287 1,535 1,505 1,731 EBITDA 942 1,206 1,442 1,829 2,053 2,361 % chg 17.1 28.1 19.6 26.8 12.3 15.0 (% of Net Sales) 16.7 16.0 16.0 17.3 17.3 17.3 Depreciation& Amortisation 214 292 354 407 433 454 EBIT 839 1,051 1,273 1,613 1,811 2,098 % chg 42.3 25.3 21.1 26.7 12.3 15.8 (% of Net Sales) 14.6 13.7 13.8 15.0 15.0 15.2 Interest & other Charges 312 415 429 487 373 373 Other Income 131 97 73 131 131 131 20 13 8 10 8 7 658 734 917 1,257 1,569 1,856 7.2 11.4 25.0 37.1 24.8 18.3 6 (5) 27 85 - - 664 729 944 1,172 1,569 1,856 73 128 203 222 314 371 (% of PBT) 11.0 17.6 21.5 18.9 20.0 20.0 PAT (reported) 591 601 741 950 1,255 1,485 Add: Share of earnings of asso. (23) (40) 32 30 34 38 10 5 (2) 7 7 7 - - - 24 - 1 PAT after MI (reported) 558 556 775 950 1,282 1,515 ADJ. PAT 552 561 754 998 1,282 1,515 1.7 1.6 34.3 32.4 28.5 18.1 (% of PBT) Recurring PBT % chg Extraordinary Expense/(Inc.) PBT (reported) Tax Less: Minority interest (MI) Prior period items % chg (% of Net Sales) October 22, 2014 FY2011 FY2012 FY2013 FY2014 FY2015E 9.8 7.5 8.4 9.4 10.8 11.1 Basic EPS (`) 12.0 12.2 17.0 23.3 29.9 35.3 Fully Diluted EPS (`) 12.0 12.2 17.0 23.3 29.9 35.3 % chg (3.2) 1.6 40.1 36.7 28.5 18.1 7 United Phosphorus | 2QFY2015 Result Update Balance Sheet (Consolidated) Y/E March (` cr) FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E SOURCES OF FUNDS Equity Share Capital 92 92 89 86 86 86 Preference Capital - - - - - - Reserves& Surplus 3,634 4,081 4,557 5,162 6,243 7,557 Shareholders’ Funds 3,726 4,173 4,645 5,247 6,329 7,643 18 250 234 172 179 186 Minority Interest Total Loans 2,679 3,389 4,203 2,873 2,873 2,873 Other Long term liabilities 42 301 395 311 311 311 Long Term Provisions 31 51 51 53 53 53 Deferred Tax Liability (8) (6) (13) 57 57 57 6,488 8,158 9,516 8,714 9,802 11,123 Gross Block 3,947 4,687 5,386 6,039 6,339 6,639 Less: Acc. Depreciation 2,174 2,605 3,173 3,580 4,014 4,468 Net Block 1,773 2,082 2,213 2,459 2,325 2,171 57 306 378 378 378 378 548 1,141 1,277 1,212 1,212 1,212 Total Liabilities APPLICATION OF FUNDS Capital Work-in-Progress Goodwill / Intangilbles Investments 823 795 1,025 737 737 737 Long Term Loan & Adv. 220 321 277 389 365 419 Current Assets 4,777 5,625 7,154 7,572 8,477 10,451 Cash 700 1,566 1,548 1,023 1,105 1,973 Loans & Advances 326 602 852 771 1,120 1,288 Other 3,751 3,458 4,754 5,779 6,252 7,189 Current liabilities 1,709 2,111 2,807 4,033 3,692 4,246 Net Current Assets 3,068 3,514 4,346 3,539 4,785 6,205 - - - - - - 6,488 8,158 9,516 8,714 9,802 11,123 Others Total Assets October 22, 2014 8 United Phosphorus | 2QFY2015 Result Update Cash Flow Statement (Consolidated) Y/E March (` cr) Profit before tax Depreciation Change in Working Capital Less: Other income Direct taxes paid 664 729 944 1,172 1,569 1,856 214 292 354 407 433 454 (1,251) 318 (806) 171 (1,140) (607) - - - - - - (73) (128) (203) (222) (314) (371) Cash Flow from Operations (446) 1,211 288 1,528 549 1,332 (Inc.)/ Dec. in Fixed Assets (753) (989) (771) (653) (300) (300) (Inc.)/ Dec. in Investments (62) 29 (231) - - - - - - - - - Inc./ (Dec.) in loans and adv. Other income Cash Flow from Investing Issue of Equity - - - - - - (815) (961) (1,002) (653) (300) (300) 312 - - (3) - - Inc./(Dec.) in loans (333) (989) (908) 1,413 (0) (0) Dividend Paid (Incl. Tax) (108) (134) (129) (201) (201) (201) Others (455) 1,738 1,733 (2,612) 34 36 Cash Flow from Financing (583) 615 696 (1,403) (167) (164) Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances October 22, 2014 FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E (878) 866 (18) (525) 82 868 1,578 700 1,566 1,548 1,023 1,105 700 1,566 1,548 1,023 1,105 1,973 9 United Phosphorus | 2QFY2015 Result Update Key Ratios Y/E March FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E Valuation Ratio (x) P/E (on FDEPS) 27.1 26.7 19.0 13.9 10.8 9.2 P/CEPS 19.5 17.5 13.0 9.9 8.1 7.1 P/BV 4.0 3.6 3.1 2.6 2.2 1.8 Dividend yield (%) 0.6 0.8 0.8 0.8 0.8 0.8 EV/Sales 1.4 1.1 0.9 0.8 0.7 0.5 EV/EBITDA 8.6 6.6 5.9 4.4 3.9 3.0 EV / Total Assets 1.2 1.0 0.9 0.9 0.8 0.6 EPS (Basic) 12.0 12.2 17.0 23.3 29.9 35.3 EPS (fully diluted) 12.0 12.2 17.0 23.3 29.9 35.3 Cash EPS 16.6 18.5 25.0 32.8 40.0 45.9 2.0 2.5 2.5 2.5 2.5 2.5 80.7 90.4 105.0 122.4 147.7 178.3 EBIT margin 14.6 13.7 13.8 15.0 15.0 15.2 Tax retention ratio 89.0 82.4 78.5 81.1 80.0 80.0 Asset turnover (x) 1.4 1.4 1.4 1.5 1.6 1.7 ROIC (Post-tax) 18.2 15.8 15.4 18.5 19.1 20.2 Cost of Debt (Post Tax) 10.9 11.3 8.9 11.2 10.4 10.4 0.4 0.5 0.5 0.5 0.3 0.2 21.1 18.0 18.6 21.9 21.9 22.2 ROCE (Pre-tax) 14.1 14.4 14.4 17.7 19.6 20.1 Angel ROIC (Pre-tax) 20.8 19.5 20.0 23.2 24.3 25.6 ROE 16.4 14.2 17.1 20.2 22.2 21.7 Asset Turnover (Gross Block) 1.6 1.8 1.8 1.9 1.9 2.1 Inventory / Sales (days) 76 78 78 83 85 84 Per Share Data (`) DPS Book Value DuPont Analysis Leverage (x) Operating ROE Returns (%) Turnover ratios (x) Receivables (days) 87 93 102 83 85 84 Payables (days) 102 102 108 69 71 70 WCcycle (ex-cash) (days) 118 105 96 92 95 106 Net debt to equity 0.3 0.5 0.4 0.6 0.4 0.3 Net debt to EBITDA 1.0 2.1 1.5 1.8 1.0 0.9 Interest Coverage (EBIT / Int.) 2.7 2.5 3.0 3.3 4.8 5.6 Solvency ratios (x) October 22, 2014 10 United Phosphorus | 2QFY2015 Result Update Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement UPL 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered No No No No Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors Ratings (Returns): October 22, 2014 Buy (> 15%) Reduce (-5% to -15%) Accumulate (5% to 15%) Sell (< -15%) Neutral (-5 to 5%) 11

© Copyright 2026